Amended Tender Offer Statement by Third Party (sc To-t/a)

June 14 2017 - 12:44PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

TO/A

Amendment

No. 11

Tender

Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

ONEMAIN

HOLDINGS, INC.

(Name

of Subject Company)

IEG

HOLDINGS CORPORATION

(Offeror

and Issuer)

(Names

of Filing Persons (identifying status as offeror, issuer or other person)

Common

Stock, $0.01 par value per share

(Title

of Class of Securities)

85172J101

(CUSIP

Number of Class of Securities)

Paul

Mathieson

President

and Chief Executive Officer

IEG

Holdings Corporation

6160

West Tropicana Ave., Suite E-13

Las

Vegas, NV 89103

(702)

227-5626

(Name,

address, and telephone numbers of person authorized to receive notices and communications

on

behalf of filing persons)

with

copies to:

Laura

Anthony, Esq.

Legal

& Compliance, LLC

330

Clematis Street, Suite 217

West

Palm Beach, FL 33401

CALCULATION

OF FILING FEE

|

Transaction Valuation*

|

|

Amount of Filing Fee

|

|

|

|

$506,079,225.00

|

|

|

$65,536.72

|

|

|

*

|

Estimated

solely for the purpose of calculating the registration fee. The market value of securities to be received was calculated as

the product of (i) 134,954,460 shares of IEG Holdings Corporation common stock to be issued if 6,747,723 OneMain Holdings,

Inc. shares are tendered and (ii) the last sale price of IEG Holdings Corporation’s common stock of $4.19 per share

on June 13, 2017.

|

|

|

|

|

[X]

|

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

Amount

Previously Paid:

|

$65,536.72

|

|

|

Form

or Registration No.:

|

Form

S-4

|

|

|

Filing

Party:

|

IEG

Holdings Corporation

|

|

|

Date

Filed:

|

January

5, 2017

|

[ ] Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check

the appropriate boxes below to designate any transactions to which the statement relates:

[X]

third-party tender offer subject to Rule 14d-1.

[ ] issuer tender offer subject to Rule 13e-4.

[ ] going-private transaction subject to Rule 13e-3.

[ ] amendment to Schedule 13D under Rule 13d-2.

Check

the following box if the filing is a final amendment reporting the results of the tender offer: [ ]

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

[ ] Rule 133-4(i) (Cross-Border Issuer Tender Offer)

[ ] Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

EXPLANATORY

NOTE

This

Amendment No. 11 to Schedule TO amends and supplements the Tender Offer Statement on Schedule TO, originally filed with the Securities

and Exchange Commission (the “SEC”) on January 5, 2017 by IEG Holdings Corporation, a Florida corporation (“IEG

Holdings”), as amended (the “Schedule TO”), relating to the offer (the “Offer”) by IEG Holdings

to exchange 20 shares of IEG Holdings common stock for each share of common stock, $0.01 par value per share, of OneMain Holdings,

Inc. (“OneMain”), a Delaware corporation, up to an aggregate of 6,747,723 shares of OneMain common stock, representing

approximately 4.99% of OneMain’s outstanding shares of common stock as of May 1, 2017. IEG Holdings initially filed with

the SEC a Registration Statement on Form S-4 on January 5, 2017, relating to the offer and sale of shares of IEG Holdings common

stock to be issued to holders of OneMain shares in the Offer, and the Registration Statement on Form S-4 was declared effective

by the SEC on May 19, 2017 (the “Registration Statement”). The terms and conditions of the Offer are set forth in

the Prospectus/Offer to Exchange, which is a part of the Registration Statement (the “Prospectus”), and the related

letter of transmittal (the “Letter of Transmittal”), which were filed as exhibits to the Schedule TO. Pursuant to

General Instruction F to Schedule TO, the information contained in the Prospectus and the Letter of Transmittal, including any

prospectus supplement or other supplement thereto related to the Offer hereafter filed with the SEC by IEG Holdings, is hereby

expressly incorporated into this Schedule TO by reference in response to Items 1 through 11 of the Schedule TO and is supplemented

by the information specifically provided for in this Schedule TO.

Amendment

to the Schedule TO

Items

1 through 11.

All

information contained in the Offer to Exchange and the related Letter of Transmittal, and any prospectus supplement or other supplement

thereto related to the Offer, is expressly incorporated herein by reference with respect to Items 1-11 of the Schedule TO, except

that such information is hereby amended and supplemented to the extent specifically provided herein.

Item

12. Exhibits.

Item

12 of the Schedule TO is amended and supplemented by adding the following:

Exhibit

No.

|

|

Description

|

|

99(a)(8)

|

|

Press

Release of IEG Holdings Corporation dated June 14, 2017.

|

Item

13. Information Required by Schedule 13E-3.

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

|

|

IEG

HOLDINGS CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

Paul Mathieson

|

|

|

Name:

|

Paul

Mathieson

|

|

|

Title:

|

President

and Chief Executive Officer

|

|

|

Date:

|

June

14, 2017

|

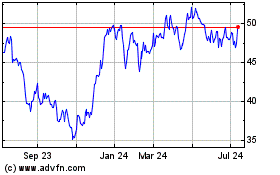

OneMain (NYSE:OMF)

Historical Stock Chart

From Mar 2024 to Apr 2024

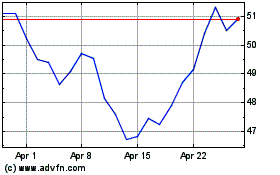

OneMain (NYSE:OMF)

Historical Stock Chart

From Apr 2023 to Apr 2024