Current Report Filing (8-k)

June 14 2017 - 11:25AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

June 12, 2017

PROPHASE

LABS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

0-21617

|

|

23-2577138

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

file

number)

|

|

Identification

No.)

|

621

N. Shady Retreat Road, Doylestown, PA, 18901

(Address

of principal executive offices)

(Registrant’s

telephone number, including area code):

(215) 345-0919

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-2)

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01

Entry into a Material Definitive Agreement.

On

June 12, 2017, ProPhase Labs, Inc. (the “Company”) entered into a Stock Purchase Agreement (each a

“Purchase Agreement,” and, collectively, the “Purchase Agreements”) with each of Mark S. Leventhal, a

former director of the Company, and other persons and entities associated and/or affiliated with Mr. Leventhal (collectively

the “Leventhal Holders”), pursuant to which the Company, at the closing on June 13, 2017, purchased all 1,061,980

shares (the “Shares”) of common stock, par value $0.0005 per share, of the Company (the “Common

Stock”) then held by the Leventhal Holders, representing an approximate 6.2% aggregate ownership interest in the

Company (based on 17,221,776 shares of Common Stock outstanding as of June 12, 2017). Upon consummation of the transactions

contemplated by the Purchase Agreements, the Leventhal Holders ceased to hold any direct or indirect ownership interest in

the Company. Additionally, the Company’s number of shares of Common Stock outstanding decreased 1,061,980 from

17,221,776 to 16,159,796 as of June 13, 2017.

Pursuant

to the terms of the Purchase Agreements, the total consideration paid by the Company to the Leventhal Holders for the Shares was

$1,858,465, which amount was equal to the product of (i) $1.75 multiplied by (ii) the number of Shares.

The

Purchase Agreements contain customary representations, warranties and covenants therein. The assertions embodied in those representations

and warranties were made for purposes of the Purchase Agreements and are subject to qualifications and limitations agreed to by

the respective parties in connection with negotiating the terms of the Purchase Agreements. In addition, certain representations

and warranties made as of a specified date may be subject to a contractual standard of materiality different from what might be

viewed as material to stockholders, or may have been used for the purpose of allocating risk between the respective parties rather

than establishing matters as facts. For the foregoing reasons, no person should rely on the representations and warranties as

statements of factual information at the time they were made or otherwise.

The

foregoing summary of the Purchase Agreements does not purport to be complete and is qualified in its entirety by reference to

the Purchase Agreements, which are attached hereto as Exhibits 10.1, 10.2, 10.3 and 10.4 and are incorporated herein by reference.

Item 7.01

Regulation FD Disclosure.

June

13, 2017, the Company issued a press release announcing the transactions described in Item 1.01 of this Current Report on Form

8-K and providing a stockholder update. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K.

The

information in this Item 7.01 and Exhibits 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, nor shall it be incorporated by reference in any registration statement filed under the Securities

Act of 1933, as amended, unless specifically identified therein as being incorporated by reference therein.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and Mark S. Leventhal.

|

|

|

|

|

|

10.2

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and Mark S. Leventhal and Donna R. Leventhal.

|

|

|

|

|

|

10.3

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and The Mark S. and Donna R. Family Foundation,

Inc.

|

|

|

|

|

|

10.4

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and The Bonnybrook Trust.

|

|

|

|

|

|

99.1

|

|

Press

Release dated June 13, 2017

|

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ProPhase

Labs, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Ted Karkus

|

|

|

|

Ted

Karkus

|

|

|

|

Chairman

of the Board, Chief Executive Officer and Director

|

Date:

June 14, 2017

Exhibits

Index

|

No.

|

|

Description

|

|

10.1

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and Mark S. Leventhal.

|

|

|

|

|

|

10.2

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and Mark S. Leventhal and Donna R. Leventhal.

|

|

|

|

|

|

10.3

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and The Mark S. and Donna R. Family Foundation,

Inc.

|

|

|

|

|

|

10.4

|

|

Stock

Purchase Agreement, dated June 12, 2017, by and between ProPhase Labs, Inc. and The Bonnybrook Trust.

|

|

|

|

|

|

99.1

|

|

Press

Release dated June 13, 2017

|

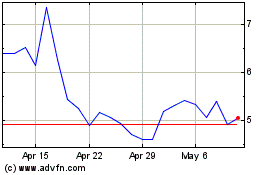

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

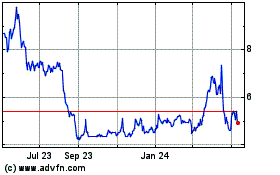

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Apr 2023 to Apr 2024