Item 1.01.

Entry into a Material Definitive Agreement

On June 12, 2017, NRG Energy, Inc. (“NRG”) entered into a restructuring support and lock-up agreement (as amended, supplemented or modified from time to time, the “RSA”) with GenOn Energy, Inc. (“GenOn”), GenOn Americas Generation, LLC (“GAG”), certain of GenOn’s and GAG’s directly and indirectly-owned subsidiaries (collectively with GenOn and GAG, the “GenOn Entities”), but not including GenOn Mid-Atlantic, LLC, an indirect and wholly-owned subsidiary of GenOn and GAG, certain holders representing greater than 93% in aggregate principal amount of GenOn’s outstanding senior unsecured notes (the “GenOn Notes”) and certain holders representing greater than 93% in aggregate principal amount of GAG’s outstanding senior unsecured notes (the “GAG Notes”) signatory thereto (collectively, the “Consenting Holders”). All capitalized terms not defined in this description of the RSA shall have the meanings ascribed to such terms in the RSA.

The RSA sets forth, subject to certain conditions, the commitments of NRG, the GenOn Entities, and the Consenting Holders to support certain restructuring and recapitalization transactions with respect to the GenOn Entities’ capital structure (including the GenOn Entities’ respective obligations under the GenOn Notes, the GAG Notes, and the credit agreement, dated as of December 14, 2012, by and among GenOn, NRG Americas, Inc., a subsidiary of GenOn, the guarantors party thereto, and NRG, as administrative agent and a lender (as amended, the “Intercompany Secured Revolver”)) (such transactions, the “Restructuring”). The Restructuring will be effectuated through a prearranged plan of reorganization (the “Plan”) to be filed in connection with voluntary cases commenced by the GenOn Entities under chapter 11 of title 11 (the “Chapter 11 Cases”) of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), as described below. The RSA, and the Plan contemplated thereby, will implement a comprehensive restructuring that, among other things, is expected to delever the GenOn Entities’ balance sheet by approximately $1.75 billion, facilitate GenOn’s transition to a standalone power generation company, and consensually resolve potential claims the GenOn Entities may have against NRG in connection with, among other things, the services agreement, dated as of December 20, 2012 (the “Shared Services Agreement”), by and between NRG and GenOn.

Certain principal terms of the RSA and the Restructuring contemplated thereby are outlined below:

·

Shared Services Agreement

. NRG will allow for and facilitate a transition of shared services to a third party services provider, but will continue to provide such services during the transition period as follows: (1) NRG will provide GenOn with transition services at a rate of $84 million on an annualized basis during the pendency of the Chapter 11 Cases; and (2) if the Settlement is approved by the Bankruptcy Court, NRG will provide GenOn with (i) shared services at no charge for two months post-emergence and (ii) an option for up to two, one-month extensions for transition services at an annualized rate of $84 million post-emergence. In addition, if the Settlement is approved by the Bankruptcy Court, GenOn will retain a $27 million credit against amounts owed to NRG for the post-petition period under the current shared services agreement, provided that to the extent GenOn has paid for services during the bankruptcy proceedings and the aforementioned credit has not been applied in full, NRG shall, upon request by GenOn, reimburse such payments in cash up to the amount of any unused portion of the credit.

·

NRG Settlement Terms

. In exchange for full releases from GenOn, GAG and the Consenting Holders, NRG will provide settlement consideration of: (a) $261.3 million in cash; (b) continued and amended shared services as set forth above; (c) retention of certain historic pension liabilities under the existing NRG pension plans (including payment of approximately $13.2 million of 2017 pension contributions due on account of GenOn employees); and (d) other consideration in varying forms. In addition, NRG will consent to the cancellation of its equity interests in GenOn and will be entitled to the related worthless stock deduction for federal income tax purposes, provided that the Plan will provide for the implementation of an exit structure in a manner that resolves any material adverse tax consequences to reorganized GenOn or its subsidiaries or any entities established by the creditors of GenOn to acquire the assets of GenOn. The RSA will be subject to termination in the event the GenOn Entities, the committee of certain Consenting Holders of GenOn Notes (the “GenOn Steering Committee”), and NRG fail to reach agreement on a proposal to address any material adverse impact of the worthless stock deduction by the earlier of (i) the date of entry of the Disclosure Statement Order and (ii) October 15, 2017.

2

·

Cooperation Agreement

. The GenOn Entities, NRG and the GenOn Steering Committee will enter into a cooperation agreement, pursuant to which (i) as it relates to certain projects on GenOn and GAG properties, the Consenting Holders, NRG and the GenOn Entities will cooperate in good faith to maximize the value of such assets and to ensure that adjacent projects will not be materially adversely impacted by the economic implications of any such projects and (ii) NRG will provide “make-whole payments” to compensate certain owners of such assets from any economic losses suffered as a result of such projects to the extent provided in the existing Shared Facilities Agreement. NRG will represent in the Settlement Agreement that there will be no such material adverse impact as a result of the completion of certain projects, subject to the Consenting Holders’ right to terminate the RSA if such representation cannot be made, after an opportunity for NRG to cure.

·

Letter of Credit Facility

. NRG shall provide the GenOn Entities with a fully cash collateralized letter of credit facility (the “LC Facility”) in an amount not to exceed $330 million. The LC Facility will be used for the issuance of new and replacement letters of credit following commencement of the Chapter 11 Cases for hedging, regulatory and other credit support needs of the GenOn Entities; provided nothing shall preclude the GenOn Entities from obtaining one or more LC Facilities from a third party, in addition to or in replacement of any LC Facility provided by NRG, which, together with any LC Facility provided by NRG, shall not exceed $330 million.

·

Exit Financing

. As more fully described below, reorganized GenOn and, subject to certain exceptions, the wholly-owned material subsidiaries of reorganized GenOn will enter into exit financing (the “Exit Financing”) consisting of (i) a senior secured revolving credit facility to be provided to the extent necessary to fund the reorganized GenOn Entities’ working capital and other operational needs (the “Exit Credit Facility”) with the commercial lending institutions providing such Exit Credit Facility (the “Lender Parties”) and (ii) an issuance of secured notes in an aggregate principal amount of up to $900,000,000 (the “New Notes”). Certain Consenting Noteholders will have the right, but not the obligation, to purchase a share of New Notes in an offering (the “Notes Offering”) to be conducted in accordance with certain procedures (the “Notes Offering Procedures”) to be agreed by GenOn and certain Consenting Holders committing to “backstop” the Notes Offering (such parties, the “Backstop Parties”), pursuant to that certain backstop commitment letter (the “Backstop Commitment Letter”) entered into contemporaneously with the RSA. GenOn will offer these rights to certain Backstop Parties and to holders of GenOn Notes that are either “accredited investors” within the meaning of Rule 501(a) of the Securities Act of 1933 (the “Securities Act”) or “qualified institutional buyers” within the meaning of Rule 144A of the Securities Act (collectively, the “Rights Recipients”). The aggregate principal amount of New Notes to be issued in the Notes Offering may be reduced by the amount of certain non-ordinary course asset sales by reorganized GenOn and its subsidiaries or as mutually agreed by GenOn and certain of the Backstop Parties. The final terms and conditions of the Exit Financing will be subject to the Notes Offering Procedures and definitive documents acceptable to the GenOn Entities, the Backstop Parties, and the Lender Parties, as applicable.

·

GenOn Noteholders

. Holders of GenOn Notes will receive (i) 100% of the equity of reorganized GenOn, together with the other consideration contemplated by the Plan, subject to dilution by the management incentive plan to be adopted by reorganized GenOn upon emergence, (ii) if such noteholder has executed the RSA (except as otherwise determined by the GenOn Entities in their sole discretion), such noteholder’s pro rata portion of (a) a cash payment of approximately $75 million and (b) such other cash for distribution as agreed to by the GenOn Entities and the GenOn Steering Committee, and (iii) subject to certain eligibility restrictions, rights to participate pro rata in the offering of the New Notes.

·

GAG Noteholders

. Holders of GAG Notes will receive (i) cash in the amount of $920 per $1,000 principal amount of such GAG Notes, plus accrued and unpaid interest through the date of the initial bankruptcy petition filing and (ii) if such noteholder has executed the RSA (except as otherwise determined by the GenOn Entities in their sole discretion), such noteholder’s pro rata portion of (a) a cash payment of approximately $14.1 million and (b) beginning on the date that is 180 days following the Petition Date, liquidated damages accruing at an annual rate of 6% of the aggregate principal amount of GAG Notes outstanding

plus

accrued interest as of the Petition Date.

3

The RSA requires the GenOn Entities, NRG and the Consenting Holders to support the Restructuring and the consummation of the Plan. The obligations include, among others: (i) voting all held claims in favor of the Plan; (ii) negotiating in good faith additional documentation to implement the Restructuring and the Plan; (iii) supporting the GenOn Entities in obtaining various court approvals, including with respect to the Settlement and the LC Facility to be provided; (iv) not supporting or participating in alternative transactions and/or restructurings of the GenOn Entities; and (v) supporting certain releases, exculpation, injunction, and discharge provisions.

Pursuant to the RSA, the GenOn Entities agreed not to directly or indirectly object to, delay, impede, or take any other action to interfere with or delay the acceptance, implementation, or consummation of the Restructuring; provided that nothing in the RSA shall require the GenOn Entities, nor any of the GenOn Entities’ directors, managers, and officers, to take or refrain from taking any action (including, without limitation, terminating the RSA pursuant to the terms and conditions thereof) to the extent such person or persons determines based on advice of counsel that taking such action, or refraining from taking such action, as applicable, would be inconsistent with applicable law or his or her fiduciary obligations under applicable law.

The RSA includes the following milestones, among others:

·

The GenOn Entities shall file the Plan, the Disclosure Statement, and the motion to approve the Disclosure Statement no later than 15 days after the Petition Date.

·

The GenOn Entities shall commence, subject to the availability of the Bankruptcy Court, a hearing on approval of the Disclosure Statement Order and the Notes Offering Approval Order no later than 60 days after the Petition Date, and the Bankruptcy Court shall have entered the Disclosure Statement Order and the Notes Offering Approval Order no later than 90 days after the Petition Date.

·

The GenOn Entities shall commence, subject to the availability of the bankruptcy court, a hearing on confirmation of the Plan and entry of the Confirmation Order, which shall also be an order approving the Settlement and the Settlement Agreement, to be held on a date that is no later than 60 days after entry of the Disclosure Statement Order, and the bankruptcy court shall have entered the Confirmation Order no later than 150 days after the Petition Date.

·

The effective date of the Plan shall have occurred no later than the earlier of (a) 15 days after entry of the Confirmation Order, and (b) 180 days after the Petition Date; provided, that, if regulatory approvals associated with the Restructuring remain pending as of such date, the effective date of the Plan shall have occurred no later than the earlier of (y) 45 days after entry of the Confirmation Order, and (z) 210 days after the Petition Date.

The RSA may be terminated upon the occurrence of certain events, including the failure to meet the milestones included therein, and in the event of certain breaches by the parties under the RSA. The RSA shall terminate automatically upon the effective date of the Plan. There can be no assurances the Restructuring will be consummated.

The information in this Form 8-K is not intended to be, and should not in any way be construed as, a solicitation of votes on the Plan, nor should the information contained herein or in the RSA be relied on for any purpose with respect to the Plan.

Special Redemption of Senior Secured First Lien Financing

Pursuant to the RSA, GenOn caused Remote Escrow Finance Vehicle LLC to exercise the special mandatory redemption of its recent offering of $550 million in aggregate principal amount of the 10.500% Senior Secured First Lien Notes due 2022.

The foregoing description of the RSA does not purport to be complete and is qualified in its entirety by reference to the complete text of the RSA, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

4

Backstop Commitment Letter

Pursuant to the Backstop Commitment Letter, the GenOn Entities and the Backstop Parties agreed to the terms and conditions upon which the Backstop Parties are willing to “backstop” the Notes Offering. The Backstop Parties have committed to purchase, subject to the terms and conditions set forth in the Backstop Commitment Letter, all of the New Notes not purchased by the Rights Recipients in the Notes Offering. The Backstop Commitment Letter further provides that the GenOn Entities and the Backstop Parties will negotiate in good faith the terms and conditions of the New Notes and the Notes Offering Procedures. The Backstop Commitment Letter is subject to termination upon the occurrence of certain events, including, among others, the termination of the RSA.

The foregoing description of the Backstop Commitment Letter does not purport to be complete and is qualified in its entirety by reference to the complete text of the Backstop Commitment Letter, which is attached hereto as Exhibit 10.2 and incorporated by reference herein.

Backstop Fee Letter

Contemporaneously with the entry into the Backstop Commitment Letter and the RSA, the GenOn Entities entered into the backstop fee letter (the “Backstop Fee Letter”) with the Backstop Parties. Pursuant to the Backstop Fee Letter, as consideration for the commitments and agreements of the Backstop Parties under the Backstop Commitment Letter, the GenOn Entities agreed to pay each Backstop Party its pro rata portion of the backstop fees described in the Backstop Fee Letter.

The foregoing description of the Backstop Fee Letter does not purport to be complete and is qualified in its entirety by reference to the complete text of the Backstop Fee Letter, which is attached hereto as Exhibit 10.3 and incorporated by reference herein.

Item 1.03.

Bankruptcy or Receivership.

On June 14, 2017, the GenOn Entities commenced the Chapter 11 Cases by filing voluntary petitions for relief (the “Bankruptcy Petitions”) under the Bankruptcy Code in the Bankruptcy Court. Subject to approval by the Bankruptcy Court, the GenOn Entities will continue in possession of their properties and will manage their businesses, as debtors in possession, in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. Through the Chapter 11 Cases, the GenOn Entities will seek to implement the Plan contemplated by the RSA described above in Item 1.01.

The GenOn Entities’ Chapter 11 Cases are being administered under the caption

In Re GenOn Energy, Inc.

, Case No. 17-33695. Additional information is available at the GenOn Entities’ restructuring website: http://dm.epiq11.com/genon. The information on the GenOn Entities’ restructuring website is not incorporated by reference in this Current Report on Form 8-K.

Item 2.04.

T

riggering Events That Accelerate or Increase a Direct Financial Obligation under an Off-Balance Sheet Arrangement.

The filing of the Bankruptcy Petitions described in Item 1.03 above constitutes an event of default by the GenOn Entities under the following debt instruments (collectively, the “Debt Documents”):

1.

The Intercompany Secured Revolver;

2.

The indenture governing the GenOn 7.875% Senior Notes due 2017 (as amended or supplemented from time to time);

3.

The indenture governing the GenOn 9.500% Notes due 2018 (as amended or supplemented from time to time);

4.

The indenture governing the GenOn 9.875% Notes due 2020 (as amended or supplemented from time to time);

5.

The indenture governing the GAG 8.50% Senior Notes due 2021 (as amended or supplemented from time to time); and

6.

The indenture governing the GAG 9.125% Senior Notes due 2031 (as amended or supplemented from time to time).

The Debt Documents set forth in 1-4 above provide that as a result of the commencement of the Chapter 11 Cases the principal and accrued interest due thereunder is immediately due and payable. The Debt Documents set forth in 5-6 above provide that as a result of the commencement of the Chapter 11 Cases the applicable indenture trustee or certain holders of the notes may declare the principal and accrued interest due thereunder to be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Documents are

5

automatically stayed as a result of the commencement of the Chapter 11 Cases and the holders’ rights of enforcement in respect of the Debt Documents are subject to the applicable provisions of the Bankruptcy Code.

Cautionary Note Regarding Forward-Looking Information

Certain of the statements included in this Current Report on Form 8-K constitute “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. In particular, they include statements relating to future actions and strategies of NRG, GenOn and their respective subsidiaries. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual performance of NRG, GenOn and their respective subsidiaries may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in NRG’s and GenOn’s reports filed with the SEC.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

|

Exhibit

|

|

Description

|

|

|

|

|

|

10.1

|

|

Restructuring Support and Lock-Up Agreement, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto, NRG Energy, Inc. and the noteholders signatory thereto.

|

|

|

|

|

|

10.2

|

|

Backstop Commitment Letter, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto and the noteholders signatory thereto.

|

|

|

|

|

|

10.3

|

|

Backstop Fee Letter, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto and the noteholders signatory thereto.

|

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

June 14, 2017

|

|

NRG Energy, Inc.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian E. Curci

|

|

|

|

Brian E. Curci

|

|

|

|

Corporate Secretary

|

7

EXHIBIT INDEX

|

Exhibit

No.

|

|

Document

|

|

|

|

|

|

10.1

|

|

Restructuring Support and Lock-Up Agreement, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto, NRG Energy, Inc. and the noteholders signatory thereto.

|

|

|

|

|

|

10.2

|

|

Backstop Commitment Letter, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto and the noteholders signatory thereto.

|

|

|

|

|

|

10.3

|

|

Backstop Fee Letter, dated as of June 12, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, the subsidiaries signatory thereto and the noteholders signatory thereto.

|

8

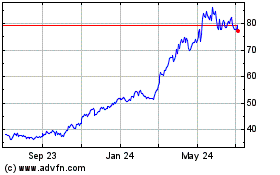

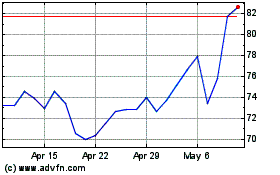

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024