Newell Brands (NYSE: NWL) announced it will reaffirm its fiscal

year 2017 outlook, as provided in its first quarter 2017 earnings

press release dated May 8, 2017, during its presentation tomorrow

at the Deutsche Bank Global Consumer Conference in Paris,

France.

The company is reaffirming its full year 2017 guidance as

follows:

2017 Full Year

Outlook

Net sales

$14.52bn to $14.72bn

Net sales growth

9.5% to 11.0%

Core sales growth

2.5% to 4.0%

Normalized earnings per share

$3.00 to $3.20

Chief Executive Officer Michael Polk will present tomorrow, June

15, 2017 at 8:00 a.m. EDT (2:00 p.m. CEST). The presentation will

be webcast live and may be accessed by selecting Events &

Presentations from the Investor Relations tab of the Newell Brands

website at www.newellbrands.com. The webcast will be archived and

available for replay following the live presentation.

About Newell Brands

Newell Brands (NYSE: NWL) is a leading global consumer goods

company with a strong portfolio of well-known brands, including

Paper Mate®, Sharpie®, Dymo®, EXPO®, Parker®, Elmer’s®, Coleman®,

Jostens®, Marmot®, Rawlings®, Oster®, Sunbeam®, FoodSaver®, Mr.

Coffee®, Rubbermaid Commercial Products®, Graco®, Baby Jogger®,

NUK®, Calphalon®, Rubbermaid®, Contigo®, First Alert®, Waddington

and Yankee Candle®. For hundreds of millions of consumers, Newell

Brands makes life better every day, where they live, learn, work

and play.

This press release and additional information about Newell

Brands are available on the company’s website,

www.newellbrands.com.

Non-GAAP Financial

Measures

This release contains non-GAAP financial measures within the

meaning of Regulation G promulgated by the Securities and Exchange

Commission and includes a reconciliation of these non-GAAP

financial measures to the most directly comparable financial

measures calculated in accordance with GAAP.

The company uses certain non-GAAP financial measures that are

included in this press release and the additional financial

information both in explaining its results to stockholders and the

investment community and in its internal evaluation and management

of its businesses. The company’s management believes that these

non-GAAP financial measures and the information they provide are

useful to investors since these measures (a) permit investors to

view the company’s performance using the same tools that management

uses to evaluate the company’s past performance, reportable

business segments and prospects for future performance and (b)

determine certain elements of management’s incentive

compensation.

The company’s management believes that core sales provides a

more complete understanding of underlying sales trends by providing

sales on a consistent basis as it excludes the impacts of

acquisitions (other than the Jarden acquisition), planned or

completed divestitures, the deconsolidation of the company’s

Venezuelan operations and changes in foreign currency from

year-over-year comparisons. As reflected in the Core Sales

Analysis, the effect of foreign currency on reported sales is

determined by applying a fixed exchange rate, calculated as the

12-month average in the prior year, to the current and prior year

local currency sales amounts (excluding acquisitions and

divestitures), with the difference in these two amounts being the

increase or decrease in core sales, and the difference between the

change in as reported sales and the change in constant currency

sales reported as the currency impact. The company’s management

believes that “normalized” gross margin, “normalized” SG&A

expense, “normalized” operating income, “normalized” earnings per

share, “normalized” interest and “normalized” tax rates, which

exclude restructuring and other expenses and one-time and other

events such as costs related to certain product recalls, the

extinguishment of debt, certain tax benefits and charges,

impairment charges, pension settlement charges, discontinued

operations, costs related to the acquisition, integration and

financing of acquired businesses, amortization of intangible assets

associated with acquisitions (beginning in the second quarter of

2016), advisory costs for process transformation and optimization

initiatives, costs of personnel dedicated to integration activities

and transformation initiatives under Project Renewal and certain

other items, are useful because they provide investors with a

meaningful perspective on the current underlying performance of the

company’s core ongoing operations.

The company determines the tax effect of the items excluded from

normalized diluted earnings per share by applying the estimated

effective rate for the applicable jurisdiction in which the pre-tax

items were incurred, and for which realization of the resulting tax

benefit, if any, is expected. In situations in which an item

excluded from normalized results impacts income tax expense, the

company uses a “with” and “without” approach to determine

normalized income tax expense.

While the company believes that these non-GAAP financial

measures are useful in evaluating the company’s performance, this

information should be considered as supplemental in nature and not

as a substitute for or superior to the related financial

information prepared in accordance with GAAP. Additionally, these

non-GAAP financial measures may differ from similar measures

presented by other companies.

Reconciliation of

Non-GAAP Financial Measures

Reconciliation of the 2017 core sales growth outlook is as follows:

Year Ending

December 31, 2017

Estimated net sales growth (GAAP) 9.5% to 11.0% Less: Pre-closing

Jarden sales included in pro forma base [1] -18.1% Add: Unfavorable

foreign exchange 1.5% to 2.0% Add: Divestitures, net of

acquisitions [2] 9.6% to

9.1% Core Sales Growth, Adjusted Pro Forma 2.5% to 4.0%

[1] Adjusted pro forma reflects Jarden sales from January 1,

2016 to April 15, 2016.

[2] Acquisitions exclude net sales until the one year

anniversary of their respective dates of acquisition, and are

comprised of Sistema, Smith Mountain Industries, GUD, Bond, and

Touch Industries. Divestitures include both actual and planned

divestitures comprised of the Levolor and Kirsch window coverings

brands ("Décor"),which the Company divested in June 2016, the Tools

(excluding Dymo® industrial labeling) and Rubbermaid® Consumer

Storage businesses, which the Company divested in March 2017; and

the Lehigh, Fire Building and Teutonia businesses, which the

Company completed in the second quarter 2017; as well as the

planned divestitures of businesses currently held for sale

including two winter sports units, V�lkl® and K2®, and the

Humidifiers and Fans business, and the planned exit of a

distribution agreement with Sprue Aegis.

As of April 15, 2016, Newell Brands core sales include pro forma

core sales associated with the Jarden transaction as if the

combination occurred April 15, 2015. Core sales exclude the impact

of foreign currency, acquisitions (other than the Jarden

acquisition) until their first anniversary, and planned and

completed divestitures. Beginning with the second quarter of 2016,

the company is excluding the amortization of intangible assets

associated with acquisitions from its calculation of normalized

earnings per share.

The company has presented forward-looking statements regarding

normalized earnings per share for 2017, which is a non-GAAP

financial measure. This non–GAAP financial measure is derived by

excluding certain amounts, expenses or income from the

corresponding financial measure determined in accordance with GAAP.

The determination of the amounts that are excluded from this

non-GAAP financial measures is a matter of management judgment and

depends upon, among other factors, the nature of the underlying

expense or income amounts recognized in a given period. We are

unable to present a quantitative reconciliation of the

aforementioned forward-looking non-GAAP financial measure to its

most directly comparable forward-looking GAAP financial measure

because such information is not available and management cannot

reliably predict all of the necessary components of such GAAP

measure without unreasonable effort or expense. The unavailable

information could have a significant impact on the company's full

year 2017 GAAP financial results.

Caution Concerning Forward-Looking

Statements

Statements in this press release that are not historical in

nature constitute forward-looking statements. These forward-looking

statements relate to information or assumptions about the effects

of sales, income, earnings per share, operating income, operating

margin or gross margin improvements or declines, Project Renewal,

capital and other expenditures, cash flow, dividends, restructuring

and other project costs, costs and cost savings, inflation or

deflation, particularly with respect to commodities such as oil and

resin, debt ratings, changes in exchange rates, expected benefits

and financial results from the Jarden acquisition and other

recently completed acquisitions and related integration activities

and planned divestitures and management's plans, projections and

objectives for future operations and performance. These statements

are accompanied by words such as "anticipate," "expect," "project,"

"will," "believe," "estimate" and similar expressions. Actual

results could differ materially from those expressed or implied in

the forward-looking statements. Important factors that could cause

actual results to differ materially from those suggested by the

forward-looking statements include, but are not limited to, our

dependence on the strength of retail, commercial and industrial

sectors of the economy in light of the continuation of challenging

economic conditions, particularly outside of the United States;

competition with other manufacturers and distributors of consumer

products; major retailers’ strong bargaining power and

consolidation of our customers; our ability to improve

productivity, reduce complexity and streamline operations; our

ability to develop innovative new products and to develop, maintain

and strengthen its end-user brands, including the ability to

realize anticipated benefits of increased advertising and promotion

spend; risks related to the substantial indebtedness that we have

incurred in connection with the Jarden acquisition; risks related

to a potential increase in interest rates; our ability to complete

planned acquisitions and divestitures; difficulties integrating

Jarden and other acquisitions and unexpected costs or expenses

associated with acquisitions; changes in the prices of raw

materials and sourced products and our ability to obtain raw

materials and sourced products in a timely manner from suppliers;

the risks inherent in our foreign operations, including currency

fluctuations, exchange controls and pricing restrictions; a failure

of one of our key information technology systems or related

controls; future events that could adversely affect the value of

our assets and require impairment charges; United States and

foreign regulatory impact on our operations including environmental

remediation costs; the potential inability to attract, retain and

motivate key employees; the imposition of tax liabilities greater

than our provisions for such matters; product liability, product

recalls or regulatory actions; our ability to protect its

intellectual property rights; changes to our credit ratings;

significant increases in the funding obligations related to our

pension plans due to declining asset values, declining interest

rates or otherwise; and those factors listed in our filings with

the Securities and Exchange Commission (including the information

set forth under the caption “Risk Factors” in the Company’s Annual

Report on Form 10-K). Changes in such assumptions or factors could

produce significantly different results. The information contained

in this news release is as of the date indicated. The company

assumes no obligation to update any forward-looking statements

contained in this news release as a result of new information or

future events or developments.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170614005092/en/

Newell BrandsInvestors:Nancy O’Donnell, +1-770-418-7723Vice

President, Investor

Relationsnancy.odonnell@newellco.comorMedia:Jason Anthoine, APR,

+1-201-610-6768Vice President, Corporate

Communicationsjason.anthoine@newellco.comorWeber ShandwickLiz

Cohen, +1-212-445-8044liz.cohen@webershandwick.com

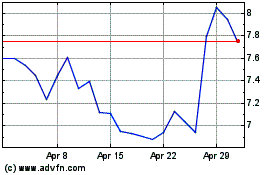

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

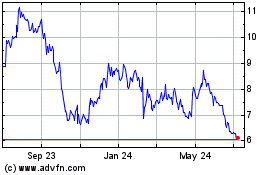

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Apr 2023 to Apr 2024