Ares Management Funds and TruAmerica Multifamily Acquire 240-Unit Apartment Community in Phoenix for $31 Million

June 13 2017 - 6:02PM

Business Wire

Funds managed by Ares Management, L.P. (NYSE:ARES) and

TruAmerica Multifamily announced today the acquisition of

Broadstone Gateway, a 240-unit family community in the Phoenix, AZ

metro area. The transaction was valued at $30.75 million.

Broadstone Gateway is located at 1700 North 103rd Avenue in

Avondale, 20 miles west of downtown Phoenix. Built in 2004, the

pet-friendly, gated community features a mix of one-, two- and

three-bedroom open concept living spaces. Amenities include a

resort-inspired swimming pool and spa with poolside cabanas,

fitness center, community barbecues, bocce ball court and

playground.

This is the second investment for the Ares-TruAmerica joint

venture, which in November acquired a 1,402-unit multifamily

portfolio in Baltimore, MD for $236 million.

“The acquisition of Broadstone Gateway is consistent with our

strategy of investing in multifamily properties that have

repositioning potential and where our expertise can add meaningful

value,” said Howard Huang, Partner in the Ares Real Estate Group.

“We look forward to continuing to partner with TruAmerica on assets

that can benefit from our collaboration and where we can enhance

the quality of rental properties in desirable markets.”

The partnership will immediately execute a multimillion-dollar

capital improvement program. Changes to the unit interiors will

include new faux-stainless steel appliances, quartz kitchen and

bathroom countertops, wood-style flooring, and new lighting and

plumbing fixtures. Significant improvements will also be made to

the pool area, clubhouse and fitness center, along with new signage

and landscaping to enhance the curb appeal of the property.

The property benefits from its location at the northwestern

corner of Loop 101 and Interstate 10, providing easy access to all

major employment centers in the Phoenix metro area.

“Avondale is an example of the first ring suburban submarket in

which we typically invest and can add meaningful value,” said Noah

Hochman, Senior Managing Director of Capital Markets for TruAmerica

Multifamily. “We look for areas with great schools and a

transportation infrastructure in place that allows residents to

easily commute to jobs in the region.”

With approximately $10 billion in assets under management across

equity and debt strategies as of March 31, 2017, the Ares Real

Estate Group has a significant presence in the multifamily sector.

Over the past decade, Ares’ U.S. equity value-add strategy has

invested in over 31,000 units across its most recent funds.

With the acquisition of Broadstone Gateway, TruAmerica adds 240

units to the 1,567 units it already owns in the greater Phoenix

area. TruAmerica specializes on acquiring and renovating Class B

multifamily properties to create affordable quality rental housing

for middle-income families.

Steve Gebing and Cliff David, Senior Managing Directors in the

Phoenix office of Institutional Property Advisors represented both

parties in the transaction.

About Ares Management, L.P.

Ares Management, L.P. is a publicly traded, leading global

alternative asset manager with approximately $100 billion of assets

under management as of March 31, 2017 and more than 15 offices in

the United States, Europe and Asia. Since its inception in 1997,

Ares has adhered to a disciplined investment philosophy that

focuses on delivering strong risk-adjusted investment returns

throughout market cycles. Ares believes each of its three distinct

but complementary investment groups in Credit, Private Equity and

Real Estate is a market leader based on assets under management and

investment performance. Ares was built upon the fundamental

principle that each group benefits from being part of the greater

whole. For more information, visit www.aresmgmt.com.

About TruAmerica Multifamily

TruAmerica Multifamily is a vertically-integrated, value-add

multifamily investment firm based in Los Angeles. Founded in July

2013 as a joint venture between Robert Hart and The Guardian Life

Insurance Company of America, TruAmerica has been one of the

country's most active multifamily investors and manages a $6.7

billion portfolio of approximately 32,000 units across prime

locations throughout Northern and Southern California, Washington,

Oregon, Colorado, Arizona, Nevada, Utah, Maryland and Florida. For

more information on TruAmerica Multifamily, visit

http://www.truamerica.com or call (424) 325-2750.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170613006548/en/

For Ares Management:Media:Mendel CommunicationsBill Mendel,

212-397-1030bill@mendelcommunications.comorInvestors:Carl Drake,

800-340-6497cdrake@aresmgmt.com

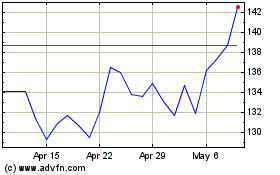

Ares Management (NYSE:ARES)

Historical Stock Chart

From Mar 2024 to Apr 2024

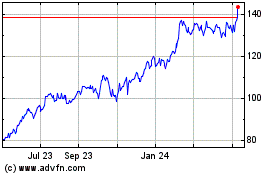

Ares Management (NYSE:ARES)

Historical Stock Chart

From Apr 2023 to Apr 2024