Filed by Teekay Tankers Ltd.

Pursuant to Rule 425 under the

Securities Act of 1933, as amended

Commission File No.:

001-33867

Subject Company: Tanker Investments Ltd.

Date: June 13, 2017

Proposed merger of tnk and til June 1, 2017

(Revised)

Forward Looking Statements This

presentation contains forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) which reflect management’s current views with respect to certain future events and performance, including

statements regarding: the timing and completion of the merger between Teekay Tankers Ltd. (Teekay Tankers, TNK or the Company) and Tanker Investments Ltd. (TIL); the expected benefits of the merger, including the expected impact on the

Company’s earnings per share, financial leverage, liquidity position and fleet age; and the timing, the completion of, and expected benefits of the acquisition of the commercial and technical management operations of Teekay Corporation; crude

oil and refined product tanker market fundamentals, including the balance of supply and demand in the tanker market, the amount of new orders for tankers, the estimated growth in the world tanker fleet, the amount of tanker scrapping, estimated

growth in global oil demand and supply, crude oil tanker demand, and the impact of the new regulations on ballast water treatment; and the effect of OPEC supply cuts on changing trading patterns and increasing U.S. exports, including the impact on

ton-mile demand and mid-size tanker demand. The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in

evaluating any such statement: changes in the production of, or demand for, oil or refined products; changes in trading patterns significantly affecting overall vessel tonnage requirements; greater or less than anticipated levels of tanker

newbuilding orders and deliveries and greater or less than anticipated rates of tanker scrapping; changes in global oil prices; changes in applicable industry laws and regulations and the timing of implementation of new laws and regulations;

increased costs; failure to satisfy the closing conditions of the merger with TIL, including obtaining the required approvals from the Teekay Tankers and TIL shareholders and relevant regulatory authorities; failure to successfully integrate TIL

into the Company and realize the expected benefits and synergies from the combined company; and other factors discussed in Teekay Tankers’ filings from time to time with the United States Securities and Exchange Commission, including its

Report on Form 20-F for the fiscal year ended December 31, 2016. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in

the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

Creates Largest Publicly-Listed Mid-Sized

Tanker Company Strategic Transactions Agreed to a merger with Tanker Investments Ltd. (TIL), adding 18 modern mid-sized vessels to the fleet Includes 13 owned Aframax tankers and three Aframax tankers with charter-in contracts that are scheduled to

expire between September 2017 and March 2021. Also excludes one Aframax tanker that TNK has agreed to sell and is scheduled to be delivered in the second quarter of 2017 20 Suezmax 16 Aframax1 7 LR2 1 VLCC 10 Suezmax 6 Aframax 2 LR2 Combined 62

vessels Conventional Tanker Commercial and Technical Management Operations Acquired Teekay Corporation’s remaining 50% of commercial and technical management operations Completes Evolution into Full Service Conventional Tanker Platform SUEZMAX

RSA AFRAMAX RSA TAURUS LR2 RSA

Merger Highlights Accretive to earnings per

share Increases asset base to $2.4 billion1 Strengthens balance sheet and liquidity position Reduces average fleet age by 1 year Reduces cash breakeven2 by ~$1,000 per day Seamless integration of two homogenous fleets Preliminary pro-forma total

assets at March 31, 2017 Includes operating expense, G&A, interest, debt repayment and dry dock costs

Establishing the World’s Leading

Tanker Brand Acquired and grew global ship-to-ship transfer business Brought ship management in-house Acquisition of remaining 50% of Teekay Operations Control commercial and technical operations Broaden service offering generating new revenue

streams Re-establish operational excellence as hallmark of Teekay brand Goals Actions Rebuild financial strength Liquidity1 of ~$200 million and reduced net debt to capitalization from 72% to 46% between 2015 to Q1-17 Since 2015, acquired 37

Suezmax, Aframax and LR2 tankers while modernizing fleet Consolidate mid-sized tanker segment Generating significant shareholder value Preliminary pro-forma March 31, 2017

Positive Long-Term Supply Outlook Mid-sized

tanker ordering for delivery in 2018 / 2019 is low 2 Suezmax, 13 Aframax newbuild contracts so far in 2017 versus 24 contracts for VLCCs Lack of scrapping in recent years leading to a build-up of potential scrap candidates Impending regulations and

associated CAPEX could boost scrapping Mid-Size Tanker Fleet and Orderbook Profile Scrapping Candidates Source: Clarksons (data as of May 2017) Small mid-size orderbook from 2018 onwards and an aging fleet

Long-Term Growth in Tonne-Mile Demand Note:

Figures in million barrels per day (m/bd) and are changes between 2017-2022 Source: IEA “Market Report Series: Oil 2017” Increasing oil production in traditional Aframax / Suezmax load regions

Fleet Utilization Forecast Down-cycle

through 2017; rebound expected from 2018

APPENDIX

TIL Fleet

All Stock Transaction Details Key

Combination Metrics Preliminary pro-forma 12 months ended December 31, 2016 Preliminary pro-forma March 31, 2017 Net debt is calculated by subtracting cash and cash equivalents from total debt. Net debt to capitalization is calculated by dividing

(a) net debt by the sum of (b) net debt and total equity. FMV adjusted net debt to capitalization is calculated by adjusting capitalization based on estimated fair market value of vessels. These are non-GAAP financial measures. Please refer to

“Definitions and Non-GAAP Financial Measures” which contain definitions of these terms and reconciliations of these non-GAAP financial measures as used in this presentation to the most directly comparable financial measures under United

States generally accepted accounting principles (GAAP). Excluding one Aframax tanker that the Company has agreed to sell and is scheduled to be delivered in the second quarter of 2017 Pre Transaction Post Transaction % Change Change Earnings per

Share 0.40 0.43 1 8% 0.03 Total Assets ($billions) 1.8 2.4 2 31% 0.6 Liquidity ($millions) 86 203 2 135% 117 FMV Adjusted Net Debt to Capitalization 3 69% 66% 2 -3% - Net Debt to Capitalization 3 46% 49% 2 3% - Number of Vessels 4 44 62 41% 18

Average Age (years) 10.5 9.5 -10% -1

This presentation includes financial

measures that are non-GAAP financial measures as defined under the rules of the U.S. Securities and Exchange Commission. These non-GAAP financial measures include Net Debt, Net Debt to Capitalization and FMV Adjusted Net Debt to Capitalization for

both Pre-Transaction and Post-Transaction and are intended to provide additional information and should not be considered a substitute for measures of performance prepared in accordance with GAAP. In addition, these measures do not have standardized

meanings, and may not be comparable to similar measures presented by other companies. The Company believes that certain investors use this information to evaluate the Company’s financial leverage, as does management. The following table

reconciles these measures to the most directly comparable financial measures under United States generally accepted accounting principles (GAAP). The $581.4 million adjustment represents the impact on the Company’s capitalization as if its

vessels were recognized at their estimated fair market value instead of historical carrying value. Net debt is adjusted by including the $309.3 million of net debt of TIL as of March 31, 2017. Capitalization is further adjusted by adding $223.2

million, representing the total equity of TIL as of March 31, 2017 adjusted as if its vessels were recognized at their estimated fair market value instead of historical carrying value. Definitions and Non-GAAP Financial Measures As at March 31, 2017

Net Debt to Capitalization – Pre Transaction TIL (2) Net Debt to Capitalization – Post Transaction FMV Adjusted Net Debt to Capitalization – Pre Transaction TIL (2) FMV Adjusted Net Debt to Capitalization – Post Transaction

Net Debt Total debt 8 45,354 348,795 1,194,149 845,354 348,795 1,194,149 Cash and cash equivalents (47,564) (39,495) (87,059) (47,564) (39,495) (87,059) 797,790 309,300 1,107,090 797,790 309,300 1,107,090 Capitalization Net d ebt 797,790 309,300

1,107,090 797,790 309,300 1,107,090 Total e quity 932,416 223,246 1,155,662 932,416 223,246 1,155,662 FMV a djustment (1) - - - (581,375) - (581,375) 1,730,206 532,546 2,262,752 1,148,831 532,546 1,681,377 Ratio 46% 49 % 69% 66%

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger of TIL and Teekay Tankers. In connection

with the proposed merger, Teekay Tankers intends to file a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC), which will include a joint proxy statement of Teekay Tankers and TIL that also constitutes a

prospectus of Teekay Tankers. After the registration statement is declared effective, Teekay Tankers and TIL will each mail the joint proxy statement/prospectus to its respective shareholders. The joint proxy statement/prospectus will contain

important information about the proposed merger and related matters. SHAREHOLDERS OF TEEKAY TANKERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND

SUPPLEMENTS), CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TEEKAY TANKERS, TIL AND THE MERGER. Shareholders will be able to obtain copies of the joint proxy statement/prospectus and

other relevant materials (when they become available) and any other documents filed with the SEC by Teekay Tankers for no charge at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Teekay Tankers also can be

obtained free of charge on Teekay Tankers’ corporate website at www.teekaytankers.com or by contacting Teekay Tankers’ Investor Relations Department by telephone at (604) 844-6654 or by mail to Teekay Tankers, Attention: Investor

Relations Department, 4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda. Additional Information about the Merger and Where to Find It Participants in the Solicitation This communication is not a solicitation of proxies in

connection with the proposed merger and the proposed amendment to Teekay Tankers’ Amended and Restated Articles of Incorporation (the Charter Amendment). However, Teekay Tankers and its directors and executive officers and certain other

employees may be deemed to be participants in the solicitation of proxies from Teekay Tankers’ shareholders in respect of the proposed merger and Charter Amendment. Information regarding persons who may be deemed participants in the proxy

solicitation, including their respective interests by security holdings or otherwise, will be set forth in the joint proxy statement/prospectus relating to the proposed merger and Charter Amendment when it becomes available and is filed with the

SEC. These documents can be obtained free of charge from the sources indicated above.

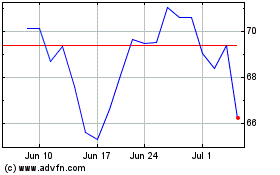

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

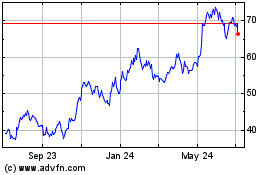

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Apr 2023 to Apr 2024