Filed by the Registrant x

Filed by a Party other than the Registrant

Check the appropriate box:

|

|

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

|

Definitive Proxy Statement

|

|

x

|

|

Definitive Additional Materials

|

|

¨

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

Mastercard Incorporated

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

|

No fee required.

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

June 13, 2017

Re: Mastercard 2017 Annual Meeting of Stockholders (June 27, 2017) Proposal 2

– Advisory Approval of Mastercard’s Executive Compensation

Dear Mastercard Stockholder,

By now you should have received Mastercard’s 2017 Proxy Statement, filed April 28, 2017. (Available here: http://www.ezodproxy.com/mastercard/2017/proxy/HTML1/tiles.htm).

We are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors on all of the proposals included in our Proxy Statement.

In particular, we request your support on Proposal 2 – the annual advisory vote on the compensation paid to our Named Officers (the “Executive Compensation Proposal”)

.

Glass, Lewis & Co., LLC (“Glass Lewis”) has recommended that stockholders vote in favor of our Executive Compensation Proposal. However, for the first time since our first stockholder vote on executive compensation, Institutional Stockholder Services, Inc. (“ISS”) has recommended that stockholders vote against the Executive Compensation Proposal. Glass Lewis and ISS have both previously supported our executive compensation program, and we have also enjoyed a high level of stockholder support for our program, at 94% or above since we began holding stockholder votes on executive compensation in 2011.

This year, although we did not alter our compensation program in any material way, ISS expressed concerns about misalignment in pay-for-performance.

For the following reasons,

we strongly disagree with ISS’s recommendation

:

|

|

|

|

•

|

The fundamental principles and policies of our program

have not

changed

|

|

|

|

|

•

|

We have had strong financial performance during our CEO’s tenure, including in 2016

|

|

|

|

|

•

|

ISS’s analysis is impacted by short-term stock market fluctuations, including the brief rotation out of payments stocks following the US Presidential election

|

Our fundamental compensation principles have not changed

At its core, our compensation policies are designed around three key elements:

(1)

alignment of the interests of our executives with those of our stockholders,

(2)

pay for performance, and (3) competitiveness of total compensation levels to successfully attract and retain executive talent. To ensure consistency around these principles, with the help of its independent compensation consultant, Frederic W. Cook & Co, Inc., the Human Resources & Compensation Committee of our Board (“HRCC”) evaluates various items every year, including the results of the annual executive compensation stockholder vote and feedback from our stockholders during periods of investor and stockholder engagement.

The core components of our annual incentive plan – including the way in which the HRCC establishes targets -- have not changed. The targets disclosed in the Proxy Statement determine the funding levels for the annual incentive pool. These targets can be impacted by foreign exchange rates and significant non-recurring tax items so it is possible that the targets set at the beginning of one year appear to be higher or lower than the prior year’s actuals, depending on these adjustments. At the end of the year, when assessing performance, the HRCC used the various metrics contained in the Corporate Scorecard, as described in the Proxy Statement. The scorecard contains various quantitative and qualitative metrics which are used in determining the corporate score for the actual bonus payments. Our prior proxy statements indicate that the HRCC has consistently paid out well below the funded levels disclosed in our public filings, and last year was no exception. The performance against the rigorous goals and metrics in the scorecard resulted in the corporate score of 120% compared with the funding pool of 200%.

Since we started holding executive compensation votes in 2011, our stockholders have supported our executive compensation program with levels in excess of 94%.

Last year, more than 96% of the votes cast for the executive compensation proposal were in favor of our programs and policies.

In each of these years, executive compensation varied based on the Company’s business performance and where relevant, our stock performance – both of which have been trending positively. As a result, the HRCC decided to maintain the fundamental design of our program for the balance of 2016 and for 2017.

In 2016, the only changes to the executive compensation program were to convert executives’ stock ownership guidelines into ownership requirements. The HRCC also moderately adjusted our peer group to better reflect the changing complexion of our competitive environment, though Mastercard’s relative size rank in the new peer group remained consistent with the rankings at the time of the peer group inception in 2014, with revenue approximating the median and market capitalization above the 75

th

percentile.

We have a history of solid financial performance during our CEO’s tenure

As illustrated in our 2017 Proxy Statement, in 2016, Mastercard had strong financial and operational performance. Key earnings metrics for Mastercard all show year-over-year growth. On a currency-neutral basis, revenue was up 13% year over year, and EPS excluding special items was up 11% (or 19% when normalized for taxes). Refer to Appendix A for the reconciliation of these financial measures to the most directly comparable results under accounting principles generally accepted in the United States (“GAAP”). Over our CEO’s 6.5 year tenure, Mastercard has had solid financial performance. The table below shows our Net Revenue, Adjusted Net Income, and Adjusted Diluted EPS growth rates over the last 3 years, 5 years and since Mr. Ajay Banga became CEO.

|

|

|

|

|

|

|

|

Mastercard Long-Term Financial Performance

|

|

|

3-year

CAGR

|

5-year

CAGR

|

CAGR Since Mr.

Banga became CEO

on July 1, 2010

|

|

Net Revenue

|

9.0%

|

9.9%

|

11.3%

|

|

Adjusted Net Income *

|

9.3%

|

11.5%

|

16.0%

|

|

Adjusted Diluted EPS *

|

13.0%

|

15.1%

|

18.9%

|

* Growth rates exclude special items and do not include any adjustment for changes in foreign

exchange rates. See Appendix A for reconciliations of these Non-GAAP financial measures to

the most directly comparable GAAP financial measures.

Additionally, the table below further details our Total Shareholder Return (TSR) performance, relative to our current peer group and the peer group used by ISS over the last 3 years, 5 years, and since Mr. Banga became CEO of Mastercard.

|

|

|

|

|

|

|

|

Mastercard TSR vs. ISS Peers and Mastercard Peers

|

|

|

3-year TSR CAGR

|

5-year TSR CAGR

|

Absolute TSR Since Mr. Banga became CEO on July 1, 2010

|

|

Mastercard

|

8.1%

|

23.3%

|

546.9%

|

|

50th Percentile of ISS Peers

|

8.4%

|

19.1%

|

283.8%

|

|

Mastercard Percentile

|

46%

|

70%

|

100%

|

|

50th Percentile of MA Peers

|

9.2%

|

18.2%

|

297.6%

|

|

Mastercard Percentile

|

48%

|

79%

|

100%

|

Mastercard has a track record of delivering strong financial performance. In fact,

Mastercard’s TSR performance over Mr. Banga’s tenure as CEO ranks highest amongst both Mastercard’s peer group and ISS’s peer group.

In addition, during Mr. Banga’s time as CEO, our stock price has increased from the $19.95 per share closing price on June 30, 2010 (adjusted for stock splits) to a closing price of $124.76 per share as of June 8, 2017,

a 525% increase

– 547% TSR when including the impact of dividends, providing a significant return to our stockholders. During this time of positive financial, absolute and relative stock price performance and significant stock price appreciation, Mr. Banga’s compensation has of course increased, largely through equity grants tied to our financial performance, but has not outpaced our financial performance by any measure.

The chart below details the compensation increases Mr. Banga has received over his tenure as well as the cumulative TSR over that same time – again, showing that the HRCC has been measured about ensuring compensation remains commensurate with our performance.

ISS’s analysis is impacted by short-term stock market fluctuations

ISS utilizes the TSR of the month end closest to a company’s fiscal year end as part of its analysis. Because our fiscal year end is December 31, the ISS evaluation incorporated a TSR level that was more indicative of post-election market conditions than of Mastercard’s general performance. At the time of the TSR measure used by ISS, there was a significant rotation into bank sector stocks which were more susceptible to the potential impacts of policy changes associated with the new administration. Public reports from industry analysts at the time support this view:

Investors Rotating Too Far Away from MA/V Amidst Political Shift, November 15, 2016

-Barclays (Darrin Peller)

“We see some rotation into yield-sensitive financials as understandable given the potential for an earnings lift and reduced regulatory overhand, but also see the sell-off in certain fin-tech names, particularly V and MA, as overdone.”

“Rotation Improves Relative Valuations on the Networks; Still Favor Visa on Valuation”, December 16, 2016

-Stifel (Christopher C. Brendler, CFA)

“We believe the powerful rotation after Trump’s surprise victory has created a buying opportunity in the network stocks. Since the Election Day close, the S&P 500 is up 5.7% while Visa is -4.1% and MA -1.3%. On the other hand, the S&P Financials are up 18.4% with closest peer AXP (Hold, $74.94) up 11.4%.”

“In our view, the Trump rally has created a compelling opportunity in the network stocks. Although these companies don’t benefit as much as the financials, we like the near-term fundamental outlook amid increasingly attractive relative valuations.”

As evidenced by the analysts’ reports, payment industry stocks such as ours were negatively impacted in the short-term following the election – even though our underlying performance had not changed. Our stock price has since rebounded. On December 30, 2016, our stock price was $103.25 and as of June 8, 2017, was $124.76. By relying on a December 30, 2016 one-time snapshot of our TSR,

the ISS analysis relied on the unusual volatility and short term rotation in the stock market that did not reflect the fundamentals of our business and long-term performance.

As evidenced in our historical performance, including our performance in 2016, our fundamentals remain very strong. Allowing a short term fluctuation in our TSR performance to negate the overwhelmingly positive historical performance does not accurately represent our compensation programs and principles. In addition, our executive compensation programs are intended for long-term performance and should not be adjusted annually to react to short-term market fluctuations.

We strongly encourage our stockholders to vote in favor of our executive compensation programs as we believe they are designed to drive continued growth.

|

|

|

|

|

Sincerely,

|

|

|

|

José Octavio Reyes Lagunes

|

|

Human Resources and Compensation

|

|

Committee Chairman

|

Appendix A

Non-GAAP Reconciliations and the Calculations of Financial Measures

2016 Net Revenue and Diluted EPS Growth

|

|

|

|

|

|

|

|

2016 vs. 2015

|

|

|

YTD Increase/(Decrease)

|

|

|

Net Revenue

|

Diluted EPS

|

|

Non-GAAP - Excluding Special Items, Currency-Neutral, Normalized Taxes

|

13%

|

19%

|

|

Significant Tax Items

1

|

—

|

(7)%

|

|

Non-GAAP - Excluding Special Items, Currency-Neutral

|

13%

|

11%

|

|

Special Items

2

|

—

|

—

|

|

FX

3

|

(1)%

|

(1)%

|

|

GAAP

|

11%

|

10%

|

Note: Figures may not sum due to rounding

|

|

|

|

1.

|

Impact of discrete tax benefits and the tax impact of non-recurring repatriation benefits occurring in 2016 and 2015.

|

|

|

|

|

2.

|

Impact of the U.K. merchant litigation provisions (2016: $117 million pre-tax, $85 million after-tax or $0.08 per diluted share; 2015: $61 million pre-tax, $44 million after-tax or $0.04 per diluted share) and the termination of the U.S. employee pension plan (2015: $79 million pre-tax, $50 million after-tax or $0.04 per diluted share).

|

|

|

|

|

3.

|

Impact of foreign currency for both the translational and transactional impacts.

|

Mastercard Long-term Financial Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAGR

|

|

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

3-Year

|

5-Year

|

Since Mr. Banga became CEO

2

|

|

Net Revenue

|

$

|

5,099

|

|

$

|

5,539

|

|

$

|

6,714

|

|

$

|

7,391

|

|

$

|

8,312

|

|

$

|

9,441

|

|

$

|

9,667

|

|

$

|

10,776

|

|

9.0

|

%

|

9.9

|

%

|

11.3

|

%

|

|

GAAP Net income

|

$

|

1,463

|

|

$

|

1,846

|

|

$

|

1,906

|

|

$

|

2,759

|

|

$

|

3,116

|

|

$

|

3,617

|

|

$

|

3,808

|

|

$

|

4,059

|

|

9.2

|

%

|

16.3

|

%

|

15.7

|

%

|

|

Special Items

1

|

4

|

|

—

|

|

495

|

|

13

|

|

61

|

|

—

|

|

95

|

|

85

|

|

|

|

|

|

Non-GAAP Net income

|

$

|

1,467

|

|

$

|

1,846

|

|

$

|

2,401

|

|

$

|

2,771

|

|

$

|

3,177

|

|

$

|

3,617

|

|

$

|

3,903

|

|

$

|

4,144

|

|

9.3

|

%

|

11.5

|

%

|

16.0

|

%

|

|

GAAP Diluted EPS

|

$

|

1.12

|

|

$

|

1.41

|

|

$

|

1.48

|

|

$

|

2.19

|

|

$

|

2.56

|

|

$

|

3.10

|

|

$

|

3.35

|

|

$

|

3.69

|

|

13.0

|

%

|

20.0

|

%

|

18.6

|

%

|

|

Special Items

1

|

—

|

|

—

|

|

0.39

|

|

0.04

|

|

0.05

|

|

—

|

|

0.08

|

|

0.08

|

|

|

|

|

|

Non-GAAP Diluted EPS

|

$

|

1.12

|

|

$

|

1.41

|

|

$

|

1.87

|

|

$

|

2.20

|

|

$

|

2.61

|

|

$

|

3.10

|

|

$

|

3.43

|

|

$

|

3.77

|

|

13.0

|

%

|

15.1

|

%

|

18.9

|

%

|

|

|

|

|

1.

|

Impact of the 2009 litigation settlements of $7 million pre-tax ($4million after-tax with no impact to diluted EPS), the U.S. Merchant Litigation Settlement (2011: $770 million pre-tax ($495 million after-tax or $0.39 per diluted share); 2012: $20 million pre-tax ($13 million after-tax or $0.01 per diluted share); 2013: $95 million pre-tax ($61 million after-tax or $0.05 per diluted share)); 2015: the termination of the U.S. employee pension plan in $79 million pre-tax ($50 million after-tax or $0.04 per diluted share) and U.K. Merchant Litigation Settlement of $61 million pre-tax ($44 million after-tax or $0.04 per diluted share); 2016: the U.K. Merchant Litigation Settlement $117 million pre-tax ($85 million after-tax or $0.08 per diluted share).

|

|

|

|

|

2.

|

Mr. Banga became CEO effective July 1, 2010. CAGR for the period since Mr. Banga became CEO is calculated using the financial results for the year ended December 31, 2009 as compared to the year ended December 31, 2016.

|

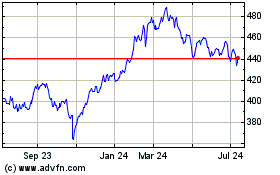

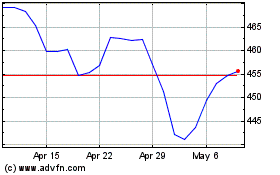

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024