Current Report Filing (8-k)

June 13 2017 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities and Exchange Act of 1934

Date of Report: June 11, 2017

(Date of earliest event reported)

Invitae

Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36847

|

|

27-1701898

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. employer

|

|

incorporation or organization)

|

|

File Number)

|

|

identification number)

|

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On June 11, 2017 (the “Effective

Date”), Invitae Corporation (“Invitae”) entered into a Stock Exchange Agreement (the “Agreement”) with the stockholders named therein (the “Selling Stockholders”) of Ommdom Inc., a Delaware corporation

(“Ommdom”), as well as Jeff Zisk solely in his capacity as agent of the Selling Stockholders, pursuant to which Invitae acquired all of the outstanding capital stock of Ommdom from the Selling Stockholders (the “Acquisition”).

Ommdom develops, commercializes and sells hereditary risk assessment and management software, including CancerGene Connect, a cancer genetic counseling platform. In connection with the Acquisition, Invitae will issue shares of its common stock to

the Selling Shareholders as follows:

|

|

(i)

|

an aggregate of approximately 600,122 shares within 10 business days after the Effective Date, which for each Selling Stockholder represents a pro rata share of an initial share amount being the quotient of (x) the

sum of (A) such Selling Stockholder’s entitlement to accrued dividends if such Selling Stockholder owns shares of Ommdom preferred stock plus (B) such Selling Stockholder’s pro rata percentage of the sum of $6,000,000 plus

or minus certain adjustments (based upon transaction expenses, net working capital, indebtedness and preferred dividends) and minus an aggregate hold-back amount of $600,000, divided by (y) the trailing average share price of Invitae common

stock for the five trading days preceding the Effective Date; and

|

|

|

(ii)

|

on the 12-month anniversary of the Effective Date, an amount of shares equal to the quotient of (x) such Selling Stockholder’s pro rata percentage of the $600,000 hold-back amount divided by (y) the

trailing average share price of Invitae common stock for the five trading days preceding the Effective Date, subject to a potential offset right of Invitae relating to indemnification.

|

The Selling Stockholders (individually and with respect to Ommdom) and Invitae each made certain customary representations, warranties and

covenants in the Agreement. In connection with the closing, each Selling Stockholder agreed to certain non-competition, non-solicitation and non-hire covenants as further described in the Agreement. The Agreement also includes

(x) indemnification obligations in favor of Invitae from the Selling Stockholders, including for breaches of representations, warranties, covenants and agreements made by the Selling Stockholders in the Agreement and (y) indemnification

obligations in favor of the Selling Stockholders from Invitae, including for breaches of representations, warranties, covenants and agreements made by Invitae in the Agreement.

The closing of the Acquisition was not subject to approval by any applicable governmental entity or the approval of the stockholders of

Invitae. As a result of the Acquisition, Ommdom became a wholly owned subsidiary of Invitae.

As of June 9, 2017, there were

42,935,737 shares of Invitae common stock outstanding. As a result of the closing of the Acquisition, the Selling Stockholders will beneficially own (based upon the initial issuance contemplated by clause (i) above, but without reference to the

issuance contemplated by clause (ii) above) approximately 1.4% of the outstanding shares of Invitae common stock.

The shares of

Invitae common stock issued to the Selling Stockholders will be issued in reliance upon the exemption from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended. Each Selling Stockholder made certain representations

as to such Selling Stockholder and that the shares were being acquired for such Selling Stockholder’s own account for investment purposes only and not with a view to, or for sale in connection with, any distribution thereof, and that such

Selling Stockholder could bear the risks of the investment and could hold the shares for an indefinite period of time.

The foregoing

description of the Agreement does not purport to be complete and is qualified in its entirety by reference to a copy of the form of Agreement attached hereto as Exhibit 2.1 and which is incorporated herein by reference.

The Agreement has been included to provide investors and security holders with information regarding its terms. It is not intended to

provide any other factual information about Invitae, Ommdom or the Selling Stockholders. The Agreement contains representations and warranties by the Selling Stockholders and by Invitae, made solely for the benefit of the other. The assertions

embodied in those representations and warranties are qualified by information in confidential disclosure schedules delivered by the Selling Stockholders in connection

2

with the signing of the Agreement. Certain representations and warranties in the Agreement were made as of a specified date, may be subject to a contractual standard of materiality different from

what might be viewed as material to investors, or may have been used for the purpose of allocating risk between the Selling Stockholders and Invitae. Accordingly, the representations and warranties in the Agreement should not be relied on by any

persons as characterizations of the actual state of facts at the time they were made or otherwise. In addition, information concerning the subject matter of the representations and warranties may change after the date of the Agreement, which

subsequent information may or may not be fully reflected in Invitae’s public disclosures.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

The information required to be

disclosed under this Item 2.01 is set forth in Item 1.01 above and is incorporated by reference into this Item 2.01.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information required to be disclosed under this Item 2.03 is set forth in Item 1.01 above and is incorporated by reference into

this Item 2.03.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information required to be disclosed under

this Item 3.02 is set forth in Item 1.01 above and is incorporated by reference into this Item 3.02.

On June 12, 2017, Invitae issued a press release with respect to the

Acquisition. A copy of such press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

2.1@

|

|

Form of Stock Exchange Agreement dated as of June 11, 2017 by and among Invitae Corporation, each of the selling Stockholders listed on Schedule 1 thereto, and the sellers’ agent.

|

|

|

|

|

99.1

|

|

Press release issued by Invitae Corporation on June 12, 2017.

|

|

@

|

The schedules and exhibits to this agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Dated: June 13, 2017

|

|

INVITAE CORPORATION

|

|

|

|

|

|

|

|

By:

|

|

/s/ Thomas R. Brida

|

|

|

|

Name:

|

|

Thomas R. Brida

|

|

|

|

Title:

|

|

General Counsel

|

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

2.1@

|

|

Form of Stock Exchange Agreement dated as of June 11, 2017 by and among Invitae Corporation, each of the selling stockholders listed on Schedule 1 thereto, and the sellers’ agent.

|

|

|

|

|

99.1

|

|

Press release issued by Invitae Corporation on June 12, 2017.

|

|

@

|

The schedules and exhibits to this agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request.

|

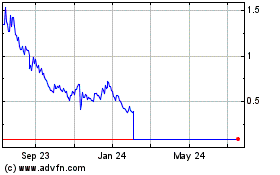

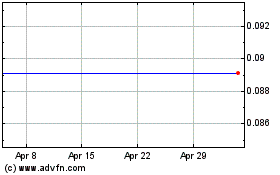

Invitae (NYSE:NVTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Invitae (NYSE:NVTA)

Historical Stock Chart

From Apr 2023 to Apr 2024