Current Report Filing (8-k)

June 12 2017 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 7, 2017

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12235

|

|

51-0347963

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification

No.)

|

|

|

|

|

|

|

|

899 Cassatt Road, Suite 210

|

|

19312

|

|

Berwyn, Pennsylvania

|

|

(Zip Code)

|

|

(Address of principal executive offices)

|

|

|

(610) 251-1000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act. [ ]

Item 8.01 Other Events

On June 7, 2017, the Compensation and Management Development Committee (the “Committee”) of the Board of Directors (the “Board”) of Triumph Group, Inc. (the “Company”) amended the Company’s 2013 Equity and Cash Incentive Plan (the “2013 Plan”) to establish that, in the event of a change in control where outstanding awards are assumed by the surviving entity or substituted in connection with such change in control, the awards issued under the 2013 Plan would not be accelerated single trigger with the change in control, but would only be subject to acceleration if the participant’s employment is terminated within two years after the change in control. In particular, the Committee has amended the 2013 Plan to provide that, in the event of a change in control:

|

|

|

|

•

|

if outstanding awards issued under the 2013 Plan are not assumed by the surviving entity or otherwise equitably converted or substituted in connection with the change in control in a manner approved by the Committee or the Board: (1) outstanding stock options, stock awards and restricted stock units, and other awards in the nature of rights that may be exercised shall become fully exercisable, (2) time-based vesting restrictions on outstanding awards shall lapse, and (3) the payout opportunities attainable under all outstanding performance-based awards shall be deemed to have been fully earned as of the date of the change in control based upon an assumed achievement of all relevant performance goals at actual performance goal achievement; provided that if such actual achievement cannot be determined, then at target level, and paid on a pro rata basis for the portion of the performance period elapsed; and

|

|

|

|

|

•

|

if outstanding awards issued under the 2013 Plan are assumed by the surviving entity or otherwise equitably converted or substituted in connection with a change in control, if within two years after the effective date of the change in control, a participant’s employment is terminated without cause or (subject to the provision of a “good reason” termination right to the participant) the participant resigns for good reason, then (1) all of that participant’s outstanding stock options, stock awards, restricted stock units and other awards in the nature of rights that may be exercised shall become fully exercisable, (2) all time-based vesting restrictions on the participant’s outstanding awards shall lapse, and (3) the payout opportunities attainable under all of such participant’s outstanding performance-based awards shall be earned based on actual performance through the end of the performance period, or if actual performance cannot be determined, at target level.

|

The foregoing description of the amendments to the 2013 Plan is qualified in its entirety by reference to the actual terms of the 2013 Plan, which is attached as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Triumph Group, Inc. 2013 Equity and Cash Incentive Plan, as amended and restated as of June 7, 2017.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date:

|

June 12, 2017

|

TRIUMPH GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John B. Wright, II

|

|

|

|

|

|

John B. Wright, II

|

|

|

|

|

|

Vice President, General Counsel and Secretary

|

TRIUMPH GROUP, INC.

CURRENT REPORT ON FORM 8-K

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Triumph Group, Inc. 2013 Equity and Cash Incentive Plan, as amended and restated as of June 7, 2017.

|

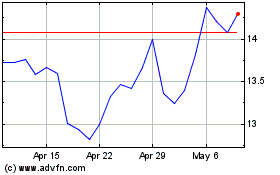

Triumph (NYSE:TGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Apr 2023 to Apr 2024