Current Report Filing (8-k)

June 12 2017 - 6:03AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_____________________

Date of Report

(Date of earliest event reported)

: June 09, 2017

Gulf Island Fabrication, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Louisiana

|

001-34279

|

72-1147390

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

16225 Park Ten Place, Suite 280, Houston, Texas

|

77084

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(713) 714-6100

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On June 9, 2017, Gulf Island Fabrication, Inc. (the “Company”) entered into a $40.0 million Credit Agreement with Whitney Bank, as lender (the “Credit Facility”). The annual interest rates applicable to amounts outstanding under the Credit Facility are (i) for Base Rate Loans, a Base Rate (defined in the Credit Facility) or (ii) for LIBOR Loans, a Base Rate plus 2.0% per annum. In addition, the commitment fee on the undrawn portion of the facility and the letter of credit fee on undrawn stated amounts under letters of credit issued by the lenders are 0.40% per annum and 2.0% per annum, respectively.

The Credit Facility: (i) is secured by substantially all of the Company’s and the guarantors’ assets (other than the assets of Gulf Marine Fabricators, L.P., which are currently held for sale, and all real estate of the Company and the guarantors); (ii) has a term from June 9, 2017 to June 9, 2019; and (iii) may be used for issuing letters of credit and/or general corporate and working capital purposes.

The Company must comply with the following financial covenants each quarter during the term of the facility:

(i) ratio of current assets to current liabilities of not less than 1.25:1.00;

(ii) minimum tangible net worth requirement of at least the sum of (A) $230,000,000, plus (B) an amount equal to 50% of Consolidated Net Income for each fiscal quarter ending after June 30, 2017 (with no deduction for a net loss in any such fiscal quarter except for any gain or loss in connection with the sale of assets by Gulf Marine Fabricators, L.P.), plus (C) 100% of all net proceeds of any issuance of any stock or other equity after deducting of any fees, commissions, expenses and other costs incurred in such offering; and

(iii) ratio of funded debt to tangible net worth of not more than 0.50:1.00.

The total revolving credit availability under the Credit Facility immediately after the consummation of the Credit Facility on June 9, 2017 was $40.0 million. As of June 9, 2017, the Company was in compliance with all covenants contained in the Credit Facility.

The foregoing summary is qualified by the full text of the Credit Facility, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

|

|

|

|

Item 1.02

|

Termination of a Material Definitive Agreement

|

On June 9, 2017, and in connection with the Company’s entrance into the Credit Facility described above, the Company terminated the Tenth Amended and Restated Credit Agreement dated as of December 16, 2016 (the “Terminated Agreement”), by and among the Company, Gulf Island, L.L.C., Dolphin Services, L.L.C., Southport, L.L.C., Gulf Marine Fabricators General Partner, L.L.C., Gulf Marine Fabricators Limited Partner, L.L.C., Gulf Marine Fabricators, L.L.C., Dolphin Steel Sales, L.L.C., Gulf Island Shipyards, L.L.C. and Gulf Marine Fabricators, L.P., the lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent. At the time of the termination, there was approximately $4.6 million of letters of credit outstanding, all of which was cash collateralized by the Company upon termination.

|

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information set forth in Item 1.01 of this Form 8-K is incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Credit Agreement dated June 9, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

GULF ISLAND FABRICATION, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ David S. Schorlemer

|

|

|

|

|

David S. Schorlemer

|

|

|

|

|

Executive Vice President, Chief Financial Officer

|

|

|

|

|

and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

June 9, 2017

|

|

|

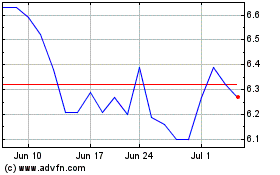

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

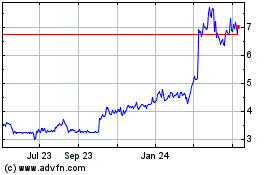

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Apr 2023 to Apr 2024