Exxon Rebuts Allegations it Misled Investors on Climate

June 09 2017 - 4:26PM

Dow Jones News

By Bradley Olson

Exxon Mobil Corp. pushed back on Friday against accusations that

it misled investors on how it accounts for climate-change risks,

saying in a legal filing that the claims by New York's attorney

general are "inflammatory, reckless and false."

The oil giant was responding to a motion filed by New York

Attorney General Eric Schneiderman in state court last week that

seeks to force Exxon to turn over reams of additional documents to

aid the state's ongoing probe of the company. As part of that

motion, Mr. Schneiderman said he had found evidence suggesting that

the way Exxon evaluates the impact of future climate regulations on

its business was a "sham."

Mr. Schneiderman claimed Exxon has used two sets of estimates

for potential future carbon prices -- a public number given to

investors, and another internal figure used privately for

decision-making. That could mislead investors by making Exxon seem

more resilient to potential climate risks than it really is, he

argued.

In its response Friday, Exxon appeared to concede that it has

used varying carbon price figures in the past, but said the numbers

were used for different purposes. One process, the one used in an

oil outlook shared publicly, involved estimates of potential future

carbon costs to assess energy demand and future prices, while

another, the one used internally, related to gauging the

profitability of specific oil and gas projects.

"ExxonMobil's use of different metrics, in different

circumstances, to accomplish different goals evinces prudent

financial stewardship, applying appropriate assumptions in

appropriate cases," Exxon's lead lawyer, Ted Wells of law firm

Paul, Weiss, Rifkind, Wharton & Garrison LLP, wrote in the

brief. "There is nothing untoward or surprising about any of

this."

Mr. Wells reiterated Exxon's claim that the investigation by the

attorney general, a Democrat, is politically motivated, saying he

has been "working backwards from an assumption of Exxon Mobil's

guilt, searching in vain for some theory to support his

prejudgment."

The state "has a substantial basis to suspect that Exxon's proxy

cost analysis may have been a sham," said Amy Spitalnick, a

spokeswoman for Mr. Schneiderman. "This office takes potential

misrepresentations to investors very seriously."

Exxon's arguments underscore the challenge New York's top

prosecutor may face in asserting that the company is guilty of

fraud in how it has accounted for climate risks.

Regulations on such disclosure are in the early stages of being

developed, and many oil-and-gas companies have been slow to make

changes or meet increasing investor demands for transparency on the

subject.

Exxon and Mr. Schneiderman have repeatedly crossed swords over

how Exxon has complied with the investigation's subpoenas. Mr.

Schneiderman has alleged that Exxon is attempting to stall and

delay the progress of the probe.

He has argued that, despite a subpoena issued in late 2015 when

the investigation started, Exxon appears to have permanently

deleted emails used by former Chief Executive Rex Tillerson under

the alias "Wayne Tracker."

New Chief Executive Darren Woods also had an alias account under

the name "J.E. Gray," although he doesn't appear to have used it,

documents in the investigation show.

Exxon has acknowledged that several months of emails from the

alias account of Mr. Tillerson, now U.S. secretary of state, were

inadvertently deleted, but said it was able to recover most of the

requested documents.

The company has submitted nearly 3 million pages of documents

for the investigation and asked the New York court to reject Mr.

Schneiderman's pursuit of additional documents and information.

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

June 09, 2017 16:11 ET (20:11 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

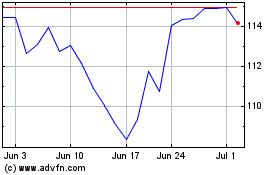

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

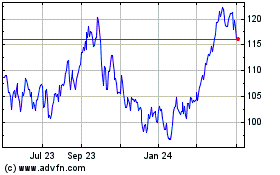

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024