Goldman Sachs Joins Bond ETF Party -- Update

June 08 2017 - 9:47AM

Dow Jones News

By Liz Hoffman

Goldman Sachs Group Inc. launched an exchange-traded fund

Thursday that gives investors a cheap way to invest in corporate

bonds.

The fund, which launches with $50 million, tracks an index of

bonds issued by investment-grade rated companies.

It is one of three new funds Goldman plans to launch in the

coming months that track fixed-income assets, branching out from

traditional ETFs that mostly mirror baskets of stocks. The other

two will focus on emerging-market government debt and riskier,

low-rated corporate bonds, according to recent regulatory

filings.

Bond ETFs have emerged as a lucrative niche on Wall Street in

recent years, promising buyers the steady income of bonds in a

package that is as easy to trade as stocks. The ETF industry is

still dominated by stock products, which account for more than

three-quarters of the roughly $4 trillion in exchange-traded

products, according to BlackRock Inc.

But their growth has sparked concerns from the Securities and

Exchange Commission and others that their popularity, combined with

thin markets for many of the underlying bonds they hold, are a

recipe for trouble during times of market turmoil.

The worry is rooted in the fact that many corporate bonds don't

trade often. So if the bond market declines and ETF investors head

for the exits, fund managers might not be able to meet redemption

requests without further driving down prices, exacerbating a

downturn.

"The obvious risk -- perhaps better labeled the 'liquidity

illusion' -- is that all investors cannot fit through a narrow exit

at the same time, " Bill Gross, the well-known bond investor and

portfolio manager at Janus Henderson, wrote in 2015.

Goldman's fund can invest up to 15% of its assets in illiquid

bonds. These are defined as instruments that couldn't be sold

within seven days at the prices at which Goldman values them,

according to a prospectus filed in March with the SEC.

The Wall Street firm launched its first ETF in 2015 and eight

have gone live so far, part of its effort to grow its

asset-management arm and grab a share of the passive-investing

craze.

The funds have attracted more than $4 billion so far, mostly by

undercutting the competition on price. Most of Goldman's funds are

priced at or slightly less than comparable offerings from low-cost

giants like Vanguard Group and BlackRock.

Goldman's new bond fund charges investors 0.14% a year, versus

0.15% for a similar ETF run by BlackRock.

That is in contrast to Goldman's traditional businesses of

trading and investment banking. For those, the firm is known for

elite services that carry big fees.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

June 08, 2017 09:32 ET (13:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

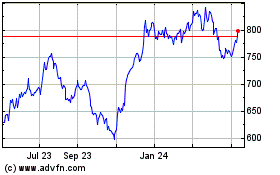

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

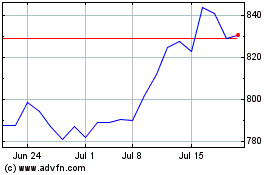

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024