Market Is Ignoring Risks to Telecom - Heard on the Street

June 06 2017 - 1:18PM

Dow Jones News

By Miriam Gottfried

Telecom stocks have shown some signs of life recently after

suffering amid a brutal price war. This isn't the time for

optimism.

The partnership between Comcast and Charter Communications

announced last month gives the cable operators a better chance to

succeed in the wireless business by giving them scale in

technology, procurement, logistics and billing. Investors should

take the risk to wireless carriers more seriously. Shares of

AT&T, Verizon, T-Mobile US and Sprint are either flat or up

since the deal's announcement.

Comcast is already selling wireless service and Charter is set

to launch its own in 2018, both of which will run on Verizon

Communications' network. Together, the two will be able to market

to roughly 97% of the U.S. wireless market, UBS estimates. Even

though they are only selling to their existing video and broadband

customers, their low pricing could help them attract a meaningful

subscriber base.

In addition to a per-gigabyte plan, Comcast offers unlimited

wireless service for $45 a month per line to households that buy

its top X1 video package, of which there are currently 2.9 million.

At one line, that represents a 50% discount to AT&T and is

cheaper than all four major wireless carriers. The cable company

also offers a $65 a month per line unlimited service to any of its

Xfinity internet customers, a 28% discount versus AT&T for a

single line.

Assuming Comcast attracts about 5% of the subscribers on the

best X1 package and about 2% of other subscribers, it would get

about 1.5 million wireless subscribers by the end of 2018, UBS

projects. Combine that with the bank's expectations for Charter,

and cable should have more than two million wireless subscribers by

the end of next year, climbing to six million by the end of

2020.

For U.S. wireless carriers, that might seem like a manageable

risk. Six million people is only 3% of the U.S. wireless market.

But that more than accounts for the industry's annual growth. Cable

could accelerate subscriber losses at AT&T and Verizon and

could curb growth at T-Mobile and Sprint.

Between the two giants, AT&T would feel more pain because

the impact on Verizon would be offset by the high-margin fees

Comcast and Charter pay for the use of its network. Every 500,000

cable subscribers adds $120 million to Verizon's annual earnings

before interest, taxes, depreciation and amortization, UBS

estimates.

The cable operators could fail to hit those subscriber estimates

if the technology, which also incorporates the cable companies'

Wi-Fi hot spots, proves unreliable. Cable lacks the extensive store

network of major wireless carriers, and Comcast doesn't yet allow

customers to bring their own devices. The economics of renting

airwaves could also curb cable's growth.

Until then, wireless investors should curb their enthusiasm.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

June 06, 2017 13:03 ET (17:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

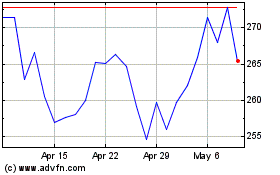

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

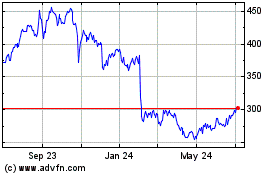

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Apr 2023 to Apr 2024