Current Report Filing (8-k)

June 06 2017 - 6:06AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 2, 2017

________________________________________________________________

IDEAL POWER INC.

(Exact name of registrant as specified in Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36216

|

|

14-1999058

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File No.)

|

|

(IRS Employee Identification No.)

|

4120 Freidrich Lane, Suite 100

Austin, Texas, 78744

(Address of Principal Executive Offices)

512-264-1542

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

|

|

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act (17 CFR 240.13(e)-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 2, 2017, Ideal Power Inc., a Delaware corporation (the “

Company

”), and Ryan O’Keefe, a named executive officer of the Company, mutually agreed to terminate Mr. O’Keefe’s employment with the Company as Senior Vice President, Business Development, effective immediately.

In connection with Mr. O’Keefe’s departure, the Company and Mr. O’Keefe entered into a Separation Agreement and General Release of All Claims, effective June 2, 2017 (the “

Separation Agreement

”). Mr. O’Keefe has the right to revoke the Separation Agreement within seven days of the execution date. Under the terms of the Separation Agreement, the Company will pay Mr. O’Keefe $58,875, less applicable withholding taxes and deductions, which is the equivalent of three months’ base salary, in equal installments over three months in accordance with the Company’s established payroll practices. The Company will also pay to Mr. O’Keefe a lump-sum bonus payment of $19,625, less applicable withholding taxes and deductions. In addition, the Company will pay Mr. O’Keefe’s COBRA premiums through the earlier of August 31, 2017, and the date when Mr. O’Keefe either elects to discontinue COBRA benefits or becomes eligible for health insurance coverage through another employer. The Separation Agreement contains customary confidentiality provisions and a mutual release of claims between the Company and Mr. O’Keefe.

The foregoing description of the Separation Agreement is a general description and is qualified in its entirety by reference to the Separation Agreement. A copy of the Separation Agreement is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 8.01 Other Events.

On June 5, 2017, the Board of Directors of the Company (the “

Board

”) elected Dr. Lon Bell as Chairman of the Board, effective immediately. Dr. Bell has been a director of the Company since November 2012 and has served as interim Chairman of the Board since March 9, 2017. The Board believes that Dr. Bell’s experience in commercializing inventions and his tenure as a director of the Company will make him an effective Chairman.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

Separation Agreement and General Release of All Claims, dated June 2, 2017, between the Company and Ryan O’Keefe.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Dated: June 5, 2017

|

IDEAL POWER INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Burns

|

|

|

|

Timothy Burns

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

Separation Agreement and General Release of All Claims, dated June 2, 2017, between the Company and Ryan O’Keefe.

|

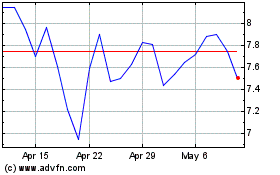

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

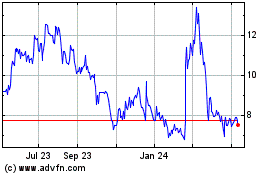

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024