Icahn Revenue Up Auto-Repair Deals -- WSJ

June 03 2017 - 3:02AM

Dow Jones News

Billionaire investor sees bigger car fleets needing national

service network

By Austen Hufford

Carl Icahn is raising his bet that Americans won't fix their own

cars, and that eventually many might not even own one.

Mr. Icahn has spent the past few years making deals aimed at

extending his automotive-service network nationwide, as

increasingly complex cars have their owners relying more on

professionals for repairs. On Friday, Icahn Automotive Group LLC

agreed to buy car-service chain Precision Auto Care Inc. for about

$35 million. The deal would add 250 locations to the billionaire

investor's 1,000 existing shops.

"We're positioning ourselves well to take advantage of an

increase in fleets," Mr. Icahn said in an interview, as he expects

ride-hailing and -sharing services to displace some personal-car

ownership and sees rental-car fleets expanding to accommodate those

without their own autos.

Mr. Icahn's goal is to build a company with nationwide reach

that can make, sell and install parts, having recently bought

parts-and-repair chains Pep Boys and Just Brakes as well as

auto-parts distributor Auto Plus. He also took parts maker

Federal-Mogul Holdings Corp. private earlier this year after owning

a significant stake for a decade.

He also owns stakes in ride-hailing service Lyft Inc. and

car-rental company Hertz Global Holdings Inc., which has a

partnership through which Lyft drivers can rent vehicles if they

don't have their own. Mr. Icahn thinks far-flung fleet chains and

ride-hailing companies could benefit from national service

providers in an industry that is often served by local shops and

regional chains.

"I have a whole team out there buying installers," he said. "We

want to build a really large national footprint servicing the

fleets."

Nick Mitchell, an analyst for Northcoast Research, said fleet

managers could potentially rely on larger chains for maintenance,

though they also could opt to do much of their work in-house,

potentially limiting the opportunities for a national, branded

service chain.

Mr. Mitchell also said expanding up and down the supply chain

risks alienating current customers and suppliers who could be

hesitant to do business with a direct competitor. "If you are going

to be vertically integrated, you only have one choice and that's to

go big -- and to go big fast," he said.

The push to own the business from start to finish -- from making

parts to selling and installing them to owning a slice of the

companies putting the cars on the roads -- accompanies a steady

decline of the shade-tree mechanic as cars become harder and more

expensive to work on at home. Consumers' automotive know-how is

decreasing, Icahn Enterprises LP said in its annual report in

March.

Many cars are more tightly packed under the hood than in the

heyday of do-it-yourself mechanic work, and some cars with more

complex electronics can require expensive tools to diagnose and fix

problems. That can even squeeze out some mom-and-pop shops for whom

the investment in those tools might not be worthwhile.

A recent report from market-research company IBISWorld Inc. said

the increasing complexity of auto repairs requires mechanics who

are more highly trained, which drives up wages. The report also

said that it is becoming more expensive to obtain more complex

repair information from manufacturers.

Meanwhile, cars are lasting longer. Last year, the number of

vehicles in operation hit a record in the U.S. as the average

lifespan of cars and trucks continues to lengthen, giving a boost

to the service providers and parts makers whose business it is to

keep cars on the road. The average age of cars and light trucks hit

11.6 years in 2016, according to data from IHS Markit.

To be sure, the rental-car industry and Hertz in particular have

struggled of late, with Hertz pouring money into turnaround

efforts. The company reported a much wider-than-expected quarterly

loss last month, and shares have plunged 76% in the past year,

including a 56% drop in the past three months.

Parts sellers also haven't fared well, with shares of AutoZone

Inc., O'Reilly Automotive Inc., Genuine Parts Co. and Advance Auto

Parts Inc. all in the red so far this year and over the past 12

months. Mr. Mitchell said a later tax-refund season and more mild

weather has hurt those companies recently.

Icahn Automotive Chief Executive Daniel Ninivaggi said Friday's

deal for Precision Auto is the next step in building out its

network. Precision has centers in 26 states, mainly in Georgia,

North Carolina and South Carolina. Its over-the-counter-traded

shares rose 90% to $1.54 after the deal announcement on Friday.

Corrections & Amplifications Precision Auto Care is traded

on the over-the-counter markets. An earlier version of this article

incorrectly stated the company was privately held. (June 2,

2017)

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 03, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

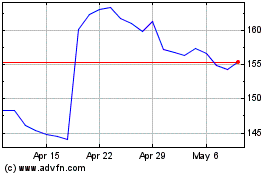

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Apr 2023 to Apr 2024