Filed pursuant to Rule 424(b)(5)

Registration No. 333-216977

|

|

|

|

|

|

|

AMENDMENT NO. 1 DATED JUNE 2, 2017

|

|

|

|

|

|

to Prospectus Supplement dated April 13, 2017

|

|

|

|

|

|

(to Prospectus dated April 6, 2017)

|

|

|

|

|

HTG Molecular Diagnostics, Inc.

$40,000,000

Common

Stock

This Amendment No. 1 to Prospectus Supplement, or this amendment, amends our prospectus supplement dated April 13, 2017, or the

prospectus supplement. This amendment should be read in conjunction with the prospectus supplement and the prospectus dated April 6, 2017, each of which are to be delivered with this amendment. This amendment amends only those

sections of the prospectus supplement listed in this amendment; all other sections of the prospectus supplement remain as is.

On

April 13, 2017, we entered into a Controlled Equity Offering

SM

Sales Agreement, or sales agreement, with Cantor Fitzgerald & Co., or Cantor Fitzgerald, relating to shares of our

common stock, $0.001 par value per share, offered by the prospectus supplement, as amended by this amendment. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of

up to $40.0 million (which amount includes shares we have already sold pursuant to the sales agreement prior to the date of this amendment) from time to time through Cantor Fitzgerald acting as a sales agent. As of the date of this amendment, we

have sold an aggregate of 2,468,104 shares of our common stock pursuant to the sales agreement for gross proceeds of $12.8 million.

Our

common stock is traded on The NASDAQ Capital Market under the symbol “HTGM.” On June 1, 2017, the last reported sale price of our common stock was $3.91. As of the date of the prospectus supplement on April 13, 2017, we were

subject to General Instruction I.B.6 of Form S-3 as a result of our public float being less than $75.0 million, which limited the amount of securities we could sell under the registration statement of which the prospectus supplement forms a part

during any 12-month period. The aggregate market value of our common stock held by non-affiliates subsequently increased above $75.0 million to approximately $81.0 million, based on 8,394,531 shares of our common stock outstanding and held

by non-affiliates on April 20, 2017 and the last reported sales price of our common stock on March 24, 2017 of $9.65.

Sales of

our common stock, if any, under the prospectus supplement, as amended by this amendment, may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as

amended, or the Securities Act. Subject to terms of the sales agreement, Cantor Fitzgerald is not required to sell any specific number or dollar amounts of securities but will act as our sales agent using commercially reasonable efforts consistent

with its normal trading and sales practices, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Cantor Fitzgerald will be entitled to compensation under the terms of the sales agreement at a fixed commission rate of 3.0% of the gross

sales price per share sold. In connection with the sale of our common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be

deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contributions to Cantor Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” on page S-2 of this amendment and under similar headings in the prospectus supplement dated April 13, 2017 and other documents that are incorporated by reference into the prospectus supplement and the

accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or determined if this amendment, the prospectus supplement and the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Amendment No. 1 to Prospectus Supplement is June 2, 2017

TABLE OF CONTENTS

Amendment No. 1 to Prospectus Supplement

ABOUT THIS AMENDMENT TO PROSPECTUS SUPPLEMENT

The prospectus supplement is part of a registration statement that we have filed with the Securities and Exchange Commission, or the SEC,

utilizing a “shelf” registration process. Under the shelf registration process, we may offer shares of our common stock having an aggregate offering price of up to $75.0 million. Under the prospectus supplement dated April 13,

2017, as amended by this amendment, we may offer shares of our common stock having an aggregate sales of up to $40.0 million (which amount includes shares we have already sold pursuant to the prospectus supplement prior to the date of this

amendment) from time to time at prices and on terms to be determined by market conditions at the time of offering.

Unless otherwise

specified or required by context, references in this amendment and the prospectus supplement to “HTG Molecular Diagnostics,” “HTG,” “we,” “us” and “our” refer to HTG Molecular Diagnostics, Inc.

Before buying any of the common stock that we are offering, we urge you to carefully read this amendment, the prospectus supplement and the

accompanying prospectus, together with the information incorporated by reference in the prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering when

making your investment decision. You should also read and consider the information in the documents we have referred you to in the prospectus supplement under the headings “Where You Can Find More Information” and “Incorporation of

Certain Information by Reference.” These documents contain important information that you should consider when making your investment decision. The prospectus supplement, as amended by this amendment, describes the terms of this offering of

common stock and also adds to and updates information contained in the documents incorporated by reference into the prospectus supplement and the accompanying prospectus. To the extent there is a conflict between the information contained in this

amendment or the prospectus supplement, on the one hand, and the information contained in any document incorporated by reference into the prospectus supplement and the accompanying prospectus that was filed with the SEC before the date of this

amendment or the prospectus supplement, on the other hand, you should rely on the information in this amendment or the prospectus supplement, as applicable. If any statement in one of these documents is inconsistent with a statement in another

document having a later date — for example, a document incorporated by reference into the prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement.

We have not, and the sales agent has not, authorized anyone to provide you with information different from that which is contained in or

incorporated by reference in the prospectus supplement, as amended by this amendment, the accompanying prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. No one is making offers to sell or

seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this amendment and the prospectus supplement is accurate as of the date of the respective

documents only and that any information we have incorporated by reference or included in the accompanying prospectus is accurate only as of the date given in the document incorporated by reference or as of the date of the prospectus, as applicable,

regardless of the time of delivery of this amendment, the prospectus supplement, the accompanying prospectus, any related free writing prospectus, or any sale of our common stock. Our business, financial condition, results of operations and

prospects may have changed since those dates.

i

This amendment, the prospectus supplement, the accompanying prospectus and the information

incorporated herein and therein by reference may include trademarks, service marks and trade names owned by us or other companies, including VERI/O, HTG Edge and HTG EdgeSeq. Solely for convenience, trademarks and trade names, including logos,

artwork and other visual displays, may appear without the

®

or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. All trademarks, service marks and trade names included or incorporated by reference into the prospectus supplement or the accompanying

prospectus are the property of their respective owners.

Information contained on, or that can be accessed through, our website does not

constitute part of this amendment, the prospectus supplement, the accompanying prospectus or any related free writing prospectus.

ii

THE OFFERING

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial

statements and related notes thereto appearing elsewhere or incorporated by reference in this amendment, the prospectus supplement and the accompanying prospectus. Before you decide to invest in our common stock, you should read this entire

amendment, the prospectus supplement and the accompanying prospectus carefully, including the risk factors and the financial statements and related notes included or incorporated by reference in, the prospectus supplement and the accompanying

prospectus.

|

|

|

|

|

Common Stock Offered By Us

|

|

Shares of our common stock having an aggregate sale price of up to $40.0 million, which includes $12.8 million in gross proceeds from the prior sale of common stock under the sales agreement.

|

|

|

|

|

Manner of Offering

|

|

“At the market offering” that may be made from time to time through our sales agent, Cantor Fitzgerald. See “Plan of Distribution” on page S-6 of this amendment.

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures, debt repayment, and research and development, sales and marketing and general and

administrative expenses. See “Use of Proceeds” on page S-3 of this amendment.

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page S-2 of this amendment and page S-4 of the prospectus supplement, and under similar headings in other documents

incorporated by reference into the prospectus supplement and the accompanying prospectus.

|

|

|

|

|

NASDAQ Capital Market Symbol

|

|

HTGM

|

S-1

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully review the risks and uncertainties described below and

under the section titled “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, as updated by our quarterly, annual and other reports and documents that are incorporated by reference into the

prospectus supplement and the accompanying prospectus before deciding whether to purchase any common stock in this offering. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as

adversely affect the value of an investment in our common stock, and the occurrence of any of these risks might cause you to lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial

may also significantly impair our business operations.

Additional Risks Related to This Offering

You may experience immediately and substantial dilution.

The offering price per share in this offering will exceed the net tangible book value per share of our common stock outstanding prior to this

offering. Assuming that an aggregate of 10,230,170 shares of our common stock are sold at a price of $3.91 per share, the last reported sale price of our common stock on The NASDAQ Capital Market on June 1, 2017, for aggregate gross

proceeds of $40.0 million, and after deducting commissions and estimated offering expenses payable by us, you would experience immediate dilution of $2.41 per share, representing the difference between our as adjusted net tangible book

deficit per share as of March 31, 2017, after giving effect to this offering, and the assumed offering price. The exercise of outstanding stock options and warrants may result in further dilution of your investment. See “Dilution” in

this amendment for a more detailed illustration of the dilution you would incur if you participate in this offering.

S-2

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $40.0 million (which amount includes the

proceeds from shares we have already sold pursuant to the sales agreement prior to the date of this amendment) from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public

offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any additional shares after the date of this amendment under the sales agreement with Cantor Fitzgerald or that

we will be able to fully utilize the sales agreement as a source of financing.

We intend to use the net proceeds from this offering for

working capital and general corporate purposes, which may include capital expenditures, debt repayment, and research and development, sales and marketing and general and administrative expenses. We may also use a portion of the net proceeds from

this offering to acquire or invest in businesses, products and technologies that are complementary to our own, although we have no current plans, commitments or agreements with respect to any such acquisitions or investments as of the date of this

amendment. We will retain broad discretion over the use of the net proceeds from this offering.

S-3

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted immediately to the extent of the difference

between the public offering price per share and the as adjusted net tangible book value per share of our common stock after this offering.

Our net tangible book deficit as of March 31, 2017 was approximately $(11.1) million, or $(1.38) per share. We calculate net

tangible book value (deficit) per share by dividing the net tangible book value (deficit), which is tangible assets less total liabilities, by the number of outstanding shares of our common stock. Dilution represents the difference between the

amount per share paid by purchasers of shares of common stock in this offering and the as adjusted net tangible book value per share after giving effect to this offering.

After giving effect to the assumed sale by us of shares of our common stock in the aggregate amount of $40.0 million in this offering at

an assumed offering price of $3.91 per share, the last reported sale price of our common stock on The NASDAQ Capital Market on June 1, 2017, and after deducting commissions and estimated offering expenses payable by us, our as adjusted net

tangible book value as of March 31, 2017 would have been approximately $27.5 million, or $1.50 per share of common stock. This represents an immediate increase in net tangible book value per share of $2.88 to our existing stockholders and

an immediate dilution in net tangible book value per share of $2.41 to new investors purchasing common stock in this offering. The following table illustrates this dilution on a per share basis:

|

|

|

|

|

|

|

|

|

|

|

Assumed offering price per share

|

|

|

|

|

|

$

|

3.91

|

|

|

Net tangible book deficit per share as of March 31, 2017

|

|

$

|

(1.38

|

)

|

|

|

|

|

|

Increase in as adjusted net tangible book value per share attributable to new investors purchasing

shares in this offering

|

|

$

|

2.88

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

$

|

1.50

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

|

$

|

2.41

|

|

The table above assumes, for illustrative purposes, that an aggregate of 10,230,179 shares of our common stock

are sold at a price of $3.91 per share, the last reported sale price of our common stock on The NASDAQ Capital Market on June 1, 2017, for aggregate gross proceeds of $40.0 million. The additional shares sold in this offering, if any, will

be sold from time to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $3.91 per share shown in the table above, assuming all of our common stock in the aggregate

amount of $40.0 million during the term of the sales agreement with Cantor Fitzgerald is sold at that price, would increase our as adjusted net tangible book value per share after the offering to $1.70 per share and would increase the dilution

in net tangible book value per share to new investors to $3.21 per share, after deducting commissions and estimated offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering

price of $3.91 per share shown in the table above, assuming all of our common stock in the aggregate amount of $40.0 million during the term of the sales agreement with Cantor Fitzgerald is sold at that price, would decrease our as adjusted net

tangible book value per share after the offering to $1.26 per share and would decrease the dilution in net tangible book value per share to new investors to $1.65 per share, after deducting commissions and estimated offering expenses payable by us.

This information is supplied for illustrative purposes only and may differ based on the actual offering price and the actual number of shares offered.

The above discussion and table are based on 8,060,687 shares outstanding as of March 31, 2017 and exclude as of that date:

|

|

•

|

|

1,441,924 shares of our common stock issuable upon the exercise of stock options, at a weighted average

exercise price of $3.03 per share;

|

S-4

|

|

•

|

|

110,215 shares of our common stock reserved for future issuance under our 2014 Equity Incentive Plan;

|

|

|

•

|

|

99,300 shares of our common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan;

|

|

|

•

|

|

256,499 shares issuable upon vesting of Restricted Stock Units granted under our 2014 Equity Incentive Plan;

|

|

|

•

|

|

245,816 shares of our common stock reserved for future issuance under our Amended and Restated Stock Purchase

Plan; and

|

|

|

•

|

|

219,723 shares of our common stock issuable upon the exercise of warrants, at a weighted average exercise

price of $12.89 per share.

|

To the extent that options or warrants outstanding as of March 31, 2017 have been or

are exercised, investors purchasing shares in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds

for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or equity-based securities, the issuance of these securities could result in further dilution to our stockholders.

S-5

PLAN OF DISTRIBUTION

We have entered into a Controlled Equity Offering

SM

Sales Agreement with Cantor

Fitzgerald, under which from time to time we may issue and sell shares of our common stock having an aggregate gross sales price of up to $40.0 million through Cantor Fitzgerald acting as agent. As of the date of this amendment, we have sold an

aggregate of 2,468,104 shares of our common stock pursuant to the sales agreement for gross proceeds of $12.8 million. Additional sales of the shares of common stock, if any, may be made on The NASDAQ Stock Market at market prices and such

other sales as agreed upon by us and Cantor Fitzgerald. The sales agreement is filed as an exhibit to a Current Report on Form 8-K filed with the SEC on April 13, 2017, which is incorporated by reference into the prospectus supplement.

Upon delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cantor Fitzgerald may offer and sell

shares of our common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act. We may instruct Cantor Fitzgerald not to sell common stock if the sales

cannot be effected at or above the price designated by us from time to time. We or Cantor Fitzgerald may suspend or terminate the offering of our common stock upon notice and subject to other conditions.

We will pay Cantor Fitzgerald commissions, in cash, for its services in acting as sales agent in the sale of our common stock. Cantor

Fitzgerald will be entitled to compensation under the terms of the sales agreement at a commission rate of 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required as a condition to this offering, the actual

total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse a portion of Cantor Fitzgerald’s expenses, including legal fees, in connection with this offering up to a

maximum of $50,000. We estimate that the total expenses for the offering, excluding commissions and expense reimbursement payable to Cantor Fitzgerald under the terms of the sales agreement, will be approximately $150,000.

Settlement for sales of shares of our common stock will occur on the third trading day following the date on which any sales are made (or such

earlier day as is industry practice for regular-way trading), or on some other date that is agreed upon by us and Cantor Fitzgerald in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement. Sales of our common stock as contemplated in the prospectus supplement, as amended by this amendment, will be settled through the facilities of The Depository Trust Company or by

such other means as we and Cantor Fitzgerald may agree upon.

Cantor Fitzgerald will act as our sales agent and use commercially

reasonable efforts, consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of The NASDAQ Stock Market. In connection with the sale of the common stock on our behalf, Cantor

Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and

contribution to Cantor Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

The offering of

shares of our common stock pursuant to the sales agreement will terminate upon the earlier of (1) the sale of all shares of our common stock subject to the sales agreement, or (2) termination of the sales agreement as permitted therein. We

and Cantor Fitzgerald may each terminate the sales agreement at any time upon ten days’ prior notice.

Cantor Fitzgerald and its

affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by

Regulation M, Cantor Fitzgerald will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement.

S-6

The prospectus supplement, as amended by this amendment, and the accompanying prospectus in

electronic format may be made available on a website maintained by Cantor Fitzgerald and Cantor Fitzgerald may distribute this amendment, the prospectus supplement and the accompanying prospectus electronically.

S-7

LEGAL MATTERS

The validity of the common stock offered by this amendment and the prospectus supplement will be passed upon by Cooley LLP, San Diego,

California. Cantor Fitzgerald & Co. is being represented in connection with this offering by Goodwin Procter LLP, New York, New York.

S-8

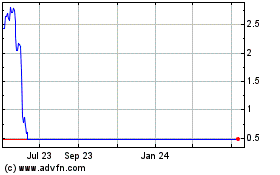

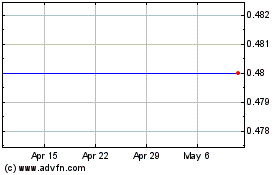

HTG Molecular Diagnostics (NASDAQ:HTGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

HTG Molecular Diagnostics (NASDAQ:HTGM)

Historical Stock Chart

From Apr 2023 to Apr 2024