Current Report Filing (8-k)

June 02 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 2, 2017

TRONOX LIMITED

(Exact name of registrant as specified in its charter)

|

Western Australia, Australia

|

001-35573

|

98-1026700

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

263 Tresser Boulevard, Suite 1100

|

|

Lot 22 Mason Road,

|

|

Stamford, Connecticut 06901

|

|

Kwinana Beach, WA 6167

Australia

|

(Address of principal executive offices, including zip code)

(203) 705-3800

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Tronox Limited and its subsidiaries (collectively referred to as "Tronox Limited," "we," "us," or "our")

is filing this Form 8-K solely to provide additional information and details regarding the revision of previously issued financial statements disclosed in its Quarterly Report on Form 10-Q for the three months ended March 31, 2017 filed with the Securities and Exchange Commission on May 4, 2017 (the "First Quarter Form 10-Q"). During the quarter ended March 31, 2017, we identified a misstatement in our selling, general, and administrative expense for certain prior periods related to a liability resulting from a non-timely filing with a statutory authority. The aggregate misstatement is $11 million, which impacts our previously issued consolidated statements of operations, comprehensive loss, balance sheets and cash flows as of and for the years ended December 31, 2015 and 2016, and the unaudited condensed consolidated financial statements for the third and fourth quarters and corresponding year-to-date periods of 2015, and each quarter and corresponding year-to-date periods of 2016.

In accordance with Staff Accounting Bulletin ("SAB") No. 99,

Materiality

, and SAB No. 108,

Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements

, management evaluated the materiality of the misstatement from qualitative and quantitative perspectives, and concluded that the misstatement was not material to our previously issued annual and interim financial statements. The cumulative amount of the prior period adjustments would have been material to our current statement of operations and comprehensive loss had we made the correction in the current period, and accordingly we will revise our previously issued financial statements to correct this misstatement. In addition, we also corrected the timing of other previously recorded immaterial out-of-period adjustments and will reflect them in the revised prior period financial statements. The previously recorded immaterial out-of-period adjustments include a $6 million decrease to cost of goods sold due to an overstated depreciation expense and a $7 million increase to cost of goods sold related to royalty tax both originating in 2013 and previously recorded as out-of-period corrections in 2014; a $5 million decrease to cost of goods sold that originated in 2012 and was previously recorded as an out-of-period correction in 2014 due to overstated depletion expense; and other miscellaneous immaterial corrections.

The revision associated with

our selling, general, and administrative expense

as well as other immaterial adjustments discussed above are filed as Exhibit 99.1 hereto and are incorporated herein by reference. The information in this Form 8-K, including the exhibit should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, and subsequent filings made with the U.S. Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

Revised Financial Statements

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TRONOX LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Richard L. Muglia

|

|

Date: June 2, 2017

|

Name:

|

Richard L. Muglia

|

|

|

Title:

|

Senior Vice President, General Counsel and Secretary

|

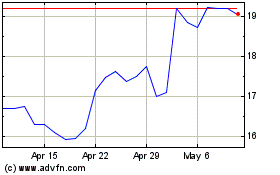

Tronox (NYSE:TROX)

Historical Stock Chart

From Mar 2024 to Apr 2024

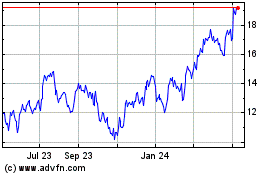

Tronox (NYSE:TROX)

Historical Stock Chart

From Apr 2023 to Apr 2024