Current Report Filing (8-k)

June 02 2017 - 3:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 1, 2017

W&T Offshore, Inc.

(Exact name of registrant as specified in its charter)

1-32414

(Commission

File

Number)

|

|

|

|

|

Texas

|

|

72-1121985

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

(Address of Principal Executive Offices)

713.626.8525

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

On June 1, 2017, W&T Offshore, Inc. (the

“Company”) issued a press release announcing that the Company received a final trial court judgment from the United States District Court for the Southern District of Texas in the previously disclosed lawsuit styled

Apache Corporation

v. W&T Offshore, Inc

. A copy of the press release is furnished herewith as Exhibit 99.1.

The information included in

Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information be deemed incorporated by reference in any

filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such a filing.

On May 31, 2017, the Company received a final trial court judgment

from the United States District Court for the Southern District of Texas in the previously disclosed lawsuit styled

Apache Corporation v. W&T Offshore, Inc.

directing the Company to pay Apache Corporation (“Apache”) $43.2

million, plus $4.4 million in prejudgment interest, attorney’s fees and costs assessed in the judgment. The lawsuit was filed by Apache in December 2014 regarding a dispute about Apache’s use of drilling rigs instead of a previously

contracted intervention vessel for the plugging and abandonment of three deepwater wells in the Mississippi Canyon area of the Gulf of Mexico. The Company contends that the costs to use the drilling rigs were unnecessary and unreasonable but that

Apache chose to use the rigs without the Company’s consent because they otherwise would have been idle at Apache’s expense. The Company believes the use of the rigs was in bad faith, as found by the jury, and in breach of the applicable

joint operating agreement, particularly since another vessel had been contracted by Apache for the abandonment a year in advance. The Company previously paid $24.9 million as an undisputed amount for the plugging and abandonment work.

The Company believes that the judgment is contrary to the applicable law given the jury’s finding in October 2016 that Apache acted in

bad faith. The judgment also nullified a $17.0 million offset claim in favor of the Company found by the jury. The Company is considering its options, including post-judgment motions and appeal.

(d) Exhibit. The following exhibit is furnished as part of this report:

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated June 1, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

W&T OFFSHORE, INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Dated: June 2, 2017

|

|

|

|

By:

|

|

/s/ John D. Gibbons

|

|

|

|

|

|

|

|

John D. Gibbons

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

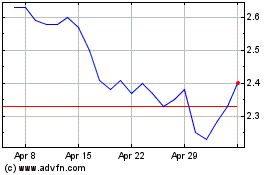

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

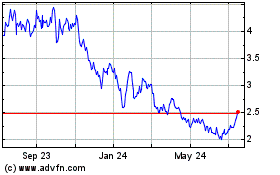

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Apr 2023 to Apr 2024