Royal Gold, Inc. (NASDAQ:RGLD) (together with its

subsidiaries, “Royal Gold” or the “Company”) is pleased to report

that the Peak Gold joint venture (“Peak Gold”), of which our Royal

Alaska subsidiary is a party, completed an estimate of mineralized

material1 at the Peak and North Peak deposits located near Tok,

Alaska. The estimate of measured and indicated resources2 contained

within mineralized material at a $1,400 per ounce gold pit shell

consists of 11.3 million tonnes grading 3.46 grams per tonne

(“gpt”) gold, 14.09 gpt silver, and 0.16% copper.

“These initial results are a great start and Peak Gold has

identified several additional targets that will be pursued over the

balance of the year,” commented Tony Jensen, President and CEO of

Royal Gold. “We are encouraged by the robust grade and near surface

characteristics of the deposits, which are located just a few miles

from the intersection of Alaska Highways 1 and 2. We already own a

royalty on the project and we will continue to focus on

opportunities in the future aligned with our core business model.

Peak Gold is progressing as we had hoped it would to this point,

and we have appreciated an excellent working relationship with our

host community of the Native Village of Tetlin and our joint

venture partner, Contango ORE, Inc.”

The measured and indicated resources were calculated with

resource cones at a gold price of $1,200 per ounce with a cut-off

grade of 0.5 grams per tonne and at $1,400 gold with a cut-off

grade of 0.43 grams per tonne.

Measured and Indicated within $1200/oz Gold Pit Shell at

a 0.50 g/t AuEq Cut-off Grade

Grade > Cut-off

Contained Metal Class Tonnage(kt)

Au(g/t) Ag(g/t) Cu(%) Au(koz)

Ag(koz) Cu(Mlbs)

Measured 484

6.25 16.73 0.15 97.3 260.4 1.6

Indicated 10,117 3.51 14.06

0.16 1,142.6 4,573.3 35.7

M&I 10,601 3.64 14.18

0.16 1,239.9 4,833.7 37.3

Measured and Indicated within $1400/oz

Gold Pit Shell at a 0.43 g/t AuEq Cut-off Grade

Grade > Cut-off

Contained Metal Class Tonnage(kt)

Au(g/t) Ag(g/t) Cu(%) Au(koz)

Ag(koz) Cu(Mlbs)

Measured 486

6.22 16.65 0.15 97.2 260.2 1.6

Indicated 10,808 3.34 13.97

0.16 1,159.5 4,854.5 38.0

M&I 11,294 3.46 14.09

0.16 1,256.7 5,114.7 39.6 Equivalent Gold = Au

+ 0.0122 x Ag

Mineralized material, of which measured and indicated resources

are a subset3, at various cut-off grades are show below.

Grade > Cut-off Contained Metal

Cut-off

(g/t AuEq)

Tonnage(kt) Au(g/t) Ag(g/t)

Cu(%) Au(koz) Ag(koz) Cu(Mlbs)

0.30

18,142 2.62 13.64

0.15

1,526 7,957 61

0.40

16,730 2.81 14.23

0.16

1,514 7,656 58

0.50

15,650 2.98 14.68

0.16

1,502 7,387 55

0.60

14,702 3.15 15.10

0.16

1,488 7,139 52

0.70

13,883 3.30 15.38

0.16

1,474 6,864 49

0.80

13,110 3.46 15.66

0.16

1,458 6,602 47

0.90

12,378 3.62 15.94

0.16

1,442 6,343 45

1.00

11,663 3.80 16.14

0.17

1,423 6,053 42 Equivalent Gold = Au + 0.0122 x

Ag

____________________________________

1 The U.S. Securities and Exchange Commission does not

recognize this term. Mineralized material is that part of a mineral

system that has potential economic significance but cannot be

included in the proven and probable ore reserve estimates until

further drilling and metallurgical work is completed, and until

other economic and technical feasibility factors based upon such

work have been resolved. Investors are cautioned not to assume that

any part or all of the mineral deposits in this category will ever

be converted into reserves. 2 The terms measured and indicated

resource are not SEC recognized terms. Estimates of resources are

subject to further exploration and development, are subject to

additional risks, and no assurance can be given that they will

eventually convert to future reserves. 3 The quantity and grade of

Inferred Resources included in this estimation are uncertain in

nature and there has been insufficient exploration to define these

Inferred Resources as an Indicated or Measured Mineral Resource and

it is uncertain if further exploration will result in upgrading

them to an Indicated or Measured Mineral Resource category.

About Peak Gold

Peak Gold, LLC is a joint venture between Royal Alaska, LLC

("Royal Alaska"), a wholly owned subsidiary of Royal Gold, and

Contango ORE, Inc. (“Contango Ore”). Peak Gold holds a 675,000 acre

lease with the Native Village of Tetlin and an additional 168,200

acres of State of Alaska mining claims, all located near Tok,

Alaska, on which Peak Gold explores for minerals. Royal Alaska has

the right to earn up to a 40% membership interest in Peak Gold by

making total contributions of up to $30.0 million to Peak Gold by

October 31, 2018. As of March 31, 2017, Royal Alaska contributed

approximately $20.0 million to Peak Gold and held a 24.9%

membership interest in the joint venture. Once Royal Alaska has

earned a 40% interest in the joint venture, Royal Alaska will have

the additional right to require Contango Ore to sell up to 20% of

its interest in Peak Gold in a sale of Royal Alaska’s entire 40%

interest to a bona fide third-party purchaser. Royal Gold also

holds a 3.0% net smelter return (“NSR”) royalty over the area of

the Tetlin lease and certain State of Alaska mining claims and a

2.0% NSR royalty over certain other State of Alaska mining claims

held by Peak Gold.

About Royal Gold

Royal Gold is a precious metals stream and royalty company

engaged in the acquisition and management of precious metal

streams, royalties, and similar production based interests. The

Company owns interests on 193 properties on six continents,

including interests on 38 producing mines and 22 development stage

projects. Royal Gold is publicly traded on the NASDAQ Global Select

Market under the symbol “RGLD.” The Company’s website is located at

www.royalgold.com.

Cautionary “Safe Harbor” Statement Under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical matters, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from

projections or estimates contained herein. Such forward-looking

statements include estimates of mineralized material and measured

and indicated resources provided by the Peak Gold joint venture.

Net gold and metal resources are subject to certain assumptions and

do not reflect actual ounces that will be produced. Like any

stream, royalty or similar interest on a non-producing or

not-yet-in-development project, our interests on development

projects are subject to certain risks, such as the ability of

operators to bring projects into production and operate in

accordance with feasibility studies, and the ability of Royal Gold

to make accurate assumptions regarding production and operating

parameters, valuation and timing and amount of payments. Factors

that could cause actual results to differ materially include, among

others, precious metals and copper prices; the ability of operators

of development properties to finance project construction to

completion and bring projects into production as expected;

operators’ delays in securing or inability to secure necessary

governmental permits; decisions and activities of the operators of

the Company’s stream and royalty properties; unanticipated grade,

environmental, geological, seismic, metallurgical, processing,

liquidity or other problems the operators of the mining properties

may encounter; completion of feasibility studies; changes in

operators’ project parameters as plans continue to be refined;

changes in estimates of reserves and mineralization by the

operators of the Company’s stream and royalty properties; contests

to the Company’s stream and royalty interests and title and other

defects to the Company’s stream and royalty properties; errors or

disputes in calculating stream deliveries and royalty payments, or

deliveries and payments not made in accordance with stream and

royalty agreements; economic and market conditions; risks

associated with conducting business in foreign countries; changes

in laws governing the Company and its stream and royalty properties

or the operators of such properties; and other subsequent events;

as well as other factors described in the Company’s Annual Report

on Form 10-K, Quarterly Report on Form 10-Q, and other filings with

the Securities and Exchange Commission. Most of these factors are

beyond the Company’s ability to predict or control. The Company

disclaims any obligation to update any forward-looking statement

made herein. Readers are cautioned not to put undue reliance on

forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170602005214/en/

Royal Gold, Inc.Karli Anderson, 303-575-6517Vice

President Investor Relations

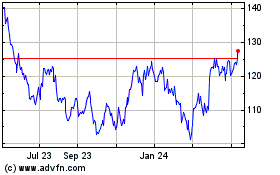

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024