Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration Statement

No. 333-215935

Issuer Free Writing Prospectus dated June 1, 2017

This pricing term sheet supplements the preliminary form of prospectus supplement issued by Cardinal Health, Inc. on June 1, 2017 (the “Preliminary

Prospectus”) relating to its Prospectus dated February 7, 2017.

Cardinal Health, Inc.

Pricing Term Sheet

|

|

|

|

|

Issuer:

|

|

Cardinal Health, Inc.

|

|

|

|

|

Current Ratings (Moody’s / S&P / Fitch)*:

|

|

Baa2/

A-

/ BBB+ (Stable/Negative Watch/Negative)

|

|

|

|

|

Trade Date:

|

|

June 1, 2017

|

|

|

|

|

Settlement Date**:

|

|

T+7; June 12, 2017

|

|

|

|

|

Underwriters:

|

|

Joint Book-Running Managers

:

Goldman Sachs & Co. LLC

Merrill Lynch, Pierce,

Fenner & Smith

Incorporated

MUFG

Securities Americas Inc.

Wells Fargo Securities, LLC

Co-Managers:

Barclays Capital Inc.

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Morgan Stanley & Co. LLC

Credit Agricole Securities (USA) Inc.

PNC Capital Markets LLC

Scotia Capital (USA) Inc.

Standard Chartered Bank

SunTrust Robinson Humphrey, Inc.

The Huntington Investment

Company

U.S. Bancorp Investments, Inc.

|

1.948% Notes due 2019

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$1,000,000,000

|

|

|

|

|

Maturity Date:

|

|

June 14, 2019

|

|

|

|

|

Interest Rate:

|

|

1.948%

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$997,500,000

|

|

|

|

|

Benchmark Treasury:

|

|

1.250% due May 31, 2019

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-29

/1.298%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+65 basis points

|

|

|

|

|

Yield to Maturity:

|

|

1.948%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 14 and December 14, commencing December 14, 2017

|

|

|

|

|

Make-whole Call:

|

|

The notes will be redeemable in whole at any time or, in part from time to time, at the Issuer’s option, at a redemption price equal to

the greater of:

(1) 100% of the principal amount of the notes to be redeemed, or

(2) as determined by a quotation agent, the sum of the present values of the remaining

scheduled payments of principal and interest thereon (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis (assuming a

360-day

year consisting of

twelve

30-day

months) at the adjusted treasury rate plus 10 basis points,

plus

, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

Special Mandatory Redemption:

|

|

The 1.948% Notes due 2019 will be subject to the special mandatory redemption provision described in the Preliminary Prospectus.

|

|

|

|

|

Business Day Convention:

|

|

New York

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBL1/ US14149YBL11

|

2

2.616% Notes due 2022

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$1,150,000,000

|

|

|

|

|

Maturity Date:

|

|

June 15, 2022

|

|

|

|

|

Interest Rate:

|

|

2.616%

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$1,143,100,000

|

|

|

|

|

Benchmark Treasury:

|

|

1.750% due May 31, 2022

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-29+

/ 1.766%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+85 basis points

|

|

|

|

|

Yield to Maturity:

|

|

2.616%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 15 and December 15, commencing December 15, 2017

|

|

|

|

|

Make-whole Call:

|

|

The notes will be redeemable, prior to May 15, 2022 (one month prior to their maturity), in whole at any time or, in part from time to

time, at the Issuer’s option, at a redemption price equal to the greater of:

(1)

100% of the principal amount of the notes to be redeemed, or

(2) as determined by a

quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due if the notes of such series matured on May 15, 2022, (exclusive of interest accrued to the date of

redemption) discounted to the date of redemption on a semi-annual basis (assuming a

360-day

year consisting of twelve

30-day

months) at the adjusted treasury rate plus

15 basis points,

plus

, in each case, accrued and unpaid interest, if any, on

the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

Par Call:

|

|

The Issuer may also redeem some or all of the notes on or after May 15, 2022 (one month prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid

interest, if any, to, but excluding, the redemption date.

|

3

|

|

|

|

|

|

|

|

Special Mandatory Redemption:

|

|

The 2.616% Notes due 2022 will be subject to the special mandatory redemption provision described in the Preliminary Prospectus.

|

|

|

|

|

Business Day Convention:

|

|

New York

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBF4 / US14149YBF43

|

4

Floating Rate Notes due 2022

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$350,000,000

|

|

|

|

|

Maturity Date:

|

|

June 15, 2022

|

|

|

|

|

Interest Rate:

|

|

Three-month LIBOR plus 77 basis points

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$347,900,000

|

|

|

|

|

Interest Payment Dates:

|

|

Quarterly on March 15, June 15, September 15 and December 15, commencing September 15, 2017

|

|

|

|

|

Interest Reset Dates:

|

|

March 15, June 15, September 15 and December 15, commencing September 15, 2017

|

|

|

|

|

Interest Rate Periods:

|

|

The initial interest reset period will be the period from, and including, the original issue date to, but excluding, the initial interest reset date. Thereafter, each interest reset period will be the period from, and including, an

interest reset date to, but excluding, the immediately succeeding interest reset date;

provided

that the final interest reset period will be the period from, and including, the interest reset date immediately preceding the maturity date of

the Floating Rate Notes due 2022 to, but excluding, the maturity date.

|

|

|

|

|

Interest Determination Dates:

|

|

The interest determination date will be the second London business day immediately preceding either (i) the original issue date, in the case of the initial interest reset period, or (ii) the applicable interest reset date,

in the case of each other interest reset period.

|

|

|

|

|

Optional Redemption:

|

|

The Floating Rate Notes due 2022 will not be redeemable at the Issuer’s option.

|

|

|

|

|

Special Mandatory Redemption:

|

|

The Floating Rate Notes due 2022 will be subject to the special mandatory redemption provision described in the Preliminary Prospectus.

|

|

|

|

|

Day Count Convention:

|

|

Actual/360

|

|

|

|

|

Business Day Convention:

|

|

New York and London

|

|

|

|

|

Calculation Agent:

|

|

The Bank of New York Mellon Trust Company, N.A.

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBG2 / US14149YBG26

|

5

3.079% Notes due 2024

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$750,000,000

|

|

|

|

|

Maturity Date:

|

|

June 15, 2024

|

|

|

|

|

Interest Rate:

|

|

3.079%

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$745,125,000

|

|

|

|

|

Benchmark Treasury:

|

|

2.000% due May 31, 2024

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-26

/ 2.029%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+105 basis points

|

|

|

|

|

Yield to Maturity:

|

|

3.079%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 15 and December 15, commencing December 15, 2017

|

|

|

|

|

Make-whole Call:

|

|

The notes will be redeemable, prior to April 15, 2024 (two months prior to their maturity), in whole at any time or, in part from time

to time, at the Issuer’s option, at a redemption price equal to the greater of:

(1) 100% of the principal amount of the notes to be redeemed, or

(2) as determined by a quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due

if the notes of such series matured on April 15, 2024 (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis (assuming a

360-day

year

consisting of twelve

30-day

months) at the adjusted treasury rate plus 20 basis points,

plus

, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

Par Call:

|

|

The Issuer may also redeem some or all of the notes on or after April 15, 2024 (two months prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption date.

|

6

|

|

|

|

|

|

|

|

Special Mandatory Redemption:

|

|

The 3.079% Notes due 2024 will be subject to the special mandatory redemption provision described in the Preliminary Prospectus.

|

|

|

|

|

Business Day Convention:

|

|

New York

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBH0 / US14149YBH09

|

7

3.410% Notes due 2027

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$1,350,000,000

|

|

|

|

|

Maturity Date:

|

|

June 15, 2027

|

|

|

|

|

Interest Rate:

|

|

3.410%

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$1,341,225,000

|

|

|

|

|

Benchmark Treasury:

|

|

2.375% due May 15, 2027

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

101-15

/2.210%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+120 basis points

|

|

|

|

|

Yield to Maturity:

|

|

3.410%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 15 and December 15, commencing December 15, 2017

|

|

|

|

|

Make-whole Call:

|

|

The notes will be redeemable, prior to March 15, 2027 (three months prior to their maturity), in whole at any time or, in part from time

to time, at the Issuer’s option, at a redemption price equal to the greater of:

(1) 100% of the principal amount of the notes to be redeemed, or

(2) as determined by a quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due

if the notes of such series matured on March 15, 2027 (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis (assuming a

360-day

year

consisting of twelve

30-day

months) at the adjusted treasury rate plus 20 basis points,

plus

, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

Par Call:

|

|

The Issuer may also redeem some or all of the notes on or after March 15, 2027 (three months prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption date.

|

8

|

|

|

|

|

|

|

|

Business Day Convention:

|

|

New York

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBJ6/ US14149YBJ64

|

9

4.368% Notes due 2047

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$600,000,000

|

|

|

|

|

Maturity Date:

|

|

June 15, 2047

|

|

|

|

|

Interest Rate:

|

|

4.368%

|

|

|

|

|

Price to Public:

|

|

100.000% of principal amount

|

|

|

|

Net Proceeds to Issuer (after the Underwriting

Discount but before expenses):

|

|

$594,750,000

|

|

|

|

|

Benchmark Treasury:

|

|

3.000% due February 15, 2047

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

102-20

/ 2.868%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+150 basis points

|

|

|

|

|

Yield to Maturity:

|

|

4.368%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 15 and December 15, commencing December 15, 2017

|

|

|

|

|

Make-whole Call:

|

|

The notes will be redeemable, prior to December 15, 2046 (six months prior to their maturity), in whole at any time or, in part from

time to time, at the Issuer’s option, at a redemption price equal to the greater of:

(1) 100% of the principal amount of the notes to be redeemed, or

(2) as determined by a quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due

if the notes of such series matured on December 15, 2046 (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis (assuming a

360-day

year

consisting of twelve

30-day

months) at the adjusted treasury rate plus 25 basis points,

plus

, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

Par Call:

|

|

The Issuer may also redeem some or all of the notes on or after December 15, 2046 (six months prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption date.

|

10

|

|

|

|

|

|

|

|

Special Mandatory Redemption:

|

|

The 4.368% Notes due 2047 will be subject to the special mandatory redemption provision described in the Preliminary Prospectus.

|

|

|

|

|

Business Day Convention:

|

|

New York

|

|

|

|

|

CUSIP/ISIN:

|

|

14149YBM9/US14149YBM93

|

Additional Modifications to the Preliminary Prospectus

In addition to the pricing information above, the Preliminary Prospectus will be updated to include the following changes relating to the floating rate notes,

and other corresponding changes will be deemed to be made where applicable throughout the Preliminary Prospectus.

Under the caption “Description of

the Notes—Interest” in the Preliminary Prospectus, the definition of “business day” will be replaced with the following:

The term “business day,” means any day other than a Saturday, a Sunday or any other day on which banking institutions in New York,

New York or the city where the corporate trust business of the trustee with respect to the indenture is principally administered at any particular time are required or authorized to close or be closed;

provided

,

that with respect to

any interest determination date, such day is also a London business day. “London business day” means any calendar day on which commercial banks are open for dealings in deposits in U.S. dollars in the London interbank market.

Under the caption “Description of the Notes—Interest” in the Preliminary Prospectus, the following terms relating to the floating rate notes

will be added:

Floating Rate Notes

Interest on the floating rate notes will accrue from June 12, 2017 and is payable quarterly in arrears on March 15,

June 15, September 15 and December 15 of each year, beginning on September 15, 2017 (each, an “interest payment date”) to the persons in whose names the floating rate notes are registered at the close of business on the

February 28, May 31, August 31 or November 30 (whether or not a business day), respectively, immediately prior to each interest payment date;

provided

that the interest due at maturity (whether or not an interest payment

date) will be paid to the person to whom principal is payable. Interest shall be calculated on the basis of the actual number of days in the period divided by 360.

The interest rate on the floating rate notes will be reset quarterly on March 15, June 15, September 15,

December 15 of each year, commencing September 15, 2017 (each, an “interest reset date”), and the floating rate notes will bear interest at an annual rate equal to three-month LIBOR (as determined below) for the applicable

interest reset period (as defined below), plus 0.770% per year. The interest rate for the initial interest reset period will be three-month LIBOR, determined as of the interest determination date (as defined below) prior to the original issue date,

plus 0.770% per year. The “initial interest reset period” will be the period from, and including, the original issue date to, but excluding, the initial interest reset date. Thereafter, each “interest reset period” will be the

period from, and including, an interest reset date to, but excluding, the immediately succeeding interest reset date;

provided

that the final interest reset period for the floating rate notes will be the period from, and including, the

interest reset date immediately

11

preceding the maturity date of the floating rate notes to, but excluding, the maturity date. The “interest determination date” will be the second London business day immediately

preceding either (i) the original issue date, in the case of the initial interest reset period, or (ii) the applicable interest reset date, in the case of each other interest reset period.

Interest payable on the floating rate notes on any interest payment date or the maturity date shall be the amount of interest

accrued from, and including, the immediately preceding interest payment date in respect of which interest has been paid or duly provided for (or from, and including, the original issue date, if no interest has been paid or duly provided for with

respect to the floating rate notes) to, but excluding, the interest payment date or maturity date, as the case may be. If any interest reset date or interest payment date for the floating rate notes (other than the maturity date) would otherwise be

a day that is not a business day, such interest reset date or interest payment date, as the case may be, will be postponed to the next succeeding day that is a business day and interest on the floating rate notes will continue to accrue on the

payment so deferred, except that if that business day is in the next succeeding calendar month, the interest reset date or interest payment date, as the case may be, shall be the immediately preceding business day. If the maturity date for any

floating rate note falls on a date that is not a business day, the related payments of principal and interest will be made on the next succeeding business day, and no additional interest will accumulate on the amount payable for the period from and

after the maturity date.

The Bank of New York Mellon Trust Company, N.A., or its successor appointed by us, will act as

calculation agent. Three-month LIBOR will be determined by the calculation agent as of the applicable interest determination date in accordance with the following provisions:

|

|

•

|

|

Three-month LIBOR will be the rate for deposits in U.S. dollars having a three-month maturity, commencing on the original issue date or the related interest reset day, as applicable, immediately following such interest

determination date, which appears on the Reuters LIBOR01 Page (as defined below) as of approximately 11:00 a.m., London time, on such interest determination date. “Reuters LIBOR01 Page” means the display designated as page

“LIBOR01” on the Reuters 3000 Xtra (or such other page as may replace the LIBOR01 page on that service, any successor service or such other service as may be nominated as the information vendor for the purpose of displaying rates or prices

comparable to the London Interbank Offered Rate for U.S. dollar deposits). If no rate appears on the Reuters LIBOR01 Page as of approximately 11:00 a.m., London time, on an interest determination date, three-month LIBOR for such interest

determination date will be determined in accordance with the provisions of the next succeeding bullet point.

|

|

|

•

|

|

With respect to an interest determination date on which no rate appears on the Reuters LIBOR01 Page as of

approximately 11:00 a.m., London time, on such interest determination date, the calculation agent shall request the principal London offices of each of four major reference banks (which may include affiliates of the underwriters) in the London

interbank market selected by us to provide the calculation agent with a quotation of the rate at which deposits of U.S. dollars having a three-month maturity, commencing on the original issue date or the related interest reset day, as applicable,

immediately following such interest determination date, are offered by it to prime banks in the London interbank market as of approximately 11:00 a.m., London time, on such interest determination date in a principal amount equal to an amount of not

less than U.S.

|

12

|

|

$1,000,000 that is representative for a single transaction in such market at such time. If at least two such quotations are provided, three-month LIBOR for such interest determination date will

be the arithmetic mean of such quotations as calculated by the calculation agent. If fewer than two quotations are provided, three-month LIBOR for such interest determination date will be the arithmetic mean of the rates quoted as of approximately

11:00 a.m., New York City time, on such interest determination date by three major banks (which may include affiliates of the underwriters) selected by us for loans in U.S. dollars to leading European banks having a three-month maturity commencing

on the original issue date or the related interest reset day, as applicable, immediately following such interest determination date and in a principal amount equal to an amount of not less than U.S. $1,000,000 that is representative for a single

transaction in such market at such time;

provided, however

, that if the banks selected by us are not quoting such rates as set forth in this sentence, three-month LIBOR for such interest determination date will be three-month LIBOR

determined with respect to the immediately preceding interest determination date.

|

All

percentages resulting from any calculation of any interest rate for the floating rate notes will be rounded, if necessary, to the nearest one hundred thousandth of a percentage point, with five

one-millionths

of a percentage point rounded upward and all dollar amounts will be rounded to the nearest cent, with

one-half

cent being rounded upward.

Promptly upon such determination, the calculation agent will notify us and the trustee (if the calculation agent is not the

trustee) of the interest rate for the new interest reset period. Upon request of a holder of floating rate notes, the calculation agent will provide to such holder the interest rate in effect on the date of such request and, if determined, the

interest rate for the next interest reset period.

All calculations made by the calculation agent for the purposes of

calculating interest on the floating rate notes shall be conclusive and binding on the holders and us, absent manifest error.

|

*

|

Note: The credit ratings above are not a recommendation to buy, sell or hold the securities. The ratings may be subject to revision or withdrawal at any time. Each of the ratings above should be evaluated

independently of any other securities rating. S&P has stated with respect to the Acquisition (as defined in the Preliminary Prospectus): “we expect to resolve our CreditWatch listing when the transaction has closed; based on the proposed

financing terms, we would likely lower the corporate credit rating [of Cardinal Health] to BBB+.”

|

|

**

|

We expect that delivery of the notes will be made to investors on or about the 7th business day following the date of this prospectus supplement (such settlement being referred to as ‘‘T+7’’).

Under Rule

15c6-1

under the Securities Exchange Act of 1934, trades in the secondary market are required to settle in three business days, unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade notes on the date of pricing or the next three succeeding business days will be required, by virtue of the fact that the notes initially settle in T+7, to specify an alternate settlement arrangement at the

time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes prior to their date of delivery hereunder should consult their advisors.

|

13

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Goldman

Sachs & Co. LLC at (866)

471-2526,

Merrill Lynch, Pierce, Fenner & Smith Incorporated at (800)

294-1322,

MUFG Securities Americas Inc. at (877)

649-6848

or Wells Fargo Securities, LLC at (800)

645-3751.

14

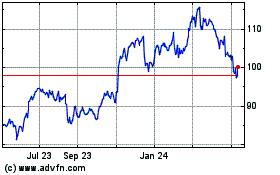

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

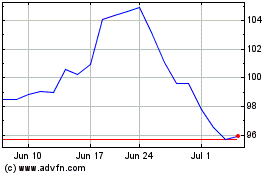

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024