Current Report Filing (8-k)

June 01 2017 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): May 26, 2017

MARTIN MIDSTREAM PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

DELAWARE

(State of incorporation

or organization)

|

|

000-50056

(Commission file number)

|

|

05-0527861

(I.R.S. employer identification number)

|

|

|

|

|

|

4200 STONE ROAD

|

|

|

|

KILGORE, TEXAS

(Address of principal executive offices)

|

|

75662

(Zip code)

|

Registrant's telephone number, including area code: (903) 983-6200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 26, 2017, the unitholders of Martin Midstream Partners L.P. (the “Partnership”) approved the Martin Midstream Partners L.P. 2017 Restricted Unit Plan (the “New LTIP”). The Board of Directors of Martin Midstream GP LLC, the general partner of the Partnership, previously approved the New LTIP.

The New LTIP authorizes 3,000,000 common units to be available for delivery with respect to awards under the plan. A summary of the New LTIP is set forth under the caption “Proposal to Approve the Martin Midstream Partners L.P. 2017 Restricted Unit Plan” in the Partnership’s definitive proxy statement filed with the Securities and Exchange Commission on April 21, 2017 (the “Proxy Statement”) and is incorporated herein by reference. The summary of the New LTIP set forth therein does not purport to be complete and is qualified in its entirety by reference to the full text of the New LTIP, a copy of which is filed as Exhibit A to the Proxy Statement and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders

A special meeting of the Partnership’s unitholders was held on May 26, 2017 (the “Special Meeting”), at which meeting the Partnership’s unitholders were asked to consider and vote upon a proposal to approve the New LTIP (the “LTIP Proposal”), and to approve the adjournment of the special meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies in the event there were not sufficient votes at the time of the special meeting to approve the New LTIP (the “Adjournment Proposal”).

The LTIP Proposal required the approval of a majority of the votes cast at the special meeting. Votes “for” and “against” and abstentions counted as votes cast. The Adjournment Proposal required the approval of a majority of the outstanding common units that are represented either in person or by proxy at the Special Meeting.

The number of votes cast with respect to each proposal were as follows:

Proposal 1 - The LTIP Proposal

The unitholders approved the LTIP Proposal. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker

Non-Votes

|

|

Votes For (as % of Vote Cast)

|

|

13,944,269

|

|

7,785,182

|

|

629,478

|

|

0

|

|

62.37%

|

Proposal 2 - The Adjournment Proposal

The unitholders approved the Adjournment Proposal. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker

Non-Votes

|

|

Votes For (as % of Vote Cast)

|

|

14,259,929

|

|

7,789,974

|

|

309,026

|

|

0

|

|

63.78%

|

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Martin Midstream Partners L.P. 2017 Restricted Unit Plan (incorporated by reference to Exhibit A to the Definitive Proxy Statement on Schedule 14A filed by the Partnership on April 21, 2017).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MARTIN MIDSTREAM PARTNERS L.P.

By: Martin Midstream GP LLC,

Its General Partner

|

|

Date: June 1, 2017

|

|

By: /s/ Robert D. Bondurant

|

|

|

|

Robert D. Bondurant

|

|

|

|

Executive Vice President, Treasurer, Principal Accounting Officer and

Chief Financial Officer

|

INDEX TO EXHIBITS

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Martin Midstream Partners L.P. 2017 Restricted Unit Plan (incorporated by reference to Exhibit A to the Definitive Proxy Statement on Schedule 14A filed by the Partnership on April 21, 2017).

|

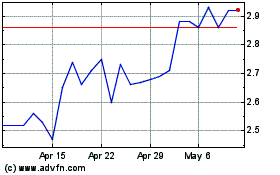

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

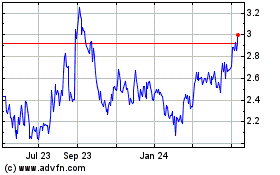

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024