Gladstone Land Acquires Farms in Arizona for $27.5 Million

June 01 2017 - 4:17PM

Gladstone Land Corporation (NASDAQ:LAND) (“Gladstone Land” or the

“Company”) announced today that it has acquired four farms totaling

3,253 gross acres and 3,032 irrigated acres (a portion of which is

organic) in southwestern Arizona for $27.5 million.

Approximately 1,221 of the irrigated acres are subject to leases

with the State of Arizona. Upon acquisition, the Company

assumed lease agreements with the existing tenants, each leading

growers, processors, and marketers of export-quality agricultural

commodities. The leases contain annual escalations throughout

their respective remaining terms, which range from two years to

nine years.

“We are excited to be adding four high-quality farms, such as

these in Southwestern Arizona,” said Bill Reiman, the Company's

Managing Director for the Western United States. “While we

already own several thousand acres in Arizona, this is a new

growing region for us and one we have been targeting for years.

Southwestern Arizona is home to a major winter growing region

of fresh produce and is also an important early-summer melon

production area. Leafy greens and melons will be two of the

primary crops grown on these farms.”

“This is our second large acquisition of 2017, and we are

excited to enter into a new growing region,” said David Gladstone,

President and CEO of Gladstone Land. “These farms have a

total of 19 wells onsite, giving them access to plenty of water,

and this transaction allowed us to partner with yet another top

grower. This is another acquisition that continues to improve

the overall diversification within our farmland portfolio, which

provides additional security to our shareholders. We also

expect this acquisition to provide us with additional earnings,

which we hope to be able to pass on to our stockholders in the form

of increased distributions. We have now increased the

distributions on our common stock six times over the past 29 months

for a total increase of 45.0%, and our goal is to continue this

trend. And the distributions we pay out to our stockholders

have been fully covered by our funds from operations for the past

six quarters.”

About Gladstone Land

Corporation:Gladstone Land is a

publicly-traded real estate investment trust that invests in

farmland located in major agricultural markets in the U.S., which

it leases to farmers, and pays monthly distributions to its

stockholders. The Company intends to report the current fair

value of its farmland on a quarterly basis; as of March 31, 2017,

the estimated net asset value of the Company was $14.47 per

share. Gladstone Land currently owns 63 farms, comprised of

57,593 acres in 7 different states across the U.S., valued at

approximately $488 million. Its acreage is predominantly

concentrated in locations where its tenants are able to grow fresh

produce annual row crops, such as berries and vegetables, which are

planted and harvested annually or more frequently; as well as

permanent crops, such as almonds, blueberries, and pistachios,

which are planted every 10 to 20-plus years. The Company also

may acquire property related to farming, such as cooling

facilities, processing buildings, packaging facilities, and

distribution centers. Gladstone Land has paid 52 consecutive

monthly cash distributions on its common stock since its initial

public offering in January 2013, and the current per-share

distribution on its common stock is $0.0435 per month, or $0.522

per year. Additional information can be found at

www.GladstoneLand.com and www.GladstoneFarms.com.

Owners or brokers who have farmland for sale in the U.S. should

contact:

- Eastern U.S. – Bill Frisbie at (703) 287-5839 or

bill.f@gladstoneland.com

- Western U.S. – Bill Reiman at (805) 263-4778 or

bill.r@gladstoneland.com

- Midwest U.S. – Bill Hughes at (618) 606-2887 or

bill.h@gladstoneland.com

For stockholder information on Gladstone Land, call (703)

287-5893. For Investor Relations inquiries related to any of

the monthly dividend-paying Gladstone funds, please visit

www.Gladstone.com.

All statements contained in this press release, other than

historical facts, may constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as "anticipates," "expects," "intends,"

"plans," "believes," "seeks," "estimates" and variations of the

foregoing words and similar expressions are intended to identify

forward-looking statements. Readers should not rely upon

forward-looking statements because the matters they describe are

subject to known and unknown risks and uncertainties that could

cause the Company's business, financial condition, liquidity,

results of operations, funds from operations or prospects to differ

materially from those expressed in or implied by such statements.

Such risks and uncertainties are disclosed under the caption

"Risk Factors" of the Company's Annual Report on Form 10-K for the

fiscal year ended December 31, 2016 (the “Form 10-K”), and

Quarterly Report on Form 10-Q for the three months ended March 31,

2017 (the “Form 10-Q”), each as filed with the SEC. The

Company cautions readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

For a definition of net asset value and a reconciliation to the

most directly-comparable GAAP measure, please see the Company’s

Form 10-K or Form 10-Q.

For further information: Gladstone Land, 703-287-5893

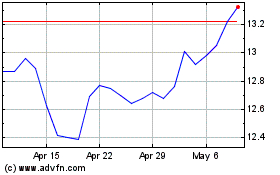

Gladstone Land (NASDAQ:LAND)

Historical Stock Chart

From Mar 2024 to Apr 2024

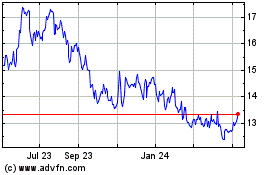

Gladstone Land (NASDAQ:LAND)

Historical Stock Chart

From Apr 2023 to Apr 2024