Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

June 01 2017 - 4:07PM

Edgar (US Regulatory)

Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Filer: Clariant Ltd

Subject Company: Huntsman Corporation

Commission File Number: 001-32427

Welcome to CEO Perspectives, a regular publication in which Clariant CEO Hariolf Kottmann shares his thoughts on important topics for our company.

For comments and questions please email us at: group.communications@clariant.com.

Mr. Kottmann, last week Clariant announced its intention to join Huntsman Corporation in a merger of equals. As you can imagine, this announcement has raised a lot of questions among the employees. So, first of all, can you give us an update on the status quo?

As regards the governance of the new company, so far, it has been agreed that the Board of Directors will consist of twelve members and that each company will propose six members for election. The Chairman of the Board will be proposed by Clariant. I will be the candidate. The Vice Chairman will be appointed by Huntsman. The new Board of Directors will then nominate a Chairman Committee, an Audit Committee and a Compensation Committee. Further committees will be discussed in due course.

During the past few days, my colleague Peter Huntsman and I, together with Patrick Jany and Kimo Esplin, Huntsman’s Executive Vice President responsible for Strategy and Investment, have been on a roadshow talking to investors of Clariant and Huntsman in order to explain the rationale and the details of the transaction. We will continue this roadshow for another two weeks, because now it is very important to convince the investors to stay on board and support the new company.

At the same time and with equal significance we are tackling internal and external communication. Several town hall meetings have been conducted by our executive committee members and the management team and several interviews with media were given.

In one of your interviews you mentioned that there will be job cuts due to the merger. For our employees this is of course a huge concern. Would you please elaborate on that?

I absolutely understand these concerns and I am fully aware of the uncertainties such a merger entails. If you plan such a merger and then claim that there won’t be any job cuts, it would be a lie. Of course there will be synergies and we have to reduce resulting redundancies. This will affect all hierarchy levels. For example, there won’t be two CFOs in the new company. The majority of redundancies will be in the regions as well as the service units.

But the vast majority of the employees of both companies will find a workplace in a bigger and more profitable company.

I cannot talk about numbers right now, because we have to very carefully go into the details first. But I promise you that all

employees who will be affected will be treated very fairly and generously.

There were some uncertainties about the headquarters as well. What is the difference between the operational headquarters in The Woodlands and the global headquarters in Pratteln?

Regardless of the company’s legal domicile in Muttenz, the headquarters of HuntsmanClariant will be located in Pratteln. This means that the offices of the Chairman of the Board, the CEO, CFO, and some of the EC members will be located there. At the same time, there will be operational headquarters in The Woodlands near Houston — as well as at other locations around the world. Having operational headquarters in Houston does not at all mean that the company will be run from there or that all business units and further entities will have to move there. Frankly, I consider it quite strange that — in times of globalization and digitalization — journalists, employees, and investors put so much thoughts into offices and locations. During a normal month I spend a lot of time travelling and only little time in the office.

Can you tell us more about the designated CEO of the new company, Peter Huntsman?

Peter Huntsman has been running Huntsman Corporation for 17 years as President and CEO, which makes him a very experienced executive. I have known him for almost ten years and I appreciate him as an intelligent, honest and reliable friend and colleague. He listens, is open to new thoughts, very communicative and trustworthy. Peter Huntsman is therefore the perfect candidate to run the new company after closing. In my new role as Chairman of the Board, in the next one to two years, I will primarily take care of the strategic set-up of the new company. From the beginning of June, I will — in close alignment with Peter — focus on the architecture of the new company.

As I mentioned before, Peter and I share the same strategic vision. Our negotiations confirmed our solid foundation of trust, and I am convinced that together we will successfully steer the new company towards success.

What will be the next steps and when will we know more about the progress of the merger?

Today we will conduct further planning for integration in Zurich, for example how the common team should tackle the design of the operating model of the new company. Besides this, we will address approaches on the topic of synergies. And on Friday there will be a GMT event held in Zurich, in order to openly address all open topics with our senior management team. Of course we will keep all employees informed about the latest developments on an ongoing basis.

How should we as individual employees behave in this phase while many details are not yet set?

In general, we will continue with our activities as planned. Clariant and Huntsman remain independent companies until the day of closing, and we as Clariant will do everything to achieve the targets we have set ourselves for 2017.

What I need from you now is your ongoing commitment. From my point of view the merger of Huntsman and Clariant is a merger of opportunities. It will create a new company with a stronger balance sheet, improved rating, higher profitability, stronger cash flow profile, and higher dividends.

HuntsmanClariant will offer us much more opportunities and financial power for international acquisitions to strengthen and deepen our portfolio. I see it as a unique opportunity — everyone can now set the basis for the success of this merger.

Disclaimer

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Clariant and Huntsman have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this communication include, without limitation, statements about the anticipated benefits of the contemplated transaction, including future financial and operating results and expected synergies and cost savings related to the contemplated transaction, the plans, objectives, expectations and intentions of Clariant, Huntsman or the combined company, the expected timing of the completion of the contemplated transaction and information relating to the proposed initial public offering of ordinary shares of Venator Materials PLC. Such statements are based on the current expectations of the management of Clariant or Huntsman, as applicable, are qualified by the inherent risks and uncertainties surrounding future expectations generally, and actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. Neither Clariant nor Huntsman, nor any of their respective directors, executive officers or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause results to differ from expectations include: uncertainties as to the timing of the contemplated transaction; uncertainties as to the approval of Huntsman’s stockholders and Clariant’s shareholders required in connection with the contemplated transaction; the possibility that a competing proposal will be made; the possibility that the closing conditions to the contemplated transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; the effects of disruption caused by the announcement of the contemplated transaction making it more difficult to maintain relationships with employees, customers, vendors and other business partners; the risk that stockholder litigation in connection with the contemplated transaction may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; ability to refinance existing indebtedness of Clariant or Huntsman in connection with the contemplated transaction; other business effects, including the effects of industry, economic or political conditions outside of the control of the parties to the contemplated transaction; transaction costs; actual or contingent liabilities; disruptions to the financial or capital markets, including with respect to the initial public offering of ordinary shares by Venator Materials PLC or financing activities related to the contemplated transaction; and other risks and uncertainties discussed in Huntsman’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the “Risk Factors” section of Huntsman’s annual report on Form 10-K for the fiscal year ended December 31, 2016. You can obtain copies of Huntsman’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and neither Clariant nor Huntsman undertakes any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

Important Additional Information and Where to Find It

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the contemplated transaction, Clariant intends to file a registration statement on Form F-4 with the SEC that will include the Proxy Statement/Prospectus of Huntsman. The Proxy Statement/Prospectus will also be sent or given to Huntsman stockholders and will contain important information about the contemplated transaction. INVESTORS

AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CLARIANT, HUNTSMAN, THE CONTEMPLATED TRANSACTION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Clariant and Huntsman through the website maintained by the SEC at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

Huntsman and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Huntsman investors and shareholders in connection with the contemplated transaction. Information about Huntsman’s directors and executive officers is set forth in its proxy statement for its 2017 Annual Meeting of Stockholders and its annual report on Form 10-K for the fiscal year ended December 31, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov. Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the Proxy Statement/ Prospectus that Huntsman intends to file with the SEC

.

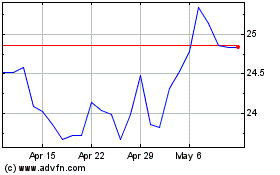

Huntsman (NYSE:HUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

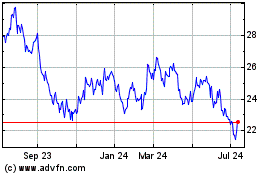

Huntsman (NYSE:HUN)

Historical Stock Chart

From Apr 2023 to Apr 2024