Local Residents Invited to “Unlock Your

Future”

Whether for big dreams or unexpected unknowns, everyone is

saving for one thing: the future. That’s why PurePoint™ Financial,

a new hybrid digital bank and division of MUFG Union Bank, N.A.

aimed at committed savers, is surprising residents in Dallas,

Houston and Tampa by letting them open the door – literally – to

the possibilities ahead with “Unlock Your Future” red door art

installations and the opportunity to win $10,000 toward their

savings goals.

When developing its new offering, PurePoint Financial listened

to what committed savers want – market-leading rates, the

convenience and around-the-clock access that comes from banking

online and the ability to meet with a savings professional in

person when they need to – and built their business model around

those needs. PurePoint Financial exclusively offers savings

accounts and certificates of deposit (CDs), combining the

convenience of online banking with in-person client service at

PurePoint Financial Centers. This model enables PurePoint to

deliver market-leading rates and an exceptional client experience

the way clients want to bank – online, over the phone or in

person.

Now, PurePoint is celebrating its launch with red door art

installations that will open to reveal beautiful murals created by

local artists and inspired by what residents are saving for.

Individuals who visit the door exhibits are invited to enter the

“Unlock Your Future” Sweepstakes at a local financial center and

instantly boost their savings.

“Our Savings Habits in America research revealed that those

working toward a goal tend to be better at saving,” said Pierre

Habis, President of PurePoint Financial. “We created the ‘Unlock

Your Future’ art installations to demonstrate our commitment to

grow Americans’ personal savings rates while empowering residents

of Dallas, Houston and Tampa to reach their savings goals

sooner.”

Urban Art Exhibits, Inspired by the Reasons Locals

Save

The “Savings in America” research revealed that the 43% of

Americans who direct their savings at a specific goal are markedly

better at saving than those without specific targets in mind. The

issue comes from temptation to think short-term about savings

accounts, and 2 in 3 Americans dip into their savings multiple

times per year. On the national spectrum, half of respondents

indicated they were saving for a vacation, and 26% and 24% stated

that their savings were focused on a home or a car respectively.

The “Unlock Your Future” art installations were inspired by savings

trends on the local level, including:

- Dallas’ results were consistent with

the top three priorities, with an extra emphasis on savings tied to

cars – more than half (51%) of those surveyed stated they are

saving for car down payments or related expenses.

- Houston’s third-most likely reason to

be saving was for medical and health/wellness expenses at 26%, and

48% of their residents also admitted to withdrawing from savings

accounts at least once a month.

- Medical and health/wellness expenses

jumped to second in Tampa as a savings priority for 28% of

respondents, versus the 20% national average in that category.

“When you are saving to reach a financial goal, higher returns

shouldn’t mean you must sacrifice personal attention or service,”

said Habis. “Whether you call our Client Support Center or visit

one of our Financial Centers, you will experience truly

personalized service to help you reach your savings goals.”

Event Schedule

Each of the three cities will feature unique art exhibits at

areas that experience significant foot traffic during the work day.

The three large red doors will remain closed for two full days

before opening to depict murals based on the three things that

city’s residents are saving for most, according to PurePoint™

“Savings Habits in America” research that examined several major

markets nationwide. The “Unlock Your Future” exhibit and

sweepstakes will occur on the following schedule:

- Dallas: Doors start appearing around

town May 30-31; savings-inspired murals by local artist on full

display June 1-June 3; sweepstakes runs June 1-June 9.

- Houston: Doors appear June 5;

savings-inspired murals by local artist shown June 7-June 9;

sweepstakes runs June 7-June 16.

- Tampa: Doors appear June 19;

savings-inspired murals by local artist shown June 21-June 23;

sweepstakes runs June 21-June 30.

About PurePoint™ Financial Centers

Each PurePoint Financial Center offers a modern, streamlined and

cashless experience with a relatively smaller footprint than

traditional banks (2,000 square feet on average) including

beautiful décor, a relaxed setting, and hospitality area. Clients

will also enjoy market-leading rates, no monthly fees and

knowledgeable savings professionals who will be available to help

answer questions about FDIC insurance1 and how best to save.

PurePoint Financial Centers are open Mon. through Fri., 9:00 am –

5:00 pm (excluding federal holidays). Sixteen PurePoint Financial

Centers are currently open in the Chicago, Dallas, Houston, Miami,

and Tampa areas, with others (including New York) slated to open

later this year.

About PurePoint™ Financial

PurePoint Financial is a division of MUFG Union Bank, N.A., a

proud member of the Mitsubishi UFJ Financial Group (MUFG), one of

the world’s leading financial groups. As the next evolution in the

financial services industry, PurePoint™ Financial is the modern way

to save − online, over the phone or in person. PurePoint offers

market-leading CD and savings rates, no monthly fees and all the

flexibility and convenience of online banking with 24/7 access from

your computer, tablet or mobile devices. PurePoint also offers

Financial Centers at select locations staffed by knowledgeable team

members who are committed to delivering exceptional service.

About the PurePoint Saving Habits in America Research

The PurePoint Saving Habits in America Research is an online

survey of 3,015 adults (18+ years of age) in the U.S. 2,015 of the

completed surveys collected were nationally representative, with an

additional 200 in each of the following designated market areas:

Miami, Tampa, Houston, Dallas, and Chicago. Data shown is from the

nationally representative sample. The research was commissioned by

PurePoint Financial and produced by independent research firm

Edelman Intelligence. The margin of error for the total sample is

+/-1.8 percentage points, +/- 2.2 percentage points for the

nationally representative sample, and +/- 6.9 percentage points for

each designated market area. Data was collected Jan. 23 – Jan. 30,

2017 by Edelman Intelligence.

About MUFG Union Bank, N.A.

MUFG Union Bank, N.A., is a full-service bank with offices

across the United States. We provide a wide spectrum of corporate,

commercial and retail banking and wealth management solutions to

meet the needs of customers. We also offer an extensive portfolio

of value-added solutions for customers, including investment

banking, personal and corporate trust, global custody, transaction

banking, capital markets, and other services. With assets of $116.1

billion, as of March 31, 2017, MUFG Union Bank has strong capital

reserves, credit ratings and capital ratios relative to peer banks.

MUFG Union Bank is a proud member of the Mitsubishi UFJ Financial

Group (NYSE: MTU), one of the world’s largest financial

organizations with total assets of approximately ¥303.3 trillion

(JPY) or $2.7 trillion (USD)2, as of March 31, 2017. The corporate

headquarters (principal executive office) for MUFG Americas

Holdings Corporation, which is the financial holding company and

MUFG Union Bank, is in New York City. The main banking office of

MUFG Union Bank is in San Francisco, California.

PurePoint Financial is a division of MUFG Union Bank, N.A.

©2017 MUFG Union Bank, N.A. All rights reserved. Member

FDIC.

PurePoint and the PurePoint logo are trademarks and brand names

of MUFG Union Bank, N.A.

1 Deposits of PurePoint Financial and MUFG Union Bank, N.A. are

combined and not separately insured for FDIC insurance purposes

2 Exchange rate of 1 USD=¥112.19 (JPY) as of March 31, 2017

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170601005190/en/

PurePoint FinancialSierra

Wilson213.236.5329Sierra.Wilson@purepoint.comorElizabeth

Dixon415.229.7685Elizabeth.Dixon@edelman.com

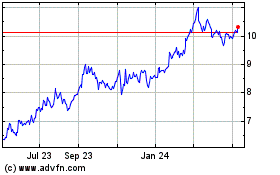

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

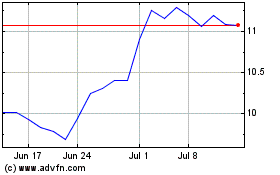

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024