Revised Proxy Soliciting Materials (definitive) (defr14a)

May 31 2017 - 5:19PM

Edgar (US Regulatory)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the

Registrant ☒ Filed by a party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

CERUS

CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s)

Filing Proxy Statement if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box)

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1.

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2.

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3.

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4.

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5.

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

6.

|

|

Amount Previously Paid:

|

|

|

|

7.

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

8.

|

|

Filing Party:

|

|

|

|

9.

|

|

Date Filed:

|

CERUS CORPORATION

2550 Stanwell Dr.

Concord, CA 94520

AMENDMENT NO.

1 TO THE PROXY STATEMENT FOR THE

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 7, 2017

EXPLANATORY

NOTE

The following information supplements and amends the definitive proxy statement (the “Proxy Statement”) of Cerus

Corporation (the “Company”) originally filed with the Securities and Exchange Commission (“SEC”) on April 28, 2017 in connection with the solicitation of proxies by the Company’s Board of Directors for use at the

Company’s 2017 Annual Meeting of Stockholders and at any adjournment thereof (the “Annual Meeting”). The Annual Meeting is scheduled to be held on Wednesday, June 7, 2017 at 9:00 a.m. local time at the Company’s principal

executive offices, located at 2550 Stanwell Drive, Concord, California 94520.

This Amendment No. 1 to the Proxy Statement (this

“Amendment”) is being filed for the sole purpose of including the “Outstanding Equity Awards at Fiscal Year-End” table that was inadvertently omitted from the Proxy Statement, as originally filed with the SEC on April 28,

2017. No other changes have been made to the Proxy Statement, and this Amendment has not been updated to reflect events occurring subsequent to the filing of the Proxy Statement. Capitalized terms used in this Amendment and not otherwise defined

have the meaning given to such terms in the Proxy Statement.

THE PROXY STATEMENT CONTAINS IMPORTANT INFORMATION AND THIS AMENDMENT AND

THE INFORMATION SET FORTH BELOW SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

CHANGE TO PROXY STATEMENT

The Proxy Statement is hereby amended and supplemented to include the following information:

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table shows for the fiscal year ended December 31, 2016, certain information regarding outstanding equity awards at fiscal

year-end for the named executive officers.

O

UTSTANDING

E

QUITY

A

WARDS

AT

D

ECEMBER

31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards

|

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration

Date

|

|

|

Number of

Shares or Units of Stock

That Have Not Vested (#)

Exercisable

|

|

|

Market Value of Shares or

Units of Stock That Have Not

Vested

($)(1)

|

|

|

William M. Greenman

|

|

|

30,000

|

|

|

|

—

|

|

|

|

8.73

|

|

|

|

9/30/2017

|

|

|

|

67,500

|

(2)

|

|

|

293,625

|

|

|

|

|

|

40,000

|

|

|

|

—

|

|

|

|

4.19

|

|

|

|

9/30/2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150,000

|

|

|

|

—

|

|

|

|

0.79

|

|

|

|

1/11/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100

|

|

|

|

—

|

|

|

|

1.06

|

|

|

|

4/22/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,000

|

|

|

|

—

|

|

|

|

2.15

|

|

|

|

9/30/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100,000

|

|

|

|

—

|

|

|

|

3.00

|

|

|

|

8/31/2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

550,000

|

|

|

|

—

|

|

|

|

2.70

|

|

|

|

4/18/2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100,000

|

|

|

|

—

|

|

|

|

2.08

|

|

|

|

8/31/2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

380,000

|

|

|

|

—

|

|

|

|

3.75

|

|

|

|

2/28/2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

365,625

|

|

|

|

24,375

|

(3)

|

|

|

3.66

|

|

|

|

2/28/2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

223,437

|

|

|

|

101,563

|

(4)

|

|

|

6.28

|

|

|

|

3/2/2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

218,750

|

|

|

|

281,250

|

(5)

|

|

|

4.46

|

|

|

|

3/1/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59,062

|

|

|

|

255,938

|

(6)

|

|

|

5.06

|

|

|

|

2/28/2026

|

|

|

|

|

|

|

|

|

|

|

Kevin D. Green

|

|

|

25,000

|

|

|

|

—

|

|

|

|

10.15

|

|

|

|

1/2/2016

|

|

|

|

18,000

|

(2)

|

|

|

78,300

|

|

|

|

|

|

7,500

|

|

|

|

—

|

|

|

|

8.73

|

|

|

|

9/30/2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,000

|

|

|

|

—

|

|

|

|

0.79

|

|

|

|

1/11/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000

|

|

|

|

—

|

|

|

|

1.05

|

|

|

|

4/30/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,000

|

|

|

|

—

|

|

|

|

2.15

|

|

|

|

9/30/2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000

|

|

|

|

—

|

|

|

|

3.00

|

|

|

|

8/31/2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50

|

|

|

|

—

|

|

|

|

2.48

|

|

|

|

1/2/2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80,000

|

|

|

|

—

|

|

|

|

2.08

|

|

|

|

8/31/2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

95,000

|

|

|

|

—

|

|

|

|

3.75

|

|

|

|

2/28/2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

93,750

|

|

|

|

6,250

|

(3)

|

|

|

3.66

|

|

|

|

2/28/2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

85,937

|

|

|

|

39,063

|

(4)

|

|

|

6.28

|

|

|

|

3/2/2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,625

|

|

|

|

84,375

|

(5)

|

|

|

4.46

|

|

|

|

3/1/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,875

|

|

|

|

73,125

|

(6)

|

|

|

5.06

|

|

|

|

2/28/2026

|

|

|

|

|

|

|

|

|

|

|

Laurence M. Corash

|

|

|

30,000

|

|

|

|

—

|

|

|

|

8.73

|

|

|

|

9/30/2017

|

|

|

|

18,000

|

(2)

|

|

|

78,300

|

|

|

|

|

|

35,000

|

|

|

|

—

|

|

|

|

4.19

|

|

|

|

9/30/2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,250

|

|

|

|

—

|

|

|

|

2.08

|

|

|

|

8/31/2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

130,000

|

|

|

|

—

|

|

|

|

3.75

|

|

|

|

2/28/2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

109,375

|

|

|

|

10,625

|

(3)

|

|

|

3.66

|

|

|

|

2/28/2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

92,812

|

|

|

|

42,188

|

(4)

|

|

|

6.28

|

|

|

|

3/2/2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67,812

|

|

|

|

87,188

|

(5)

|

|

|

4.46

|

|

|

|

3/1/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

|

|

50,000

|

(7)

|

|

|

5.13

|

|

|

|

2/31/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,875

|

|

|

|

73,125

|

(6)

|

|

|

5.06

|

|

|

|

2/28/2026

|

|

|

|

|

|

|

|

|

|

|

Richard Benjamin

|

|

|

123,958

|

|

|

|

226,042

|

(8)

|

|

|

4.72

|

|

|

|

8/31/2025

|

|

|

|

9,000

|

(2)

|

|

|

39,150

|

|

|

|

|

|

8,437

|

|

|

|

36,563

|

(6)

|

|

|

5.06

|

|

|

|

2/28/2026

|

|

|

|

|

|

|

|

|

|

|

Vivek Jayaraman

|

|

|

—

|

|

|

|

250,000

|

(9)

|

|

|

6.36

|

|

|

|

8/31/2026

|

|

|

|

75,000

|

(10)

|

|

|

326,250

|

|

|

(1)

|

The market values of the RSU awards that have not vested are calculated by multiplying the number of shares underlying the RSU awards shown in the table by $4.35, the closing price of our common stock on

December 30, 2016.

|

|

(2)

|

The shares subject to this RSU award vest in three equal annual installments commencing on March 10, 2017.

|

|

(3)

|

The shares subject to this stock option award vested as to 12.5% of the shares on September 1, 2013, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(4)

|

The shares subject to this stock option award vested as to 12.5% of the shares on September 1, 2014, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(5)

|

The shares subject to this stock option award vested as to 12.5% of the shares on September 1, 2015, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(6)

|

The shares subject to this stock option award vested as to 12.5% of the shares on September 1, 2016, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(7)

|

The shares subject to this stock option award vest as to 50% of the shares on June 1, 2017, and vest as to the remainder of the shares in 24 equal monthly installments thereafter.

|

|

(8)

|

The shares subject to this stock option award vest as to 12.5% of the shares on January 13, 2016, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(9)

|

The shares subject to this stock option award vest as to 12.5% of the shares on March 1, 2017, and vest as to the remainder of the shares in 42 equal monthly installments thereafter.

|

|

(10)

|

The shares subject to this RSU award vest in four equal annual installments commencing on August 29, 2017.

|

********

Important Notice

Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be

Held on June 7, 2017, at 2550

Stanwell Drive, Concord, California 94520:

This Amendment No. 1 to the proxy statement, the proxy statement and annual report

to stockholders are available at

www.proxyvote.com

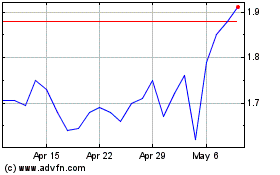

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Apr 2023 to Apr 2024