Current Report Filing (8-k)

May 31 2017 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (date of Earliest Event Reported): May 25, 2017

moleculin

biotech, INC.

(Exact Name of Registrant as Specified in

its Charter)

|

DELAWARE

|

|

001-37758

|

|

47-4671997

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File No.)

|

|

(I.R.S. Employer

Identification No.)

|

2575

WEST BELLFORT, SUITE 333, HOUSTON TX 77054

(Address of principal executive offices

and zip code)

(713) 300-5160

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

from last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-14(c)).

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

x

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 25, 2017, Moleculin

Biotech, Inc. (“Company”) approved a form of indemnification agreement to be entered into with its current and future

directors and executive officers (the “Indemnification Agreement”). The Company has entered into, or will be entering

into, an Indemnification Agreement with each of its directors and executive officers.

The Indemnification

Agreement provides, among other things, that the Company will indemnify indemnitees to the fullest extent permitted by law. The

Indemnification Agreement provides procedures for the determination of an indemnitee’s right to receive indemnification and

the advancement of expenses. Subject to the express terms of the Indemnification Agreement, the Company’s obligations under

the Indemnification Agreement continue even after an indemnitee ceases to be a director, officer or employee of the Company.

The foregoing description

of the Indemnification Agreement does not purport to be complete and is qualified in its entirety by reference to the form Indemnification

Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On May 25, 2017, Moleculin

Biotech, Inc. held its 2017 Annual Meeting of Stockholders (the “Annual Meeting”). As of April 26, 2017, the record

date for the Annual Meeting, there were 17,756,872 shares of common stock issued and outstanding and entitled to vote on the proposals

presented at the Annual Meeting, of which 13,056,679, or 73.5%, were present in person or represented by proxy, which constituted

a quorum. The holders of shares of our common stock are entitled to one vote for each share held. Set forth below are the final

voting results for each of the proposals submitted to a vote of the Company’s stockholders at the Annual Meeting.

Proposal 1. The Company’s stockholders

elected Walter V. Klemp; Robert George; Jacqueline Northcut; and Michael Cannon, each to serve until the 2018 annual meeting of

stockholders of the Company or until such person’s successor is qualified and elected. The voting for each director was

as follows:

|

Nominee

|

|

Votes For

|

|

Votes Withheld

|

|

Broker Non-Votes

|

|

Walter V. Klemp

|

|

8,752,388

|

|

216,450

|

|

4,087,841

|

|

Robert George

|

|

7,350,337

|

|

1,618,501

|

|

4,087,841

|

|

Jacqueline Northcut

|

|

7,352,941

|

|

1,615,897

|

|

4,087,841

|

|

Michael Cannon

|

|

8,218,953

|

|

749,885

|

|

4,087,841

|

Proposal 2. The Company’s stockholders ratified the appointment of Grant Thornton, LLP as the Company's independent

registered public accounting firm for the fiscal year ending December 31, 2017, by the following vote:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

12,882,524

|

|

108,668

|

|

65,487

|

|

n/a

|

Proposal 3. The Company’s stockholders

approved the adoption of an amendment to the Company's Amended and Restated Certificate of Incorporation to effect reverse stock

split of the outstanding shares of the Company’s common stock, at one of the following reverse stock split ratios, 1-for-5,

1-for-6, 1-for-7, 1-for-8, 1-for-9, 1-for-10, 1-for-11, 1-for-12, 1-for-13, 1-for-14, or 1-for-15, as determined by the Board

of Directors in its sole discretion, prior to the one-year anniversary of the Annual Meeting. The voting on this proposal is set

forth below:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

11,941,530

|

|

1,074,821

|

|

40,327

|

|

n/a

|

Proposal 4. The Company's stockholders

approved the proposal to authorize the proxy holder to adjourn the Annual Meeting to another time and place, if necessary, to

solicit additional proxies in the event that there are not sufficient votes to approve Proposal 3. The voting on this proposal

is set forth below:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

8,598,746

|

|

355,943

|

|

14,149

|

|

4,087,841

|

Adjournment of the Annual Meeting was

not necessary or appropriate because there were sufficient votes in favor of Proposal 3.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

10.1

|

Form of Indemnification Agreement

|

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

MOLECULIN BIOTECH, INC.

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 31, 2017

|

|

|

|

|

|

By:

|

/s/ Jonathan Foster

|

|

|

|

|

Jonathan Foster

|

|

|

|

|

Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Form of Indemnification Agreement

|

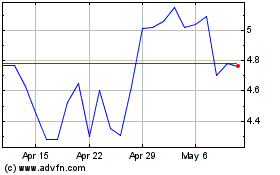

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

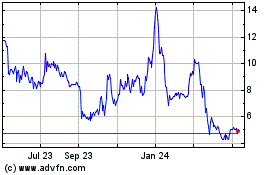

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024