Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No.

)

Filed by the Registrant

x

Filed by a Party other than the Registrant

o

|

Check the appropriate box:

|

|

x

|

Preliminary Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

o

|

Definitive Information Statement

|

|

|

Virtu Financial, Inc.

|

|

|

(Name of Registrant As Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Information Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

Table of Contents

VIRTU FINANCIAL, INC.

900 Third Avenue, 29

th

Floor

New York, New York 10022

[

·

], 2017

NOTICE OF ACTION TAKEN

PURSUANT TO WRITTEN CONSENTS OF STOCKHOLDERS

To Our Stockholders:

Virtu Financial, Inc., a Delaware corporation (the “Company”, “Virtu” or “we”) hereby gives notice to the holders of its Class A common stock, par value $0.00001 per share (“Company Class A Common Stock”), that TJMT Holdings LLC (the “Founder Member”), an affiliate of Mr. Vincent Viola, our Founder and Executive Chairman, and other members of the Viola family, which holds a majority of the voting power of the outstanding capital stock of the Company, has taken certain actions by written consent, which consent is set forth in

Appendix A

hereto, to approve the issuance of greater than 20 percent of the Company’s outstanding Company Class A Common Stock (the “Share Issuance”) in connection with financing the acquisition by the Company (the “Acquisition”) of KCG Holdings, Inc. (the “Target” or “KCG”).

The Company Class A Common Stock is listed and traded on The NASDAQ Stock Market LLC (“NASDAQ”) under the symbol “VIRT.” Under the NASDAQ rules, the holders of outstanding shares of capital stock of the Company holding at least a majority of the voting power must approve the Share Issuance because we will have issued in connection with the transactions required to finance the consideration for the Acquisition securities in excess of 20 percent of the number of shares of Company Class A Common Stock outstanding before such issuance. Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) and our organizational documents permit any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of a majority of the voting power of the outstanding capital stock of the Company required to approve the action at a meeting. Accordingly, the Founder Member, which holds a majority of the voting power of the outstanding capital stock of the Company, has approved the Share Issuance to finance the consideration required to complete the Acquisition, subject to the terms and conditions set forth in the documents governing the transactions.

All necessary corporate approvals in connection with the matters referred to in this Information Statement relating to the Share Issuance have been obtained, and the Company may issue the shares of Company Class A Common Stock upon providing necessary notice to its non-consenting stockholders in accordance with the DGCL and the U.S. federal securities laws and upon satisfaction of the terms and conditions set forth in the documents governing these transactions. The Company is not required to obtain, nor is it seeking, approval of any other transactions in connection with the Acquisition, including the Merger (as defined below), for which no stockholder vote for the Company is required. This Information Statement is being furnished to all stockholders of the Company pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, solely for the purpose of informing the non-consenting stockholders of these corporate actions before the Company takes such actions set forth in the written consent. In accordance with Rule 14c-2 under the Exchange Act, the Company may issue the shares of Company Class A Common Stock no sooner than 20 calendar days after the definitive form of the accompanying Information Statement is first being mailed to the Company’s stockholders, subject to notice and approval of NASDAQ.

We are mailing this Information Statement to our holders of record as of the close of business on April 19, 2017, which was the date on which the written consent received approval of the Founder Member. This Information Statement is being provided to you for your information to comply with the Exchange Act requirements. You are urged to read this Information Statement carefully in its entirety. No action is required on your part in connection with this document. No stockholder meeting will be held in connection with this Information Statement.

We are not asking you for a proxy and you are requested not to send us a proxy.

Table of Contents

We thank you for your continued support.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

Vincent Viola

|

|

|

Founder, Executive Chairman and Chairman of the Board of Directors

|

New York, New York

[

·

], 2017

Neither the U.S. Securities and Exchange Commission nor any state securities regulatory agency has approved or disapproved the Acquisition or the Share Issuance, passed upon the merits or fairness of the Acquisition or passed upon the adequacy or accuracy of the disclosures in this notice or the accompanying Information Statement. Any representation to the contrary is a criminal offense.

Table of Contents

VIRTU FINANCIAL, INC.

900 Third Avenue, 29

th

Floor

New York, New York 10022

INFORMATION STATEMENT

We are required to deliver this Information Statement to holders of the Company Class A Common Stock to inform them that the Founder Member, which holds a majority of the voting power of the outstanding capital stock of the Company, has taken certain actions by written consent, which would normally require a meeting of stockholders. April 19, 2017, which was the date on which the written consent received approval of the Founder Member, has been fixed as the record date for the determination of stockholders entitled to receive this Information Statement.

THIS INFORMATION STATEMENT IS FIRST BEING SENT ON OR ABOUT [

·

], 2017

TO THE RECORD HOLDERS AS OF APRIL 19, 2017.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

Table of Contents

SUMMARY

This Summary and the section titled “Questions and Answers About the Acquisition” summarize certain information contained in this Information Statement, but do not contain all of the information that is important to you. The description and summaries of the documents and agreements below do not purport to be complete and are qualified in their entirety by reference to the actual documents and agreements. You should carefully read this entire Information Statement, including the attached Appendix.

ISSUANCE OF 48,076,924 SHARES OF COMPANY CLASS A COMMON STOCK

On April 20, 2017, Virtu Financial, Inc., a Delaware corporation (the “Company,” “Virtu” or “we”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Orchestra Merger Sub, Inc., a Delaware corporation and indirect wholly-owned subsidiary of the Company (“Merger Sub”), and KCG Holdings, Inc., a Delaware corporation (the “Target” or “KCG”).

Pursuant to the Merger Agreement, subject to the satisfaction or waiver of specified conditions, Merger Sub will merge with and into the Target (the “Merger”), with the Target surviving the Merger as a wholly-owned subsidiary of the Company (the “Acquisition”).

Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each of the Target’s issued and outstanding shares of Class A common stock, par value $0.01 per share (“Target Class A Common Stock”), will be cancelled and extinguished and converted into the right to receive $20.00 in cash, without interest (the “Merger Consideration”), less any applicable withholding taxes.

In connection with financing the consideration for the Acquisition, the Company entered into the following transactions (collectively, the “Financing Transactions”):

Equity Financing

Temasek Investment Agreement and NIH Investment Agreement

In connection with financing the Merger Consideration, on April 20, 2017, the Company entered into (i) an investment agreement (the “Temasek Investment Agreement”) with an affiliate of one of our existing holders of Company Class A Common Stock, Aranda Investments Pte. Ltd. (“Temasek”), pursuant to which the Company will issue to Temasek 8,012,821 shares of the Company’s Class A common stock, par value $0.00001 per share (“Company Class A Common Stock”), at a purchase price of $15.60 per share (the “Temasek Investment”) and (ii) an investment agreement (the “NIH Investment Agreement”) with North Island Holdings I, LP (“NIH”) pursuant to which the Company will issue to NIH 40,064,103 shares of Company Class A Common Stock at a purchase price of $15.60 per share (the “NIH Investment”), representing the issuance of a total of 48,076,924 shares of Company Class A Common Stock and gross proceeds to the Company of approximately $750.0 million.

Each of the Temasek Investment and NIH Investment is contingent upon the closing of the Acquisition and is subject to customary and other closing conditions, including receipt of required regulatory approvals, and the execution and delivery of certain documents.

The Company Class A Common Stock was offered and will be sold in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act, and may not be offered or sold absent registration or an applicable exemption from registration.

Debt Financing

In connection with financing the Merger Consideration, on April 20, 2017, the Company also entered into a debt financing commitment letter (the “Debt Commitment Letter”) with JPMorgan Chase Bank, N.A. (“J.P. Morgan” or the “Lender”). Pursuant to the Debt Commitment Letter, the Lender has committed to arrange and provide the Company with: (i) up to $825.0 million aggregate principal amount of senior secured term B loans (the “Term Loan Facilities”) and (ii) if $825.0 million aggregate principal amount of senior secured second lien notes (the “Notes”) are not issued and sold on or prior to the date of consummation of the Acquisition in such amount, $825.0 million aggregate principal amount (minus the gross proceeds of Notes issued prior to the date of consummation of the Acquisition) in senior secured second lien bridge loans (the “Bridge Loans” and together with the Term Loan Facilities and certain senior secured rollover loans and senior secured exchange notes, the “Facilities”).

Table of Contents

The proceeds of the applicable Facilities and the Notes (to the extent borrowed or issued on or prior to the closing of the Acquisition) may be used (i) to finance the Acquisition, (ii) to pay the fees, costs and expenses incurred in connection with, among other things, the Acquisition and the Facilities and (iii) to fund the refinancing of the Target’s and certain of the Company’s existing debt. The availability of the borrowings under the Facilities is subject to the satisfaction of certain customary conditions, including the consummation of the Acquisition.

Other Information

The Company ha

s four classes of authorized common stock consisting of

Class A Common Stock, Class B common stock, par value $0.00001 per share (“Company Class B Common Stock”), Class C common stock, par value $0.00001 per share (“Company Class C Common Stock”), and Class D common stock, par value $0.00001 per share (“Company Class D Common Stock”). The Company Class A Common Stock and the Company Class C Common Stock have one vote per share. The Company Class B Common Stock and the Company Class D Common Stock have 10 votes per share. Shares of our common stock generally vote together as a single class on all matters submitted to a vote of our stockholders.

TJMT Holdings LLC (the “Founder Member”), an affiliate of Mr. Vincent Viola, our Founder and Executive Chairman, and other members of the Viola family,

holds all of our issued and outstanding Company Class D Common Stock and controls approximately 92.7% of the combined voting power of our outstanding capital stock. As a result, it is able to control any action requiring the general approval of our stockholders, including approving the issuance of Company Class A Common Stock in connection with the Financing Transactions described above (the “Share Issuance”).

The Company Class A Common Stock is listed and traded on The NASDAQ Stock Market LLC (“NASDAQ”) under the symbol “VIRT.” Under the NASDAQ rules, the holders of outstanding shares of capital stock of the Company holding at least a majority of the voting power must approve the Share Issuance because we will have issued in connection with the Financing Transactions in excess of 20 percent of the number of shares of Company Class A Common Stock outstanding before such issuance. Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) and our organizational documents permit any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of a majority of the voting power of the outstanding capital stock of the Company required to approve the action at a meeting. Accordingly, the Founder Member, which holds a majority of the voting power of the outstanding capital stock of the Company, has approved the Share Issuance in connection with the Financing Transactions, subject to the terms and conditions set forth in the documents governing the transactions.

All necessary corporate approvals in connection with the matters referred to in this Information Statement relating to the Share Issuance have been obtained, and the Company may issue the shares of Company Class A Common Stock upon providing necessary notice to its non-consenting stockholders in accordance with the DGCL and the U.S. federal securities laws and upon satisfaction of the terms and conditions set forth in the documents governing these transactions. The Company is not required to obtain, nor is it seeking, approval of any other transactions in connection with the Acquisition, including the Merger, for which no stockholder vote for the Company is required. This Information Statement is being furnished to all stockholders of the Company pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, solely for the purpose of informing the non-consenting stockholders of these corporate actions before the Company takes such actions set forth in the written consent. In accordance with Rule 14c-2 under the Exchange Act, the Company may issue the shares of Company Class A Common Stock no sooner than 20 calendar days after the definitive form of this accompanying Information Statement is first being mailed to the Company’s stockholders, subject to notice and approval of NASDAQ.

We are mailing this Information Statement to our holders of record as of the close of business on April 19, 2017, which was the date on which the written consent received approval of the Founder Member. This Information Statement is being provided to you for your information to comply with the Exchange Act requirements. You are urged to read this Information Statement carefully in its entirety. No action is required on your part in connection with this document. No stockholder meeting will be held in connection with this Information Statement.

We are not asking you for a proxy and you are requested not to send us a proxy.

2

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ACQUISITION

Q:

Why am I receiving this Information Statement?

A:

Virtu is acquiring KCG in accordance with the terms of the Merger Agreement, as described in this Information Statement, and is partially financing the Acquisition through the Share Issuance. We are required to deliver this Information Statement to holders of the Company Class A Common Stock to inform them that the Founder Member, which holds a majority of the voting power of the outstanding capital stock of the Company, has taken certain actions by written consent to approve the Share Issuance to finance the Acquisition. We are mailing this Information Statement to our holders of record as of the close of business on April 19, 2017, which was the date on which the written consent received approval of the Founder Member. This Information Statement is being provided to you for your information to comply with the Exchange Act requirements. You are urged to read this Information Statement carefully in its entirety. However, no action is required on your part in connection with this document.

We are not asking you for a proxy and you are requested not to send us a proxy.

Q:

When and where is the stockholder meeting?

A:

No stockholder meeting will be held in connection with this Information Statement.

Q:

Will I be able to vote on approving the Acquisition or any other matter?

A:

No. This Information Statement relates to approval of the Share Issuance, which has been approved by written consent by the Founder Member, the holder of a majority of the voting power of the outstanding capital stock of the Company. The Company is not required to obtain, nor is it seeking, approval of any other transactions in connection with the Acquisition, including the Merger, for which no stockholder vote for the Company is required.

Q:

What is the record date for stockholders entitled to receive this Information Statement?

A:

The record date is April 19, 2017, which was the date on which the written consent approving the Share Issuance received approval of the Founder Member, which holds a majority of the voting power of the outstanding capital stock of the Company.

Q:

Why is the Company acquiring the Target?

A

:

After careful consideration of various factors described in “The Merger—Reasons for the Merger,” the Board has determined that it is advisable and in the best interests of the Company and its stockholders that the Company enter into the Merger Agreement and the other documents contemplated by the Merger Agreement. The Board has unanimously recommended that the stockholders entitled to vote on the Share Issuance approve the Share Issuance.

Q:

What is the Merger Consideration being paid by the Company to acquire 100% of the outstanding stock of the Target?

A:

The Company will pay approximately $1.4 billion to acquire all of the outstanding stock of the Target, which is equal to $20.00 per share of Target Class A Common Stock.

Q:

What is the ownership of the Company following the Acquisition?

A:

Following closing of the Acquisition, based on outstanding shares of capital stock of the Company as of the record date, the Company stockholders immediately before the Closing will own approximately 74.6% of the outstanding Company Class A Common Stock and the two investors that are acquiring Company Class A Common Stock in connection with the Share Issuance, Temasek, which is an affiliate of an existing Company stockholder, will receive approximately 4.2% of the outstanding Company Class A Common Stock, and NIH will receive approximately 21.2% of the outstanding Company Class A Common Stock. The foregoing assumes the conversion of all shares of the Company Class C Common Stock and Company Class D Common Stock into shares of Company Class A Common Stock.

3

Table of Contents

Q:

Who will manage the Company after the Closing?

A:

The Company will continue to be overseen by the Board, which, upon the closing of the Acquisition, will include two new members appointed by NIH, Robert Greifeld, who will be appointed as Chairman of the Board, and Glenn Hutchins. The executive officers of the Company will remain unchanged.

Q:

When do you expect to complete the Acquisition?

A:

We are working to complete the Acquisition as soon as possible. We expect to complete the Acquisition in the third quarter of 2017. The closing of the Acquisition is subject to the conditions and approvals described in this Information Statement and more specifically set forth in the Merger Agreement.

Q:

Who can help answer your questions?

A:

If you have more questions about the Acquisition, the Financing Transactions and the other transactions provided for in the Merger Agreement and described in this Information Statement, you should contact:

Virtu Financial, Inc.

900 Third Avenue, 29th Floor

New York, New York 10022

Attention: Andrew Smith, Investor Relations

Phone: (212) 418-0100

4

Table of Contents

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Information Statement, as well as our and KCG’s other public documents and statements, contain forward-looking statements that are subject to the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties, which are based on the beliefs, expectations, estimates, projections, assumptions, forecasts, plans, anticipations, targets, outlooks, initiatives, visions, objectives, strategies, opportunities, drivers, focus and intents of management. While we believe that our estimates and assumptions are reasonable, we caution that it is very difficult to predict the impact of known and unknown factors, and it is impossible to anticipate all factors that could affect our results. Forward-looking statements can be identified by, among other things, the use of forward-looking language such as “estimates,” “objectives,” “visions,” “projects,” “forecasts,” “focus,” “drive towards,” “plans,” “targets,” “strategies,” “opportunities,” “assumptions,” “drivers,” “believes,” “intends,” “outlooks,” “initiatives,” “expects,” “scheduled to,” “anticipates,” “seeks,” “may,” “will” or “should” or the negative of those terms, or other variations of those terms or comparable language, or by discussions of strategies, targets, long-range plans, models or intentions. Forward-looking statements speak only as of the date they are made, and except for Virtu’s ongoing obligations under the U.S. federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. The following factors, among others, could cause our actual results to differ materially from those expressed in any forward-looking statements made by the Company:

·

Virtu’s beliefs, expectations, guidance, focus and/or plans regarding future events, including Virtu’s plans to consummate the Acquisition and the related financing transactions, as well as the terms and conditions of such transactions and the timing thereof;

·

risks and uncertainties relating to the Acquisition not being timely completed, if completed at all;

·

risks associated with the financing of the transaction;

·

the significant costs and significant indebtedness that will be incurred in connection with the consummation of the Acquisition, and the integration of KCG into our business;

·

the risk that our operating results after the Acquisition may materially differ from the pro forma financial information contained in this Information Statement;

·

the risk that integrating KCG’s business into our business may divert management’s attention away from operations;

·

the risk that we may encounter significant difficulties or delays in integrating the two businesses and the anticipated benefits, cost savings and synergies or capital release may not be achieved;

·

the significant uncertainty to us and KCG while the Acquisition is pending;

·

the assumption of potential liabilities relating to KCG’s business;

·

unanticipated circumstances or results affecting KCG’s financial performance, including, among others, (i) the inability to manage trading strategy performance and grow revenue and earnings, (ii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the self-regulatory organization and the media on market structure issues, and in particular, the scrutiny of high frequency trading, best execution, internalization, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; and (iii) KCG’s ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG’s customers and potential customers;

·

the effects of and changes in economic conditions (such as volatility in the financial markets, inflation, monetary conditions and foreign currency fluctuations, foreign currency controls and/or government-mandated pricing controls, as well as in trade, monetary, fiscal and tax policies in international markets) and political conditions (such as military actions and terrorist activities);

5

Table of Contents

·

prior to the completion of the Acquisition, the Company’s or KCG’s respective businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities;

·

the effect that the Acquisition may have on employee relations;

·

reduced levels of overall trading activity;

·

dependence upon trading counterparties and clearing houses performing their obligations to us;

·

failures of our customized trading platform;

·

risks inherent to the electronic market making business and trading generally;

·

increased competition in market making activities;

·

dependence on continued access to sources of liquidity;

·

risks associated with self-clearing and other operational elements of our business;

·

compliance with laws and regulations, including those specific to our industry;

·

our obligation to comply with applicable regulatory capital requirements;

·

litigation or other legal and regulatory-based liabilities;

·

proposed legislation that would impose taxes on certain financial transactions in the European Union, the U.S. and other jurisdictions;

·

our obligation to comply with laws and regulations applicable to our international operations;

·

enhanced media and regulatory scrutiny and its impact upon public perception of us or of companies in our industry;

·

our need to maintain and continue developing proprietary technologies;

·

failure to maintain system security or otherwise maintain confidential and proprietary information;

·

capacity constraints, system failures, and delays;

·

dependence on third party infrastructure or systems;

·

use of open source software;

·

failure to protect or enforce our intellectual property rights in our proprietary technology;

·

risks associated with international operations and expansion, including failed acquisitions or dispositions;

·

fluctuations in currency exchange rates;

·

risks associated with potential growth and associated corporate actions;

·

inability to, or delay in, accessing the capital markets to sell shares or raise additional capital;

·

loss of key executives and failure to recruit and retain qualified personnel; and

6

Table of Contents

·

risks associated with losing access to a significant exchange or other trading venue.

Factors other than those listed above could also cause our results to differ materially from expected results. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

7

Table of Contents

THE ACQUISITION

The Merger

The Parties to the Merger

Virtu

Virtu Financial, Inc.

900 Third Ave., 29

th

Floor

New York, NY 10022

Telephone: (212) 418-0100

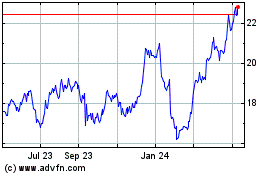

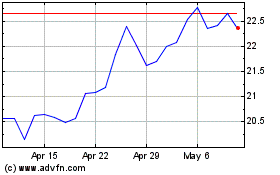

Virtu Financial, Inc. is a leading technology-enabled market maker and liquidity provider to the global financial markets. Virtu generates revenue by buying and selling securities and other financial instruments and earning small amounts of money on individual transactions based on the difference between what buyers are willing to pay and what sellers are willing to accept, often referred to as “bid/ask spreads,” across a large volume of transactions. Virtu makes markets by providing quotations to buyers and sellers in more than 12,000 securities and other financial instruments on more than 235 unique exchanges, markets and liquidity pools in 36 countries around the world. Virtu also generates revenue by using its proprietary technology to earn technology services revenue, by providing technology infrastructure and agency execution services to select third parties. Virtu’s shares of its Class A common stock are listed on the NASDAQ under the symbol “VIRT.”

KCG

KCG Holdings, Inc.

300 Vesey Street

New York, NY 10282

Telephone: (646) 682-6000

KCG Holdings, Inc., a Delaware corporation, is a leading independent securities firm offering clients a range of services designed to address trading needs across asset classes, product types and time zones. KCG combines advanced technology with specialized client service across market making, agency execution and trading venues and also engages in principal trading via exchange-based electronic market making. KCG has multiple access points to trade global equities, options, fixed income, currencies and commodities via voice or automated execution. Shares of KCG common stock are listed on the NYSE under the symbol “KCG.”

Additional information about KCG and its subsidiaries is included in documents incorporated by reference in this Information Statement. See “Incorporation of Certain Information by Reference.” KCG maintains a website at http://www.kcg.com. The information provided on KCG’s website is not part of this Information Statement and is not incorporated by reference.

Merger Sub

Orchestra Merger Sub, Inc.

c/o Virtu Financial, Inc.

900 Third Ave., 29

th

Floor

New York, NY 10022

Telephone: (212) 418-0100

Orchestra Merger Sub, Inc. is a Delaware corporation and an indirect, wholly-owned subsidiary of Virtu. Merger Sub was incorporated on April 17, 2017 for the sole purpose of effecting the merger. As of the date of this Information Statement, Merger Sub has not conducted any activities other than those incidental to its incorporation, the execution of the Merger Agreement and the transactions contemplated by the Merger Agreement.

8

Table of Contents

The Merger Agreement

The following discussion contains certain information about the Acquisition and the Merger Agreement. The discussion is subject, and qualified in its entirety by reference, to the Merger Agreement attached as Exhibit 2.1 to our Current Report on Form 8-K filed on April 21, 2017 and incorporated herein by reference. We urge you to read carefully this entire Information Statement, including the Merger Agreement attached as Exhibit 2.1 to our Current Report on Form 8-K filed on April 21, 2017, for a more complete understanding of the merger.

Explanatory Note Regarding the Merger Agreement

The Merger Agreement and this summary of terms are included to provide you with information regarding the terms of the Merger Agreement. Factual disclosures about the Company and Target contained in this Information Statement or in the public reports of the Company and Target filed with the SEC may supplement, update or modify the factual disclosures about the Company and Target contained in the Merger Agreement. The Merger Agreement contains representations and warranties by the Company, on the one hand, and Target, on the other hand. The representations, warranties and covenants made in the Merger Agreement by the Company and Target were qualified and subject to important limitations that were negotiated and agreed to by the Company and Target. In particular, in your review of the representations and warranties contained in the Merger Agreement, and described in this summary, it is important to bear in mind that the representations and warranties were negotiated with the principal purposes of establishing circumstances in which a party to the Merger Agreement may have the right not to consummate the merger and allocating risk between the parties to the Merger Agreement, rather than establishing matters as facts. The representations and warranties also may be subject to a contractual standard of materiality different from that generally relevant to investors or applicable to reports and documents filed with the SEC, and some were qualified by the matters contained in confidential disclosure schedules that the Company and Target each delivered in connection with the Merger Agreement and certain documents filed with the SEC. Moreover, information concerning the subject matter of the representations and warranties, which do not purport to be accurate as of the date of this Information Statement, may have changed since the date of the Merger Agreement.

For the foregoing reasons, the representations and warranties, or any descriptions of those provisions, should not be read alone or relied upon as characterizations of the actual state of facts or condition of the Company, Target or any of their respective subsidiaries or affiliates. Instead, such provisions or descriptions should be read only in conjunction with the other information provided elsewhere in this document or incorporated by reference into this Information Statement. See “Where You Can Find More Information.” The Company will provide additional disclosures in their public reports to the extent they are aware of the existence of any material facts that are required to be disclosed under federal securities laws and that might otherwise contradict the terms and information contained in the Merger Agreement and will update such disclosure as required by federal securities laws.

Structure of the Merger

Each of the Company’s and Target’s respective boards of directors has unanimously approved the Merger Agreement and the merger. Under the Merger Agreement, Merger Sub, an indirect wholly owned subsidiary of Virtu, will merge with and into Target, so that the Target will be the surviving entity in the merger and will be an indirect wholly owned subsidiary of Virtu when the merger is completed.

Merger Consideration

In the merger, each share of Target Class A Common Stock issued and outstanding immediately prior to the effective time, except for specified shares held by Target or owned by Virtu or Merger Sub and shares of Target Class A Common Stock held by Target stockholders who properly exercise dissenters’ rights, shall be converted into the right to receive $20.00 in cash without interest.

At the effective time, all Target Class A Common Stock will convert into the right to receive the merger consideration, will no longer be outstanding and will automatically be cancelled and will cease to exist, and will thereafter represent only the right to receive the merger consideration to be paid in accordance with the Merger Agreement.

The price to be paid for each share of Target Class A Common Stock in the merger will be adjusted appropriately to reflect the effect of any change in the outstanding shares of Target Class A Common Stock, including if Target pays dividends

9

Table of Contents

in, splits, combines into a smaller number or issues by reclassification any shares of Target Class A Common Stock (or undertakes any similar act) prior to the effective time.

At the effective time, each share of common stock of Merger Sub issued and outstanding immediately prior to the effective time will be converted into one share of common stock of the surviving corporation.

Shares of Target Class A Common Stock held by the Target as treasury stock (other than shares in a “Company plan” (as defined in “The Merger Agreement—Covenants and Agreements”) (which we refer to in this Information Statement as a “Target plan”)) or owned by Virtu or Merger Sub (other than shares held in trust accounts, managed accounts, mutual funds and the like, or otherwise held in a fiduciary or agency capacity, that are beneficially owned by third parties) immediately prior to the effective time of the merger, and shares held by Target stockholders who have properly exercised appraisal rights with respect to their shares, will be cancelled, and no merger consideration will be paid with respect to those shares.

Treatment of

Target

Equity Awards

Stock Options

: At the effective time, each outstanding stock option under the Target plan will be cancelled and will entitle the holder of such stock option to receive an amount in cash equal to the product of (i) the number of shares of Target Class A Common Stock subject to such stock option immediately prior to the effective time and (ii) the excess, if any, of (x) the merger consideration of $20.00 per share over (y) the exercise price per share of such stock option, less applicable taxes required to be withheld with respect to such payment. Any stock option that has an exercise price per share that is greater than or equal to the merger consideration of $20.00 per share will be cancelled at the effective time for no consideration or payment.

SARs

: At the effective time, each outstanding SAR granted under the Target plan will be cancelled and will entitle the holder of such SAR to receive an amount in cash equal to the product of (i) the number of shares of Target Class A Common Stock subject to such SAR immediately prior to the effective time and (ii) the excess of (x) the merger consideration of $20.00 per share over (y) the exercise price per share of such SAR, less applicable taxes required to be withheld with respect to such payment. Because all outstanding SARs have an exercise price per share that is greater than or equal to the merger consideration of $20.00 per share, all SARs will be cancelled at the effective time for no consideration or payment.

RSUs

: At the effective time, any vesting conditions applicable to each outstanding RSU under the Target plan, whether vested or unvested, will be cancelled and will entitle the holder of such RSU to receive an amount in cash equal to the product of (x) the number of shares of Target Class A Common Stock subject to such RSU immediately prior to the effective time and (y) the merger consideration of $20.00 per share, less applicable taxes required to be withheld with respect to such payment.

Treatment of Target Warrants

Each of the Target’s Class A warrants to purchase shares of the Target Class A Common Stock for a purchase price per share of $11.70, the Target’s Class B warrants to purchase shares of the Target Class A Common Stock for a purchase price per share of $13.16, the Target’s Class C warrants to purchase shares of the Target Class A Common Stock for a purchase price per share of $14.63 issued and outstanding immediately prior to the effective time of the merger will be converted into the right to receive an amount in cash equal to the product of (A) the total number of shares of Target Class A Common Stock subject to such Target warrant and (B) the excess, if any, of the merger consideration over the then-current exercise price per share of Target Class A Common Stock (without giving effect to any of the transactions contemplated by the Merger Agreement) previously subject to such Target warrant, less applicable taxes required to be withheld with respect to such payment (such amount being referred to as the “warrant consideration”).

Closing and Effective Time

The merger will be completed only if all conditions to the merger discussed in this Information Statement and set forth in the Merger Agreement are either satisfied or waived. See “—Conditions to Complete the Merger.”

The merger will become effective as set forth in the certificate of merger to be filed with the Secretary of State of the State of Delaware. The closing of the transactions contemplated by the Merger Agreement will occur on the later of (i) the fifth business day following the first day on which there is satisfaction or waiver of all of the conditions set forth in the Merger Agreement and (ii) the earlier of (A) a date during the marketing period selected by Virtu on one business day’s notice to the Target and (B) the fifth business day following the final day of the marketing period, in each case unless changed by mutual agreement of the parties. It currently is anticipated that the completion of the merger will occur in the third quarter of 2017

10

Table of Contents

subject to the receipt of stockholder and required governmental approvals and the satisfaction of other closing conditions, but neither the Target nor Virtu can guarantee when or if the merger will be completed.

As used herein, “marketing period” means the first period of 17 consecutive business days, throughout and at the end of which Virtu has obtained all necessary information from the Target in connection with the debt financing.

Delivery of Merger Consideration

At or promptly after the effective time, and in any event within two business days thereafter, Virtu shall deposit, or shall cause to be deposited, with a paying agent selected by Virtu and consented to by the Target (such consent not to be unreasonably withheld), for the benefit of the Target’s stockholders, an amount in cash sufficient to pay the aggregate merger consideration, to be paid in exchange for outstanding shares of Target Class A Common Stock.

Pursuant to the terms of the Merger Agreement, the warrant consideration will be paid by the surviving corporation in accordance with the terms of the warrant agreement between the Target and Computershare Shareowner Services LLC, dated July 1, 2013 (which we refer to as the “warrant agreement”).

The conversion of Target Class A Common Stock into the right to receive the merger consideration will occur automatically at the effective time. After completion of the merger, the paying agent will exchange certificates representing shares of Target Class A Common Stock for the merger consideration to be received pursuant to the terms of the Merger Agreement.

As soon as reasonably practicable after the completion of the merger, and in any event within five business days thereafter, the paying agent will mail to each holder of record of Target Class A Common Stock immediately prior to the effective time a letter of transmittal and instructions on how to surrender shares of Target Class A Common Stock in exchange for the merger consideration the holder is entitled to receive under the Merger Agreement.

Upon surrender to the paying agent of a certificate or certificates (or affidavit of loss in lieu thereof) or transfer of uncertificated shares to the paying agent, together with a properly completed letter of transmittal, each Target stockholder eligible to receive the merger consideration will be entitled to receive the merger consideration for each share of Target Class A Common Stock formerly represented by a certificate or for each uncertificated share of Target Class A Common Stock.

If a certificate for Target Class A Common Stock has been lost, stolen or destroyed, the paying agent will issue the merger consideration upon receipt of an affidavit of that fact by the claimant and, if required by the surviving corporation, the posting of a bond in an amount as Virtu may direct as indemnity against any claim that may be made against it with respect to such certificate.

After completion of the merger, there will be no further transfers on the stock transfer books of the Target of shares of Target Class A Common Stock that were issued and outstanding immediately prior to the effective time. If, after the effective time, certificates or uncertificated shares are presented to the surviving corporation, they will be cancelled and exchanged for the merger consideration to be paid in consideration therefor in accordance with the procedures set forth in the Merger Agreement.

Appraisal Rights

If required by the DGCL, Target stockholders who do not vote in favor of the adoption of the Merger Agreement and who otherwise comply with the applicable provisions of Section 262 of the DGCL will be entitled to exercise appraisal rights thereunder. Any shares of Target Class A Common Stock held by a Target stockholder as of the record date who has not voted in favor of the adoption of the Merger Agreement and who has validly made and not effectively withdrawn a demand for appraisal rights pursuant to Section 262 of the DGCL will not be converted into a right to receive the merger consideration unless such holder fails to perfect, withdraws or otherwise loses such holder’s rights under Section 262 of the DGCL, or if a court of competent jurisdiction determines that such holder is not entitled to the relief provided by Section 262 of the DGCL.

Under the Merger Agreement, the Target must give Virtu (i) prompt notice of any demands for appraisal, withdrawals or attempted withdrawals of such demands, and any other instruments served pursuant to Section 262 of the DGCL and received by the Target relating to Section 262 of the DGCL and (ii) the opportunity to participate in and direct all negotiations and proceedings with respect to such notices and demands. The Target may not, except with the prior written consent of Virtu, make

11

Table of Contents

any payments with respect to any demands for appraisal or settle, compromise, offer to settle or compromise, or otherwise negotiate any such demands.

Withholding

Virtu and the paying agent will be entitled to deduct and withhold from the merger consideration the amounts they are required to deduct and withhold under the Code or any provision of state, local or foreign tax law. If any such amounts are withheld and paid over to the appropriate governmental entity, these amounts will be treated for all purposes of the Merger Agreement as having been paid to the stockholders from whom they were withheld.

Representations and Warranties

The Merger Agreement contains representations and warranties of each of the Target and Virtu. The representations and warranties are subject, in some cases, to specified exceptions and qualifications contained in the Merger Agreement, information contained in certain public filings made by the Target with the SEC and information in the confidential disclosure schedules that the Target and Virtu each delivered in connection with the Merger Agreement. The representations and warranties in the Merger Agreement do not survive the effective time.

Each of the Target and Virtu makes representations and warranties with respect to itself and its business regarding, among other things:

·

corporate matters, including due organization and qualification and subsidiaries;

·

corporate power and authority to own or lease its properties and assets and carry on its business;

·

authority relative to execution and delivery of the Merger Agreement and the absence of conflicts with, or violations of, organizational documents or other obligations as a result of the merger;

·

required governmental and other regulatory filings and consents and approvals in connection with the merger;

·

binding effect of the Merger Agreement;

·

legal proceedings;

·

broker’s fees payable in connection with the merger; and

·

the accuracy of information supplied for inclusion in this Information Statement and other similar documents.

In addition, certain representations and warranties are made only by the Target, including:

·

compliance with applicable laws;

·

capitalization;

·

compliance of documents filed with (or furnished to) the SEC by the Target with the published rules and regulations of the SEC;

·

certain material contracts and the absence of defaults related to such contracts;

·

absence of certain changes or events from December 31, 2016 through the date of the Merger Agreement;

·

tax matters;

·

labor relations matters;

·

employee and employee benefit plan matters;

·

absence of any material undisclosed liabilities;

·

intellectual property matters;

·

privacy of customer information;

·

environmental matters;

·

insurance matters;

12

Table of Contents

·

disclosure controls and procedures;

·

real property;

·

the accuracy of information supplied for inclusion in the information statement distributed by Virtu regarding the approval of the equity financing by its stockholders; and

·

related party transactions.

In addition, certain representations and warranties are made only by Virtu and Merger Sub (which we refer to together as the “Acquirer Parties”), including:

·

ownership and operations of Merger Sub; and

·

financing matters and availability of funds.

Certain representations and warranties of the Acquirer Parties and the Target are qualified as to knowledge, “materiality,” “material adverse effect” or material delay or material impairment of the ability of the Acquirer Parties to consummate the merger and other transactions contemplated by the Merger Agreement on a timely basis.

For purposes of the Merger Agreement, a “material adverse effect” with respect to the Target means any change, effect, event, occurrence, state of facts or development that (i) materially impairs or delays, or would reasonably be expected to materially impair or materially delay the Target’s ability to consummate the merger or (ii) has a material adverse effect on the business, financial condition or results of operations of the Target and its subsidiaries, taken as a whole, excluding the impact of:

·

changes in global, national or regional economic or political (including results of elections) conditions (including any outbreak or escalation of hostilities or war or any act of terrorism) or changes in the securities, credit or financial markets;

·

changes, after the date of the Merger Agreement, adversely and generally affecting the industry in which the Target and its subsidiaries operates;

·

any failure, in and of itself, by the Target and its subsidiaries to meet any internal or external projections, forecasts or revenue or earnings predictions for any period ending after the date of the Merger Agreement;

·

changes, after the date of the Merger Agreement, in laws, or interpretations thereof by courts or governmental entities, applicable to the Target and its subsidiaries or any of their respective properties or assets or in U.S. generally accepted accounting principles or applicable accounting regulations;

·

public announcement of the transactions contemplated by the Merger Agreement;

·

any action or omission taken pursuant to the express terms of the Merger Agreement with the express prior written consent of the Acquirer Parties or any action taken by the Acquirer Parties after disclosure to the Acquirer Parties by the Target of all material and relevant facts and information to the knowledge of the Target;

·

any hurricane, tornado, flood, earthquake or other natural disaster; or

·

any pending, initiated or threatened stockholder litigation against the Target or any of its directors or officers relating to the Merger Agreement;

except that the first, second and fourth bullet points above will be taken into account to the extent that the effects of such change have a disproportionate impact on the Target and its subsidiaries, taken as a whole, as compared to other for-profit participants in the industry in which the Target and its subsidiaries conduct their businesses.

For purposes of the Merger Agreement, a “material adverse effect” with respect to the Acquirer Parties means a material adverse effect on the ability of the Acquirer Parties to timely consummate the transactions contemplated by the Merger Agreement.

13

Table of Contents

Covenants and Agreements

Conduct of Businesses Prior to the Completion of the Merger

The Target has agreed to certain restrictions on itself and its subsidiaries, and its and their conduct of business, prior to the completion of the merger (or earlier termination of the Merger Agreement in accordance with its terms). In general, the Target will, and will cause each of its subsidiaries to, (i) conduct its and its subsidiaries’ operations in the ordinary course of business consistent with past practice and (ii) use its reasonable best efforts to preserve intact the business organization of the Target and its subsidiaries and to preserve the goodwill of customers, suppliers and all other persons having business relationships with the Target and its subsidiaries.

Without limiting the foregoing, prior to the completion of the merger (or earlier termination of the Merger Agreement in accordance with its terms), the Target has also agreed that, except as otherwise required by the Merger Agreement or as disclosed in the confidential disclosure schedule delivered by the Target to Virtu at the time of the Merger Agreement, the Target will not, and will not permit any of its subsidiaries to do any of the following without the prior written consent of Virtu (such consent not to be unreasonably withheld):

·

adopt or propose any change in its organizational documents;

·

engage in any material transaction (including capital expenditures) outside of the ordinary course of business that would require expenditures by the surviving corporation, Virtu or any of Virtu’s subsidiaries in excess of $5 million per annum or $10 million in the aggregate;

·

issue, reissue, sell, grant, pledge or otherwise encumber, or authorize the issuance, reissuance, sale, grant, pledge or other encumbrance of shares of Target capital stock, or securities convertible into capital stock of any class of the Target, or any rights, warrants or options to acquire any convertible securities or capital stock of the Target (other than the issuance of shares of Target capital stock in connection with the exercise of Target equity awards or Target warrants, in each case outstanding as of the date of the Merger Agreement in accordance with the Target stock plan or the warrant agreement, respectively, in each case as in effect as of the date of the Merger Agreement);

·

(i) increase the compensation or benefits payable or provided to any current or former director, officer, employee or independent contractor, other than any such increases made in the ordinary course of business and consistent with past practice for employees whose total annual compensation does not exceed $300,000, (ii) grant or pay to any current or former director, officer, employee or independent contractor any severance, change in control or termination pay, or modifications thereto or increases therein, other than pursuant to any Target plan (as defined below) as in effect on the date hereof, in accordance with their terms as in effect on such date, (iii) pay any benefit or grant or amend any award (including in respect of stock options, stock appreciation rights, performance units, restricted stock or other stock-based or stock-related awards or the removal or modification of any restrictions in any Target plan or awards made thereunder) except as required to comply with any applicable law or any Target plan as in effect as of the date hereof, (iv) adopt, enter into, amend, modify or terminate any collective bargaining agreement or other labor union contract, (v) take any action to accelerate the vesting or payment of any compensation or benefit (including in respect of Target equity awards) under any Target plan or awards made thereunder or other contract with any current or former director, officer, employee or independent contractor of the Target or any of its subsidiaries, other than as required pursuant to the Merger Agreement, (vi) amend or terminate any, or enter into or adopt any new, Target plan or any other plan, trust, fund, policy, agreement or arrangement for the benefit of any current or former directors, officers, employees or independent contractors of the Target or any of its subsidiaries, other than in the ordinary course of business consistent with past practice and as would not have a material cost to the Target or its subsidiaries, (vii) hire any employee whose total annual compensation exceeds $300,000, or (viii) waive or materially amend any restrictive covenant entered into by any current or former director, officer, employee or independent contractor of the Target or any of its subsidiaries;

·

except in the ordinary course of business consistent with past practice, sell, lease, encumber or otherwise surrender, relinquish, dispose of, transfer, exclusively license, mortgage, pledge or grant any lien on any material assets, properties or rights (including the capital stock of its subsidiaries) except (i) to the extent they are used, retired or replaced in the ordinary course of business or (ii) to the Target or any subsidiary of the Target;

·

(i) declare, set aside or pay any dividends on, or make any other distributions (whether in cash, stock or property) in respect of, any of its capital stock, other than dividends or distributions declared, set aside, paid or made by a direct or indirect subsidiary of the Target to the Target or a subsidiary of the Target, (ii) adjust, split, combine or reclassify any of its capital stock or issue or propose or authorize the issuance of any other securities

14

Table of Contents

(including options, warrants, or any similar security exercisable for or convertible into, such other security) in respect of, in lieu of or in substitution for shares of its capital stock or (iii) purchase, redeem or otherwise acquire any shares of its capital stock or the capital stock of any of its subsidiaries or any other securities thereof or any rights, warrants or options to acquire any such shares or other securities, except for purchases, redemptions or other acquisitions of capital stock or other securities pursuant to an existing restricted stock purchase agreement with current or former employees and acceptance of shares of Target capital stock as payment for the exercise price of any outstanding Target stock options or for withholding taxes incurred in connection with the exercise of Target stock options or the vesting or settlement of other Target equity awards, in each case outstanding as of the date of the Merger Agreement;

·

make, change or revoke any material tax election, file any material amended tax return, settle or compromise any material claim, action, proceeding or assessment for taxes, change any method of tax accounting, enter into any closing agreement with respect to taxes or make or surrender any material claim for a refund of taxes, in each case except (i) as required by applicable tax law, or (ii) consistent with past practice;

·

take any action or omit to take any action or enter into any transaction which, to the knowledge of the Target, prior to taking or omitting to take any such action or prior to entering into any such transaction, has, or would reasonably be expected to have, the effect of materially delaying or otherwise materially impeding or preventing the consummation of the transactions contemplated by the Merger Agreement;

·

except in the ordinary course of business consistent with past practice, (i) modify, amend or terminate any material contract of the Target, (ii) enter into any successor agreement to an expiring material contract that changes the terms of the expiring material contract or (iii) enter into any new agreement that would have been considered a material contract if it were entered into at or prior to the date hereof, in each of cases (i), (ii) and (iii) if the effect of such action would be materially adverse to the Target and its subsidiaries, taken as a whole;

·

incur any indebtedness in excess of $5 million in the aggregate or issue any debt securities or assume, guarantee or endorse, or otherwise as an accommodation become responsible for or cancel, the indebtedness of any person (other than the Target or any of the Target’s subsidiaries), or make or authorize any material loan to any person (in each case other than loans or advances made to the Target or by the Target or any of its subsidiaries), other than indebtedness in replacement of existing indebtedness (provided that such replacement indebtedness shall be prepayable without premium or penalty and shall have a principal amount no greater than the principal amount of the indebtedness it replaces);

·

acquire or agree to acquire by merging or consolidating with, or by purchasing all or substantially all the assets of or all or substantially all the outstanding equity interests in, any business or any corporation, partnership, joint venture, limited liability company or other company, association or other business organization;

·

change any significant method of accounting or accounting principles or practices by the Target or any of its subsidiaries, except for such changes required by U.S. GAAP or applicable regulatory accounting requirements;

·

terminate, cancel, or materially amend or modify any material insurance policies maintained by the Target covering the Target or any of its subsidiaries or their respective properties which is not replaced by a comparable amount of insurance coverage;

·

adopt a plan of complete or partial liquidation, dissolution, restructuring, recapitalization or other reorganization of the Target or any of its subsidiaries;

·

abandon, encumber, convey title (in whole or in part), exclusively license or grant any right or other licenses to material intellectual property owned or exclusively licensed to the Target or any of its subsidiaries, or enter into licenses or agreements that impose material new restrictions upon the Target or any of its subsidiaries with respect to intellectual property owned by any third party, in each case, other than in the ordinary course of business consistent with past practice;

·

materially change any of the architecture or infrastructure of the Target’s or any of its subsidiaries’ network or information technology infrastructure systems or any material component thereof or any other material information technology assets of the Target, other than maintenance or upgrades to any product provided by any existing vendor of the Target or such subsidiary or otherwise in the ordinary course of business consistent with past practice;

15

Table of Contents

·

institute, compromise, settle or agree to settle any claims (a) involving amounts in excess of $5 million individually or $15 million in the aggregate or (b) that would impose any material non-monetary obligation on the Target that would continue after the effective time; or

·

authorize or enter into any agreement or otherwise make any commitment to do any of the foregoing.

For purposes of the Merger Agreement, “Target plan” means any plan (i) under which any employee or former employee of the Target or any of its subsidiaries or individual or sole proprietorship serving as a consultant or independent contractor to the Target or any of its subsidiaries has any present or future right to benefits and that the Target or any of its subsidiaries sponsors, maintains or contributes or is obligated to contribute, or (ii) with respect to which the Target or any of its subsidiaries has any actual or contingent liability.

Additionally, prior to the completion of the merger (or earlier termination of the Merger Agreement), Virtu has agreed that, except as otherwise required by the Merger Agreement, Virtu will not, and will not permit any of its subsidiaries to, take any action or omit to take any action or enter into any transaction which, to the knowledge of Virtu, has, or would reasonably be expected to have, the effect of materially delaying or otherwise materially impeding or preventing the consummation of the transactions contemplated by the Merger Agreement.

Regulatory Matters

Virtu and the Target have agreed to cooperate and use their respective reasonable best efforts to promptly prepare and file all necessary documentation, to effect all applications, notices, petitions and filings, to obtain as promptly as practicable all consents, approvals, rulings and authorizations required by law, including of all third parties and governmental entities which are necessary or advisable to consummate the transactions contemplated by the Merger Agreement and to comply with the terms and conditions of all such permits, consents, approvals, rulings and authorizations of all such third parties and government entities. Without limitation to the foregoing, as soon as practicable and in no event later than 15 days after the date of the Merger Agreement, the parties agree to prepare and file any applications, notices and filings required to be filed with any regulatory agency in order to obtain the required governmental approvals. All such applications, notices and filings related to required governmental approvals were made on or before the date hereof.

However, Virtu will not be required to take, and shall not be required to cause its affiliates to take, any action that would result in a material adverse effect on the surviving corporation and the Acquirer Parties on a combined basis after the merger.

Virtu and the Target have also agreed to furnish each other with all information reasonably necessary or advisable in connection with any statement, filing, notice or application to any governmental entity in connection with the merger, as well as to promptly keep each other apprised of the status of matters related to the completion of the transactions contemplated by the Merger Agreement.

Employee Benefit Matters

During the one-year period commencing at the effective time and ending on the first anniversary of the closing, Virtu has agreed to cause the surviving corporation to provide each Target employee who continues to be employed by the surviving corporation after the effective time (which we refer to as a “continuing employee”) with (i) (x) base salary or base wage and (y) target annual cash bonus opportunities that are generally made available to similarly situated employees of Virtu or (ii) (x) base salary or base wage and (y) target annual cash bonus opportunities that are substantially comparable to those provided by the Target immediately prior to the effective time and (iii) employee benefits in the aggregate that are either (x) generally made available to similarly situated employees of Virtu or (y) substantially comparable to those provided by the Target immediately prior to the effective time. Virtu will or will cause the surviving corporation to provide to each continuing employee whose employment terminates during the one-year period with severance benefits pursuant to and in accordance with the Target’s broad-based severance plan currently in effect, without taking into account any reduction in compensation paid to such continuing employee after the effective time.

Following the effective time, with respect to any employee benefit plans of Virtu in which any continuing employees become eligible to participate (which we refer to as “new plans”), subject to certain customary exclusions, Virtu will or will cause the surviving corporation to: (i) waive all pre-existing conditions, exclusions, evidence of insurability and waiting periods except to the extent they would apply under the most closely analogous Target benefit plans; (ii) provide credit for any eligible expenses incurred prior to the effective time of the merger under a Target benefit plan in satisfying any applicable deductible, co-payment or out-of-pocket requirements under any new plans; and (iii) recognize all service of continuing employees for all purposes in any new plan to the same extent that such service was taken into account under the most closely

16

Table of Contents

analogous Target benefit plan prior to the effective time of the merger, provided that the service recognition shall not apply to the extent it would result in duplication of benefits for the same period of services, for purposes of benefit accrual under any defined benefit pension for purposes of qualifying for subsidized early retirement benefits.

Prior to the effective time, the Target will take irrevocable action, effective of and contingent upon the closing, to terminate the Target’s voluntary deferred compensation, incentive unit and deferred cash plans. Virtu will or will cause the surviving corporation to distribute all balances in such plans to the applicable participants as soon as practicable following the closing through the surviving corporation’s payroll.

Director and Officer Indemnification and Insurance

The Merger Agreement provides that all rights, existing as of the date of the Merger Agreement, to indemnification, advancement of expenses and exculpation from liabilities for acts or omissions occurring at or prior to the completion of the merger in favor of the current or former officers, directors or employees of the Target or any of its subsidiaries will continue in full force and effect. The Merger Agreement also provides that, following completion of the merger, the surviving corporation will indemnify and hold harmless, to the fullest extent permitted by applicable law, all individuals who are, as of the date of the Merger Agreement and at any time from and after the date of the Merger Agreement until the completion of the merger, directors or officers of the Target and its subsidiaries (in their capacity as such), against any costs, claims, expenses and liabilities, whether arising before or after the effective time, arising out of the fact that such person is or was a director or officer of the Target or its subsidiaries, and pertaining to matters existing or occurring at or prior to the effective time, and will also advance expenses to such persons, provided that such person provides an undertaking to repay such advances if it is ultimately determined that such person is not entitled to indemnification.

The Merger Agreement requires the surviving corporation to maintain, for a period of six years after completion of the merger, the Target’s existing directors’ and officers’ liability insurance policy, or policies with a substantially comparable insurer of at least the same coverage and amounts and containing terms and conditions that are no less advantageous to the insured, with respect to claims against present and former officers and directors of the Target and its subsidiaries arising from facts or events that occurred at or prior to the completion of the merger. However, the surviving corporation is not required to spend annually more than 300% of the annual premium by the Target for such insurance for the year ended December 31, 2016 (which we refer to as the “maximum amount”), and if such premiums for such insurance would at any time exceed that amount, then Virtu will maintain policies of insurance which, in its good faith determination, provide the maximum coverage available at an annual premium equal to the maximum amount. If the surviving corporation is unable to obtain the insurance required by the Merger Agreement it will obtain as much comparable insurance as possible for the years within such six-year period for an annual premium equal to the maximum amount, in respect of each policy year within such period. In lieu of such insurance, Virtu may direct the Target to obtain at or prior to the effective time a “tail” policy under the Target’s existing directors’ and officers’ insurance policy. If the Target purchases such a “tail” policy, Virtu must maintain the policy in full force and effect and continue to honor its obligations under the policy.

Financing

Pursuant to the Merger Agreement, Virtu is required to use its reasonable best efforts to consummate the equity financing and the debt financing. Further, in the event that any portion of the equity financing or the debt financing becomes unavailable, Virtu is required to use its reasonable best efforts to obtain as promptly as practicable alternate equity financing or debt financing, as the case may be, on terms not materially less favorable to Virtu. To the extent Virtu is unable to obtain any amount of alternate equity financing, Virtu is required to draw upon any additional amounts available under the debt financing to cover the shortfall.

The Target has agreed to use its reasonable best efforts to provide to Virtu such reasonable cooperation that is customary in connection with the arrangement of the debt financing, as reasonably requested by Virtu, including by using its reasonable best efforts to (i) cause members of the Target’s senior management and other representatives to be available, upon reasonable advance notice, to participate in a reasonable number of meetings, presentations, drafting sessions and due diligence sessions, (ii) furnish to Virtu as promptly as reasonably practicable information about the Target that the Target has agreed to provide in connection with preparing customary documents in connection with any offering document or marketing materials related to the debt financing, (iii) assist with the preparation of pro forma financial statements, (iv) issue customary representation letters to the Target’s independent registered public accounting firm and using reasonable best efforts to obtain, consistent with customary practice, necessary consents to the inclusion of the Target’s financial information and reports in connection with any offering document related to the debt financing; (v) provide customary authorization letters to debt financing sources; (vi) provide documentation required by applicable “know your customer” and anti-money laundering laws and regulations; (vii) assist with the preparation and execution of certain contracts for indebtedness, including the definitive agreements in

17

Table of Contents

connection with the debt financing; (viii) permit the debt financing sources to evaluate the Target’s assets and cash management policies; (ix) take necessary corporate actions to effect the debt financing; (x) obtain customary evidence of authority and deliver other customary ancillary documents in connection with the closing of the debt financing; (xi) allow access to existing lending relationships of the Target and (xii) effect the payoff of the Target’s Credit Agreement, dated June 5, 2015, among KCG Americas LLC, the Target, Bank of America, N.A., BMO Harris Bank N.A., and the financial institutions from time to time party thereto, concurrently with the closing of the merger.

Virtu has agreed to, promptly upon written request by the Target, reimburse the Target for all reasonable and documented out-of-pocket costs incurred by the Target or its subsidiaries in connection with such cooperation provided by the Target.

The obligations of Virtu and Merger Sub to complete the merger are not contingent upon the receipt of the financing.

Certain Additional Covenants