Current Report Filing (8-k)

May 31 2017 - 7:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

May 31, 2017

Northwest Biotherapeutics, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

0-35737

(Commission

File Number)

|

94-3306718

(IRS Employer

Identification No.)

|

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(240) 497-9024

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR 240.12b-2 of this chapter).

Emerging

Growth Company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

As previously reported by Northwest Biotherapeutics,

Inc. (the “Company”), on March 9, 2017, the Company and the holders (the “Holders”) of the Company’s

5.00% Convertible Senior Notes due 2017 (the “Old Notes”) entered into a Note Repurchase Agreement (the “Repurchase

Agreement”). Pursuant to the Repurchase Agreement, the Company was required to repurchase the outstanding Notes in installments

of specified amounts at specified times, including in May. Certain unaffiliated institutional investors (the “Investors”)

desired to purchase Notes directly from the Holders. So, the Company engaged in negotiations with the investors and the Holders,

and the Company did not effect the repurchase that was due in May.

Pursuant to the Note Repurchase Agreement,

an aggregate principal amount of $2.5 million was required to be repurchased in May (the “May Notes”). On May 31, 2017,

the Investors agreed to purchase $3.0 million of the Old Notes from the Holders (the “Acquired Notes”), pursuant to

a Purchase Agreement (the “Purchase Agreement”).

Also on May 31, 2017, the Company and

the Investor entered into an Exchange Agreement (the “Exchange Agreement”) pursuant to which the Investor agreed

to exchange its $3.0 million of Acquired Notes for 20,628,571 shares of common stock, par value $.001 per share

(“Common Stock”), of the Company, warrants to acquire up to 16,071,428 shares of Common Stock at an exercise price

of $0.175 per share and exercisable for two years from the date of issuance of such warrants, and prepaid warrants for

800,000 shares of Common Stock (such Common Stock and warrants, collectively, the “Exchange Securities”).

The closing of the transactions set forth

in the Exchange Agreement and Purchase Agreement is expected to occur on May 31, 2017 or as soon as practicable thereafter.

The Exchange Securities are being issued

pursuant to the exemption from the registration requirements afforded by Section 4(a)(2) of the Securities Act of 1933, as amended.

A copy of the Exchange Agreement is attached

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information contained above in Item

1.01 is hereby incorporated by reference into this Item 3.02.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits

.

|

|

Exhibit No.

|

Description,

|

|

|

10.1

|

Securities Exchange Agreement, dated May 31, 2017, between Northwest Biotherapeutics, Inc. and the investor named therein

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

Date: May 31, 2017

|

By:

/s/ Linda Powers

|

|

|

Name: Linda Powers

Title: Chief Executive Officer and Chairman

|

EXHIBIT INDEX

|

|

Exhibit No.

|

Description

|

|

|

10.1

|

Securities Exchange Agreement, dated May 31, 2017, between Northwest Biotherapeutics, Inc. and the investor named therein

|

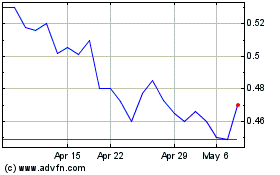

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024