Amended Annual and Transition Report (foreign Private Issuer) (20-f/a)

May 31 2017 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:

December 31, 2016

|

|

|

Commission file number:

001-36165

|

AMBEV S.A.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Federative Republic of Brazil

|

|

(Jurisdiction of incorporation or organization)

|

|

|

|

Rua Dr. Renato Paes de Barros, 1017, 3

rd

floor

04530-001 São Paulo, SP, Brazil

(Address of principal executive offices)

Ricardo Rittes de Oliveira Silva, Chief Financial and Investor Relations Officer

Address: Rua Dr. Renato Paes de Barros, 1017, 3

rd

floor, 04530-001, São Paulo, SP, Brazil

Telephone No.: +55 (11) 2122-1200

e-mail: ir@ambev.com.br

|

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

Name of each exchange on which registered

|

|

American Depositary Shares,

evidenced by American Depositary

Receipts, each representing

1 (one) common share*,

no par value

|

New York Stock Exchange

|

* Not for trading, but in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission.

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

|

|

|

|

|

|

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Guaranty for the R$300,000,000 9.500% Notes due 2017 of AmBev International Finance Co. Ltd. by Ambev S.A.

|

Not applicable

|

|

|

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

|

|

15,701,102,928 common shares, without par value

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

|

Yes X No

|

|

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

|

|

Yes No X

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

|

Yes X No

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).*

|

|

|

Yes No

|

|

* This requirement does not apply to the registrant in respect of this filing.

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

Large accelerated filer X

|

Accelerated filer

|

Non-accelerated filer

|

Emerging growth company

|

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

|

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

U.S. GAAP

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board X

|

Other

|

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

N/A

|

|

|

Item 17 Item 18

|

|

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

|

Yes No X

|

|

|

|

|

|

|

|

|

|

|

Explanatory Note

This Amendment No.

1 on Form 20-F/A (this “Amendment No. 1”) to our annual report on Form 20-F for

the year ended December 31, 2016, filed with the Securities and Exchange

Commission on March 22, 2017 (the “2016 Form 20-F”), is filed to amend and

restate “Item 15. Control and Procedures” of Part I of the 2016 Form 20-F. In

the amended and restated “Item 15(B). Management’s Annual Report on Internal

Control over Financial Reporting”, we inserted the following additional

paragraph:

“Based on the aforementioned material weakness, our

management concluded that the Company’s system of internal control over

financial reporting was not effective as of December 31, 2016.”

Pursuant to Rule

12b-15 promulgated under the Securities Exchange Act of 1934, as amended

(“Rule 12b‑15”), we have included the entire text of Item 15 of the

Form 20-F in this Amendment No. 1. However, there have been no changes to the

text of such item other than the changes stated in the immediately preceding

paragraph.

Pursuant to Rule

12b-15, new certifications by our chief executive officer and chief financial

officer are being filed as exhibits to this Amendment No. 1. The amended “Item

19. Exhibits” of Part III of the 2016 Form 20‑F is included in this Amendment

No. 1.

This Amendment No.

1 speaks as of the filing date of the 2016 Form 20-F on March 22, 2017. Other

than as described above, this Amendment No. 1 does not, and does not purport

to, amend, update or restate any other information or disclosure included in

the 2016 Form 20-F or reflect any events that have occurred after the filing of

the 2016 Form 20-F on March 22, 2017.

TABLE OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

ITEM 15

|

CONTROLS AND PROCEDURES

|

2

|

|

ITEM 19

|

EXHIBITS

|

4

|

ITEM 15. CONTROLS AND PROCEDURES

A. Disclosure Controls and Procedures

The Company has carried out an evaluation, as of December 31, 2016, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures under the supervision and with the participation of the Company’s management, which is responsible for the management of the internal controls, including the Chief Executive Officer and Chief Financial Officer. While there are inherent limitations to the effectiveness of any system of disclosure controls and procedures, including the possibility of human error and the circumvention or overriding of the controls and procedures, the Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives.

As a result of the material weakness related to controls over the accounting and presentation of complex, non-routine transactions detailed below, the Chief Executive Officer and Chief Financial Officer of the Company have concluded that, as of December 31, 2016, the disclosure controls and procedures were not effective at the reasonable assurance level and, accordingly, are not (1) effective in ensuring that information required to be disclosed in the reports that are filed or submitted under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the Commissions’ rules and forms and (2) effective in ensuring that information to be disclosed in the reports that are filed or submitted under the Exchange Act is accumulated and communicated to the management of the Company, including the Chief Executive Officer and the Chief Financial Officer, to allow timely decisions regarding required disclosure.

B. Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting.

Internal control over financial reporting is defined in rules 13a-15(f) and 15d-15(f) under the Exchange Act as a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, and includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the audited consolidated financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect material misstatements. Therefore, effective control over financial reporting cannot, and does not, provide absolute assurance of achieving our control objectives. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The effectiveness of our internal control over financial reporting as of December 31, 2016, is based on the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission.

Based on the assessment performed by our management, as of December 31, 2016, our management has identified a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

2

The material weakness in internal control over financial reporting that our management identified relates to our management’s review controls and other controls over the accounting and presentation of complex, non-routine transactions that were not adequately designed and documented. In 2016, the complex, non-routine transaction that exposed the material weakness was a stock swap recorded in the last quarter of 2016 as a result of the agreement with ABI pursuant to which we agreed to transfer to ABI our businesses in Colombia, Peru and Ecuador, in exchange for which ABI agreed to transfer SABMiller’s Panamanian business to us. See “Item 4. Information on the Company—A. History and Development of the Company—Recent Acquisitions, Divestments and Strategic Alliances” of the 2016 Form 20-F. Specifically, our management identified that our controls lacked sufficient specificity and a formal plan detailing the extent of procedures to be performed to ensure sufficient consideration of the evaluation of all relevant accounting standards and practices and to address the completeness and accuracy of key assumptions and other data used in the analysis of the transactions important to the underlying accounting and presentation.The material weakness described above did not result in misstatements to our consolidated financial statements and, accordingly, no adjustments are required to our financial statements as a result of such weakness. However, these deficiencies create a reasonable possibility that a material misstatement to the consolidated financial statements will not be prevented or detected on a timely basis.

Based on the aforementioned material weakness, our management concluded that the Company’s system of internal control over financial reporting was not effective as of December 31, 2016.

Remediation Plan for the Material Weakness

Our management is actively engaged in the planning for, and implementation of, remediation efforts to address the material weakness identified specifically relating to the accounting and presentation of complex, non-routine transactions. Our management will undertake the following changes to remediate the material weakness described above:

·

strengthen the detailed framework for the treatment of such complex non-routine transaction;

·

formalize all the required steps to be taken in connection with the analysis of the applicable accounting practices for such transactions; and

·

formalize the other procedures to be undertaken when reviewing the key assumptions and other data relating to complex, non-routine that may impact the accounting record of such transactions.

Our management believes that these actions will remediate the material weakness in internal control over financial reporting described above and the timescale for implementing the remediation plan will be until the next management internal control over financial report, when the Company expects the design review process to be concluded.

C. Attestation Report of the Registered Public Accounting Firm

The effectiveness of our internal control over financial reporting as of December 31, 2016, has been audited by Deloitte Touche Tohmatsu Auditores Independentes, the Company’s independent registered public accounting firm. Their audit report and their report on management’s assessment of internal control over financial reporting are included in our audited consolidated financial statements included in the 2016 Form 20-F. Their report on management’s assessment of internal control over financial reporting expresses an adverse opinion on the effectiveness of our internal control over financial reporting as of December 31, 2016.

D. Changes in Internal Control over Financial Reporting

During the period covered by the 2016 Form 20-F, we have not made any change to our internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

3

ITEM 19. EXHIBITS

|

1.1

|

Restated Bylaws of Ambev S.A. (English-language translation) (incorporated by reference to the report on Form 6-K furnished by Ambev on April 30, 2015).

|

|

2.1

|

Deposit Agreement among Ambev S.A., The Bank of New York Mellon, as Depositary, and all Owners and Holders from time to time of American Depositary Shares, representing Common Shares (incorporated by reference to Exhibit 4.1 to Form F-4 filed by Ambev on June 28, 2013).

|

|

2.2

|

Indenture, dated July 24, 2007, between AmBev International Finance Co. Ltd., Deutsche Bank Trust Company Americas, as Trustee, and Deutsche Bank Luxembourg S.A., as Luxembourg Paying and Transfer Agent, relating to the US$300,000,000 9.5% Notes due 2017 (incorporated by reference to Exhibit 4.1 to Form F-4 filed by Ambev on September 19, 2008).

|

|

2.3

|

Form of Note (contained in Exhibit 2.2).

|

|

2.4

|

Guaranty, dated July 24, 2007, between Companhia de Bebidas das Américas – Ambev, as Guarantor, and Deutsche Bank Trust Company Americas, as Trustee (incorporated by reference to Exhibit 4.4 to Form F-4 filed by Ambev on July 8, 2013).

|

|

2.5

|

First Amendment to Guaranty, dated as of January 2, 2014, between Ambev

,

as successor company by merger of Companhia de Bebidas das Américas – Ambev, and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 2.5 to Form 20-F filed by Ambev on March 25, 2014).

|

|

2.6

|

Indenture, date September 9, 2015, as amended, between Ambev S.A. and Simplific Pavarini Distribuidora de Títulos e Valores Mobiliários Ltda., as Trustee, relating to the R$1,000,000,000 14.476% Non-Convertible Debentures of Ambev S.A. due 2021.

|

|

3.1

|

Shareholders’ Agreement of Ambev S.A., dated April 16, 2013, effective as from the approval of the Stock Swap Merger until July 1, 2019, among Fundação Antonio e Helena Zerrenner Instituição Nacional de Beneficência, Interbrew International B.V., AmBrew S.A., Ambev S.A. and Anheuser-Busch InBev N.V./S.A. (English-language translation) (incorporated by reference to Exhibit 9.1 to Form F-4 filed by Ambev on June 28, 2013).

|

|

3.2

|

Shareholders’ Agreement of Ambev S.A., dated April 16, 2013, to be effective starting on July 2, 2019, among Fundação Antonio e Helena Zerrenner Instituição Nacional de Beneficência, Interbrew International B.V., AmBrew S.A. and Ambev S.A. (English-language translation) (incorporated by reference to Exhibit 9.2 to Form F-4 filed by Ambev on June 28, 2013).

|

|

3.3

|

First Amendment to the Shareholders’ Agreement of Companhia de Bebidas das Américas - Ambev, dated as of March 3, 2004, among Fundação Antonio e Helena Zerrenner Instituição Nacional de Beneficência, Braco S.A., Empresa de Administração e Participações S.A., Companhia de Bebidas das Américas - Ambev, Jorge Paulo Lemann, Marcel Herrmann Telles, Carlos Alberto da Veiga Sicupira and Interbrew S.A. (English-language translation) (incorporated by reference to Exhibit 9.3 to Form F-4 filed by Ambev on June 28, 2013).

|

|

3.4

|

Instrument of Accession to the Shareholders’ Agreement of Companhia de Bebidas das Américas – Ambev, dated July 28, 2005, between Interbrew International B.V. and AmBrew S.A. (incorporated by reference to Exhibit 9.4 to Form F-4 filed by Ambev on June 28, 2013).

|

|

3.5

|

Shareholders’ Voting Rights Agreement and other Covenants of S-Braco Participações S.A., or S-Braco, dated August 30, 2002, among Santa Judith Participações S.A., Santa Irene Participações S.A., Santa Estela Participações S.A. and Santa Prudência Participações S.A., with Jorge Paulo Lemann, Carlos Alberto da Veiga Sicupira and Marcel Herrmann Telles as intervening parties, and S-Braco, Braco S.A., Empresa de Administração e Participações S.A. – ECAP and Companhia de Bebidas das Américas - Ambev as

acknowledging parties (English-language translation) (incorporated by reference to Exhibit 9.5 to Form F-4 filed by Ambev on June 28, 2013).

|

|

3.6

|

New Shareholders’ Agreement, dated December 18, 2014, among BRC S.à.R.L., Eugénie Patri Sébastien S.A., EPS Participations S.à.R.L., Rayvax Société d’Investissements S.A. and Stichting Anheuser-Busch InBev (incorporated by reference to Exhibit 2.34 to Schedule 13D/A filed by Ambev on December 30, 2014).

|

|

3.7

|

Shareholders’ Agreement, dated October 17, 2008, between Stichting Administratiekantoor InBev, Fonds Inbev Baillet Latour and Fonds President Verhelst (incorporated by reference to Exhibit 9.7 to Form F-4 filed by Ambev on June 28, 2013).

|

|

4.2

|

Protocol and Justification of Stock Swap Merger of Companhia de Bebidas das Américas - Ambev (

Protocolo e Justificação de Incorporação de Ações

), dated May 10, 2013, between the Management of Companhia de Bebidas das Américas - Ambev and the Members of the Board of Directors of Ambev S.A. (English-language translation) (incorporated by reference to Exhibit 2.1 to Form F-4 filed by Ambev on July 8, 2013).

|

|

8.1*

|

List of Material Subsidiaries of Ambev S.A.

|

|

11.1

|

Code of Business Conduct dated August 30, 2013 (English-language translation) (incorporated by reference to Exhibit 11.1 to Form 20-F filed by Ambev on March 25, 2014).

|

|

11.2.

|

Manual on Disclosure and Use of Information and Policies for Trading with Securities issued by Ambev dated March 1, 2013 and amended on August 27, 2014 and on March 28, 2016 (English-language translation) (incorporated by reference).

|

|

12.1**

|

Principal Executive Officer Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

12.2**

|

Principal Financial Officer Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

13.1**

|

Principal Executive Officer Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

13.2**

|

Principal Financial Officer Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

* Previously filed as an exhibit to the annual report on Form 20-F for the year ended December 31, 2016, filed with the Securities and Exchange Commision on March 22, 2017.

** Filed herewith.

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Amendment No. 1 on Form 20-F/A on its behalf.

AMBEV S.A.

|

|

By:

/s/ Bernardo Pinto Paiva

Name: Bernardo Pinto Paiva

Title: Chief Executive Officer

|

|

|

|

|

|

By:

/s/ Ricardo Rittes de Oliveira Silva

Name: Ricardo Rittes de Oliveira Silva

Title: Chief Financial Officer

|

Date: May 30, 2017.

Exhibit 12.1

PRINCIPAL EXECUTIVE OFFICER CERTIFICATION

I, Bernardo Pinto Paiva, certify that:

1.

I have reviewed the annual report on Form 20-F, as amended by Amendment No. 1 thereto, of Ambev S.A. (the “Company”);

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the Company as of, and for, the periods presented in this report;

4.

The Company’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the Company and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Company, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)

Evaluated the effectiveness of the Company’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)

Disclosed in this report any change in the Company’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting; and

5.

The Company’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Company’s auditors and the audit committee of Company’s Board of Directors (or persons performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company’s ability to record, process, summarize and report financial information; and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting.

|

Date: May 30, 2017.

|

/s/ Bernardo Pinto Paiva

Name: Bernardo Pinto Paiva

Title: Chief Executive Officer

|

Exhibit 12.2

PRINCIPAL FINANCIAL OFFICER CERTIFICATION

I, Ricardo Rittes de Oliveira Silva, certify that:

1.

have reviewed the annual report on Form 20-F, as amended by Amendment No. 1 thereto, of Ambev S.A. (the “Company”);

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the Company as of, and for, the periods presented in this report;

4.

The Company’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the Company and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Company, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)

Evaluated the effectiveness of the Company’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)

Disclosed in this report any change in the Company’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting; and

5.

The Company’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Company’s auditors and the audit committee of Company’s Board of Directors (or persons performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company’s ability to record, process, summarize and report financial information; and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting.

|

Date: May 30, 2017.

|

/s/ Ricardo Rittes de Oliveira Silva

Name: Ricardo Rittes de Oliveira Silva

Title: Chief Financial Officer

|

Exhibit 13.1

Certification of the Principal Executive Officer

Pursuant to 18 U.S.C. Section 1350,

As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the annual report of Ambev S.A. (the “Company”) on Form 20-F for the year ended December 31, 2016, as amended by Amendment No. 1 thereto, as filed with the Securities and Exchange Commission on the date hereof, or the Report, I, Bernardo Pinto Paiva, Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes–Oxley Act of 2002, that:

(1)

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)); and

(2)

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

Date: May 30, 2017.

|

/s/ Bernardo Pinto Paiva

Name: Bernardo Pinto Paiva

Title: Chief Executive Officer

|

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 13.2

Certification of the Principal Financial Officer

Pursuant to 18 U.S.C. Section 1350,

As Adopted Pursuant to Section 906 of the Sarbanes - Oxley Act of 2002

In connection with the annual report of Ambev S.A. (the “Company”) on Form 20-F for the year ended December 31, 2016, as amended by Amendment No. 1 thereto, as filed with the Securities and Exchange Commission on the date hereof, or the Report, I, Ricardo Rittes de Oliveira Silva, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes–Oxley Act of 2002, that:

(1)

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)); and

(2)

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

Date: May 30, 2017.

|

/s/ Ricardo Rittes de Oliveira Silva

Name: Ricardo Rittes de Oliveira Silva

Title: Chief Financial Officer

|

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

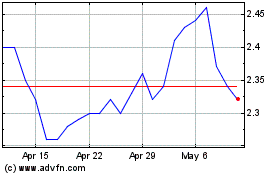

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

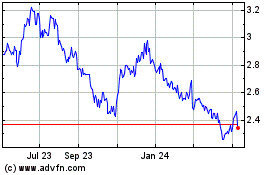

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024