Current Report Filing (8-k)

May 31 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 30, 2017

COMMUNITY HEALTH SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-15925

|

|

13-3893191

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4000 Meridian Boulevard

Franklin, Tennessee 37067

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (615) 465-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 30, 2017, Community Health

Systems, Inc. (the “Company”) and its wholly-owned subsidiary CHS/Community Health Systems, Inc. (the “Borrower”) entered into a Loan Modification Agreement (the “Agreement”), among the Company, the Borrower, the

subsidiary guarantors party thereto, the lenders party thereto and Credit Suisse AG, as administrative agent and collateral agent (the “Agent”), to the Credit Agreement dated as of July 25, 2007, as amended and restated as of

November 5, 2010, February 2, 2012 and January 27, 2014, and as further amended as of March 9, 2015, May 18, 2015 and December 5, 2016 (as the same may be further amended, restated, amended and restated,

supplemented or otherwise modified from time to time, the “Credit Agreement”) among the Company, the Borrower, the subsidiaries of the Borrower party thereto, the lenders party thereto, and the Agent.

Pursuant to the Agreement, the scheduled termination date of the Borrower’s existing $1.0 billion revolving credit facility was extended

from January 27, 2019 to January 27, 2021 in respect of a $739 million portion of the commitments thereunder and the aggregate commitments of the extending lenders were reduced to $739 million.

Pursuant to the Agreement, certain specified financial covenants (consisting of a maximum secured net leverage ratio and an interest coverage

ratio) were also amended. The Agreement provides that the secured net leverage ratio must not exceed the following levels for the following periods: (i) from April 1, 2017 through December 31, 2019, 4.50 to 1.00; (ii) from

January 1, 2020 through September 30, 2020, 4.25 to 1.00; and (iii) thereafter, 4.00 to 1.00. The Amendment also provides that the interest coverage ratio must be greater than or equal to the following levels for the following

periods: (i) from December 31, 2013 through December 31, 2017, 1.75 to 1.00 and (ii) thereafter, 2.00 to 1.00.

The

Amendment also contains certain additional covenants by the Company and the Borrower, for the benefit of the Revolving Credit Lenders.

The foregoing summary of the Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and

qualified in its entirety by, the full text of the Agreement, which is attached hereto as

Exhibit 10.1

and incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.0.1 above is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

10.1

|

Loan Modification Agreement, dated as of May 30, 2017, among CHS/Community Health Systems, Inc., Community Health Systems, Inc., the subsidiary guarantors party thereto, the lenders party thereto and Credit Suisse

AG, as Administrative Agent and Collateral Agent.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: May 30, 2017

|

|

|

|

Community Health Systems, Inc.

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Thomas J. Aaron

|

|

|

|

|

|

|

|

|

|

Thomas J. Aaron

Executive Vice President and

Chief Financial Officer (principal financial officer)

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Loan Modification Agreement, dated as of May 30, 2017, among CHS/Community Health Systems, Inc., Community Health Systems, Inc., the subsidiary guarantors party thereto, the lenders party thereto and Credit Suisse AG, as

Administrative Agent and Collateral Agent.

|

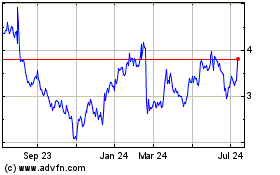

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Apr 2023 to Apr 2024