Filed Pursuant to Rule 425

Filing Person: SmartFinancial, Inc.

Subject Company: Capstone Bancshares, Inc.

Commission File

No. 001-37661

The following materials are filed herewith pursuant to Rule 425 under the Securities Act of 1933

|

|

•

|

|

Transcript of investor conference call of SmartFinancial, Inc. held on May 24, 2017.

|

|

|

|

SmartFinancial

|

|

|

|

Conference Call

|

|

|

|

May 24, 2017 at 10:00 a.m. Eastern

|

|

|

|

CORPORATE PARTICIPANTS

Frank Hughes

–

Investor Relations Officer

Miller Welborn

– Chairman

Billy Carroll

– President and

Chief Executive Officer

|

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

1

PRESENTATION

Operator

Good morning, everyone. Welcome to the

SmartFinancial, Incorporated Capstone Acquisition Conference Call. Today’s conference is being recorded.

At this time, I would like to turn the

conference over to Mr. Frank Hughes, Investor Relations Officer. Mr. Hughes, the floor is yours, sir.

Frank Hughes

Thank you, Carrie. Good morning and thank you for joining us for our Capstone Acquisition Conference Call. With me this morning is Miller Welborn, Chairman of

SmartFinancial, Inc.; Billy Carroll, President and CEO; and Bryan Johnson, our Chief Financial Officer. After our prepared remarks, we will then take questions.

Yesterday evening, we announced the acquisition of Capstone Bancshares, Inc. We also prepared a slide presentation, which we will refer to during our remarks

this morning. Both of these can be found on our website at smartbank.com in our Investor Relations section.

During today’s call, we will take

forward-looking statements, which are subject to risk and uncertainties and are intended to be covered by the Safe Harbor provisions of federal securities law. Actual results and trends could differ materially from those set forth in such statements

due to various risk, uncertainties and other factors. More detailed information about these and other risks can be found on our press release that preceded this call and in the Risk Factors and Forward-Looking Statements sections of our Annual

Report on Form

10-K.

Statements are valid only as of today’s date. The company disclaims any obligation to update this information, except as may be required by applicable law.

I will turn over the call over to our Chairman of the Board, Miller Welborn.

Miller Welborn

Thanks, Frank, good morning and I

appreciate everybody joining in this morning. It is exciting times for us here at SmartFinancial, Inc., and SmartBank. I appreciate you all joining in this morning as we talk about Capstone acquisition. As you all know, part of our thesis, as we

raised this capital in January, was to grow our markets and grow our brands.

And as Billy and I have traveled several states here extensively over the

last couple of months, there are really four criteria that we use, at least four, but the four main ones to evaluate acquisition opportunities were, we need a strong earner. If anybody had a knock on us, it is that we have been a little earnings

light to date. We wanted somebody, a franchise, that had some good management to help support the management team that Billy has put together to date, and we wanted something that was going to be enough size to really help us grow and scale this and

somebody in that $300 (million) to $500 million range.

The last one was location and a decision of ours, whether to get more dense in the state of

Tennessee and in our current market or do we begin to fill in the franchise between Chattanooga and the Florida Panhandle. And we have said that that would become very evident and very clear over the next 18 months, and we think it has become

clearer now.

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

2

So, we’re very excited about this opportunity. Capstone Bank is a good market, a good location. Gosh, if

I’ve got a question if I’m you all, it’s why in the world do they want to sell. They seem to be doing well, growing, been able to scale, improved all their metrics over the last couple of years. And I think part of that reason is they

believe in just what Billy and I’ve been telling investors and shareholders over the past two years, that we believe in this strong culture and the strong brand that we’re building and as a newly traded NASDAQ public company that

we’ve got a lot of upside. They bought into the brand and bought into the franchise and really liked the leg of the stool that they bring to us.

Tuscaloosa, being the prime market for this bank, it’s very familiar to me. As you all know, I lived in Tuscaloosa for close to 40 years of my life, very

familiar with that market, that area, very familiar with Robert Kuhn, their CEO. He’s been a lifelong friend and most of their founding directors, the vast majority of them, I’ve known since they’ve founded this bank.

So, it fits a lot of the criteria, or all of the criteria, that we have. And, gosh, it’s hard to argue that our thesis that we have talked about and

preached about of

mid-size

college and university towns continues, we continue to feel very strongly about that thesis and we’ll continue to work it.

And, with that, I’m going to turn it over to Billy and let Billy walk through the slide deck.

Billy Carroll

Thank you, Miller. Good morning, everyone.

As Miller said, we can’t be more excited, we couldn’t be more excited about this announcement. This is a great next step for our company and one that, as we get integrated, I think will yield some great results and we’ll talk a little

bit about that today.

I’m going to use the slide deck that I think everybody has had access to and should have in front of them, to walk through for

my remarks, and then we’ll open it up for Q&A and Bryan Johnson, our CFO, is on the line. Bryan will be able to answer in detail if you have any additional financial questions.

As you start on slide 4 of the deck, I think when you look at the transaction rationale, Miller hit the nail on the head. It really, what we liked about

Capstone, was solid bank, great management group, nice earnings metrics and very clean credit. When you look at us now, we’ve got a combined—a pro forma company at $1.6 billion in assets. We’ve entered what we think is one of the

best markets in the state of Alabama with Tuscaloosa but also has some nice, a little more of a rural mix below, a fairly smaller part of their franchise but then a really nice growing market in the Baldwin County area in the Fairhope-Daphne MSA.

So, when you look at the franchise, it’s a great market force, it’s a financially attractive acquisition. When you look at the profitability

metrics, we’re looking at over 25% earnings per share accretion over the next couple of years. And then in an earn back that also is right in the tolerance level, as we’ve talked publically about tangible value. Earn-back tangible book

dilution is very sensitive to Miller and I and our board. We don’t take dilution lightly but we felt like, with this transaction, and obviously a quality organization like Capstone, we knew we had to have a certain financial component to it

that would cause a little bit of an earn back. And inside three years and in is right where we felt comfortable and this meets that metric. It’s a pro forma company, it’s going to be well capitalized and, again, just really strong

financial metrics, $0.5 billion in assets, a loan portfolio of over $400 million, low NPAs and a nice efficiency metric which we can improve on.

If you flip over to slide 5, we’ll talk a little bit about the market. I’m going to let Miller opine on this some, too. Tuscaloosa, if you’ve

not been into Alabama, and many though probably are familiar with Alabama, the state of Alabama and the different markets, Tuscaloosa, for those that haven’t been, is

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

3

just a dynamic, as Miller said, smaller

MSA-type

market, one where we think we can jump in and really have some nice growth. Capstone is number four in

market share in that community and we think we can really continue to scale that with our lending and sales culture.

But, when you look at it, you have,

number one, the University of Alabama is a great driver for that economy, not too dissimilar to what we experience in Knoxville with the University of Tennessee. So having a university like that, that drives a market in such a great way and also

provides a lot of stability, even at times of slight economic downturns, the university systems are there. BHC Health System’s a great employer and they have a very large

Mercedes-Benz

manufacturing

facility there in Tuscaloosa County that really drives a great number of jobs and earnings growth.

So, Miller, I’ll let you just jump in and add

some color. You’ve been in and around Tuscaloosa for a number of years. I think that is really the jewel of their franchise. Talk about that a second.

Miller Welborn

Yes. A couple other of the big employers

and really solid long-term businesses in Tuscaloosa, Michelin Tire’s acquired the BF Goodrich plant there years back and Michelin’s got a strong presence there. Hunt Refinery, Hunt Oil Company, branched out at one of their only locations

outside of Texas. It is located in Tuscaloosa and has been a, gosh, I know that 50 years,

58-years-old

I am, and I don’t ever remember it not being there. And,

Nucor Steel, a large, as you all well know, a good public, solid steel company that has been in Tuscaloosa.

So, it’s a thriving business community,

other than the University of Alabama. But there’s no doubt that earnings engine, the employment engine and they’re just a, gosh, as you all well know in a college town of that size, the small businesses that are related to a university

setting have just been tremendous.

Billy Carroll

And as you roll through into the next slide, I’m going to let Miller touch on this one, as well. We’ve got some leadership that will be joining our

SmartFinancial team. Capstone CEO Robert Kuhn is going to be stepping in and assuming a role as our Alabama Regional President. Robert is also going to be taking over as regional president for our Florida franchise, so we’re going to really

look to grow our Southern Region, as we call it, and roll our $140 million in footings base out of Florida into this $0.5 billion base to create a nice, really a nice Southern region for our company. Robert’s a great banker, has been

in and around Tuscaloosa in that market for a number of years, grew up in the Regions Bank system and is a very experienced and quality banker and really excited to have Robert added to our team.

We’re also going to be adding two board members to our team, Steve Tucker and Beau Wicks, our great board members at Capstone that are going to be

assimilating into our board at both SmartFinancial and SmartBank. These are folks that Miller’s also had a personal relationship with for a number of years. So, we know what we’re getting with these guys and they’re just, they’re

outstanding individuals and business leaders in the community down there.

Miller, you might just touch on Steve and Beau a bit.

Miller Welborn

I think one of the things that make a

board strong is having a dynamic board that is well rounded, good entrepreneurial, free thinkers, open to dialogue and discuss but that understand business. I’ve known both Steve and Beau for

30-plus

years. You can tell by their education, Steve being a CPA with an MBA, Arthur Anderson background, bought, owned, operated, grown, sold small businesses. Beau

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

4

Wicks same way with an accounting degree from Alabama, natural entrepreneur. His father was a banker that was with one of the largest, First Federal Savings and Loan, for years, his entire life

there in Tuscaloosa. So, they understand the banking world there. Great additions and I think the ability for the two of them to fit the culture of what this board has assembled and the way we’re structured will be great additions to us and

we’re excited to have them.

Thanks, Billy.

Billy

Carroll

Going onto the next slide, slide 7 talks about obviously you can see the pro forma branch maps because this is really what we felt like we

needed to really start to shore up that Southern component of our franchise. As Miller referred to it, really, it’s a three-legged stool. Miller and I put our companies together a couple of years ago at about a $0.5 billion apiece. This is

the third $0.5 billion company that we’re bringing into this franchise and, again, starts to really round out what we want to do as far as our regional growth strategy. It opens the doors for continued expansion in East Tennessee. But it

also opened the doors now to further expansion into the Panhandle and into the state of Alabama. There are some great opportunities, we believe, as we look ahead to where we can grow from here and really excited about what that branch map provides.

Talking about pro forma SMBK, slide 8 touched on that just a few minutes ago. You see where our asset size is; we’re right around the

$1.6 billion mark, gross loans of $1.2 billion, deposits $1.3 billion. Capitalization ratios are going to be strong in this pro forma company. We’re going to leverage some of the powder of the capital raise that we did earlier in

the year and take that capital, put that to work in this transaction. We anticipate, as we say this we’re probably doing a small holding company line, we estimate $10 million that we would downstream to make sure the ratios stay up and

that we’re right there, staying right around that 10% leverage ratio at a 12% tier 1.

Slide 9 talks a little bit about our transaction terms.

Transaction terms, deal value’s $84.8 million. We’re doing that with an 80/20 stock/cash component, $69 million of stock and $15.8 million in cash. The multiples that we paid for Capstone, we think, are very reasonable. We

looked at banks and bank valuations for banks similar to them. We did write at about 159 of their tangible book and about a 22x on their earnings metrics but we think with the efficiency gains that we can achieve out of that, it will continue to

accrue well to us.

Anticipated closing date is Q4. We anticipate filing regulatory application here in the second quarter, probably late second, early

third quarter, on our regulatory filings and be able to close in Q4 of this year with an integration and rebrand anticipated for February of 2018. So, the cost saves will not come into play until we fully get into play, until we get them fully

integrated with systems and we anticipate that in February of next year.

Sliding down to slide 10, cost saves, we anticipate a 25% cost save in this

transaction. We hope we can do better but we think that’s a very fair assessment of where we are related to headcount and

non-interest

expense components, 85% realized probably in 2018, 100% thereafter.

As I said, we really won’t fully realize the employment saves until we get into probably March but should be able to pick up those cost saves early in 2018.

Merger-related expenses, purchase accounting marks you see on slide 10 and, again, the big thing for us is what we feel is a reasonable dilution component and

then a 25% earnings per share accretion. As Miller alluded to in his initial comments that we really believe that the earnings accretion piece, that’s where we have put our focus and where I think where there are efficiency gains that

we’re continuing to pick up as SmartFinancial becomes more efficient and bringing this component in should accelerate that even more.

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

5

Slide 11 talks about our diligence summary. One of the things that I feel really good about with our team now is

that we do a nice job on diligence. We did a broad diligence process, really dug into credit, reviewed all loans in excess of $0.5 million and then anything else that we felt might have a little more in the way of past dues, a little more in

the way of issues, so we dug deep, about 65% of the overall portfolio. In addition to that, we also did an overlay with an external review firm just to help us on a few selected loans, take that outside opinion on those and then did a nice dive into

the cost saves, as well. We had anticipated an $8 million credit mark on this and about a $600,000 interest mark, as well.

Slides 12 and 13, I will

wrap up with. When you look at the pro forma loan composition and pro forma deposit composition, really like what Capstone brings to our model going forward. As you can see, on the loan side, Capstone’s portfolio mix is nicely diversified.

They’ve got a great C&I base of almost 25%, 25% of their net, 22.5% of their loan portfolios of C&I. We’ve got some nice room to grow in

owner-occ

as well but, really, they have a nice

diversified mix and when you look at the pro forma company, again, a really nice diversified portfolio.

The same thing on the deposit side. Capstone

believes in growing a core deposit franchise. As you can see, their

non-interest

bearing balances at about 20% and interest-bearing demand and savings around the 47% metrics and then smaller pieces on the CDs.

Very similar to us and when you combine in pro forma, the pro forma deposit top, really a nice deposit mix that we’re very excited about.

I will

stop at that point and ask, Miller, anything else on your side related to the deck or any other color? If not, we can open it up for questions.

Miller

Welborn

No, I think, I’m fine here, Billy, and why don’t we just turn it over to questions, if there are any?

QUESTION AND ANSWERS

Operator

We will now begin the question and answer session. To ask a question, you may press star then one on your touchtone phone. If you are using a speakerphone,

please pick up your handset before pressing the keys. If at any time, your question has been addressed and you would like to withdraw your question, please press star then two. Again, it is star then one to ask a question. At this time, we will just

pause momentarily to assemble our roster.

The first question comes from Daniel Cardenas of Raymond James. Please go ahead.

Daniel Cardenas

Good morning, guys.

Miller Welborn

Good morning, Dan.

Billy Carroll

Good morning, Dan.

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

6

Daniel Cardenas

Just a quick question on your acquisition strategy going forward. Is there really any significant change in terms of the size of institutions you’d be

willing to look at on a pro forma basis versus what you’re looking at now and then, maybe, what’s your appetite for additional deals over the near term?

Miller Welborn

I’ll tackle that one first, Billy,

and then let you jump in. Dan, I don’t think this changes our strategy at all going forward. I think we would continue to look for opportunities to get more dense in the market we’re in and really get extremely dense in East Tennessee to

Chattanooga and also continue to fill in between the Chattanooga and the Florida Panhandle.

Success begets success and I think it’s one of the

things that we are most excited about is, gosh, the meetings that we continue to have and the story that we continue to tell to bank CEOs or bank Chairs or bank boards, we had warm reception a year ago. We’re getting more warm reception now and

I just think that the story is gaining momentum. I will tell you, Billy told me, “Hey, Miler, please go to the beach and take a week off before you announce another one or before you have anything else to say.” So I think we better take a

deep breath for a couple of months and get this thing under our belt.

Billy Carroll

Hi, Dan, I’ll second that. I told Miller, and because a number of you guys on the call have gotten to know us and we’ve got—we run an aggressive

strategy. We don’t want it to be too fast. We never want to get out over our skies and, for that, we feel like exactly what Miller said. We want to stay right on top of that plan. I think the markets that we’ve looked at are still the

markets. I think the size bank, that 200 to 500, is still right there. I don’t think that changes at all.

Again, what this does is legitimize the

Southern part of our franchise. We add another outstanding market and we add a great team. It’s been great and what I’ve got done, we’ve both been getting emails and comments and congratulatory remarks from a number of our banker

friends throughout the Southeast. And it was just resounding about a lot of the banks in Alabama that we know that know these teams, it’s like, not only do you get a great market, a great bank but you got a great team.

So, I think our strategy about finding great bankers that we can integrate into our system and banks and boards and shareholder bases that would like to start

having liquidity but also want to partner with a bank that’s got this, still has got this really strong community bank strategy. We don’t do anything, we just work hard and I think bankers and CEOs feel that and folks like Capstone and

Robert Kuhn, I think they realize that, as well.

So nothing really changes as far as that goes but I did tell Miller to take a few weeks off. We got to

catch our breath and we’re going to work on beginning our integration strategy on this. And I still think that our one a year that we publicly said, if we can look at layering in another good, solid acquisition if we can find where the

financial metrics mesh and the cultures mesh, we’d love to try to continue on that

one-a-year

pace.

Miller Welborn

And, Dan, just one other point I’ll

make is we have bought this Cleveland, Tennessee branch from FSG/Atlantic Capital. That literally closed on Friday. We rebranded that over the weekend, opened up Monday morning and then Billy and I both hightailed it to Tuscaloosa to announce this

Monday night. So there’s no grass growing under our feet but we do think we’re taking it in thoughtful, strategic steps but we’re not going to sit back and be too passive for too long.

Daniel Cardenas

Okay, good, good. And then as you look

at the Alabama market and, what kind of loan growth do you think you can get out of this organization going forward?

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

7

Billy Carroll

I’ll take that one, guys, and anybody else can jump in. Capstone, over the last several years under Robert’s leadership has really grown in a nice

way. I think they had a really strong growth year last year as they brought in this evolving county market. With the addition of that and the team that we have down there, we think that’s probably a high single-digits. I think we’re

projecting a high single-digits loan growth pace, added a franchise that we’re acquiring there, pretty much right in line with what we talked about doing organically with our legacy SmartFinancial franchise here. So I think that high

single-digit loan growth pace for the pro forma institution is still right on.

Daniel Cardenas

Okay, great. Well, congratulations on the deal and I’ll step back for right now.

Billy Carroll

Thank you, Dan.

Miller Welborn

Thanks, Dan.

Operator

Again, if you have a question, please press

star then one at this time. Seeing no further questions, I’d like to turn the call back over to Miller Welborn for any closing remarks.

CONCLUSION

Miller Welborn

Again, thank you all for joining in this morning and it was good to get this call done, good to get this acquisition announced. We appreciate the support that

each of you investors and analysts have given SmartBank over the last couple of years. We appreciate your continued support and your interest in our bank. You’re welcome to call any of us anytime and we look forward to the months and years

ahead, so thank you very much.

Operator

The

conference is now concluded. Thank you for attending today’s presentation. You may now disconnect.

Important Information for Investors and

Shareholders

In connection with the proposed merger, SmartFinancial, Inc. will file with the Securities and Exchange Commission a registration

statement on Form

S-4

containing a joint proxy statement/prospectus of Capstone Bancshares, Inc. and SmartFinancial. A definitive joint proxy statement/prospectus will be mailed to shareholders of both

SmartFinancial and Capstone. Shareholders of SmartFinancial and Capstone are urged to read the joint proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because

they will contain important information. Shareholders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SmartFinancial through the

website maintained by the SEC at http://www.sec.gov. Copies of the

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

8

documents filed with the SEC by SmartFinancial will also be available free of charge on SmartFinancial’s website at www.smartbank.com or by contacting SmartFinancial’s Investor

Relations Department at 423.385.3009.

SmartFinancial and Capstone, their directors and executive officers, and other members of management and

employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of SmartFinancial is set forth in SmartFinancial’s proxy statement for

its 2017 annual shareholders meeting. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy

statement/prospectus and other relevant materials to be filed with the SEC when they become available.

SmartFinancial

May 24, 2017 at 10:00 a.m. Eastern

9

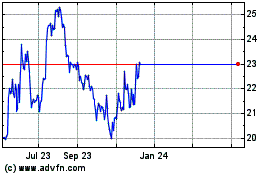

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Apr 2023 to Apr 2024