Current Report Filing (8-k)

May 30 2017 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 25, 2017

WEST BANCORPORATION, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Iowa

|

0-49677

|

42-1230603

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1601 22

nd

Street, West Des Moines, Iowa 50266

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

515-222-2300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section13(a) of the Exchange Act.

o

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 25, 2017, the Company entered into a credit agreement with an unaffiliated commercial bank and borrowed $25,000,000 under the term note entered into in connection therewith. This credit agreement replaced a prior credit agreement with the same unaffiliated commercial bank, which had an outstanding principal balance of approximately $3,000,000 remaining. The additional borrowing will be used to make a capital injection into the Company's subsidiary, West Bank. Principal and interest under the term note are payable quarterly over five years. The interest rate is variable at 195 basis points over the one month LIBOR rate. In the case of an event of default in respect of the loan (which events include, among others, non-payment of principal or interest, failure to comply with the covenants in the credit agreement, and certain bankruptcy-related and insolvency-related events), the unaffiliated commercial bank may accelerate the payment of the loan. The loan is secured by the stock of West Bank.

Item 8.01 Other Events.

The Company previously owned four banking offices that it leased to its wholly-owned subsidiary, West Bank. On May 30, 2017, the Company sold those offices to West Bank for approximately $18,000,000. Combined with the loan proceeds noted above in Item 2.03, $40,000,000 will be added to the capital of West Bank. This will increase West Bank’s legal lending limit by $6,000,000.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

West Bancorporation, Inc.

|

|

|

|

|

|

|

|

|

|

May 30, 2017

|

By:

|

/s/ Douglas R. Gulling

|

|

|

|

Name: Douglas R. Gulling

|

|

|

|

Title: Executive Vice President, Treasurer and Chief Financial Officer

|

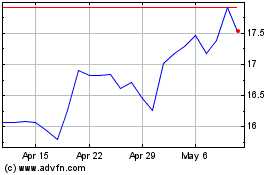

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

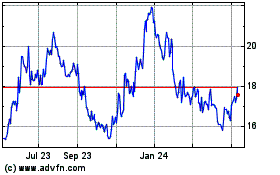

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

From Apr 2023 to Apr 2024