Filed Pursuant to Rule 424(b)(3)

Registration No. 333-217282

PROSPECTUS

35,130,017

Common Shares

offered

by the Selling Shareholders

The Selling Shareholders listed herein (the “Selling Shareholders”)

or any of their pledgees, donees, transferees or successors in interest, may sell in one or more offerings pursuant to this prospectus

up to 35,130,017 of our common shares, 2.75 million of which are issued and outstanding on the date hereof and 32,380,017 of which

are issuable upon the exercise of warrants (which if all exercised would result in gross proceeds to the Company of approximately

$51.8 million).

The Selling Shareholders or any of their pledgees, donees, transferees

or successors in interest may sell any or all of these common shares on any stock exchange, market or trading facility on which

the shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing

at the time of sale or at negotiated prices. Information on the Selling Shareholders and the times and manners in which they or

any of their pledgees, donees, transferees or successors in interest may offer and sell our common shares is described under the

sections entitled “Selling Shareholders”, “The Offering”, and “Plan of Distribution” in this

prospectus. We will not receive any of the proceeds from the sale of our common shares by the Selling Shareholders.

Our common shares are listed on the Nasdaq Capital Market under

the symbol “GLBS.” The closing sales price of our common stock on the Nasdaq Capital Market on May 26, 2017 was $1.37

per share. There were 27,630,273 of our common shares outstanding as of May 26, 2017.

An investment in these securities is speculative and involves

a high degree of risk. See the section entitled “Risk Factors” which begins on page 3 of this prospectus, and

other risk factors contained in any applicable prospectus supplement and in the documents incorporated by reference herein and

therein.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is May 30,

2017

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

As permitted under the rules of the Securities

and Exchange Commission, or the Commission, this prospectus incorporates important business information about us that is contained

in documents that we have previously filed with the Commission but that are not included in or delivered with this prospectus.

You may obtain copies of these documents, without charge, from the website maintained by the Commission at www.sec.gov, as well

as other sources. You may also obtain copies of the incorporated documents, without charge, upon written or oral request to Globus

Maritime Limited, 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Athens, Greece, or by telephone at +30 210 960 8300. See

“Where You Can Find Additional Information.”

You should rely only on the information

contained or incorporated by reference in this prospectus. Neither we nor the Selling Shareholders authorize any person to provide

information other than that provided in this prospectus and the documents incorporated by reference. Neither we nor the Selling

Shareholders are making an offer to sell common shares in any state or other jurisdiction where the offer or sale is not permitted.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front

of this prospectus regardless of its time of delivery, and you should not consider any information in this prospectus or in the

documents incorporated by reference herein to be investment, legal or tax advice. We encourage you to consult your own counsel,

accountant and other advisors for legal, tax, business, financial and related advice regarding an investment in our securities.

Unless otherwise indicated or unless the

context requires otherwise, all references in this prospectus to “Globus,” the “Company,” “we,”

“us,” “our,” or similar references, mean Globus Maritime Limited and, where applicable, its consolidated

subsidiaries. In addition, we use the term deadweight, or dwt, in describing the size of vessels. Dwt expressed in metric tons,

each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry. To

the extent the Selling Shareholders transfer our common shares or our warrants and the shares are not unrestricted, we may add

the recipients of those common shares and warrants as Selling Shareholders via a prospectus supplement or post-effective amendment.

Any references to the “Selling Shareholders” shall be deemed to be references to each such additional Selling Shareholders.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Marshall Islands company, and

our principal executive office is located outside of the United States, in Greece. Most of our directors, officers and the experts

named in this registration statement and prospectus reside outside the United States. In addition, a substantial portion of our

assets and the assets of certain of our directors, officers and experts are located outside of the United States. As a result,

you may have difficulty serving legal process within the United States upon us or any of these persons. You may also have difficulty

enforcing, both in and outside the United States, judgments you may obtain in United States courts against us or these persons.

CAUTIONARY STATEMENT REGARDING FORWARD

LOOKING STATEMENTS

This prospectus includes “forward-looking

statements,” as defined by U.S. federal securities laws, with respect to our financial condition, results of operations and

business and our expectations or beliefs concerning future events. Forward-looking statements provide our current expectations

or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives,

intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Forward-looking

statements and information can generally be identified by the use of forward-looking terminology or words, such as “anticipate,”

“approximately,” “believe,” “continue,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “ongoing,” “pending,” “perceive,” “plan,”

“potential,” “predict,” “project,” “seeks,” “should,” “views”

or similar words or phrases or variations thereon, or the negatives of those words or phrases, or statements that events, conditions

or results “can,” “will,” “may,” “must,” “would,” “could”

or “should” occur or be achieved and similar expressions in connection with any discussion, expectation or projection

of future operating or financial performance, costs, regulations, events or trends. The absence of these words does not necessarily

mean that a statement is not forward-looking. Forward-looking statements and information are based on management’s current

expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult

to predict.

All forward-looking statements involve

risks and uncertainties. The occurrence of the events described, and the achievement of the expected results, depend on many events,

some or all of which are not predictable or within our control. Actual results may differ materially from expected results.

In addition, important factors that, in

our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

|

|

·

|

general dry bulk shipping market conditions, including fluctuations in charterhire rates and vessel values;

|

|

|

·

|

the strength of world economies;

|

|

|

·

|

the stability of Europe and the Euro;

|

|

|

·

|

fluctuations in interest rates and foreign exchange rates;

|

|

|

·

|

changes in demand in the dry bulk shipping industry, including the market for our vessels;

|

|

|

·

|

changes in our operating expenses, including bunker prices, dry docking and insurance costs;

|

|

|

·

|

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

|

·

|

potential liability from pending or future litigation;

|

|

|

·

|

general domestic and international political conditions;

|

|

|

·

|

potential disruption of shipping routes due to accidents or political events;

|

|

|

·

|

the availability of financing and refinancing;

|

|

|

·

|

our ability to meet requirements for additional capital and financing to grow our business;

|

|

|

·

|

vessel breakdowns and instances of off-hire;

|

|

|

·

|

potential exposure or loss from investment in derivative instruments;

|

|

|

·

|

potential conflicts of interest involving our Chief Executive Officer, his family and other members of our senior management;

|

|

|

·

|

our ability to complete acquisition transactions as planned; and

|

|

|

·

|

other important factors described in “Risk Factors” and in other places incorporated by reference.

|

We have based these statements on assumptions

and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments

and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking statements attributable

to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred

to in this section. We undertake no obligation, and specifically decline any obligation, except as required by law, to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

See the sections entitled “Risk Factors”

of this prospectus and in our Annual Report on Form 20-F for the year ended December 31, 2016, which is incorporated herein

by reference, for a more complete discussion of these risks and uncertainties and for other risks and uncertainties. These factors

and the other risk factors described in this prospectus are not necessarily all of the important factors that could cause actual

results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable

factors also could harm our results. Consequently, there can be no assurance that actual results or developments anticipated by

us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given

these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

As required by the Securities Act, we filed

a registration statement relating to the securities offered by this prospectus with the Commission. This prospectus is a part of

that registration statement, which includes additional information.

Government Filings

We file annual and special reports with

the Commission. You may read and copy any document that we file and obtain copies at prescribed rates from the Commission’s

Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public

Reference Room by calling 1 (800) SEC-0330. The Commission maintains a website (http://www.sec.gov) that contains reports,

proxy and information statements and other information regarding issuers that file electronically with the Commission. Our filings

are also available on our website at http://www.globusmaritime.gr. The information on our website, however, is not, and should

not be deemed to be, a part of this prospectus.

This prospectus and any applicable prospectus

supplement are part of a registration statement that we filed with the Commission and do not contain all of the information in

the registration statement. The full registration statement may be obtained from the Commission or us, as indicated below. Documents

establishing the terms of the offered securities are filed as exhibits to the registration statement. Statements in this prospectus

or any applicable prospectus supplement about these documents are summaries and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters. You may inspect a copy of the registration statement at the Commission’s Public Reference Room in Washington, D.C.,

as well as through the Commission’s website.

Information Incorporated by Reference

The Commission allows us to “incorporate

by reference” information that we file with it. This means that we can disclose important information to you by referring

you to those filed documents. The information incorporated by reference is considered to be a part of this prospectus, and certain

information that we file later with the Commission prior to the termination of this offering will also be considered to be part

of this prospectus and will automatically update and supersede previously filed information, including information contained in

this document.

The following documents, filed with or

furnished to the SEC, are specifically incorporated by reference and form an integral part of this prospectus:

We are also incorporating by reference

all subsequent Annual Reports on Form 20-F that we file with the Commission and certain reports on Form 6-K that we furnish to

the Commission after the date of this prospectus (if they state that they are incorporated by reference into this prospectus) until

we file a post-effective amendment indicating that the offering of the securities made by this prospectus has been terminated.

In all cases, you should rely on the later information over different information included in this prospectus or the applicable

prospectus supplement.

You should rely only on the information

contained or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not, and any underwriters

have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not, and any underwriters are not, making an offer to sell these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and

any applicable prospectus supplement as well as the information we previously filed or furnished with the Commission and incorporated

by reference, is accurate as of the dates on the front cover of those documents only. Our business, financial condition and results

of operations and prospects may have changed since those dates.

You may request a free copy of the above

mentioned filing or any subsequent filing we incorporate by reference to this prospectus by writing or telephoning us at the following

address:

Globus Maritime Limited

c/o Globus Shipmanagement Corp.

128 Vouliagmenis Avenue

3rd Floor

166 74 Glyfada

Athens, Greece

+30 210 960 8300

Information provided by the Company

We will furnish holders of our common shares

with Annual Reports containing audited financial statements and a report by our independent registered public accounting firm.

The audited financial statements will be prepared in accordance with International Financial Reporting Standards. As a “foreign

private issuer,” we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements

to shareholders. While we furnish proxy statements to shareholders in accordance with the rules of the Nasdaq Capital Market, those

proxy statements do not conform to Schedule 14A of the proxy rules promulgated under the Exchange Act. In addition, as a “foreign

private issuer,” our officers and directors are exempt from the rules under the Exchange Act relating to short swing profit

reporting and liability.

PROSPECTUS SUMMARY

This summary highlights information

that appears later in this prospectus and is qualified in its entirety by the more detailed information and financial statements

included or incorporated by reference elsewhere in this prospectus. This summary may not contain all of the information that may

be important to you. As an investor or prospective investor, you should carefully review the entire prospectus, including the section

of this prospectus entitled “Risk Factors” and the more detailed information that appears later in this prospectus

before making an investment in our common shares.

Our Business

Our Company

We are an integrated dry bulk shipping

company, providing marine transportation services on a worldwide basis. We own, operate and manage a fleet of dry bulk vessels

that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally. Our Manager also

provides ship-management consulting services regarding vessels that we do not own. We intend to grow our fleet through timely and

selective acquisitions of modern vessels in a manner that we believe will provide an attractive return on equity and will be accretive

to our earnings and cash flow based on anticipated market rates at the time of purchase. There is no guarantee however, that we

will be able to find suitable vessels to purchase or that such vessels will provide an attractive return on equity or be accretive

to our earnings and cash flow.

Our operations are managed by our Athens,

Greece-based wholly owned subsidiary, Globus Shipmanagement Corp., which we refer to as our Manager, which provides in-house commercial

and technical management for our vessels. Our Manager has entered into a ship management agreement with each of our wholly owned

vessel-owning subsidiaries to provide services that include managing day-to-day vessel operations, such as supervising the crewing,

supplying, maintaining of vessels and other services, and has also entered into a consultancy agreement with another ship-management

company to consult for such ship-management company

We originally incorporated as Globus Maritime

Limited on July 26, 2006 pursuant to the Companies (Jersey) Law 1991 (as amended), and began operations in September 2006. On November

24, 2010, we redomiciled into the Marshall Islands. Our common shares trade on the NASDAQ Global Market under the ticker “GLBS.”

The following table presents information

concerning our vessels, each of which is owned by a wholly owned subsidiary of Globus Maritime Limited. We use the term deadweight

ton, or “dwt,” in describing the size of vessels. Deadweight ton or “dwt” is a unit of a vessel’s

capacity for cargo, fuel oil, stores and crew, measured in metric tons. A vessel’s dwt or total deadweight is the total weight

the vessel can carry when loaded to a particular line.

|

Vessel

|

|

Year

Built

|

|

|

Flag

|

|

Direct

Owner

|

|

Shipyard

|

|

Vessel Type

|

|

Delivery

Date

|

|

Carrying

Capacity

(dwt)

|

|

|

m/v Sun Globe

|

|

2007

|

|

|

Malta

|

|

Longevity Maritime Limited

|

|

Tsuneishi Cebu

|

|

Supramax

|

|

September 2011

|

|

|

58,790

|

|

|

m/v River Globe

|

|

2007

|

|

|

Marshall Islands

|

|

Devocean Maritime Ltd.

|

|

Yangzhou Dayang

|

|

Supramax

|

|

December 2007

|

|

|

53,627

|

|

|

m/v Sky Globe

|

|

2009

|

|

|

Marshall Islands

|

|

Domina Maritime Ltd.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

|

56,855

|

|

|

m/v Star Globe

|

|

2010

|

|

|

Marshall Islands

|

|

Dulac Maritime S.A.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

|

56,867

|

|

|

m/v Moon Globe

|

|

2005

|

|

|

Marshall Islands

|

|

Artful Shipholding S.A.

|

|

Hudong-Zhonghua

|

|

Panamax

|

|

June 2011

|

|

|

74,432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

|

|

300,571

|

|

Corporate Information

Our executive office is located at the

office of our Manager at 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Athens, Greece. Our telephone number is +30 210 960

8300. Our registered agent in the Marshall Islands is The Trust Company of the Marshall Islands, Inc. and our registered address

in the Marshall Islands is Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960. We maintain

our website at www.globusmaritime.gr. Information that is available on or accessed through our website does not constitute part

of, and is not incorporated by reference into, this registration statement on Form F-3.

Recent and Other Developments

On February 8, 2017, we entered into a

Share and Warrant Purchase Agreement (the “SPA”) pursuant to which we sold for $5 million an aggregate of 5 million

of our common shares, par value $0.004 per share and warrants (the “Warrants”) to purchase 25 million of our common

shares at a price of $1.60 per share (subject to adjustment as more fully described herein in “Description of Capital Stock

- Description of the Warrants”) to a number of investors in a private placement. These securities were issued in transactions

exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”).

On February 9, 2017 we entered into a registration

rights agreement with the Purchasers providing them with certain rights relating to registration under the Securities Act of the

Shares and the common shares underlying the Warrants.

In connection with the closing of the private

placement, we also entered into two loan amendment agreements (each, a “Loan Amendment Agreement”) with each of two

of our lenders.

One loan amendment agreement was entered

into by the Company with Firment Trading Limited, a Marshall Islands corporation (“Firment”), a related party to us

(it is an affiliate of our chairman) and the lender of the then outstanding loan in the principal amount of $18,523,787 to the

Company (the “Firment Credit Facility”), pursuant to which Firment released (the “Firment Loan Amendment”)

an amount equal to $16,885,000 (but to have an amount equal to $1,638,787 remain outstanding, and to continue to accrue under the

Firment Credit Facility as though it were principal) of the Firment Credit Facility and the Company issued to Firment Shipping

Inc., an affiliate of Firment 16,885,000 common shares (the “Firment Shares”) and a warrant to purchase 6,230,580 common

shares at a price of $1.60 per share (subject to adjustment as more fully described herein in “Description of Capital Stock

- Description of the Warrants”) (the “Firment Warrant”, together with Firment Shares, the “Firment Securities”).

Subsequent to the closing of the February 2017 private placement, Globus repaid the outstanding amount on the Firment Credit Facility

in its entirety.

The other loan amendment agreement was

entered into by the Company with Silaner Investments Limited, a Cyprus company (“Silaner”), a related party to us (it

is an affiliate of our chairman) and the lender of the then outstanding loan in the principal amount of $3,189,048 to the Company

(the “Silaner Credit Facility”), pursuant to which Silaner agreed to release (the “Silaner Loan Amendment”)

an amount equal to the outstanding principal of $3,115,000 (but to have an amount equal to the accrued and unpaid interest of $74,048

remain outstanding, and to continue to accrue under the Silaner Credit Facility as though it were principal) of the Silaner Credit

Facility and the Company issued to Firment Shipping Inc., an affiliate of Silaner 3,115,000 common shares (the “Silaner Shares”)

and a warrant to purchase 1,149,437 common shares at a price of $1.60 per share (subject to adjustment as more fully described

herein in “Description of Capital Stock - Description of the Warrants”) (the “Silaner Warrant”, together

with the Silaner Shares, the “Silaner Securities”). Subsequent to the closing of the February 2017 private placement,

Globus repaid the outstanding amount on the Silaner Credit Facility in its entirety.

The Warrants, the Firment Warrant and the

Silaner Warrant are each exercisable for 24 months after their respective issuance. We refer to the entry into the Loan Amendment

Agreements and Registration Rights Agreements and the issuances of the 5 million common shares, the Warrants, Firment Securities,

and the Silaner Securities as the “February 2017 Transactions.”

In this Registration Statement, we are

registering for resale (a) 2.75 million common shares sold in the Private Placement, (b) the 25 million common shares issuable

upon exercise of the Warrants, and (c) 7,380,017 common shares issuable upon exercise of the Firment Warrant and Silaner Warrant.

As of the date hereof, none of the warrants have been exercised.

Under the terms of the warrants, all Selling

Shareholders (other than Firment Shipping Inc., which has no such restriction in its warrants) may not exercise their warrants

to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution parties, to beneficially

own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’ notice, but not

to exceed 9.99%) of our then outstanding common shares immediately following such exercise, excluding for purposes of such determination

common shares issuable upon exercise of the warrants which have not been exercised. This provision does not limit a Selling Shareholder

from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring up to 4.99% of our common

shares. We refer to this as the “Blocker Provision”.

The Warrants, Firment Warrant, and Silaner

Warrant all contain a provision whereby the warrant’s holder has the right to a cashless exercise if, six months after their

issuance, a registration statement covering their resale is not effective. If for any reason we are unable to keep such a registration

statement active and our share price is higher than the $1.60 exercise price, we could be required to issue shares without receiving

cash consideration.

In March 2017, we

reached an agreement in principle with DVB Bank SE (which remain subject to definite documentation) to amend the DVB Loan Agreement,

including amendments to relax or waive certain covenants for the period from April 1, 2017 to April 1, 2018 (the “Restructuring

period”). The amendments with respect to the Restructuring Period will be subject to a $1.7 million prepayment by September

2017, which is the aggregated amount of two quarterly installments for each tranche, and another $1.7 million would be deferred

to the balloon payment of each tranche.

In March 2017, we

reached an agreement in principle with HSH Nordbank AG to amend the HSH Loan Agreement (which remain subject to definite documentation)

including amendments to relax or waive certain covenants of the original loan agreement until April 15, 2018. The Company will

pay in September 2017 $1 million for repayment of debt and the four scheduled principal installments due within 2017, each amounting

to $693,595, will be deferred to the balloon payment. In addition, the Company has undertaken the liability to raise new equity

of at least $1,800,000.

The Offering

Our selling shareholders named in the table

located on page 8 of this prospectus (the “Selling Shareholders”) are offering an aggregate of 35,130,017 common shares,

2.75 million of which are currently issued and outstanding and 32,380,017 of which are issuable upon the exercise of currently

outstanding warrants, subject to the terms and limitations contained within the Warrants. See “Description of Capital Stock

- Description of the Warrants” on page 11 of this prospectus. We will not receive any proceeds upon the sale of

common shares by the Selling Shareholders, but we will receive the exercise price of $1.60 each time a Warrant is exercised for

cash. See “Use of Proceeds” on page 5 of this prospectus.

RISK FACTORS

Investing in our common shares involves

a high degree of risk. You should carefully consider the risks set forth below and the discussion of risks under the heading “Item

3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2016, filed

with the Commission on April 11, 2017, and the other documents that are incorporated by reference in this prospectus. Please see

the section of this prospectus entitled “Incorporation by Reference of Certain Documents.” Any of the following risks

could materially and adversely affect our business, financial condition, results of operations or cash flows. In such a case, you

may lose all or part of your original investment.

RISKS RELATED TO THIS OFFERING

Our shareholders were significantly diluted by virtue of

the February 2017 transactions and it is unclear whether the full ramification of those transactions have been reflected in our

stock price.

As described above under the caption “Recent

and Other Developments”, in February 2017 we issued in the aggregate 25 million common shares and warrants to issue an additional

32,380,017 common shares in exchange for $20 million of debt cancellation and $5 million in cash. Prior to such issuance, a total

of 2,627,674 common shares were issued and outstanding. Our share price has not proportionately decreased to reflect the additional

number of common shares that are issued and issuable pursuant to exercise of the Warrants, and it remains to be seen how the market

will perceive this change in our increased number of shares. If the market views these transactions negatively, our share price

could substantially depreciate.

Our stock price has been volatile and no assurance can

be made that it will not substantially depreciate.

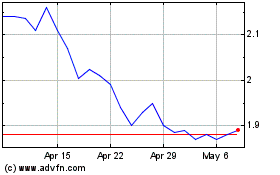

As you can see from our stock price history

contained within this prospectus under the caption “Per Share Market Information”, our stock price has been volatile

recently. The closing price of our common shares within the past 18 months has ranged from a low of $0.30 on January 29, 2016 to

a peak of $14.23 on November 16, 2016. Adjusting for the 4:1 stock split we effected on October 20, 2016, this represents a 1085%

increase from January 29, 2016. Our closing stock price as of May 26, 2017 was $1.37. We can offer no comfort or assurance that

our stock price will stop being volatile or not substantially depreciate.

Our existing shareholders will be diluted each time our

outstanding warrants are exercised.

As of May 30, 2017, our warrant holders

had the right to purchase an aggregate of 32,380,017 common shares. The number of common shares issuable upon exercise and price

of exercise are subject to adjustment as more fully described in “Description of Capital Stock - Description of the Warrants”.

We expect the exercise of such outstanding warrants to dilute the value of our shares.

A substantial number of common shares are

being offered by this prospectus, and we cannot predict if and when the purchasers may sell such shares in the public markets.

Furthermore, in the future, we may issue additional common shares or other equity or debt securities convertible into common shares

in connection with a financing, acquisition, litigation settlement, employee arrangements, or otherwise. Any such issuance could

result in substantial dilution to our existing shareholders and could cause our stock price to decline.

The sale of a substantial amount of our common shares,

including resale of the common shares issuable upon the exercise of the Warrants held by the Selling Shareholders, in the public

market could adversely affect the prevailing market price of our common shares.

The Selling Stockholders hold outstanding

warrants to purchase an aggregate of 32,380,017 common shares at an exercise price of $1.60 per share and 2.75 million shares.

Both the number of common shares issuable upon exercise of the warrants and the exercise price are subject to adjustment as more

fully described in “Description of Capital Stock - Description of the Warrants”. Sales of substantial amounts of our

common shares in the public market, or the perception that such sales might occur, could adversely affect the market price of our

common shares, and the market value of our other securities.

A substantial number of common shares are

being offered by this prospectus, and we cannot predict if and when the Selling Shareholders may sell such shares in the public

markets. Furthermore, in the future, we may issue additional common shares or other equity or debt securities convertible into

common shares in connection with a financing, acquisition, litigation settlement, employee arrangements, or otherwise. Any such

issuance could result in substantial dilution to our existing shareholders and could cause our stock price to decline.

Certain shareholders hold registration rights, which may

have an adverse effect on the market price of our common shares.

In connection with the February 8, 2017

transactions, we issued to Firment Shipping Inc. 20 million common shares and warrants to purchase 7,380,017 common shares. Firment

Shipping Inc. has the right to register those common shares for resale pursuant to a registration rights agreement we entered into

with its affiliate, Firment Trading Limited. The resale of those common shares in addition to the offer and sale of the other securities

included in this registration statement and prospectus may have an adverse effect on the market price of our common shares.

Our warrants could have cashless exercise at our expense

if, six months after the warrants were issued, the underlying common shares issuable upon exercise of the warrants are not registered

for sale pursuant to an effective registration statement.

The Warrants, Firment Warrant, and Silaner

Warrant all contain a provision whereby the warrant’s holder has the right to a cashless exercise if, six months after their

issuance, a registration statement covering their resale is not effective. If for any reason we are unable to keep such a registration

statement active and our share price is higher than the $1.60 exercise price, we could be required to issue shares without receiving

cash consideration. As 32,380,017 common shares are issuable upon exercise of the warrants, this could mean that we issue all such

shares but do not receive $51,808,027.20 (which is the $1.60 exercise price multiplied by 32,380,017), which would dilute our shareholders

and likely decrease our share price.

If we are unable to deliver common shares free of restrictive

legends where required by the Share Purchase Agreement and the warrants, we must make whole any purchaser who loses money by purchasing

common shares on the market to complete a trade.

The warrants and SPA require us, within

the later of (a) five full trading days of the exercise of a warrant and (b) three full trading days after receipt of the purchase

price for such exercised warrants, to issue common shares, which, where called for in the warrants and the SPA, must be free of

restrictive legends. We are similarly obligated, where called for pursuant to the terms of the SPA, to remove restrictive legends

from 2.75 million common shares issued to purchasers in the February 2017 Transactions that are being registered in this prospectus.

If we are unable to deliver proof that the above has occurred when required and if a warrant or shareholder has traded the common

shares that we have failed to deliver unlegended, penalty provisions of the SPA and warrants require us to make whole any warrant

holder or shareholder who loses money by purchasing shares on the common market to complete its trade. Depending on our share price

during this time and the number of shares to which the payments relate, we could be required to pay a substantial sum.

USE OF PROCEEDS

This prospectus registers for resale 35,130,017

common shares, of which:

|

|

·

|

2.75 million have already been issued to the Selling Shareholders, and we will not receive any proceeds from sales of common

shares by the Selling Shareholders.

|

|

|

|

|

|

|

·

|

Up to 32,380,017 million are issuable upon the exercise of warrants (upon the conditions further described in “Description

of Capital Stock - Description of the Warrants”). We will receive $1.60 each time a warrant is exercised (up to a total of

approximately $51.8 million), but we will not receive any proceeds from the sales of these common shares by the Selling Shareholders.

|

We intend to use any proceeds received

from the exercise of the warrants for working capital and general corporate purposes. We will incur all costs associated with this

registration statement and prospectus (other than underwriting discounts and commissions and any transfer taxes), which we anticipate

to be approximately $50,000.

PER SHARE MARKET PRICE INFORMATION

Since April 11, 2016 our common shares

have traded on the Nasdaq Capital Market under the symbol “GLBS”. Prior to April 11, 2016, our common shares traded

on the Nasdaq Global Select Market. You should carefully review the high and low prices of our common shares in the tables for

the months, quarters and years indicated under the heading Item 9. “The Offer and Listing” in our annual report

on Form 20-F for the year ended December 31, 2016, which is incorporated by reference herein.

On October 20, 2016, we effected a four

to one reverse stock split which reduced number of outstanding common shares from 10,510,741 to 2,627,674 shares (adjustments were

made based on fractional shares). The share prices below have been adjusted to reflect the stock split.

The table below sets forth the high

and low closing prices for each of the periods indicated for our common shares as reported, from April 11, 2016 onwards, by

the NASDAQ Capital Market, and prior to April 11, 2016, from the Nasdaq Global Select Market.

|

Period Ended

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

Monthly

|

|

|

|

|

|

|

|

|

|

May 2017 (through and including May 26, 2017)

|

|

$

|

2.05

|

|

|

$

|

0.91

|

|

|

April 2017

|

|

$

|

4.41

|

|

|

$

|

2.24

|

|

|

March 2017

|

|

$

|

6.74

|

|

|

$

|

4.32

|

|

|

February 2017

|

|

$

|

9.70

|

|

|

$

|

7.10

|

|

|

January 2017

|

|

$

|

10.77

|

|

|

$

|

3.07

|

|

|

December 2016

|

|

$

|

7.67

|

|

|

$

|

4.08

|

|

|

November 2016

|

|

$

|

14.23

|

|

|

$

|

1.74

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly

|

|

|

|

|

|

|

|

|

|

First Quarter 2017

|

|

$

|

10.77

|

|

|

$

|

3.07

|

|

|

Fourth Quarter 2016

|

|

$

|

14.23

|

|

|

$

|

1.66

|

|

|

Third Quarter 2016

|

|

$

|

3.28

|

|

|

$

|

1.64

|

|

|

Second Quarter 2016

|

|

$

|

5.16

|

|

|

$

|

1.00

|

|

|

First Quarter 2016

|

|

$

|

0.88

|

|

|

$

|

0.24

|

|

|

Fourth Quarter 2015

|

|

$

|

3.96

|

|

|

$

|

0.60

|

|

|

Third Quarter 2015

|

|

$

|

6.32

|

|

|

$

|

3.88

|

|

|

Second Quarter 2015

|

|

$

|

7.60

|

|

|

$

|

4.56

|

|

|

First Quarter 2015

|

|

$

|

10.16

|

|

|

$

|

4.80

|

|

|

|

|

|

|

|

|

|

|

|

|

Yearly

|

|

|

|

|

|

|

|

|

|

2016

|

|

$

|

7.09

|

|

|

$

|

0.20

|

|

|

2015

|

|

$

|

10.16

|

|

|

$

|

0.60

|

|

|

2014

|

|

$

|

17.76

|

|

|

$

|

8.88

|

|

|

2013

|

|

$

|

16.84

|

|

|

$

|

6.80

|

|

|

2012

|

|

$

|

23.08

|

|

|

$

|

5.92

|

|

CAPITALIZATION

The following table sets forth our capitalization

table as of December 31, 2016, on

|

|

·

|

An as Adjusted basis, as of February 9, 2017, to give effect to the completion of the February 2017 Transactions. In the February

2017 Transactions, an aggregate of 5 million common shares and warrants to purchase 25 million common shares were issued to purchasers

for a total of $5 million, and 20 million common shares and warrants to purchase 7,380,017 common shares were issued to Firment

Shipping Inc., an affiliate of two of our lenders (each of which is a related party to us) in exchange for an aggregate of $20

million in debt cancellation (an amount of $0.55 million of outstanding debt as of December 31, 2016 was settled in cash). We have

assumed no exercise of the warrants in the adjusted figures below.

|

|

|

|

As of Dec 31, 2016

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(dollars in thousands except

per share and share data)

|

|

|

Capitalization:

|

|

|

|

|

|

|

|

|

|

Total debt (including current portion)

|

|

$

|

65,572

|

|

|

$

|

45,022

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred shares, $0.001 par value; 100,000,000 shares authorized, none issued, actual and as adjusted

|

|

|

—

|

|

|

|

—

|

|

|

Common shares, $0.004 par value; 500,000,000 shares authorized, 2,627,674 shares issued and outstanding actual, 27,627,674 shares issued and outstanding as adjusted (assuming no exercise of the warrants)

|

|

$

|

10

|

|

|

$

|

111

|

|

|

Additional paid-in capital

|

|

$

|

110,004

|

|

|

$

|

134,903

|

|

|

Accumulated deficit

|

|

$

|

(89,254

|

)

|

|

$

|

(89,254

|

)

|

|

Total shareholders’ equity

|

|

$

|

20,760

|

|

|

$

|

45,760

|

|

|

Total capitalization

|

|

$

|

86,332

|

|

|

$

|

90,782

|

|

Other than the adjustments described above,

there have been no significant adjustments to our capitalization since December 31, 2016. This table should be read in conjunction

with the consolidated financial statements and related notes included in our annual report for the year ended December 31,

2016, on Form 20-F filed with the Commission on April 11, 2017 and incorporated by reference herein.

SELLING SHAREHOLDERS

Based solely upon information furnished

to us by the Selling Shareholders, the following table sets forth information with respect to the beneficial ownership of our common

shares held as of the date of this prospectus (or to be held, as noted below) by the Selling Shareholders. The Selling Shareholders

are offering an aggregate of up to 35,130,017 of our common shares, 2.75 million of which are outstanding and 32,380,017 of which

may be issued upon exercise of warrants that were acquired in private transactions. The Selling Shareholders may sell some, all

or none of their shares covered by this prospectus. The Selling Shareholders may also transfer their warrants. We may update this

table by filing a prospectus supplement in the event the Selling Shareholders transfer their warrants.

Under the terms of the warrants, all Selling

Shareholders (other than Firment Shipping Inc., which has no such restriction in its warrants) may not exercise their warrants

to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution parties, to beneficially

own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’ notice, but not

to exceed 9.99%) of our then outstanding common shares following such exercise, excluding for purposes of such determination common

shares issuable upon exercise of the warrants which have not been exercised. We refer to this as the “Blocker Provision”.

The Blocker Provision does not limit a

Selling Shareholder from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring up to

4.99% of our common shares. Until the warrants expire or the selling shareholders each exercise and sell all of their common shares,

the calculation of the number of common shares issuable to any Selling Shareholder at any given point in time will change based

upon the total number of common shares outstanding. Accordingly, the table below assumes that the Blocker Provision does not exist,

with the effect that beneficial ownership of the Selling Shareholders is presented (for purposes of disclosure in this prospectus

only) on a fully as exercised basis:

|

Selling Shareholders

|

|

Common

Shares

Prior to the

Offering(1)

|

|

|

Percentage

of Class

(2)

|

|

|

Total

Common

Shares

Offered

Hereby

|

|

|

Percentage

of the

Class

Following

the

Offering (3)

|

|

|

Xanthe Holdings Ltd. (4)

|

|

|

5,625,000

|

(5)

|

|

|

16.9

|

%

|

|

|

5,625,000

|

|

|

|

0

|

%

|

|

JTT Investments Ltd. (6)

|

|

|

5,625,000

|

(7)

|

|

|

16.9

|

%

|

|

|

5,625,000

|

|

|

|

0

|

%

|

|

Aizac Investment Corp. (8)

|

|

|

6,000,000

|

(9)

|

|

|

18.4

|

%

|

|

|

6,000,000

|

|

|

|

0

|

%

|

|

Robelle Holding Co. (10)

|

|

|

10,500,000

|

(11)

|

|

|

28.9

|

%

|

|

|

10,500,000

|

|

|

|

0

|

%

|

|

Firment Shipping Inc. (12)

|

|

|

27,380,017

|

(13)

|

|

|

78.2

|

%

|

|

|

7,380,017

|

|

|

|

57.1

|

%

|

|

(1)

|

These figures assume full exercise of each Selling Shareholder’s warrants (as though the Blocker Provisions were not in effect).

|

|

|

(2)

|

These percentages assume full exercise of each Selling Shareholder’s warrants (as though the Blocker Provisions did not exist) and without exercise of any other Selling Shareholder’s warrants.

|

|

|

(3)

|

Assumes that the Selling Shareholder sells all of its common shares offered hereby.

|

|

|

(4)

|

Xanthe Holdings Ltd. is a British Virgin Islands company with address at c/o Palm Grove House, P.O. Box 438, Road Town, Tortola, British Virgin Islands.

|

|

|

(5)

|

These 5,625,000 common shares are issuable upon exercise of the Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not in effect.

|

|

|

(6)

|

JTT Investments Ltd. is a British Virgin Islands company with address at JTT Investments Ltd., Craigmuir Chambers, P.O. Box 71, Road Town, Tortola, VG1110, British Virgin Islands.

|

|

|

(7)

|

These 5,625,000 common shares are issuable upon exercise of the Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not in effect.

|

|

|

(8)

|

Aizac Investment Corp. is a Marshall Islands corporation with address at Aizac Investment Corp., 10 Skouze Street, 18536, Piraeus, Greece.

|

|

|

(9)

|

These 6,000,000 common shares consist of (a) 1,000,000 common shares currently issued and (b) 5,000,000 common shares issuable upon exercise of the Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not in effect.

|

|

|

(10)

|

Robelle Holding Co. is a Marshall Islands corporation beneficially owned by Konstantina Feidaki with address at Pallazo Tukelan, Riva Antonio Caccia 3, 6900 Lugano, Switzerland. Konstantina Feidaki is the sister of Globus’ Chief Executive Officer Athanasios Feidakis and the daughter of Globus’ Chairman Georgios Feidakis.

|

|

|

(11)

|

These 10,500,000 common shares consist of (a) 1,750,000 common shares currently issued and (b) 8,750,000 common shares issuable upon exercise of the Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not in effect.

|

|

|

(12)

|

Firment Shipping Inc. is a Marshall Islands corporation with address at 17 Ifigenias street, 2007 Strovolos, Nicosia, Cyprus. Firment Shipping Inc. is our majority shareholder and is 100% owned by our Chairman Georgios Feidakis. Georgios Feidakis is the father of our Chief Executive Officer Athanasios Feidakis. The 27,380,017 figure does not include an additional 1,141,517 common shares that Georgios Feidakis is deemed to own through his control of Firment Trading Limited.

|

|

|

(13)

|

These 27,380,017 common shares consist of 20,000,000 common shares and 7,380,017 common shares issuable upon exercise of the Firment Warrant and Silaner Warrant. The only shares being registered in this prospectus are the 7,380,017 common shares issuable upon exercise of the Firment Warrant and Silaner Warrant. The Firment Warrant and Silaner Warrant do not contain the Blocker Provision.

|

|

PLAN OF DISTRIBUTION

The Selling Shareholders may sell our common

shares through underwriters, through agents, to dealers, in private transactions, at market prices prevailing at the time of sale,

at prices related to the prevailing market prices, or at negotiated prices.

In addition, the Selling Shareholders may

sell our common shares included in this prospectus through:

|

|

·

|

a block trade in which a broker-dealer may resell a portion of the block, as principal, in order to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

·

|

ordinary brokerage transactions and transactions in which a broker solicits purchasers; or

|

|

|

|

|

|

|

·

|

trading plans entered into by the Selling Shareholders pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as

amended, or the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus

supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans.

|

In addition, the Selling Shareholders may

enter into option or other types of transactions that require us or them to deliver our securities to a broker-dealer, who will

then resell or transfer the securities under this prospectus. The Selling Shareholders may enter into hedging transactions with

respect to our securities. For example, any Selling Shareholder may:

|

|

·

|

enter into transactions involving short sales of our common shares by broker-dealers;

|

|

|

|

|

|

|

·

|

sell common shares short and deliver the shares to close out short positions;

|

|

|

|

|

|

|

·

|

enter into option or other types of transactions that require the Selling Shareholders to deliver common shares to a broker-dealer,

who will then resell or transfer the common shares under this prospectus; or

|

|

|

|

|

|

|

·

|

loan or pledge the common shares to a broker-dealer, who may sell the loaned shares or, in the event of default, sell the pledged

shares.

|

The Selling Shareholders may also sell

shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

The Selling Shareholders may enter into

derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated

transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell

securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the

third party may use securities pledged by the Selling Shareholders or borrowed from the Selling Shareholders or others to settle

those sales or to close out any related open borrowings of stock, and may use securities received from the Selling Shareholders

in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions

will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition,

the Selling Shareholders may otherwise loan or pledge securities to a financial institution or other third party that in turn may

sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short

position to investors in our securities or in connection with a concurrent offering of other securities.

The Selling Shareholders and any broker-dealers

or other persons acting on our behalf or on the behalf of the Selling Shareholders that participate with the Selling Shareholders

in the distribution of the securities may be deemed to be underwriters and any commissions received or profit realized by them

on the resale of the securities may be deemed to be underwriting discounts and commissions under the Securities Act of 1933, as

amended, or the Securities Act. As a result, we have informed the Selling Shareholders, that Regulation M, promulgated under the

Exchange Act, may apply to sales by the Selling Shareholders in the market. The Selling Shareholders may agree to indemnify any

broker, dealer or agent that participates in transactions involving the sale of our common shares against certain liabilities,

including liabilities arising under the Securities Act.

At the time that any particular offering

of securities is made, to the extent required by the Securities Act, a prospectus supplement will be distributed, setting forth

the terms of the offering, including the aggregate number of securities being offered, the purchase price of the securities, the

initial offering price of the securities, the names of any underwriters, dealers or agents, any discounts, commissions and other

items constituting compensation from us and any discounts, commissions or concessions allowed or re-allowed or paid to dealers.

Furthermore, the Selling Shareholders may agree, subject to certain exemptions, that for a certain period from the date of the

prospectus supplement under which the securities are offered, they will not, without the prior written consent of an underwriter,

offer, sell, contract to sell, pledge or otherwise dispose of any of our common shares or any securities convertible into or exchangeable

for our common shares. However, an underwriter, in its sole discretion, may release any of the securities subject to these lock-up

agreements at any time without notice. We expect an underwriter to exclude from these lock-up agreements securities exercised and/or

sold pursuant to trading plans entered into by any Selling Shareholders pursuant to Rule 10b5-1 under the Exchange Act, that are

in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for

periodic sales of the Selling Shareholders’ securities on the basis of parameters described in such trading plans.

Underwriters or agents could make sales

in privately negotiated transactions and/or any other method permitted by law, including sales deemed to be an at-the-market offering

as defined in Rule 415 promulgated under the Securities Act, which includes sales made directly on or through the Nasdaq Capital

Market, the existing trading market for our common shares, or sales made to or through a market maker other than on an exchange.

As a result of requirements of the Financial

Industry Regulatory Authority, or FINRA, formerly the National Association of Securities Dealers, Inc., the maximum commission

or discount to be received by any FINRA member or independent broker/dealer may not be greater than eight percent (8%) of

the gross proceeds received by the Selling Shareholders for the sale of any securities being registered pursuant to Rule 415 promulgated

by the Commission under the Securities Act. If more than 5% of the net proceeds of any offering of common shares made under this

prospectus will be received by a FINRA member participating in the offering or affiliates or associated persons of such a FINRA

member, the offering will be conducted in accordance with FINRA Rule 5121.

Each Selling Shareholder represented and

warranted to us that it acquired the securities subject to this registration statement with no intent to distribute the securities.

DESCRIPTION OF CAPITAL STOCK

We refer you to “Item 10. Additional

Information B. Memorandum and Articles of Association” contained within our Annual Report on Form 20-F for the year ended

December 31, 2016, which was filed on April 11, 2017 and is incorporated by reference into this prospectus, for the description

of our capital stock.

Transfer Agent

The registrar and transfer agent for our

common shares is Computershare Inc.

Share History

February 2017 Transaction

On February 8, 2017, we entered into the

SPA pursuant to which we sold for $5 million an aggregate of 5 million of our common shares, par value $0.004 per share and Warrants

to purchase 25 million of our common shares at a price of $1.60 per share (subject to adjustment as more fully described herein

in “Description of Capital Stock - Description of the Warrants”) to a number of investors in a private placement. These

securities were issued in transactions exempt from registration under the Securities Act.

On February 9, 2017 we entered into a registration

rights agreement with the Purchasers providing them with certain rights relating to registration under the Securities Act of the

Shares and the common shares underlying the Warrants.

In connection with the closing of the private

placement, we also entered into two Loan Amendment Agreements with two lenders.

One loan amendment agreement was entered

into by the Company with Firment, a related party to us (it is an affiliate of our chairman), and the lender of the outstanding

loan in the principal amount of $18,523,787 to the Company, pursuant to which Firment released an amount equal to $16,885,000 (but

to have an amount equal to $1,638,787 remain outstanding, and to continue to accrue under the Firment Credit Facility as though

it were principal) of the Firment Credit Facility and the Company issued to Firment Shipping Inc., an affiliate of Firment 16,885,000

common shares and a warrant to purchase 6,230,580 common shares at a price of $1.60 per share (subject to adjustment as more fully

described herein in “Description of Capital Stock - Description of the Warrants”).Subsequent to the closing of the

February 2017 private placement, Globus repaid the outstanding amount on the Firment Credit Facility in its entirety.

The other loan amendment agreement was

entered into by the Company with Silaner, a related party to us (it is an affiliate of our chairman), and the lender of the outstanding

loan in the principal amount of $3,189,048 to the Company, pursuant to which Silaner agreed to release an amount equal to the outstanding

principal of $3,115,000 (but to have an amount equal to the accrued and unpaid interest of $74,048 remain outstanding, and to continue

to accrue under the Silaner Credit Facility as though it were principal) of the Silaner Credit Facility and the Company issued

to Firment Shipping Inc., an affiliate of Silaner 3,115,000 common shares and a warrant to purchase 1,149,437 common shares at

a price of $1.60 per share (subject to adjustment as more fully described herein in “Description of Capital Stock - Description

of the Warrants”). Subsequent to the closing of the February 2017 private placement, Globus repaid the outstanding amount

on the Silaner Credit Facility in its entirety.

The Warrants, the Firment Warrant and the

Silaner Warrant are each exercisable for 24 months after their respective issuance. We refer to the entry into the Loan Amendment

Agreements and Registration Rights Agreements and the issuances of the 5 million common shares, the Warrants, Firment Securities,

and the Silaner Securities as the “February 2017 Transactions”.

In this Registration Statement, we are

registering for resale (a) 2.75 million common shares sold in the Private Placement, (b) the 25 million common shares issuable

upon exercise of the Warrants, and (c) 7,380,017 common shares issuable upon exercise of the Firment Warrant and Silaner Warrant.

As of the date hereof, none of the warrants have been exercised.

On October 20, 2016, we effected a four

to one reverse stock split which reduced number of outstanding common shares from 10,510,741 to approximately 2,627,674 shares

(adjustments were made based on fractional shares).

In March 2016, as part of a settlement

with one our lenders, outstanding indebtedness of $15.65 million was released in exchange for $6.86 million of sale proceeds from

the sale of the shares of Kelty Marine Ltd. (the owner of

m/v Energy Globe)

plus overdue interest of $40,708.

In May 2015, the Company entered into a

Memorandum of Agreement for the sale of

m/v

Tiara Globe

for a sale price of $5.5 million. The book value of the

m/v

Tiara Globe

as of March 31, 2015 was $13.3 million. The

m/v

Tiara Globe

was delivered on July 10, 2015, and

caused the weighted average age of the fleet to be reduced by 1.7 years. Of the $5.3 million in net proceeds for the

m/v

Tiara Globe,

approximately $5.0 million were used to pay down existing debt and $0.3 million were used for general corporate

purposes.

Description of the Warrants

The Warrants underlying 25 million of the

common shares being registered in this prospectus were issued on February 9, 2017 and have an exercise price of $1.60 per share.

Both the number of shares issuable and the exercise price are subject to adjustments under customary conditions including share

dividends and stock splits, as provided under the terms of the Warrants.

Under the terms of the Warrants issued

pursuant to the SPA, a Selling Shareholder may not exercise the Warrants to the extent such exercise would cause such Selling Shareholder,

together with its affiliates and attribution parties, to beneficially own a number of our common shares which would exceed 4.99%

(which may be increased upon no less than 61 days’ notice, but not to exceed 9.99%) of our then outstanding common shares

following such exercise, excluding for purposes of such determination common shares issuable upon exercise of the Warrants which

have not been exercised. This provision does not limit a Selling Shareholder from acquiring up to 4.99% of our common shares, selling

all of their common shares, and re-acquiring up to 4.99% of our common shares. We refer to this as the “Blocker Provisions”.

The Warrants were immediately exercisable

upon their issuance and will expire two years after their issuance (February 9, 2019).

The Firment Warrant and Silaner Warrant,

both of which are held by Firment Shipping Inc., together grant Firment Shipping Inc. the right to purchase 7,380,017 common shares

at an exercise price of $1.60 per share. Both the number of shares issuable and the exercise price are subject to adjustments under

customary conditions including share dividends and stock splits, as provided under the terms of the Firment Warrant and Silaner

Warrant. The Firment Warrant and Silaner Warrant were immediately exercisable upon their issuance and will expire two years after

their issuance (February 8, 2019). The Firment Warrant and Silaner Warrant contain substantially similar provisions as the Warrants,

but do not contain the Blocker Provisions.

The Warrants, Firment Warrant, and Silaner

Warrant all contain a penalty provision whereby the warrant’s holder has the right to a cashless exercise if, six months

after their issuance, a registration statement covering their resale is not effective. If for any reason we are unable to keep

such a registration statement active and our share price is higher than the $1.60 exercise price, we could be required to issue

shares without receiving cash consideration.

The warrants and SPA require us, within

the later of (a) five full trading days of the exercise of a warrant and (b) three full trading days after receipt of the purchase

price for such exercised warrants, to issue common shares, which, where called for in the warrants and the SPA, must be free of

restrictive legends. We are similarly obligated, where called for pursuant to the terms of the SPA, to remove restrictive legends

from 2.75 million common shares issued to purchasers in the February 2017 Transactions being registered for resale in this prospectus.

If we are unable to deliver proof that the above has occurred when required and if a warrant or shareholder has traded the common

shares that we have failed to deliver unlegended, penalty provisions of the SPA and warrants require us to make whole any warrant

holder or shareholder who loses money by purchasing shares on the common market to complete its trade.

Listing

Our

common stock is listed on The NASDAQ Capital Market under the symbol “GLBS”.

TAX CONSIDERATIONS

Marshall Islands Tax Considerations

The following discussion is based upon

the opinion of Watson Farley & Williams LLP and the current laws of the Republic of the Marshall Islands and is applicable

only to persons who are not citizens of and do not reside in, maintain offices in or engage in business or transactions in the

Republic of the Marshall Islands.

Because we and our subsidiaries do not,

and we do not expect that we or any of our subsidiaries will, conduct business or operations in the Republic of the Marshall Islands,

and because we anticipate that all documentation related to any offerings pursuant to this prospectus will be executed outside

of the Republic of the Marshall Islands, under current Marshall Islands law holders of our common shares will not be subject to

Marshall Islands taxation or withholding on dividends. In addition, holders of our common shares will not be subject to Marshall

Islands stamp, capital gains or other taxes on the purchase, ownership or disposition of common shares, and you will not be required

by the Republic of the Marshall Islands to file a tax return relating to the shares of common shares.

It is the responsibility of each shareholder

to investigate the legal and tax consequences, under the laws of pertinent jurisdictions, including the Marshall Islands, of its

investment in us. Accordingly, each shareholder is urged to consult its tax counsel or other advisor with regard to those matters.

Further, it is the responsibility of each shareholder to file all state, local and non-U.S., as well as U.S. federal, tax returns

which may be required of such shareholder.

United States Tax Considerations

The following is a discussion of material United States federal

income tax consequences of the ownership and disposition of the Company’s common shares that, subject to the representations,

covenants, assumptions, conditions and qualifications described herein, may be relevant to prospective shareholders and, unless

otherwise noted in the following discussion, is the opinion of Watson Farley & Williams LLP, our United States counsel,

insofar as it relates to matters of United States federal income tax law and legal conclusions with respect to those matters. The

opinion of our counsel is dependent on the accuracy of representations made by us to them, including descriptions of our operations

contained herein. This discussion is based upon the provisions of the Internal Revenue Code of 1986, as amended, or the Code, existing

final, temporary and proposed regulations thereunder and current administrative rulings and court decisions, all as in effect on

the effective date of this prospectus and all of which are subject to change, possibly with retroactive effect. Changes in these

authorities may cause the tax consequences to vary substantially from the consequences described below. No rulings have been or

are expected to be sought from the United States Internal Revenue Service, or the IRS, with respect to any of the United States

federal income tax consequences discussed below, and no assurance can be given that the IRS will not take contrary positions.

The following summary does not deal with all United States federal

income tax consequences applicable to any given holder of our common shares, nor does it address the United States federal income

tax considerations applicable to categories of investors subject to special taxing rules, such as expatriates, banks, real estate

investment trusts, regulated investment companies, insurance companies, tax-exempt organizations, dealers or traders in securities

or currencies, partnerships, S corporations, estates and trusts, investors that hold their common shares as part of a hedge, straddle

or an integrated or conversion transaction, investors whose “functional currency” is not the United States dollar or

investors that own, directly or indirectly, 10% or more of our stock by vote or value. Furthermore, the discussion does not address

alternative minimum tax consequences or estate or gift tax consequences, or any state tax consequences, and is limited to shareholders

that will hold their common shares as “capital assets” within the meaning of Section 1221 of the Code. Each shareholder

is encouraged to consult, and discuss with his or her own tax advisor the United States federal, state, local and non-United States

tax consequences particular to him or her of the acquisition, ownership or disposition of common shares. Further, it is the responsibility

of each shareholder to file all state, local and non-United States, as well as United States federal, tax returns that may be required

of it.

United States Federal Income Taxation of United

States Holders

As used herein, “United States Holder” means a beneficial

owner of the Company’s common shares that is an individual citizen or resident of the United States for United States federal

income tax purposes, a corporation or other entity taxable as a corporation created or organized in or under the laws of the United

States or any state thereof (including the District of Columbia), an estate the income of which is subject to United States federal

income taxation regardless of its source or a trust where a court within the United States is able to exercise primary supervision

over the administration of the trust and one or more United States persons (as defined in the Code) have the authority to control