As filed with the Commission on May 26, 2017

File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

![[TRCS1MAY1817EV3002.GIF]](http://content.edgar-online.com/edgar_conv_img/2017/05/26/0001052918-17-000301_TRCS1MAY1817EV3002.GIF)

TIMBERLINE RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

|

|

1040

|

|

82-0291227

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer Identification No.)

|

101 East Lakeside Avenue

Coeur D

’

Alene, Idaho 83814

(208) 664-4859

(Address, including zip code, and telephone number, including area code, of registrant

’

s principal executive offices)

Dorsey & Whitney LLP

400 Wewatta Street, Suite 400

Denver, CO 80202

(303) 629-3400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jason K. Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, CO 80202

From time to time after the effective date of this registration statement

(Approximate date of commencement of proposed sale to public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box:

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering.

□

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

□

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

□

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of

“

large accelerated filer,

”

“

accelerated filer

”

,

“

smaller reporting company

”

and

“

emerging growth company

”

in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

Large Accelerated Filer

□

|

Accelerated Filer

□

|

|

Non-Accelerated Filer

□

|

Smaller Reporting Company

x

|

|

|

|

|

|

Emerging Growth Company

□

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section(7)(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be

Registered

|

|

Amount to be

Registered

(1)

|

|

|

Proposed Maximum

Offering Price Per

Share

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

Shares of common stock, par value $0.001 per share, offered by selling shareholders

|

|

|

8,000,000

|

|

|

$

|

0.41

|

(2)

|

|

$

|

3,280,000

|

(2)

|

|

$

|

380.15

|

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of common stock, par value $0.001 per share, issuable upon exercise of common stock purchase warrants held by selling shareholders exercisable at $0.40 per share

|

|

|

8,000,000

|

|

|

$

|

0.40

|

(3)

|

|

$

|

3,200,000

|

(3)

|

|

$

|

370.88

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

16,000,000

|

|

|

$

|

-

|

|

|

$

|

6,480,000

|

|

|

$

|

751.03

|

(4)

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act, the shares of common stock being registered hereunder include such indeterminate number of shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(c) under the Securities Act. The proposed maximum offering price per share and proposed maximum aggregate offering price are based upon the average of the high and low prices of the shares of common stock as of May 25, 2017 as quoted on the OTCQB of $0.41.

|

|

(3)

|

Estimated solely for purpose of calculating the amount of registration fee pursuant to Rule 457(g) based on the highest exercise price of the warrants of $0.40 per share.

|

|

(4)

|

The filing fee of $751.03 is being paid concurrently with the filing of this registration statement on Form S-1.

|

|

|

|

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until we will file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement will become effective on such date as the Securities and Exchange Commission, in accordance with Section 8(a) may determine.

The information contained in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these shares, and the selling security holders are not soliciting an offer to buy these shares in any state where the offer or sale is not permitted.

.

Subject To Completion: Dated May 26, 2017

![[TRCS1MAY1817EV3004.GIF]](http://content.edgar-online.com/edgar_conv_img/2017/05/26/0001052918-17-000301_TRCS1MAY1817EV3004.GIF)

TIMBERLINE RESOURCES CORPORATION

16,000,000 SHARES OF COMMON STOCK

This prospectus relates to the resale, transfer or other disposition from time to time of up to

16,000,000

shares of the common stock, par value $0.001 per share, of Timberline Resources Corporation by the selling shareholders as further described in this prospectus. The shares of common stock registered for sale are as follows:

·

8,000,000 shares of common stock held by selling security holders as of May 26, 2017; and

·

8,000,000 shares of common stock acquirable upon exercise of common stock purchase warrants at an exercise price of $0.40 per share.

The shares of common stock and warrants held by the selling shareholders were issued to such selling shareholders pursuant to private transactions between the Company and the selling shareholders. The selling shareholders may sell or otherwise dispose of the shares of common stock covered by this prospectus or interests therein on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Additional information about the selling shareholders, and the times and manner in which they may offer and sell shares of common stock under this prospectus, is provided in the sections entitled

“

Selling Shareholders

”

and

“

Plan of Distribution

”

of this prospectus.

We will not receive any proceeds from the resale of the shares of common stock by the selling shareholders.

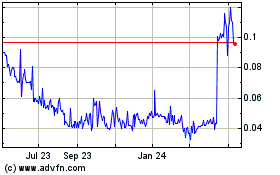

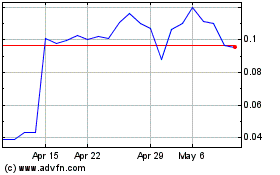

Our shares of common stock are traded on the TSX Venture Exchange (the

“

TSX-V

”

) under the symbol

“

TBR

”

and quoted on the OTCQB under the symbol

“

TRLS

”

. On May 25, 2017, the last reported closing bid price of our shares of common stock was $0.41 per share on the OTCQB and C$0.58 per share on the TSX-V. The over-the-counter quotations on the OTCQB reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. You are urged to obtain current market quotations of the shares of common stock.

All dollar amounts reflected herein refer to U.S. Dollars unless otherwise noted. As used herein,

“

C$

”

means Canadian Dollars.

Investing in the shares of common stock involves a high degree of risk. See

“

Risk Factors

”

beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission (the

“

SEC

”

) nor any state securities commission has approved or disapproved of the securities offered hereby or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS MAY ___, 2017

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

iv

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESERVE AND RESOURCE

ESTIMATES

vi

ABOUT THIS PROSPECTUS

vii

PROSPECTUS SUMMARY

1

RISK FACTORS

7

USE OF PROCEEDS

15

SELLING SHAREHOLDERS

15

PLAN OF DISTRIBUTION

21

DESCRIPTION OF SECURITIES TO BE REGISTERED

23

BUSINESS

23

DESCRIPTION OF PROPERTY

29

LEGAL PROCEEDINGS

45

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

46

MANAGEMENT

’

S DISCUSSION AND ANALYSIS

48

DIRECTORS, EXECUTIVE OFFICERS, AND CONTROL PERSONS

57

EXECUTIVE COMPENSATION

61

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

68

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

71

PRINCIPAL ACCOUNTANT FEES AND SERVICES

73

THE SEC

’

S POSITION ON INDEMNIFICATION FOR

73

SECURITIES ACT LIABILITIES

73

TRANSFER AGENT AND REGISTRAR

73

INTERESTS OF EXPERTS

74

LEGAL MATTERS

74

WHERE YOU CAN FIND MORE INFORMATION

74

GLOSSARY OF CERTAIN MINING TERMS

75

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this prospectus includes

“

forward-looking statements

”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements concern the Company

’

s anticipated results and developments in the Company

’

s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

·

the establishment and estimates of mineralization and reserves;

·

the grade of mineralization and reserves;

·

anticipated expenditures and costs in our operations;

·

planned exploration activities and the anticipated timing and outcomes of such exploration activities;

·

planned production of technical reports, economic assessments and feasibility studies on our properties;

·

plans and anticipated timing for obtaining permits and licenses for our properties;

·

expected future financing and its anticipated outcome;

·

plans and anticipated timing regarding production dates;

·

anticipated gold and silver prices;

·

anticipated liquidity to meet expected operating costs and capital requirements;

·

our ability to obtain financing to fund our estimated expenditure and capital requirements; and

·

factors expected to impact our results of operations.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as

“

expects

”

or

“

does not expect

”

,

“

is expected

”

,

“

anticipates

”

or

“

does not anticipate

”

,

“

plans

”

,

“

estimates

”

or

“

intends

”

, or stating that certain actions, events or results

“

may

”

,

“

could

”

,

“

would

”

,

“

might

”

or

“

will

”

be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

•

risks related to our limited operating history;

•

risks related to our ability to continue as a going concern;

•

risks related to our history of losses and our expectation of continued losses;

•

risks related to our properties being in the exploration or, if warranted, development stage;

•

risks related to our bringing our projects into production;

•

risks related to our mineral operations being subject to government and environmental regulation;

•

risks related to future legislation and administrative changes to mining laws;

•

risks related to future legislation regarding climate change;

•

risks related to our ability to obtain additional capital for exploration or to develop our reserves, if any;

•

risks related to land reclamation requirements and costs;

•

risks related to mineral exploration and development activities being inherently hazardous;

•

risks related to our insurance coverage for operating risks;

•

risks related to cost increases for our exploration and development projects;

•

risks related to a shortage of skilled personnel, equipment and supplies adversely affecting our ability to operate;

•

risks related to mineral resource and economic estimates;

•

risks related to the fluctuation of prices for precious and base metals, such as gold, silver and copper;

•

risks related to the competitive industry of mineral exploration;

•

risks related to our title and rights in our mineral properties;

•

risks related to integration issues with acquisitions;

•

risks related to our stock trading on the Over-the-Counter markets

•

risks related to joint ventures and partnerships;

•

risks related to potential conflicts of interest with our management;

•

risks related to our dependence on key management;

•

risks related to our Talapoosa Project, Eureka and other acquired growth projects;

•

risks related to our business model;

•

risks related to our acquisition of Wolfpack Gold Corp.;

•

risks related to our acquisition and amendment of the Talapoosa option;

•

risks related to evolving corporate governance standards for public companies;

ii

•

risks related to our Canadian regulatory requirements; and

•

risks related to our shares of common stock or other securities.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings

“

Risk Factors and Uncertainties

”

,

“

Description of the Business

”

and

“

Management

’

s Discussion and Analysis

”

of this prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this prospectus by the foregoing cautionary statements.

iii

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

Certain of the technical reports referenced in this prospectus use the terms "mineral resource," "measured mineral resource," "indicated mineral resource" and "inferred mineral resource". We advise investors that these terms are defined in and required to be disclosed in accordance with Canadian National Instrument 43-101

–

Standards of Disclosure for Mineral Projects (

“

NI 43-101

”

) and the Canadian Institute of Mining, Metallurgy and Petroleum (the

“

CIM

”

)

–

CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended; however, these terms are not defined terms under the United States Securities and Exchange Commission

’

s (the

“

SEC

”

) Industry Guide 7 (

“

Guide 7

”

) and are normally not permitted to be used in reports and registration statements filed with the SEC. Under Guide 7 standards, a

“

final

”

or

“

bankable

”

feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. Disclosure of

“

contained ounces

”

in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute

“

reserves

”

by Guide 7 standards as in place tonnage and grade without reference to unit measures. As a reporting issuer in Canada, we are required to prepare reports on our mineral properties in accordance with NI 43-101. We reference those technical reports in this Annual Report for informational purposes only and such reports are not incorporated herein by reference. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Investors are cautioned not to assume that any part or all of mineral deposits in the above categories will ever be converted into Guide 7 compliant reserves.

iv

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus is offering to sell, and is seeking offers to buy, the securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of our Common Shares.

We may provide a prospectus supplement containing specific information about the terms of a particular offering by the selling shareholders, or their transferees. The prospectus supplement may add, update or change information in this prospectus. If information in a prospectus supplement is inconsistent with the information in this prospectus, you should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable, any prospectus supplement hereto. See

“

Where You Can Find More Information

”

for more information.

This prospectus includes industry and market data and other information that we have obtained from, or which is based upon, market research, independent industry publications or other publicly available information. Any such data and other information is subject to change based on various factors, including those described below under the heading

“

Risk Factors

”

and elsewhere in this prospectus.

Our logo and some of our trademarks are used in this prospectus, which remain our sole intellectual property. This prospectus also includes trademarks, tradenames, and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the TM symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

We have not, and the selling shareholder has not, authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or in any supplement to this prospectus or free writing prospectus, and neither we nor the selling shareholder takes any responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

v

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that you should consider before investing in our common shares. You should read this entire prospectus carefully, including the

“

Risk Factors

”

and the financial statements and related notes included herein. This prospectus includes forward-looking statements that involve risks and uncertainties. See

“

Cautionary Note Regarding Forward-Looking Statements.

”

Unless otherwise indicated, any reference to Timberline, or as

“

we

”

,

“

us

”

, or

“

our

”

refers to Timberline Resources Corporation (

“

Timberline

”

or the

“

Company

”

).

About the Company

We were incorporated in the State of Idaho on August 28, 1968 under the name Silver Crystal Mines, Inc., to engage in the business of exploring for precious metal deposits and advancing them toward production. We ceased exploration activities during the 1990

’

s and became virtually inactive. In December 2003, a group of investors purchased 80 percent of the issued and outstanding common stock from the then-controlling management team. In January 2004, we affected a one-for-four reverse split of our issued and outstanding shares of common stock and increased our authorized common stock to 100 million with a par value of $.001. Unless otherwise indicated, all references herein to shares outstanding and share issuances have been adjusted to give effect to the aforementioned stock split. On February 2, 2004, our name was changed to Timberline Resources Corporation. On August 27, 2008, we reincorporated into the State of Delaware pursuant to a merger agreement approved by our shareholders on August 22, 2008.

We commenced our exploration stage in January 2004 with the change in the management of the Company. From January 2004 until March 2006, we were strictly a mineral exploration company. Beginning with the management appointments of John Swallow and Paul Dircksen and our acquisition of Timberline Drilling Incorporated (formerly, Kettle Drilling Inc., which we refer to herein as Timberline Drilling), in March 2006, we have advanced a new, aggressive business plan. Prior to our new business model, the addition of new management, and the purchase of Timberline Drilling, the Company had accumulated losses and no reported revenues.

In March 2006, we acquired Timberline Drilling, Inc. (

“

TDI

”

), formerly known as Kettle Drilling, as a wholly owned subsidiary. TDI was formed in 1996 and provides mineral core drilling services to the mining and mineral exploration industries primarily in the western United States. In September 2011, we announced that we had entered into a non-binding letter of intent to sell TDI to a private company formed by a group of investors, including certain members of the senior management team of TDI. In November 2011, the sale of TDI was completed for a total value of approximately $15 million.

In July 2007, we closed our purchase of the Butte Highlands Gold Project. In October 2008, we announced that we had agreed to form a 50/50 joint venture at the Butte Highlands project. In July 2009, we finalized the joint venture agreement with Highland Mining, LLC (

“

Highland

”

) to create Butte Highlands JV, LLC (

“

BHJV

”

). Under terms of the joint venture agreement, development began in the summer of 2009, with Highland funding all mine development costs through development. Both Timberline

’

s and Highland

’

s 50-percent share of costs were to be paid out of net proceeds from future mine production. On January 29, 2016, we executed a Member Interest Purchase Agreement (the

“

Purchase Agreement

”

) with New Jersey Mining Company pursuant to which we sold all of our 50% interest in BHJV.

In June 2010, we closed our acquisition of Staccato Gold Resources Ltd., a Canadian-based resource company (

“

Staccato Gold

”

) that was in the business of acquiring, exploring, and developing mineral properties with a focus on gold exploration in the dominant gold producing trends in Nevada. As a result of this acquisition, we obtained Staccato

’

s flagship gold exploration project (

“

Lookout Mountain

”

), and several other projects at various stages of exploration in the Battle Mountain/Eureka gold trend in north-central Nevada, along with Staccato Gold

’

s wholly owned U.S. subsidiary, BH Minerals USA, Inc. (

“

BH Minerals

”

).

In August 2014, our stockholders approved an increase in the number of authorized shares of common stock from 100,000,000 shares, par value $0.001, to 200,000,000 shares of common stock, par value $0.001.

In August 2014, our stockholders approved a one-for-twelve reverse stock split of the company

’

s common stock. The one-for-twelve reverse stock split was effective October 31, 2014. As a result of the reverse stock split, the number of issued and outstanding shares was adjusted and the number of shares underlying outstanding stock options and warrants and the related exercise prices were adjusted. Following the effective date of the reverse stock split, the par value of the common stock remained at $0.001 per share. Unless otherwise indicated, all references herein to shares outstanding and share issuances have been adjusted to give effect to the aforementioned stock split.

1

In August 2014, we closed our acquisition of Wolfpack Gold (Nevada) Corp. (

“

Wolfpack US

”

), a U.S. company and a wholly-owned subsidiary of Wolfpack Gold Corp. a Canadian-based resource company (

“

Wolfpack Gold

”

), that was in the business of acquiring, exploring, and developing mineral properties with a focus on gold exploration in the dominant gold producing trends in Nevada. As a result of this acquisition, we obtained cash and several projects at various stages of exploration in the gold trends in Nevada.

We currently maintain our administrative office at 101 East Lakeside Ave., Coeur d

’

Alene, ID 83814. The telephone number is (866) 513-4859 (toll free) or (208) 664-4859. We also maintain field offices and warehouse space at 55 Freeport Blvd, Sparks, NV 89431 and 901 S. Main Street, Eureka, NV 89316.

Recent Corporate Developments

On March 12, 2015 (the

“

Effective Date

”

), we entered into a property option agreement (

“

Agreement

”

) with Gunpoint Exploration Ltd. (

“

Gunpoint

”

), which closed on March 31, 2015. Gunpoint granted us an exclusive and irrevocable option (

“

Option

”

) to purchase a 100% interest in Gunpoint

’

s Talapoosa project (the

“

Project

”

) in western Nevada. Pursuant to the Agreement, we had the right to exercise the Option at any time through September 12, 2017, unless sooner terminated (

“

Option Period

”

). In October 2016, the Agreement was amended in order to extend the option exercise period until March 31, 2019. Amended terms include interim payments due in March 2017 and March 2018, a commitment to undertake cumulative project expenditures of a minimum of $7.5 million by December 31, 2018, and the elimination of Timberline

’

s purchase option of the royalty retained by Gunpoint.

On September 13, 2015, we signed a non-binding Letter Agreement ("Letter Agreement") with Waterton Precious Metals Fund II Cayman, LP (together with its subsidiaries and affiliated and associated entities, "Waterton"). Waterton offered to acquire all of the issued and outstanding shares of our common stock for cash consideration of US$0.58 per share (the "Transaction"). In connection with the Transaction, Waterton subscribed for 1,331,861 common shares of Timberline on a

private placement basis at a price of $0.375 per share for total proceeds of $499,448. The private placement was not contingent on completion of the Transaction, and Waterton reserved the right to maintain its pro rata ownership position in us in the event the Transaction was not completed.

On December 3, 2015, we announced that the exclusivity period granted to Waterton under the Letter Agreement had expired, and while Waterton was continuing certain due diligence activities, the Transaction as previously proposed had been withdrawn by Waterton. We continued to review strategic alternatives, and discussions between us and various parties, including Waterton, continued, but no strategic alternatives are the subject of material discussions as of the date of this Registration Statement on Form S-1.

On December 21, 2015, the Board of Directors of the Company received a letter of resignation from Mr. Kiran Patankar, pursuant to which Mr. Patankar resigned as Chief Executive Officer and President of the Company effective January 20, 2016. Mr. Patankar claimed in his letter to the Board that his resignation was for

“

good reason

”

as set forth in Mr. Patankar

’

s employment agreement dated August 28, 2015. As such, Mr. Patankar would be owed severance payments by the Company as set forth in the agreement. The Company

’

s Board disagrees with Mr. Patankar

’

s characterization of the resignation. On January 19, 2016, the Board dismissed effective immediately Mr. Kiran Patankar as President and Chief Executive Officer of the Company.

Effective January 19, 2016, the Board of Directors of the Company accepted the resignation of Mr. Randal Hardy as Chief Financial Officer of the Company. Effective January 19, 2016, the Board of Directors of the Company appointed Mr. Steven A. Osterberg to serve as the Company

’

s President and Chief Executive Officer and a director of the Company.

On May 26, 2016, the Company entered into three loan and securities purchase agreements (collectively, the

“

Loan Agreements

”

) whereby the Company agreed to issue certain unsecured promissory notes (collectively, the

“

Notes

”

) in the aggregate amount of $57,200. One Note was issued in favor of Steven Osterberg (the

“

Osterberg Note

”

), the Company

’

s President & Chief Executive Officer, one Note in favor of Robert Martinez (the

“

Martinez Note

”

), a member of the Company

’

s Board of Directors, and one Note in favor of Randal Hardy (the

“

Hardy Note

”

), an advisor to the Company. The Osterberg Note had an original principal amount of $22,000, the Martinez Note had an original principal amount of $13,200 and the Hardy Note had an original principal amount of $22,000. Each Note did not bear interest but was subject to an original issue discount equal to 9.1% of the principal amount of such Note. Each Note was unsecured, and matured on May 31, 2016. A total amount of $57,200 was re-paid to the note holders, including financing fees of $5,200 as consideration for providing the loans. The issuance of the Notes was approved by a majority of the disinterested members of the Company

’

s Board of Directors on May 20, 2016.

2

On April 26, 2016, Mr. William M. Sheriff resigned from the Company

’

s Board of Directors effective immediately. Mr. Sheriff indicated that his resignation was due to the significant demands on his time from his other obligations. He expressed confidence in Timberline

’

s leadership and projects, and he further indicated that he intends to remain a large shareholder of Timberline. Mr. Leigh Freeman was appointed to succeed Mr. Sheriff as the Chairman of Timberline

’

s Board of Directors.

On July 6, 2016, the Company

’

s Board of Directors appointed Giulio T. Bonifacio and Paul H. Zink as directors of the Company, effective July 6, 2016.

On September 8, 2016, the Company

’

s Board of Directors appointed Mr. Randal L. Hardy as the Company

’

s Chief Financial Officer and Corporate Secretary.

On October 19, 2016, we amended our property option agreement (the

“

Amended Agreement

”

) in which Gunpoint Exploration Ltd. (

“

Gunpoint

”

) had granted us an exclusive and irrevocable option (the

“

Option

”

) to purchase a 100% interest in Gunpoint

’

s Talapoosa project (the

“

Project

”

) in western Nevada. Pursuant to the Amended Agreement, we have the right to exercise the Option to purchase the Project through March 31, 2019, subject to certain interim payments and cumulative project expenditures. On March 31, 2017, we paid a $1 million cash payment to American Gold Capital US Inc. (

“

AGC

”

), a wholly owned subsidiary of Gunpoint, in satisfaction of the cash option payment due on March 31, 2017 pursuant to the Amended Agreement. On April 13, 2017, upon approval by the TSX Venture Exchange, we issued one million shares of our common stock to AGC in satisfaction of the share payment due on March 31, 2017, pursuant to the Amended Agreement.

On January 6, 2017, we entered into an employment offer letter with our Chief Financial Officer, Randal Hardy. Pursuant to the terms of the offer letter, Mr. Hardy became an employee of the Company on December 16, 2016 with a deemed employment start date of August 27, 2007, due to Mr. Hardy

’

s continual role with the Company as a former employee and consultant. Mr. Hardy will continue to serve as Chief Financial Officer and Corporate Secretary of the Company.

On February 16, 2017, we closed the sale of the first tranche of a private placement offering of Units of the Company (the

“

2017 Offering

”

) at a price of $0.25 per Unit. Each Unit consisted of one share of common stock of the Company and one common share purchase warrant (each a

“

Warrant

”

), with each Warrant exercisable to acquire an additional share of common stock of the Company at a price of $0.40 per share until January 31, 2020. In the first tranche of the 2017 Offering that closed on February 16, 2017, accredited investors subscribed for 1,945,000 Units on a private placement basis at a price of $0.25 per unit for total proceeds of $486,250. As a result, 1,945,000 shares of common stock of the Company and 1,945,000 Warrants were issued and 1,945,000 shares of common stock were reserved for issuance pursuant to Warrant exercises.

On March 28, 2017, we closed the sale of the second tranche of the 2017 Offering at a price of $0.25 per Unit. Each Unit consisted of one share of common stock of the Company and one Warrant, with each Warrant exercisable to acquire an additional share of common stock of the Company at a price of $0.40 per share until January 31, 2020. In the second tranche of the 2017 Offering that closed on March 28, 2017, accredited investors subscribed for 4,210,000 Units on a private placement basis at a price of $0.25 per unit for total proceeds of $1,052,500. As a result, 4,210,000 shares of common stock of the Company and 4,210,000 Warrants were issued, and 4,210,000 shares of common stock were reserved for issuance pursuant to Warrant exercises.

On April 12, 2017, we closed the sale of the third and final tranche of the 2017 Offering at a price of $0.25 per Unit. Each Unit consisted of one share of common stock of the Company and one Warrant, with each Warrant exercisable to acquire an additional share of common stock of the Company at a price of $0.40 per share until January 31, 2020. In the third and final tranche of the 2017 Offering that closed on April 12, 2017, accredited investors subscribed for 1,845,000 Units on a private placement basis at a price of $0.25 per unit for total proceeds of $461,250. As a result, 1,845,000 shares of common stock of the Company and 1,845,000 Warrants were issued, and 1,845,000 shares of common stock were reserved for issuance pursuant to Warrant exercises. The 2017 Offering totaled 8 million Units for total gross consideration of $2,000,000, less offering costs,.

Overview of Our Mineral Exploration Business

We are a mineral exploration business and, if and when we establish mineral reserves, a development company. Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies. We acquire properties which we believe have potential to host economic concentrations of minerals, particularly gold and silver. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims or private property owned by others. An unpatented mining claim is an interest that can be acquired to the mineral rights on open lands of the federally owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded

3

with the federal government pursuant to laws and regulations established by the Bureau of Land Management (the Federal agency that administers America

’

s public lands), and grant the holder of the claim a possessory interest in the mineral rights, subject to the paramount title of the United States.

We will perform basic geological work to identify specific drill targets on the properties, and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). We may enter into joint venture agreements with other companies to fund further exploration and/or development work. It is our plan to focus on assembling a high quality group of gold and silver exploration prospects using the experience and contacts of the management group. By such prospects, we mean properties that may have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will either have some prior exploration history or will have strong similarity to a recognized geologic ore deposit model. We will place geographic emphasis on the western United States and Nevada in particular.

The focus of our activity has been to acquire properties that we believe to be undervalued; including those that we believe to hold previously unrecognized mineral potential. Properties have been acquired through the location of unpatented mining claims (which allow the claimholder the right to mine the minerals without holding title to the property), or by negotiating lease/option agreements. Our President and CEO, Steven Osterberg, and our CFO, Randal Hardy, as well as our Directors, have experience in evaluating, staking and filing unpatented mining claims, and in negotiating and preparing mineral lease agreements in connection with those mining claims.

The geologic potential and ore deposit models have been defined and specific drill targets identified on the majority of our properties. Our property evaluation process involves using basic geologic fieldwork to perform an initial evaluation of a property. If the evaluation is positive, we seek to acquire it, either by staking unpatented mining claims on open public domain, or by leasing the property from the owner of private property or the owner of unpatented claims. Once acquired, we then typically make a more detailed evaluation of the property. This detailed evaluation involves expenditures for exploration work which may include rock and soil sampling, geologic mapping, geophysics, trenching, drilling, or other means to determine if economic mineralization is present on the property.

Our strategy with properties deemed to be of higher risk or those that would require very large exploration expenditures is to present them to larger companies for joint venture. Our joint venture strategy is intended to maximize the abilities and skills of the management group, conserve capital, and provide superior leverage for investors. If we present a property to a major company and they are not interested, we will continue to seek an interested partner.

For our prospects where drilling costs are reasonable and the likelihood of success seems favorable, we will undertake our own drilling. The target depths, the tenor of mineralization on the surface, and the general geology of the area are all factors that determine the risk as calculated by us in conducting a drilling operation. Mineral exploration is a research and development activity and is, by definition, a high risk business that relies on numerous untested assumptions and variables. Accordingly, we make our decisions on a project-by-project basis. We do not have any steadfast formula that we apply in determining the reasonableness of drilling costs in comparison to the likelihood of success, i.e., in determining whether the probability of success seems

“

favorable.

”

4

THE OFFERING

|

|

|

|

Shares Offered By the Selling shareholders

|

|

16,000,000 shares of common stock, par value $0.001, including:

•

8,000,000 shares held by selling shareholders; and

•

8,000,000 shares issuable upon exercise of share purchase warrants held by selling shareholders exercisable at a price per share of $0.40.

|

|

|

|

|

|

Offering Price

|

|

Determined at the time of sale by the selling shareholders

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the shares by selling shareholders covered by this prospectus.

|

|

|

|

|

|

Shares of Common Stock Outstanding as of May 26, 2017

|

|

33,146,952 shares

|

|

|

|

|

|

OTCQB and TSX-V Trading Symbol

|

|

The shares are quoted on the OTCQB under the symbol

“

TRLS

”

and listed on the TSX-V under the symbol

“

TBR

”

.

|

|

|

|

|

|

Risk Factors

|

|

Investing in our securities involves a high degree of risk. See

“

Risk Factors

”

beginning on page 7 of this prospectus.

|

|

|

|

|

|

Dividend Policy

|

|

We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends.

|

5

SELECTED FINANCIAL DATA

The selected financial information presented below as of and for the periods indicated is derived from our financial statements contained elsewhere in this prospectus and should be read in conjunction with those financial statements.

|

|

|

|

|

|

Statement of

Operations Data

|

Year Ended

September 30, 2016

|

Year Ended

September 30, 2015

|

Six Months Ended

March 31, 2017

(Unaudited)

|

Six Months Ended

March 31, 2016

(Unaudited)

|

|

|

|

|

|

|

|

Revenue

|

nil

|

nil

|

nil

|

nil

|

|

Total Operating Expenses

|

$

2,866,856

|

$

3,991,321

|

$

848,555

|

$

1,225,235

|

|

Net Loss

|

(2,757,242)

|

(4,372,448)

|

(858,154)

|

(1,196,496)

|

|

(Loss) per Common

share*

|

(0.16)

|

(0.40)

|

(0.04)

|

(0.09)

|

|

Weighted Average

Number of common

shares Outstanding*

|

16,786,343

|

10,999,230

|

24,669,699

|

13,438,912

|

|

|

|

|

|

|

|

* Basic and diluted.

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data

|

At September 30,

2016

|

At September 30,

2015

|

At March 31,

2017

(Unaudited)

|

At March 31,

2016

(Unaudited)

|

|

|

|

|

|

|

|

Working Capital (Deficiency)

|

$

143,097

|

$

(133,172)

|

$

209,864

|

$

(276,280)

|

|

Total Assets

|

16,704,138

|

17,224,434

|

17,886,232

|

16,391,255

|

|

Total Liabilities

|

520,071

|

802,207

|

1,067,171

|

766,456

|

|

Accumulated Deficit

|

(51,892,864)

|

(49,135,622)

|

(52,751,018)

|

(50,332,118)

|

|

Total Stockholders

’

Equity

|

$

16,184,067

|

$

16,422,227

|

$

16,819,061

|

$

15,624,799

|

6

RISK FACTORS

An investment in an exploration stage mining company such as ours involves an unusually high degree of risk, known and unknown, present and potential, including, but not limited to the risks enumerated below.

Failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Estimates of mineralized material are forward-looking statements inherently subject to error. Although mineralization and reserve estimates require a high degree of assurance in the underlying data when the estimates are made, unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates. Actual results will inherently differ from estimates. The unforeseen events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. We cannot accurately predict the timing and effects of variances from estimated values.

Risks Related To Our Company

Our ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany our consolidated financial statements for the year ended September 30, 2016, disclose a

‘

going concern

’

qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared under the assumption that we will continue as a going concern. We are an exploration stage company, and we have incurred losses since our inception. We do not have sufficient cash to fund normal operations and meet all of our obligations for the next 12 months without deferring payment on certain current liabilities and/or raising additional funds.

We currently have no historical recurring source of revenue, and our ability to continue as a going concern is dependent on our ability to raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan. Our plans for the long-term return to and continuation as a going concern include engaging in a strategic transaction which may include selling the Company or any or all of its assets, entering into joint venture arrangements regarding our assets, financing our future operations through sales of our common stock and/or debt and/or the eventual profitable exploitation of our mining properties. Additionally, the current capital markets and general economic conditions in the United States are significant obstacles to raising the required funds. These factors raise substantial doubt about our ability to continue as a going concern.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

We have a limited operating history on which to base an evaluation of our business and prospects.

Although we have been in the business of exploring mineral properties since our incorporation in 1968, we were inactive for many years prior to our new management in 2004. Since 2004 we have not yet located any mineral reserves. As a result, we have not had any revenues from our exploration division. However, we have had a drilling services wholly-owned subsidiary which has generated revenues in past fiscal years. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties, and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. Other than through conventional and typical exploration methods and procedures, we have no additional way to evaluate the likelihood of whether our mineral properties contain any mineral reserves or, if they do that they will be operated successfully. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

•

completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient gold reserves to support a commercial mining operation;

•

the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining, and processing facilities;

7

•

the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required;

•

compliance with environmental and other governmental approval and permit requirements;

•

the availability of funds to finance exploration, development, and construction activities, as warranted;

•

potential opposition from non-governmental organizations, environmental groups, local groups, or local inhabitants which may delay or prevent development activities;

•

potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and

•

potential shortages of mineral processing, construction, and other facilities-related supplies.

The costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction, and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception and expect to continue to incur losses in the future. We incurred the following losses during each of the following periods:

•

$2,757,242 for the year ended September 30, 2016;

•

$4,372,448 for the year ended September 30, 2015;

•

$2,777,886 for the year ended September 30, 2014; and

•

$3,724,582 for the year ended September 30, 2013.

We had an accumulated deficit of approximately $52 million as of September 30, 2016. We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses, and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Management changes, minimal staffing and the temporary consolidation of the offices of Principal Executive Officer and Principal Financial Officer may have been reasonably likely to materially affect the Company

’

s internal control over financial reporting.

Certain recent changes in management and the temporary consolidation of the offices of Principal Executive Officer and Principal Financial Officer were reasonably likely to materially affect the Company

’

s internal control over financial reporting and may result in material weaknesses in our internal control over financial reporting. These weaknesses primarily relate to the appropriate segregation of duties. The Company addressed these potential material weaknesses by re-appointing the Company

’

s previous Chief Financial Officer in order to separate the offices of Principal Executive Officer and Principal Financial Officer and to maintain consistency in the Company

’

s financial, reporting and other administrative functions. While this effort has improved our internal controls over financial reporting, management has concluded that minimal staffing continues to inhibit the effectiveness of our internal controls over financial reporting and our disclosure controls and procedures

Conflicts of Interest May Exist.

Certain of our officers and directors may be or become associated with other businesses, including natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. Our directors are required by Delaware Corporation law to act honestly and in good faith with a view to our best interests and to disclose any interest, which they may have in any of our projects or opportunities. In general, if a conflict of interest arises at a meeting of the board of directors, any director in a conflict will disclose his interest and abstain from voting on such matter or, if he does vote, his vote will not be counted. We have not adopted any separate formal corporate policy regarding conflicts of interest; however other corporate governance measures have been adopted, such as creating a directors

’

audit committee requiring independent directors. Additionally, our Code of Ethics does address areas of possible conflicts of interest. As of the date of filing of this Registration Statement, we had four independent directors on our board of directors (Leigh Freeman, Robert Martinez, Giulio Bonifacio and Paul Zink). We have formed three committees to

8

ensure our legal compliance. We established an independent audit committee consisting of three independent directors, all of whom were determined to be

“

financially literate

”

and one of whom was designated as the

“

financial expert.

”

We also formed a compensation committee and a corporate governance and nominating committee, both of which are comprised entirely of independent directors. At this time, we feel that these committees and our Code of Ethics provide sufficient corporate governance for our purposes.

Dependence on Key Management Employees.

Our ability to continue our exploration and development activities and to develop a competitive edge in the marketplace depends, in large part, on our ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that we will be able to attract and retain such personnel. Our development now and in the future will depend on the efforts of key management figures such as Steven Osterberg and Randal Hardy. The loss of any of these key people could have a material adverse effect on our business. In this regard, we have attempted to reduce the risk associated with the loss of key personnel and have obtained directors and officers insurance coverage. In addition, our shareholders have approved our 2015 Stock and Incentive Plan so that we can

provide incentives for our key personnel.

We may not realize the benefits of Talapoosa, Eureka and other acquired growth projects.

As part of our strategy, we will continue existing efforts and initiate new efforts to develop gold and other mineral projects. We have three such projects, including the Talapoosa project, the Eureka project, and the Seven Troughs project. A number of risks and uncertainties are associated with the development of these types of projects, including political, regulatory, design, construction, labor, operating, technical and technological risks, and uncertainties relating to capital and other costs and financing risks. The failure to successfully develop any of these initiatives could have a material adverse effect on our financial position and results of operations.

As part of our business model, we pursue a strategy that may cause us to expend significant resources exploring properties that may not become revenue-producing sites, including the Talapoosa and Eureka projects.

Part of our business model is to pursue a strategy which includes significant exploration activities, such as proposed exploration and, if warranted, development at the Talapoosa project and proposed exploration at the Eureka project. Because of the nature of exploration for precious metals, a property

’

s exploration potential is not known until a significant amount of geologic information has been generated. We may spend significant resources exploring and developing the Talapoosa project and the Eureka project and gathering certain geologic information only to determine that the project is not capable of being a revenue-producing property for us.

Our business is subject to evolving corporate governance and public disclosure regulations that have increased both our compliance costs and the risk of noncompliance, which could have an adverse effect on our stock price.

We are subject to changing rules and regulations promulgated by a number of governmental and self-regulated organizations, including the SEC and the Financial Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity, and many new requirements have been created in response to laws enacted by Congress, making compliance more difficult and uncertain. For example, on July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the

“

Dodd-Frank Act

”

) with increased disclosure obligations for public companies and mining companies in the United States. Our efforts to comply with the Dodd-Frank Act and other new regulations have resulted in, and are likely to continue to result in, increased general and administrative expenses and a

diversion of our management

’

s time and attention from operating activities to compliance activities.

We are required to comply with Canadian securities regulations and are subject to additional regulatory scrutiny in Canada.

We are a

“

reporting issuer

”

in the Canadian provinces of British Columbia and Alberta. As a result, our disclosure outside the United States differs from the disclosure contained in our SEC filings. Our reserve and resource estimates disseminated outside the United States are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report reserves and resources in accordance with Canadian practices. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated, and inferred resources, which are generally not permitted in disclosure filed with the SEC. In the United States, mineralization may not be classified as a

“

reserve

”

unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further,

“

inferred resources

”

have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of

“

contained

9

ounces

”

is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report

“

resources

”

as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization, reserves, and resources contained in disclosure released outside the United States may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

We are also subject to increased regulatory scrutiny and costs associated with complying with securities legislation in Canada. For example, we are subject to civil liability for misrepresentations in written disclosure and oral statements. Legislation has been enacted in these provinces which creates a right of action for damages against a reporting issuer, its directors and certain of its officers in the event that the reporting issuer or a person with actual, implied, or apparent authority to act or speak on behalf of the reporting issuer releases a document or makes a public oral statement that contains a misrepresentation or the reporting issuer fails to make timely disclosure of a material change. We do not anticipate any particular regulation that would be difficult to comply with. However, failure to comply with regulations may result in civil awards, fines, penalties, and orders that could have an adverse effect on us.

Risks Associated With Mining and The Exploration Portion of Our Business

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties, and if we do not do so, we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail.

We have not established that any of our mineral properties contain any mineral reserves according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability, our mineral properties do not contain any

“

reserve

”

, and any funds that we spend on exploration will probably be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines to extract those minerals. Both mineral exploration and development involve a high degree of risk, and few properties that are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade, and other attributes of the

mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads, and a point for shipping, government regulation, and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral reserve in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral reserve. If we cannot exploit any mineral reserve that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Regarding our future ground disturbing activity on federal land, we will be required to obtain a permit from the US Forest Service or the Bureau of Land Management prior to commencing exploration. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

10

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. In past years we have been engaged in exploration in northern Idaho, which is currently the site of a Federal Superfund cleanup project. Although the Company is no longer involved in this or other areas at present, it is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise. At the date of this prospectus, the Company is not aware of any environmental issues or litigation relating to any of its current or former properties.

Future legislation and administrative changes to the mining laws could prevent us from exploring our properties.

New state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

Regulations and pending legislation involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners, and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels, and changing temperatures. These impacts may adversely impact the cost, production, and financial performance of our operations.

If we establish the existence of a mineral reserve on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.

If we do discover mineral reserves in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long-term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and re-establish pre-disturbance land forms and vegetation.

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Mining exploration and development is inherently hazardous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

11

•

environmental hazards;

•

power outages;

•

metallurgical and other processing problems;

•

unusual or unexpected geological formations;

•

personal injury, flooding, fire, explosions, cave-ins, landslides, and rock-bursts;

•

inability to obtain suitable or adequate machinery, equipment, or labor; metals losses;

•

fluctuations in exploration, development, and production costs; labor disputes;

•

unanticipated variations in grade;

•

mechanical equipment failure; and

•

periodic interruptions due to inclement or hazardous weather conditions.