UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 20-F/A

(Amendment No. 1)

____________________________________

(Mark One)

|

|

|

|

|

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2016

OR

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

|

|

|

|

|

¨

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report

For the transition period from

to

Commission file number 1-12874

____________________________________

TEEKAY CORPORATION

(Exact name of Registrant as specified in its charter)

____________________________________

Republic of The Marshall Islands

(Jurisdiction of incorporation or organization)

Not Applicable

(Translation of Registrant’s name into English)

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Telephone: (441) 298-2530

(Address and telephone number of principal executive offices)

Edith Robinson

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Telephone: (441) 298-2530

Fax: (441) 292-3931

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered, or to be registered, pursuant to Section 12(b) of the Act.

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, par value of $0.001 per share

|

|

New York Stock Exchange

|

Securities registered, or to be registered, pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

____________________________________

Indicate the number of outstanding shares of each issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

86,149,975 shares of Common Stock, par value of $0.001 per share.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No

ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

¨

No

ý

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

ý

No

¨

Indicate by check mark if the registrant (1) has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

ý

No

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer", "accelerated filer", and "emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer

¨

Accelerated Filer

ý

Non-Accelerated Filer

¨

Emerging growth company

¨

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

†

provided pursuant to Section 13(a) of the Exchange Act.

¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

|

|

U.S. GAAP

x

|

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board

¨

|

|

Other

¨

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17

¨

Item 18

¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

¨

No

ý

Explanatory Note

Teekay Corporation (“Teekay”) is filing this Amendment No. 1 on Form 20-F/A (the “Form 20-F/A”) to amend Part III Item 19 of its annual report on Form 20-F for the fiscal year ended December 31, 2016 (the “Form 20-F”) as originally filed with the Securities and Exchange Commission (the “SEC”) on April 12, 2017, in order to update the consent of Teekay’s independent auditors, KPMG LLP, originally filed as Exhibit 23.1 of the Form 20-F, to include the conformed signature of KPMG LLP, which conformed signature reflects the signature of KPMG that was dated as of, and received by Teekay on, April 12, 2017. The conformed signature was inadvertently omitted from the Form 20-F. Other than as expressly set forth above, this Form 20-F/A does not, and does not purport to, revise, amend, update or restate the information presented in any other item of the Form 20-F, or reflect any events that have occurred after the Form 20-F was originally filed.

The following exhibits are filed as part of this Annual Report:

|

|

|

|

|

|

1.1

|

Amended and Restated Articles of Incorporation of Teekay Corporation.

(13)

|

|

1.2

|

Articles of Amendment of Articles of Incorporation of Teekay Corporation.

(13)

|

|

1.3

|

Amended and Restated Bylaws of Teekay Corporation.

(1)

|

|

2.1

|

Registration Rights Agreement among Teekay Corporation, Tradewinds Trust Co. Ltd., as Trustee for the Cirrus Trust, and Worldwide Trust Services Ltd., as Trustee for the JTK Trust.

(2)

|

|

2.2

|

Specimen of Teekay Corporation Common Stock Certificate.

(2)

|

|

2.8

|

Indenture dated as of January 27, 2010 among Teekay Corporation and The Bank of New York Mellon Trust Company, N.A. for $450,000,000 8.5% Senior Notes due 2020.

(14)

|

|

2.9

|

Agreement, dated October 5, 2012, for NOK 700,000,000 Senior Unsecured Bonds due October 2015, among us and Norsk Tillitsmann ASA.

(18)

|

|

2.10

|

First Supplemental Indenture dated November 16, 2015 among Teekay Corporation and The Bank of New York Mellon Trust Company, N.A. for $200,000,000 8.5% Senior Unsecured Notes due 2021.

(22)

|

|

4.1

|

1995 Stock Option Plan.

(2)

|

|

4.2

|

Amendment to 1995 Stock Option Plan.

(3)

|

|

4.3

|

Amended 1995 Stock Option Plan.

(4)

|

|

4.4

|

Amended 2003 Equity Incentive Plan.

(16)

|

|

4.5

|

Annual Executive Bonus Plan.

(5)

|

|

4.7

|

Form of Indemnification Agreement between Teekay and each of its officers and directors.

(2)

|

|

4.8

|

Amended Rights Agreement, dated as of July 2, 2010 between Teekay Corporation and The Bank of New York, as Rights Agent.

(7)

|

|

4.9

|

Agreement dated June 26, 2003 for a $550,000,000 Secured Reducing Revolving Loan Facility among Norsk Teekay Holdings Ltd., Den Norske Bank ASA and various other banks.

(8)

|

|

4.10

|

Agreement dated September 1, 2004 for a $500,000,000 Credit Facility Agreement to be made available to Teekay Nordic Holdings Incorporated by Nordea Bank Finland PLC.

(5)

|

|

4.11

|

Supplemental Agreement dated September 30, 2004 to Agreement dated June 26, 2003, for a $550,000,000 Secured Reducing Revolving Loan Facility among Norsk Teekay Holdings Ltd., Den Norske Bank ASA and various other banks.

(5)

|

|

4.12

|

Agreement dated May 26, 2005 for a $550,000,000 Credit Facility Agreement to be made available to Avalon Spirit LLC et al by Nordea Bank Finland PLC and others.

(6)

|

|

4.13

|

Agreement dated October 2, 2006, for a $940,000,000 Secured Reducing Revolving Loan Facility among Teekay Offshore Operating L.P., Den Norske Bank ASA and various other banks.

(9)

|

|

4.14

|

Agreement dated August 23, 2006, for a $330,000,000 Secured Reducing Revolving Loan Facility among Teekay LNG Partners L.P., ING Bank N.V. and various other banks.

(9)

|

|

4.15

|

Agreement, dated November 28, 2007 for a $845,000,000 Secured Reducing Revolving Loan Facility among Teekay Corporation, Teekay Tankers Ltd., Nordea Bank Finland PLC and various other banks.

(10)

|

|

4.16

|

Agreement dated May 16, 2007 for a $700,000,000 Credit Facility Agreement to be made available to Teekay Acquisition Holdings L.L.C. et al by HSH NordBank AG and others.

(11)

|

|

4.17

|

Amended and Restated Omnibus Agreement dated as of December 19, 2006, among Teekay Corporation, Teekay GP L.L.C., Teekay LNG Partners L.P., Teekay LNG Operating L.L.C., Teekay Offshore GP L.L.C., Teekay Offshore Partners L.P., Teekay Offshore Operating GP. L.L.C. and Teekay Offshore Operating L.P.

(12)

|

|

4.18

|

2013 Equity Incentive Plan.

(15)

|

|

4.19

|

Agreement, dated December 21, 2012 for a $200,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others.

(17)

|

|

4.20

|

Amendment Agreement, dated December 18, 2013 for a $300,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others.

(19)

|

|

4.21

|

Agreement, dated February 24, 2014 for a $815,000,000 Secure Term Loan Facility Agreement among Knarr L.L.C., Citibank, N.A. and others.

(20)

|

|

4.22

|

Agreement dated July 7, 2014; Teekay LNG Operating L.L.C. entered into a shareholder agreement with China LNG Shipping (Holdings) Limited to form TC LNG Shipping L.L.C in connection with the Yamal LNG Project.

(21)

|

|

4.23

|

Agreement dated December 17, 2014, for a $450,000,000 secured loan facility between Nakilat Holdco L.L.C. and Qatar National Bank SAQ.

(21)

|

|

4.24

|

Amendment Agreement No. 2, dated December 19, 2014 for a $200,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others.

(21)

|

|

4.25

|

Amendment Agreement No. 3, dated October 5, 2015 for a $500,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others.

(22)

|

|

4.26

|

Amendment Agreement No. 4, dated December 17, 2015 for a $500,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others.

(22)

|

|

4.27

|

Agreement, dated July 31, 2015, among OOGTK Libra GmbH & Co KG, ABN AMRO Bank N.V. and various other banks for a $803,711,786.92 term loan due 2027.

(22)

|

|

|

|

|

|

|

4.28

|

Purchase Agreement, dated as of November 10, 2015, between Teekay Corporation and J.P. Morgan Securities LLC, for itself and on behalf of the several initial purchasers listed in Schedule 1 thereto.

(22)

|

|

4.29

|

Registration Rights Agreement, dated November 16, 2015 by and among Teekay Corporation and J.P. Morgan Securities LLC, for itself and as representative of the several initial purchasers listed in Schedule 1 thereto.

(22)

|

|

4.30

|

Secured Term Loan and Revolving Credit Facility Agreement dated January 8, 2016 between Teekay Tankers Ltd., Nordea Bank Finland PLC and various other banks, for a $894.4 million long-term debt facility.

(22)

|

|

4.31

|

Share Purchase Agreement, dated May 18, 2016, by and among Teekay Corporation and the purchasers named therein.

(23)

|

|

4.32

|

Registration Rights Agreement, dated June 29, 2016, by and among Teekay Corporation and the investors named therein

.

(23)

|

|

4.33

|

Equity Distribution Agreement, dated September 9, 2016, between Teekay Corporation and Citigroup Global Markets Inc.

(24)

|

|

8.1

|

List of Subsidiaries.

(25)

|

|

12.1

|

Rule 13a-14(a)/15d-14(a) Certification of Teekay’s Chief Executive Officer.

|

|

12.2

|

Rule 13a-14(a)/15d-14(a) Certification of Teekay’s Chief Financial Officer.

|

|

13.1

|

Teekay Corporation Certification of Kenneth Hvid, Chief Executive Officer, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

(25)

|

|

13.2

|

Teekay Corporation Certification of Vincent Lok, Chief Financial Officer, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

(25)

|

|

23.1

|

Consent of KPMG LLP, as independent registered public accounting firm.

|

|

23.2

|

Consolidated Financial Statements of Exmar LPG BVBA.

(25)

|

|

101.INS

|

XBRL Instance Document

(25)

|

|

101.SCH

|

XBRL Taxonomy Extension Schema

(25)

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase

(25)

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase

(25)

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase

(25)

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase

(25)

|

_________________________

|

|

|

|

(1)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No.1-12874), filed with the SEC on August 31, 2011, and hereby incorporated by reference to such Report.

|

|

|

|

|

(2)

|

Previously filed as an exhibit to the Company’s Registration Statement on Form F-1 (Registration No. 33-7573-4), filed with the SEC on July 14, 1995, and hereby incorporated by reference to such Registration Statement.

|

|

|

|

|

(3)

|

Previously filed as an exhibit to the Company’s Form 6-K (File No.1-12874), filed with the SEC on May 2, 2000, and hereby incorporated by reference to such Report.

|

|

|

|

|

(4)

|

Previously filed as an exhibit to the Company’s Annual Report on Form 20-F (File No.1-12874), filed with the SEC on April 2, 2001, and hereby incorporated by reference to such Report.

|

|

|

|

|

(5)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 8, 2005, and hereby incorporated by reference to such Report.

|

|

|

|

|

(6)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 10, 2006, and hereby incorporated by reference to such Report.

|

|

|

|

|

(7)

|

Previously filed as an exhibit to the Company’s Form 8-A/A (File No.1-12874), filed with the SEC on July 2, 2010, and hereby incorporated by reference to such Report.

|

|

|

|

|

(8)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on August 14, 2003, and hereby incorporated by reference to such Report.

|

|

|

|

|

(9)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on December 21, 2006, and hereby incorporated by reference to such Report.

|

|

|

|

|

(10)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 11, 2008, and hereby incorporated by reference to such Report.

|

|

|

|

|

(11)

|

Previously filed as an exhibit to the Company’s Schedule TO – T/A, filed with the SEC on May 18, 2007, and hereby incorporated by reference to such schedule.

|

|

|

|

|

(12)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 19, 2007, and hereby incorporated by reference to such Report.

|

|

|

|

|

(13)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 7, 2009, and hereby incorporated by reference to such Report.

|

|

|

|

|

(14)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on January 27, 2010, and hereby incorporated by reference to such Report.

|

|

|

|

|

(15)

|

Previously filed as an exhibit to the Company’s Registration Statement on Form S-8 (Registration No. 333-187142), filed with the SEC on March 8, 2013, and hereby incorporated by reference to such Registration Statement.

|

|

|

|

|

(16)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 25, 2012, and hereby incorporated by reference to such Report.

|

|

|

|

|

(17)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 29, 2013, and hereby incorporated by reference to such Report.

|

|

|

|

|

(18)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 28, 2014, and hereby incorporated by reference to such Report.

|

|

|

|

|

(19)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 28, 2014, and hereby incorporated by reference to such Report.

|

|

|

|

|

(20)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on September 2, 2014, and hereby incorporated by reference to such Report.

|

|

|

|

|

(21)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 29, 2015, and hereby incorporated by reference to such Report.

|

|

|

|

|

(22)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 26, 2016, and hereby incorporated by reference to such Report.

|

|

|

|

|

(23)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on June 30, 2016, and hereby incorporated by reference to such Report.

|

|

|

|

|

(24)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on September 9, 2016, and hereby incorporated by reference to such Report.

|

|

|

|

|

(25)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 12, 2017, and hereby incorporated by reference to such Report.

|

SIGNATURE

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F/A and that it has duly caused and authorized the undersigned to sign this Annual Report on its behalf.

|

|

|

|

|

|

|

TEEKAY CORPORATION

|

|

By:

|

|

/s/ Vincent Lok

|

|

Vincent Lok

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial and Accounting Officer)

|

Dated: May 26, 2017

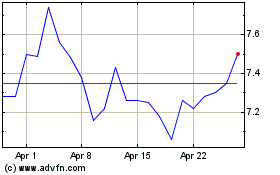

Teekay (NYSE:TK)

Historical Stock Chart

From Mar 2024 to Apr 2024

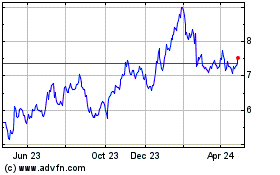

Teekay (NYSE:TK)

Historical Stock Chart

From Apr 2023 to Apr 2024