AECOM announces launch of exchange offer for $1 billion aggregate principal amount of its 5.125% Senior Notes due 2027

May 26 2017 - 10:31AM

Business Wire

AECOM (NYSE:ACM), a premier, fully integrated global

infrastructure firm, announced today that it has launched an offer

to exchange new registered notes for the outstanding unregistered

notes that it issued in February 2017 in a private placement

pursuant to Rule 144A and Regulation S under the Securities Act of

1933, as amended (the “Securities Act”).

AECOM is offering to exchange (the “Exchange Offer”) $1 billion

aggregate principal amount of its newly issued 5.125% Senior Notes

due 2027, as well as all related guarantees (the “Exchange Notes”)

for a like principal amount of its outstanding 5.125% Senior Notes

due 2027, as well as all related guarantees (the “Old Notes”). The

Exchange Notes have been registered under the Securities Act and

will be guaranteed by AECOM’s subsidiaries that guarantee the Old

Notes. AECOM will not receive any proceeds from the issuance of the

Exchange Notes. The sole purpose of the Exchange Offer is to

fulfill AECOM’s obligations under the registration rights agreement

entered into with holders of the Old Notes in connection with the

February 2017 offering.

The Exchange Offer will expire at 5:00 p.m. New York City time

on June 26, 2017, unless otherwise extended (such date and time, as

they may be extended, the “Expiration Date”). The settlement date

for the Exchange Offer will occur as promptly as practicable

following the Expiration Date. The Exchange Offer is made only

pursuant to AECOM’s prospectus dated May 26, 2017, which has been

filed with the United States Securities and Exchange Commission.

AECOM has not authorized any person to provide information other

than as set forth in the prospectus.

Copies of the exchange offer prospectus and related materials

may be obtained from the exchange agent for the Exchange Offer,

U.S. Bank National Association, by emailing or faxing a request to

cts.specfinance@usbank.com or (651) 466-7372 (for Eligible

Institutions only) or by mailing or delivering a request to U.S.

Bank National Association, Global Corporate Trust Services, 111

Fillmore Ave. East, EP-MN-WS2N, St. Paul, MN 55107, Attention:

Specialized Finance.

This press release is for informational purposes only and is

neither an offer to buy, nor a solicitation of an offer to sell,

the Exchange Notes or any other securities, and shall not

constitute an offer, solicitation or sale in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About AECOM

AECOM (NYSE:ACM) is built to deliver a better world. We design,

build, finance and operate infrastructure assets for governments,

businesses and organizations in more than 150 countries. As a fully

integrated firm, we connect knowledge and experience across our

global network of experts to help clients solve their most complex

challenges. From high-performance buildings and infrastructure, to

resilient communities and environments, to stable and secure

nations, our work is transformative, differentiated and vital. A

Fortune 500 firm, AECOM had revenue of approximately $17.4 billion

during fiscal year 2016. See how we deliver what others can only

imagine at aecom.com and @AECOM.

All statements in this press release other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including statements relating to

the future exchange offer. Although we believe that the

expectations reflected in our forward-looking statements are

reasonable, actual results could differ materially from those

projected or assumed in any of our forward-looking statements.

Important factors that could cause our actual results,

performance and achievements, or industry results to differ

materially from estimates or projections contained in our

forward-looking statements include, but are not limited to, the

following: our business is cyclical and vulnerable to economic

downturns and client spending reductions; uncertainties related to

government contract appropriations; Budget Control Act of 2011;

governmental agencies may modify, curtail or terminate our

contracts; government contracts are subject to audits and

adjustments of contractual terms; losses under fixed-price

contracts; limited control over operations run through our joint

venture entities; misconduct by our employees or consultants or our

failure to comply with laws or regulations applicable to our

business; our leveraged position and ability to service our debt;

ability to maintain surety and financial capacity; exposure to

legal, political and economic risks in different countries as well

as currency exchange rate fluctuations; the failure to retain and

recruit key technical and management personnel; our insurance

policies may not provide adequate coverage; Brexit; unexpected

adjustments and cancellations related to our backlog; dependence on

third party contractors who fail to satisfy their obligations;

systems and information technology interruption; and changing

client preferences/demands, fiscal positions and payment patterns.

Additional factors that could cause actual results to differ

materially from our forward-looking statements are set forth in our

reports filed with the Securities and Exchange Commission. We do

not intend, and undertake no obligation, to update any

forward-looking statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170526005383/en/

For AECOMMedia:Brendan Ranson-Walsh,

212-739-7212VP, Externals

Communicationsbrendan.ranson-walsh@aecom.comorInvestors:Will

Gabrielski, 213-593-8208VP, Investor

Relationswilliam.gabrielski@aecom.com

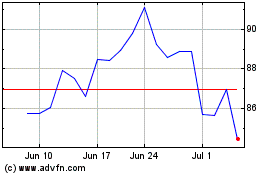

AECOM (NYSE:ACM)

Historical Stock Chart

From Mar 2024 to Apr 2024

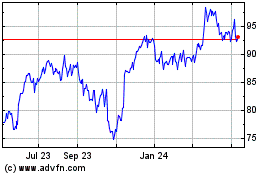

AECOM (NYSE:ACM)

Historical Stock Chart

From Apr 2023 to Apr 2024