Current Report Filing (8-k)

May 25 2017 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 22, 2017

|

BIGLARI HOLDINGS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

INDIANA

|

0-8445

|

37-0684070

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

17802

IH 10 West, Suite 400

San Antonio, Texas

|

78257

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including

Area Code:

(210) 344-3400

|

|

|

(Former Name or Former Address, If Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction

A.2. below):

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 22, 2017, Biglari

Holdings Inc. (the “Company”) through its wholly-owned subsidiary BHIC Inc. (“Acquirer”), entered into

a Stock Purchase Agreement (the “Purchase Agreement”) with John M. McGraw (“JM McGraw”), JDM Living Trust,

Michael J. McGraw (“MJ McGraw”), Michael Joseph McGraw Family Trust to purchase all of the outstanding capital stock

of two companies, McGraw Insurance, Inc. and Western Service Contract Corporation (“Western”), the parent company of

Pacific Specialty Insurance Company, for a purchase price of $299.5 million, which consists of $24 million in cash payable at the

closing of the transaction and $275.5 million of deferred payments. $175.5 million is payable in cash over a 10-year period, and

$100 million is payable by a promissory note that matures upon the death of MJ McGraw (or in 10 years following the closing should

death occur within that time period) for the benefit of the University of Notre Dame, payable at maturity either in securities

or in cash, at the election of Acquirer. The interest during Mr. McGraw’s lifetime is set at the rate of 6% per annum.

The respective obligations

of the parties to consummate the transactions contemplated by the Purchase Agreement are subject to customary conditions, including

the obtaining of required antitrust and regulatory approvals. The Purchase Agreement obligates JM McGraw and MJ McGraw to repay

outstanding indebtedness owing to Western and its subsidiaries.

The foregoing summary of the Purchase

Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety

by, the full text of the Purchase Agreement, a copy of which is attached as Exhibit 2.1 to this report and is incorporated herein

by reference.

The Purchase Agreement and the above

description have been included to provide investors and security holders with information regarding the terms of the Purchase Agreement.

They are not intended to provide any other factual information about the parties to the Purchase Agreement or their respective

subsidiaries, affiliates or shareholders. Investors should read the representations and warranties in the Purchase Agreement not

in isolation but only in conjunction with the other information about the Company and its subsidiaries that the Company includes

in reports, statements and other filings it makes with the Securities and Exchange Commission.

On May 25, 2017, the Company issued

a press release regarding the transaction. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated

herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

No.

|

Description

|

|

2.1

|

Stock Purchase Agreement, dated as of May 22, 2017, by and among BHIC Inc., John M. McGraw, JDM Living Trust, Michael J. McGraw, Michael Joseph McGraw Family Trust and, for certain limited purposes, Biglari Holdings Inc.

|

|

99.1

|

Press release dated May 25, 2017.

|

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed

on its behalf by the undersigned hereunto duly authorized.

|

May 25, 2017

|

BIGLARI HOLDINGS INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Bruce Lewis

|

|

|

|

Name:

|

Bruce Lewis

|

|

|

|

Title:

|

Controller

|

Exhibit Index

|

Exhibit

No.

|

Description

|

|

2.1

|

Stock Purchase Agreement, dated as of May 22, 2017, by and among BHIC Inc., John M. McGraw, JDM Living Trust, Michael J. McGraw, Michael Joseph McGraw Family Trust and, for certain limited purposes, Biglari Holdings Inc.

|

|

99.1

|

Press release dated May 25, 2017.

|

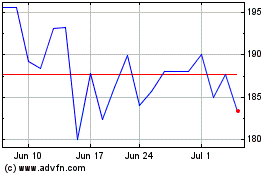

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

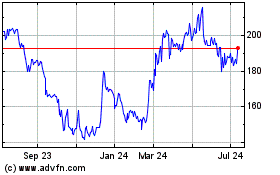

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024