21Vianet Group, Inc. (Nasdaq:VNET) ("21Vianet" or the "Company"), a

leading carrier-neutral internet data center services provider in

China, today announced its unaudited financial results for the

first quarter ended March 31, 2017. The Company will hold a

conference call at 8:00 p.m. Eastern Time on Thursday, May 25,

2017. Dial-in details are provided at the end of the release.

Mr. Steve Zhang, Chief Executive Officer of the

Company, stated, "We started 2017 with solid execution and

improvement on our overall financial and operating results, as our

restructuring efforts started to bear fruit. In particular, our

hosting and related services continued to witness strong growth

momentum in the first quarter, but was partially offset by the

competitive challenges we faced in our managed network services

(MNS) business. With respect to the development of our partnership

with Warburg Pincus, we are finalizing one of the asset transfers

for the initial joint venture, as well as exploring new data center

project opportunities. In addition, by leveraging our abundant

partnership resources and strong expertise and technology

advantages, we aim to provide more hybrid IT services that

encompass all customer needs. Going forward, we will continue our

restructuring efforts by focusing on expanding our core retail

colocation business as well as our cloud-neutral platform,

optimizing our MNS business, shifting towards an asset-light

business model, and capitalizing upon the new growth opportunities

in the market such as wholesale data center services and hybrid IT

solutions. We are confident in our ability to fortify our leading

position as an internet infrastructure services provider and

generate incremental value for our shareholders.”

Mr. Terry Wang, Chief Financial Officer of the

Company, further commented, "In the first quarter of 2017, our

total net revenues was RMB862.2 million, which came in above the

mid-point of our guidance. This was primarily due to an increase in

revenue from our core hosting and related services business, which

grew 18.5% year-over-year. We were able to expand the number of

cabinets while improving our utilization rate. We increased the

number of self-built cabinets while simultaneously decreasing the

number of partnered cabinets, which had a positive effect on our

gross margins. And while revenues from MNS declined, we implemented

cost controls and expense reduction measures to limit the impact on

EBITDA. As a result, our overall adjusted EBITDA was RMB100.3

million, exceeding the high-end of our guidance, and net loss

narrowed by 22.8% to RMB116.8 million. These results can be

directly linked to the strong execution of our business

restructuring strategy. As we move forward with our restructuring

plan, we believe we are well positioned to further drive topline

growth, lift operational efficiency and improve our

profitability.”

First Quarter 2017 Financial

Results

REVENUES: Net revenues were

RMB862.2 million (US$125.3 million) in the first quarter of 2017

compared to RMB862.3 million in the comparative period in 2016. Net

revenues remained flat due to the increase in revenues from hosting

and related services being offset by the decrease in revenues from

MNS.

Net revenues for hosting and related services

were RMB706.7 million (US$102.7 million) in the first quarter of

2017 compared to RMB596.5 million in the comparative period in

2016. The increase was primarily due to an increase in total number

of billable cabinets and utilization rate.

Net revenues for MNS were RMB155.5 million

(US$22.6 million) in the first quarter of 2017 compared to RMB265.8

million in the comparative period in 2016. The decrease was

primarily due to intensified competition and pricing pressure.

GROSS PROFIT: Gross profit was

RMB180.5 million (US$26.2 million) in the first quarter of 2017

compared to RMB169.0 million in the comparative period in 2016.

Gross margin was 20.9% in the first quarter of 2017 compared to

19.6% in the comparative period in 2016. The increase was primarily

due to a shift towards more self-built cabinets and a reduction in

the number of partnered cabinets.

Adjusted gross profit, which excludes

share-based compensation expenses and amortization of intangible

assets derived from acquisitions, was RMB211.6 million (US$30.7

million) in the first quarter of 2017 compared to RMB211.1 million

in the comparative period in 2016. Adjusted gross margin was 24.5%

in the first quarter of 2017 compared to 24.5% in the comparative

period in 2016.

OPERATING EXPENSES: Total

operating expenses was RMB252.6 million (US$36.7 million) in the

first quarter of 2017 compared to RMB254.5 million in the

comparative period in 2016.

Adjusted operating expenses, which excludes

share-based compensation expenses and changes in the fair value of

contingent purchase consideration payable, were RMB250.9 million

(US$36.5 million) in the first quarter of 2017 compared to RMB219.5

million in the comparative period in 2016. As a percentage of net

revenues, adjusted operating expenses were 29.1% in the first

quarter of 2017 compared to 25.5% in the comparative period in

2016.

Sales and marketing expenses were RMB65.8

million (US$9.6 million) in the first quarter of 2017 compared to

RMB77.3 million in the comparative period in 2016. The decrease was

primarily due to reduced agency fees.

General and administrative expenses were

RMB135.8 million (US$19.7 million) in the first quarter of 2017

compared to RMB133.8 million in the comparative period in 2016.

Research and development expenses were RMB38.4

million (US$5.6 million) in the first quarter of 2017 compared to

RMB41.9 million in the comparative period in 2016.

Bad debt provisions were RMB15.5 million (US$2.2

million) in the first quarter of 2017. We had negligible bad debt

provisions in the comparative period in 2016.

Changes in the fair value of contingent purchase

consideration payable was a gain of RMB2.9 million (US$0.4 million)

in the first quarter of 2017 compared to a loss of RMB1.5 million

in the comparative period in 2016.

ADJUSTED EBITDA: Adjusted

EBITDA, which excludes share-based compensation expenses and

changes in the fair value of contingent purchase consideration

payable was RMB100.3 million (US$14.6 million) in the first quarter

of 2017 compared to RMB108.6 million in the comparative period in

2016. Adjusted EBITDA margin was 11.6% in the first quarter of 2017

compared to 12.6% in the comparative period in 2016.

Adjusted EBITDA for hosting and related services

was RMB152.7 million (US$22.2 million) in the first quarter of 2017

compared to RMB94.1 million in the comparative period in 2016.

Adjusted EBITDA for MNS was negative RMB52.4

million (US$7.6 million) in the first quarter of 2017 compared to

positive RMB14.5 million in the comparative period in 2016.

NET PROFIT/LOSS: Net loss was

RMB116.8 million (US$17.0 million) in the first quarter of 2017

compared to RMB151.3 million in the comparative period in 2016.

Adjusted net loss, which excludes share-based

compensation expenses, amortization of intangible assets derived

from acquisitions, and changes in the fair value of contingent

purchase consideration payable and related deferred tax impact, was

RMB84.0 million (US$12.2 million) in the first quarter of 2017

compared to RMB73.8 million in the comparative period in 2016.

Adjusted net margin was negative 9.7% in the first quarter of 2017

compared to negative 8.6% in the comparative period in 2016.

LOSS PER SHARE: Diluted loss

per share was RMB0.17 in the first quarter of 2017, which

represents the equivalent of RMB1.02 (US$0.15) per American

Depositary Share ("ADS"). Each ADS represents six ordinary

shares.

Adjusted diluted loss per share was RMB0.12 in

the first quarter of 2017, which represents the equivalent of

RMB0.72 (US$0.10) per ADS. Adjusted diluted loss per share is

calculated using adjusted net loss divided by the weighted average

number of shares.

As of March 31, 2017, the Company had a total of

678.6 million ordinary shares outstanding, or the equivalent of

113.1 million ADS.

BALANCE SHEET: As of March 31,

2017, the Company's cash and cash equivalents and short-term

investment were RMB1.26 billion (US$183.7 million).

First quarter 2017 Operational Highlights

- Monthly Recurring Revenues ("MRR") per cabinet was RMB8,363 in

the first quarter of 2017, compared to RMB8,490 in the fourth

quarter of 2016.

- Total cabinets under management increased to 26,394 as of March

31, 2017 from 26,380 as of December 31, 2016, with 19,518 cabinets

in the Company's self-built data centers and 6,876 cabinets in its

partnered data centers.

- Utilization rate increased to 75.8% in the first quarter of

2017, compared to 75.2% in the fourth quarter of 2016.

- Hosting churn rate, which is based on the Company’s core IDC

business, was 0.48% in the first quarter of 2017, compared to 0.55%

in the fourth quarter of 2016.

Recent Developments

In late March of 2017, the Company was approved

as a silver level partner for Akamai’s NetAlliance Program. As a

NetAlliance partner, the Company will be able to leverage the

exceptional brand of Akamai, a global leader in Content Delivery

Network (CDN) services, to profitably grow 21Vianet’s CDN

business.

Financial Outlook

For the second quarter of 2017, the Company

expects net revenues to be in the range of RMB870 million to RMB910

million, compared to RMB910.8 million in the prior year period.

Adjusted EBITDA is expected to be in the range of RMB100 million to

RMB120 million, compared to RMB15.5 million in the prior year

period.

Conference Call

The Company will hold a conference call on

Thursday, May 25, 2017 at 8:00 pm U.S. Eastern Time, or Friday, May

26, 2017 at 8:00 am Beijing Time to discuss the financial

results.

|

Participants may access the call by dialing the following

numbers: |

| |

|

| United States Toll

Free: |

+1-855-500-8701 |

| International: |

+65-6713-5440 |

| China Domestic: |

400-120-0654 |

| Hong Kong: |

+852-3018-6776 |

| Conference ID: |

16187549 |

| |

|

| The replay

will be accessible through June 2, 2017, by dialing the following

numbers: |

| |

|

| United States Toll

Free: |

+1-855-452-5696 |

| International: |

+61-2-9003-4211 |

| Conference ID: |

16187549 |

A live and archived webcast of the conference

call will be available through the Company's investor relation

website at http://ir.21vianet.com.

Non-GAAP Disclosure

In evaluating its business, 21Vianet considers

and uses the following non-GAAP measures defined as non-GAAP

financial measures by the SEC as supplemental measure to review and

assess its operating performance: adjusted gross profit, adjusted

gross margin, adjusted operating expenses, adjusted net profit,

adjusted net margin, adjusted EBITDA, adjusted EBITDA margin,

adjusted basic earnings per share, adjusted diluted earnings per

share, adjusted basic earnings per ADS and adjusted diluted

earnings per ADS. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with U.S. GAAP. For more information on these non-GAAP

financial measures, please see the table captioned "Reconciliations

of GAAP and non-GAAP results" set forth at the end of this press

release.

The non-GAAP financial measures are provided as

additional information to help investors compare business trends

among different reporting periods on a consistent basis and to

enhance investors' overall understanding of the Company's current

financial performance and prospects for the future. These non-GAAP

financial measures should be considered in addition to results

prepared in accordance with U.S. GAAP, but should not be considered

a substitute for, or superior to, U.S. GAAP results. In addition,

the Company's calculation of the non-GAAP financial measures may be

different from the calculation used by other companies, and

therefore comparability may be limited.

Exchange Rate

This announcement contains translations of

certain RMB amounts into U.S. dollars (“USD”) at specified rates

solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to USD were made at the rate of RMB6.8832

to US$1.00, the noon buying rate in effect on March 31, 2017 in the

H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or USD amounts referred could

be converted into USD or RMB, as the case may be, at any particular

rate or at all. For analytical presentation, all percentages are

calculated using the numbers presented in the financial statements

contained in this earnings release.

Statement Regarding Unaudited Condensed

Financial Information

The unaudited financial information set forth

above is preliminary and subject to potential adjustments.

Adjustments to the consolidated financial statements may be

identified when audit work has been performed for the Company's

year-end audit, which could result in significant differences from

this preliminary unaudited condensed financial information.

About 21Vianet

21Vianet Group, Inc. is a leading

carrier-neutral Internet data center services provider in China.

21Vianet provides hosting and related services, managed network

services, cloud services, content delivery network services,

last-mile wired broadband services and business VPN services,

improving the reliability, security and speed of its customers'

Internet infrastructure. Customers may locate their servers and

networking equipment in 21Vianet's data centers and connect to

China's Internet backbone through 21Vianet's extensive fiber optic

network. In addition, 21Vianet's proprietary smart routing

technology enables customers' data to be delivered across the

Internet in a faster and more reliable manner. 21Vianet operates in

more than 30 cities throughout China, servicing a diversified and

loyal base of more than 4,000 hosting enterprise customers that

span numerous industries ranging from Internet companies to

government entities and blue-chip enterprises to small- to

mid-sized enterprises

Safe Harbor Statement

This announcement contains forward-looking

statements. These forward-looking statements are made under the

"safe harbor" provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements can be identified by

terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates" and similar statements.

Among other things, quotations from management in this announcement

as well as 21Vianet's strategic and operational plans contain

forward-looking statements. 21Vianet may also make written or oral

forward-looking statements in its reports filed with, or furnished

to, the U.S. Securities and Exchange Commission, in its annual

reports to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about 21Vianet's beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: 21Vianet's goals and strategies;

21Vianet's expansion plans; the expected growth of the data center

services market; expectations regarding demand for, and market

acceptance of, 21Vianet's services; 21Vianet's expectations

regarding keeping and strengthening its relationships with

customers; 21Vianet's plans to invest in research and development

to enhance its solution and service offerings; and general economic

and business conditions in the regions where 21Vianet provides

solutions and services. Further information regarding these and

other risks is included in 21Vianet's reports filed with, or

furnished to, the Securities and Exchange Commission. All

information provided in this press release and in the attachments

is as of the date of this press release, and 21Vianet undertakes no

duty to update such information, except as required under

applicable law.

| |

| 21VIANET GROUP, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”)) |

| |

|

|

| |

As of |

As of |

| |

|

|

|

|

December 31, 2016 |

March 31, 2017 |

|

| |

RMB |

RMB |

|

US$ |

|

| |

(Audited) |

(Unaudited) |

|

(Unaudited) |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash and cash

equivalents |

1,297,418 |

|

779,513 |

|

113,249 |

|

| Restricted cash |

1,963,561 |

|

2,065,166 |

|

300,030 |

|

| Accounts and notes

receivable, net |

655,459 |

|

720,858 |

|

104,727 |

|

| Short-term

investments |

277,946 |

|

484,949 |

|

70,454 |

|

| Inventories |

4,431 |

|

4,585 |

|

666 |

|

| Prepaid expenses and

other current assets |

777,131 |

|

862,661 |

|

125,328 |

|

| Amount due from related

parties |

182,615 |

|

183,546 |

|

26,666 |

|

|

Total current assets |

5,158,561 |

|

5,101,278 |

|

741,120 |

|

| Non-current

assets: |

|

|

|

|

|

|

| Property and equipment,

net |

3,781,613 |

|

3,795,852 |

|

551,466 |

|

| Intangible assets,

net |

977,341 |

|

941,918 |

|

136,843 |

|

| Land use rights,

net |

167,646 |

|

166,687 |

|

24,216 |

|

| Deferred tax

assets |

100,676 |

|

96,859 |

|

14,072 |

|

| Goodwill |

1,755,970 |

|

1,755,970 |

|

255,110 |

|

| Long term

investments |

298,871 |

|

301,296 |

|

43,773 |

|

| Restricted cash |

33,544 |

|

3,551 |

|

516 |

|

| Other non-current

assets |

147,302 |

|

124,224 |

|

18,047 |

|

|

Total non-current assets |

7,262,963 |

|

7,186,357 |

|

1,044,043 |

|

| Total

assets |

12,421,524 |

|

12,287,635 |

|

1,785,163 |

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Short-term bank

borrowings |

1,683,676 |

|

1,638,676 |

|

238,069 |

|

| Accounts and notes

payable |

529,569 |

|

590,059 |

|

85,725 |

|

| Accrued expenses and

other payables |

787,916 |

|

700,306 |

|

101,741 |

|

| Deferred revenue |

320,023 |

|

281,466 |

|

40,892 |

|

| Advances from

customers |

201,397 |

|

313,296 |

|

45,516 |

|

| Income taxes

payable |

21,899 |

|

28,608 |

|

4,156 |

|

| Amounts due to related

parties |

121,928 |

|

126,953 |

|

18,444 |

|

| Current portion of

long-term bank borrowings |

39,303 |

|

42,361 |

|

6,154 |

|

| Current portion of

capital lease obligations |

243,723 |

|

259,469 |

|

37,696 |

|

| Current portion of

deferred government grant |

5,107 |

|

4,959 |

|

720 |

|

| Current portion of

bonds payable |

419,316 |

|

419,905 |

|

61,004 |

|

| Total current

liabilities |

4,373,857 |

|

4,406,058 |

|

640,117 |

|

| Non-current

liabilities: |

|

|

|

|

|

|

| Long-term bank

borrowings |

268,221 |

|

272,227 |

|

39,549 |

|

| Deferred revenue |

62,531 |

|

58,014 |

|

8,428 |

|

| Unrecognized tax

benefits |

28,689 |

|

29,781 |

|

4,327 |

|

| Deferred tax

liabilities |

274,700 |

|

271,123 |

|

39,389 |

|

| Non-current portion of

capital lease obligations |

536,623 |

|

541,828 |

|

78,717 |

|

| Non-current portion of

deferred government grant |

25,886 |

|

24,732 |

|

3,593 |

|

| Total

non-current liabilities |

1,196,650 |

|

1,197,705 |

|

174,003 |

|

| |

|

|

|

|

|

|

| Redeemable

noncontrolling interests |

700,000 |

|

700,000 |

|

101,697 |

|

| |

|

|

|

|

|

|

| Shareholders'

equity |

|

|

|

|

|

|

| Treasury stock |

(204,557 |

) |

(270,978 |

) |

(39,368 |

) |

| Ordinary shares |

45 |

|

45 |

|

7 |

|

| Additional paid-in

capital |

9,015,846 |

|

9,027,182 |

|

1,311,480 |

|

| Accumulated other

comprehensive gain |

118,290 |

|

105,374 |

|

15,309 |

|

| Statutory reserves |

64,622 |

|

66,062 |

|

9,598 |

|

| Accumulated

deficit |

(2,869,031 |

) |

(2,970,265 |

) |

(431,523 |

) |

| Total 21Vianet

Group, Inc. shareholders’ equity |

6,125,215 |

|

5,957,420 |

|

865,503 |

|

| Noncontrolling

interest |

25,802 |

|

26,452 |

|

3,843 |

|

| Total

shareholders' equity |

6,151,017 |

|

5,983,872 |

|

869,346 |

|

| Total

liabilities, redeemable noncontrolling interests and shareholders'

equity |

12,421,524 |

|

12,287,635 |

|

1,785,163 |

|

| |

|

|

|

|

|

|

| 21VIANET GROUP, INC. |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”) except for number of shares and per share

data) |

|

| |

|

|

|

|

|

| |

Three months ended |

|

| |

March 31, 2016 |

|

December 31, 2016 |

|

March 31, 2017 |

|

|

| |

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

| Hosting and related

services |

596,484 |

|

703,174 |

|

706,711 |

|

102,672 |

|

|

| Managed network

services |

265,788 |

|

197,473 |

|

155,466 |

|

22,586 |

|

|

| Total net revenues |

862,272 |

|

900,647 |

|

862,177 |

|

125,258 |

|

|

| Cost of revenues |

(693,292 |

) |

(717,276 |

) |

(681,700 |

) |

(99,038 |

) |

|

| Gross

profit |

168,980 |

|

183,371 |

|

180,477 |

|

26,220 |

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

| Sales and

marketing |

(77,315 |

) |

(92,018 |

) |

(65,832 |

) |

(9,564 |

) |

|

| Research and

development |

(41,857 |

) |

(38,425 |

) |

(38,387 |

) |

(5,577 |

) |

|

| General and

administrative |

(133,806 |

) |

(186,744 |

) |

(135,803 |

) |

(19,730 |

) |

|

| Bad debt provision |

5 |

|

(47,450 |

) |

(15,465 |

) |

(2,247 |

) |

|

| Changes in the fair

value of contingent purchase consideration payable |

(1,481 |

) |

67,197 |

|

2,867 |

|

417 |

|

|

| Impairment of

long-lived assets |

- |

|

(392,947 |

) |

- |

|

- |

|

|

| Total operating

expenses |

(254,454 |

) |

(690,387 |

) |

(252,620 |

) |

(36,701 |

) |

|

| Operating

loss |

(85,474 |

) |

(507,016 |

) |

(72,143 |

) |

(10,481 |

) |

|

| Interest income |

8,882 |

|

4,839 |

|

8,252 |

|

1,199 |

|

|

| Interest expense |

(55,692 |

) |

(40,652 |

) |

(37,027 |

) |

(5,379 |

) |

|

| Other income |

1,106 |

|

555 |

|

4,826 |

|

701 |

|

|

| Other expense |

(1,104 |

) |

(1,825 |

) |

(1,562 |

) |

(227 |

) |

|

| Foreign exchange (loss)

gain |

(5,243 |

) |

28,849 |

|

(5,481 |

) |

(796 |

) |

|

| Loss before

income taxes and gain from equity method investments |

(137,525 |

) |

(515,250 |

) |

(103,135 |

) |

(14,983 |

) |

|

| Income tax (expense)

benefit |

(14,994 |

) |

17,818 |

|

(16,127 |

) |

(2,343 |

) |

|

| Gain from equity method

investments |

1,201 |

|

12,225 |

|

2,425 |

|

352 |

|

|

| Net

loss |

(151,318 |

) |

(485,207 |

) |

(116,837 |

) |

(16,974 |

) |

|

| Net loss

attributable to noncontrolling interest |

8,518 |

|

225,353 |

|

17,043 |

|

2,476 |

|

|

| Net loss

attributable to ordinary shareholders |

(142,800 |

) |

(259,854 |

) |

(99,794 |

) |

(14,498 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss per share |

|

|

|

|

|

|

|

|

|

| Basic |

(0.28 |

) |

(0.69 |

) |

(0.17 |

) |

(0.02 |

) |

|

| Diluted |

(0.28 |

) |

(0.69 |

) |

(0.17 |

) |

(0.02 |

) |

|

| Shares used in loss per

share computation |

|

|

|

|

|

|

|

|

|

| Basic* |

525,041,586 |

|

681,210,352 |

|

678,649,016 |

|

678,649,016 |

|

|

| Diluted* |

525,041,586 |

|

681,210,352 |

|

678,649,016 |

|

678,649,016 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss per ADS (6

ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

| Basic |

(1.68 |

) |

(4.14 |

) |

(1.02 |

) |

(0.15 |

) |

|

| Diluted |

(1.68 |

) |

(4.14 |

) |

(1.02 |

) |

(0.15 |

) |

|

| |

|

|

|

|

|

| * Shares

used in loss per share/ADS computation were computed under weighted

average method. |

|

| 21VIANET GROUP, INC. |

|

| RECONCILIATIONS OF GAAP AND NON-GAAP

RESULTS |

|

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”) except for number of shares and per share

data) |

|

| |

|

|

|

|

|

| |

Three months ended |

|

| |

March 31, 2016 |

|

December 31, 2016 |

|

March 31, 2017 |

|

|

| |

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

| Gross profit |

168,980 |

|

183,371 |

|

180,477 |

|

26,220 |

|

|

| Plus: share-based

compensation expense |

3,925 |

|

1,865 |

|

(222 |

) |

(32 |

) |

|

| Plus: amortization of

intangible assets derived from acquisitions |

38,197 |

|

37,369 |

|

31,372 |

|

4,558 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted gross

profit |

211,102 |

|

222,605 |

|

211,627 |

|

30,746 |

|

|

| Adjusted gross

margin |

24.5 |

% |

24.7 |

% |

24.5 |

% |

24.5 |

% |

|

| Operating expenses |

(254,454 |

) |

(690,387 |

) |

(252,620 |

) |

(36,701 |

) |

|

| Plus: share-based

compensation expense |

33,468 |

|

54,808 |

|

4,545 |

|

660 |

|

|

| Plus: changes in the

fair value of contingent purchase consideration payable |

1,481 |

|

(67,197 |

) |

(2,867 |

) |

(417 |

) |

|

| Plus: impairment of

long-lived assets |

- |

|

392,947 |

|

- |

|

- |

|

|

| Adjusted

operating expenses |

(219,505 |

) |

(309,829 |

) |

(250,942 |

) |

(36,458 |

) |

|

| Net loss |

(151,318 |

) |

(485,207 |

) |

(116,837 |

) |

(16,974 |

) |

|

| Plus: share-based

compensation expense |

37,393 |

|

56,673 |

|

4,323 |

|

628 |

|

|

| Plus: amortization of

intangible assets derived from acquisitions |

38,197 |

|

37,369 |

|

31,372 |

|

4,558 |

|

|

| Plus: changes in the

fair value of contingent purchase consideration payable and related

deferred tax impact |

1,976 |

|

(67,874 |

) |

(2,867 |

) |

(417 |

) |

|

| Plus: impairment of

long-lived assets |

- |

|

392,947 |

|

- |

|

- |

|

|

| Adjusted net

loss |

(73,752 |

) |

(66,092 |

) |

(84,009 |

) |

(12,205 |

) |

|

| Adjusted net

margin |

-8.6 |

% |

-7.3 |

% |

-9.7 |

% |

-9.7 |

% |

|

| Net loss |

(151,318 |

) |

(485,207 |

) |

(116,837 |

) |

(16,974 |

) |

|

| Minus: Provision for

income taxes |

(14,994 |

) |

17,818 |

|

(16,127 |

) |

(2,343 |

) |

|

| Minus: Interest

income |

8,882 |

|

4,839 |

|

8,252 |

|

1,199 |

|

|

| Minus: Interest

expenses |

(55,692 |

) |

(40,652 |

) |

(37,027 |

) |

(5,379 |

) |

|

| Minus: Exchange (loss)

gain |

(5,243 |

) |

28,849 |

|

(5,481 |

) |

(796 |

) |

|

| Minus: Gain from equity

method investment |

1,201 |

|

12,225 |

|

2,425 |

|

352 |

|

|

| Minus: Other

income |

1,106 |

|

555 |

|

4,826 |

|

701 |

|

|

| Minus: Other

expenses |

(1,104 |

) |

(1,825 |

) |

(1,562 |

) |

(227 |

) |

|

| Plus: depreciation |

108,940 |

|

130,486 |

|

129,609 |

|

18,830 |

|

|

| Plus: amortization |

46,222 |

|

46,092 |

|

41,344 |

|

6,007 |

|

|

| Plus: share-based

compensation expense |

37,393 |

|

56,673 |

|

4,323 |

|

628 |

|

|

| Plus: changes in the

fair value of contingent purchase consideration payable |

1,481 |

|

(67,197 |

) |

(2,867 |

) |

(417 |

) |

|

| Plus: impairment of

long-lived assets |

- |

|

392,947 |

|

- |

|

- |

|

|

| Adjusted

EBITDA |

108,562 |

|

51,985 |

|

100,266 |

|

14,567 |

|

|

| Adjusted EBITDA

margin |

12.6 |

% |

5.8 |

% |

11.6 |

% |

11.6 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted net loss |

(73,752 |

) |

(66,092 |

) |

(84,009 |

) |

(12,205 |

) |

|

| Less: Net loss

attributable to noncontrolling interest |

8,518 |

|

225,353 |

|

17,043 |

|

2,476 |

|

|

| Adjusted net (loss)

profit attributable to the Company’s ordinary shareholders |

(65,234 |

) |

159,261 |

|

(66,966 |

) |

(9,729 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted loss per

share |

|

|

|

|

|

|

|

|

|

| Basic |

(0.14 |

) |

(0.08 |

) |

(0.12 |

) |

(0.02 |

) |

|

| Diluted |

(0.14 |

) |

(0.08 |

) |

(0.12 |

) |

(0.02 |

) |

|

| Shares used in adjusted

loss per share computation: |

|

|

|

|

|

|

|

|

|

| Basic* |

525,041,586 |

|

681,210,352 |

|

678,649,016 |

|

678,649,016 |

|

|

| Diluted* |

525,041,586 |

|

700,264,943 |

|

678,649,016 |

|

678,649,016 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted loss per ADS

(6 ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

| Basic |

(0.84 |

) |

(0.48 |

) |

(0.72 |

) |

(0.10 |

) |

|

| Diluted |

(0.84 |

) |

(0.48 |

) |

(0.72 |

) |

(0.10 |

) |

|

| |

|

|

|

|

|

| * Shares

used in adjusted loss/ADS per share computation were computed under

weighted average method. |

|

| 21VIANET GROUP, INC. |

| CONSOLIDATED STATEMENT OF CASH

FLOWS |

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”)) |

| |

|

|

|

| |

|

| |

December 31, 2016 |

March 31, 2017 |

| |

RMB |

RMB |

US$ |

| |

(Unaudited) |

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

| Net loss |

(485,207 |

) |

(116,837 |

) |

(16,974 |

) |

| Adjustments to

reconcile net loss to net cash generated from operating

activities: |

|

|

|

|

|

|

| Foreign exchange (loss)

gain |

(28,849 |

) |

5,481 |

|

796 |

|

| Changes in the fair

value of contingent purchase consideration payable |

(67,197 |

) |

(2,867 |

) |

(417 |

) |

| Depreciation of

property and equipment |

130,486 |

|

129,609 |

|

18,830 |

|

| Amortization of

intangible assets |

44,860 |

|

41,344 |

|

6,007 |

|

| Gain on disposal of

property and equipment |

12,101 |

|

- |

|

- |

|

| Provision for doubtful

accounts and other receivables |

48,706 |

|

15,465 |

|

2,247 |

|

| Share-based

compensation expense |

56,672 |

|

4,323 |

|

628 |

|

| Deferred income taxes

(benefit) expense |

(31,605 |

) |

240 |

|

35 |

|

| Gain from equity method

investment |

(12,225 |

) |

(2,425 |

) |

(352 |

) |

| Impairment of

long-lived assets |

392,947 |

|

- |

|

- |

|

| Changes in

operating assets and liabilities |

|

|

|

|

|

|

| Restricted cash |

11,846 |

|

(24,102 |

) |

(3,502 |

) |

| Inventories |

1,617 |

|

(154 |

) |

(22 |

) |

| Accounts and notes

receivable |

51,084 |

|

(80,864 |

) |

(11,748 |

) |

| Unrecognized tax

benefits |

5,984 |

|

1,092 |

|

159 |

|

| Prepaid expenses and

other current assets |

(10,221 |

) |

(85,428 |

) |

(12,411 |

) |

| Amounts due from

related parties |

(6,359 |

) |

(1,082 |

) |

(157 |

) |

| Accounts and notes

payable |

(20,145 |

) |

60,490 |

|

8,788 |

|

| Accrued expenses and

other payables |

25,348 |

|

(4,161 |

) |

(606 |

) |

| Deferred revenue |

(9,192 |

) |

(43,074 |

) |

(6,258 |

) |

| Advances from

customers |

12,473 |

|

111,899 |

|

16,257 |

|

| Income taxes

payable |

(14,864 |

) |

6,709 |

|

975 |

|

| Amounts due to related

parties |

4,031 |

|

7,892 |

|

1,147 |

|

| Deferred government

grants |

(1,344 |

) |

(1,302 |

) |

(189 |

) |

| Net cash

generated from operating activities |

110,947 |

|

22,248 |

|

3,233 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

|

| Purchases of property

and equipment |

(136,544 |

) |

(99,432 |

) |

(14,446 |

) |

| Purchases of intangible

assets |

(11,859 |

) |

(9,386 |

) |

(1,364 |

) |

| Payment for asset

acquisition |

(6,859 |

) |

(15,053 |

) |

(2,187 |

) |

| Proceeds from disposal

of property and equipment |

51 |

|

- |

|

- |

|

| Receipt of loans from

third parties |

40,000 |

|

- |

|

- |

|

| Payments for short-term

investments |

(272,914 |

) |

(207,003 |

) |

(30,074 |

) |

| Proceeds received from

maturity of short-term investments |

10,000 |

|

- |

|

- |

|

| Payments for long-term

investments |

(5,025 |

) |

- |

|

- |

|

| Net cash used

in investing activities |

(383,150 |

) |

(330,874 |

) |

(48,071 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

|

| Restricted cash |

(76,284 |

) |

(48,515 |

) |

(7,048 |

) |

| Proceeds from exercise

of stock options |

662 |

|

555 |

|

81 |

|

| Proceeds from long-term

bank borrowings |

54,620 |

|

9,038 |

|

1,313 |

|

| Proceeds from

short-term bank borrowings |

37,000 |

|

50,000 |

|

7,264 |

|

| Repayments of

short-term bank borrowings |

(123,000 |

) |

(95,000 |

) |

(13,802 |

) |

| Repayments of long-term

bank borrowings |

(27,003 |

) |

(1,974 |

) |

(287 |

) |

| Consideration paid to

selling shareholders |

(142 |

) |

- |

|

- |

|

| Prepayment for shares

repurchase plan |

|

|

- |

|

- |

|

| Payments for shares

repurchase plan |

(1,603 |

) |

(41,192 |

) |

(5,984 |

) |

| Rental prepayments and

deposits for sales and leaseback transactions |

(28,897 |

) |

(33,886 |

) |

(4,923 |

) |

| Payments for capital

leases |

(32,719 |

) |

(32,055 |

) |

(4,657 |

) |

| Contribution from

noncontrolling interest in a subsidiary |

4,000 |

|

- |

|

- |

|

| Net cash used

in financing activities |

(193,366 |

) |

(193,029 |

) |

(28,043 |

) |

| Effect of

foreign exchange rate changes on cash and short term

investments |

100,505 |

|

(16,250 |

) |

(2,361 |

) |

| Net decrease in

cash and cash equivalents |

(365,064 |

) |

(517,905 |

) |

(75,242 |

) |

| Cash and cash

equivalents at beginning of period |

1,662,482 |

|

1,297,418 |

|

188,491 |

|

| Cash and cash

equivalents at end of period |

1,297,418 |

|

779,513 |

|

113,249 |

|

| |

|

|

|

|

|

|

Investor Relations Contacts:

21Vianet Group, Inc.

Calvin Jiang

+86 10 8456 2121

IR@21Vianet.com

ICR, Inc.

Xueli Song

+1 (646) 405-4922

IR@21Vianet.com

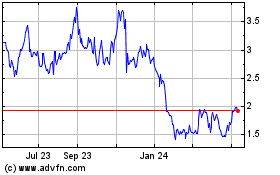

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

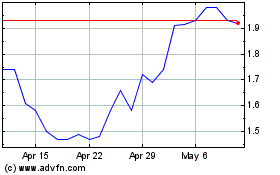

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024