SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2017

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Exercise of Preferential Right in the Second and Third Bidding Rounds for areas under Production Sharing Regime

Rio de Janeiro, May 25, 2017 - Petróleo Brasileiro S.A. – Petrobras informs that it submitted today to the National Energy Policy Council (CNPE) its first formal statement in connection to the preferential right for the second and third bidding rounds for exploration blocks under the production sharing regime, pursuant to Law 12.351/2010 and Federal Decree 9.041/2017.

Considering the parameters disclosed in CNPE resolutions no. 2 and no. 9, of 2017, after technical analysis, approval by the Executive Board and deliberation within the Board of Directors, Petrobras decided to exercise the preferential right in the following areas and in the minimum percentage of 30% in each area, focusing on maximizing the value of its portfolio:

|

•

|

Second Round: unitizable area adjacent to Sapinhoá field;

|

|

•

|

Third Round: Peroba and Alto de Cabo Frio Central.

|

The value corresponding to the signature bonus to be paid by Petrobras, considering that auction results confirm the minimum stake indicated above in each block, is R$ 810 million. New priorities were stablished on the planning to provide for financial resources for the acquisition of these new exploratory areas, without impact on metrics during the period of the 2017-2021 Business and Management Plan.

Petrobras' position in these bids is aligned to the foundations of the Strategic Plan, which provides for the sustainability of oil and gas production, with strengthening of the exploratory portfolio and operations in partnerships.

The flowchart below represents the possible Petrobras’ scenarios for exercising the preferential right, pursuant to Decree no. 9,047 of 5/2/2017:

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2016, and the Company’s other filings with the U.S. Securities and Exchange Commission.

It is important to highlight that Petrobras may expand the percentage of 30% indicated for the areas where it is exercising its preferential rights, forming consortiums to participate in the bids.

In relation to blocks in which Petrobras has not exercised its preferential rights, the company may participate on equal terms with other bidders, whether to act as operator or non-operator.

With the completion of the auctions, expected to occur in 2017, Petrobras will timely communicate the results of its participation to the market, in compliance with current legislation.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2016, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 25, 2017

PETRÓLEO BRASILEIRO S.A—PETROBRAS

By: /s/ Ivan de Souza Monteiro______________________________

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer

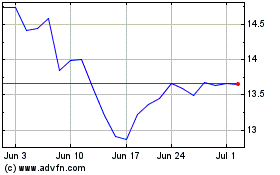

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

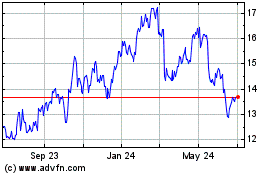

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024