FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2017

Commission File Number: 001-15002

ICICI Bank

Limited

(Translation of registrant’s name into English)

CIN-L65190GJ1994PLC021012

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing

the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate

below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table of Contents

|

|

1.

|

Notice of Annual General Meeting

|

|

|

2.

|

Legend attached to the Notice sent to ADS holders

|

Item 1

NOTICE

NOTICE

is hereby given that the Twenty-Third Annual General Meeting of the Members of ICICI Bank Limited (the Bank/Company) will be held

on Friday, June 30, 2017 at 12.00 noon at Professor Chandravadan Mehta Auditorium, General Education Centre, Opposite D.N. Hall

Ground, The Maharaja Sayajirao University, Pratapgunj, Vadodara 390002 to transact the following business:

ORDINARY

BUSINESS

|

|

1.

|

To

receive, consider and adopt the financial statements for the financial year ended March 31, 2017 together with the Reports of the

Directors and the Auditors.

|

|

|

2.

|

To

declare dividend on preference shares.

|

|

|

3.

|

To

declare dividend on equity shares.

|

|

|

4.

|

To

appoint a director in place of Ms. Vishakha Mulye (DIN: 00203578), who retires by rotation and, being eligible, offers herself

for re-appointment.

|

|

|

5.

|

To

consider and, if thought fit, to pass, the following Resolution as an Ordinary Resolution:

|

RESOLVED

THAT

in terms of the provisions of Sections 139-142 and other applicable provisions, if

any, of the Companies Act, 2013 read with the underlying rules viz. Companies (Audit and Auditors) Rules, 2014 as may be applicable

and the Banking Regulation Act, 1949 (including any statutory modification(s) or re-enactment(s) thereof) and pursuant to the

resolution passed by the Members at the Twentieth Annual General Meeting held on June 30, 2014 appointing M/s B S R & Co.

LLP, Chartered Accountants (Registration No. 101248W)

as

statutory auditors to hold office from the conclusion of the Twentieth AGM till conclusion of the Twenty-Fourth AGM,

the

appointment of M/s B S R & Co. LLP, Chartered Accountants (Registration No. 101248W), as statutory auditors of the Company,

to hold office from the conclusion of this Meeting i.e. Twenty-Third Annual General Meeting until the conclusion of the Twenty-Fourth

Annual General Meeting of the Company, be ratified by the Members on a remuneration inclusive of service tax and such other tax(es)

(as may be applicable) and reimbursement of all out-of-pocket expenses in connection with the audit of the accounts of the Company

(including terms of payment) to be fixed by the Board of Directors of the Company, based on the recommendation of the Audit Committee

in connection with the audit of the accounts of the Company for the year ending March 31, 2018.

|

|

6.

|

To

consider and, if thought fit, to pass, the following Resolution as an Ordinary Resolution:

|

RESOLVED

THAT

pursuant to the provisions of Section 143(8) and other applicable provisions, if any,

of the Companies Act, 2013,

read

with the underlying rules viz. Companies (Audit and Auditors) Rules, 2014 as may be applicable,

the

Banking Regulation Act, 1949

(including

any statutory modification(s) or re-enactment(s) thereof)

and

subject to such regulatory approvals and consents as may be required, the Board of Directors of the Company be and is hereby authorised

to appoint branch auditors, as and when required, in

consultation

with the statutory auditors, to audit the accounts in respect of the Company’s branches/offices in or outside India and to

fix their terms and conditions of appointment and remuneration, based on the recommendation of the Audit Committee, plus service

tax and such other tax(es), as may be applicable, and reimbursement of all out-of-pocket expenses in connection with the audit

of the accounts of the branches/offices in or outside India for the year ending March 31, 2018.

SPECIAL

BUSINESS

|

|

7.

|

To consider and, if thought fit, to pass, the following Resolution as an Ordinary Resolution:

|

RESOLVED THAT

Mr. Anup

Bagchi, (DIN: 00105962) in respect of whom the Bank has received notice in writing under Section 160 of the Companies Act, 2013

along with deposit of Rs.100,000 from a Member proposing his candidature for the office of Director be and is hereby appointed

as a Director of the Bank liable to retire by rotation.

|

|

8.

|

To consider and, if thought fit, to pass, the following Resolution as an Ordinary Resolution:

|

RESOLVED

THAT

pursuant to the applicable provisions of the Companies Act, 2013 (“the Act”) and the rules made thereunder,

the Banking Regulation Act, 1949 (including any statutory modification(s) or re-enactment(s) thereof), the appointment of Mr.

Anup Bagchi, (DIN: 00105962) as a Wholetime Director (designated as Executive Director) of the Bank for a period of five years

effective February 1, 2017 to January 31, 2022 on the following terms and conditions be and is hereby approved

:

Salary:

In the range of Rs. 950,000 to

Rs. 1,700,000 per month with the present salary being in the scale of Rs. 1,327,500 per month.

Perquisites:

Perquisites (evaluated as per

Income-tax Rules, wherever applicable, and at actual cost to the Bank in other cases) such as the benefit of the Bank’s furnished

accommodation, gas, electricity, water and furnishings, club fees, personal insurance, use of car and telephone at residence or

reimbursement of expenses in lieu thereof, payment of income-tax on perquisites by the Bank to the extent permissible under the

Income-tax Act, 1961 and rules framed thereunder, medical reimbursement, leave and leave travel concession, education benefits,

provident fund, superannuation fund, gratuity and other retirement benefits, in accordance with the scheme(s) and rule(s) applicable

from time to time to retired Wholetime Directors of the Bank or the members of the staff. In line with the staff loan policy applicable

to specified grades of employees who fulfill prescribed eligibility criteria to avail loans for purchase of residential property,

the Wholetime Directors are also eligible for housing loans subject to approval of RBI.

Supplementary Allowance:

In the range of Rs. 675,000

to Rs. 1,225,000 per month with the present monthly allowance being in the scale of Rs. 975,200 per month.

Bonus

:

An amount up to the maximum

limit permitted under RBI guidelines or any modifications thereof, as may be determined by the Board or any Committee thereof,

based on achievement of such performance parameters as may be laid down by the Board or any Committee thereof, subject to such

other approvals as may be necessary.

RESOLVED FURTHER THAT

the Board or any Committee thereof be and is hereby authorised to decide the remuneration (salary, perquisites and bonus)

payable to Mr. Bagchi and his designation during his tenure as a Wholetime Director of the Bank within the terms mentioned above,

subject to the approval of RBI from time to time.

RESOLVED FURTHER THAT

in the event of absence or inadequacy of net profits in any financial year, the remuneration payable to Mr. Bagchi shall be

governed by Section II of Part II of Schedule V of the Act and rules made thereunder, as amended from time to time.

RESOLVED FURTHER THAT

the Board (also deemed to include any Committee of the Board) be and is hereby authorised to do all such acts, deeds, matters

and things including the power to settle all questions or difficulties that may arise with regard to the said appointment as it

may deem fit and to execute any agreements, documents, instructions, etc. as may be necessary or desirable in connection with

or incidental to give effect to the aforesaid resolution.

|

|

9.

|

To

consider and, if thought fit, to pass, the following Resolution as a Special Resolution:

|

RESOLVED

THAT

pursuant

to

the

provisions of Section 42 and such other provisions of the Companies Act, 2013 as may be applicable and underlying Rules viz. Companies

(Prospectus and Allotment of Securities) Rules, 2014 as amended from time to time and such other regulations as may be applicable,

the consent of the Members of the Company be and is hereby accorded to the Board of Directors to borrow from time to time, by

way of issue of non-convertible securities including but not limited to bonds and non-convertible debentures in one or more tranches

of upto

Rs.

25,000

crore (Rupees Twenty Five Thousand crore) on private placement basis during a period of one year from the date of passing of this

Resolution within the overall borrowing limits of the Company as approved by the Members from time to time.

RESOLVED FURTHER THAT

the Board of Directors of the Company (also deemed to include the Committee of Executive Directors to which the powers of

borrowings have been delegated by the Board) be and is hereby authorised to do all such acts, deeds, matters and things including

the power to settle all questions or difficulties that may arise with regard to the aforesaid resolution as it may deem fit and

to execute any agreements, documents,

instructions, etc. as may

be necessary or desirable in connection with or incidental to give effect to the aforesaid resolution

.

|

|

a.

|

The

relevant Explanatory Statement pursuant to Section 102(1) of the Companies Act, 2013, in respect of Item Nos. 5, 7 to 9 set out

in the Notice is annexed hereto.

|

|

|

b.

|

A

MEMBER ENTITLED TO ATTEND AND VOTE IS ENTITLED TO APPOINT A PROXY TO ATTEND AND, ON A POLL, TO VOTE INSTEAD OF HIMSELF. SUCH A

PROXY NEED NOT BE A MEMBER OF THE COMPANY. PROXIES, IN ORDER TO BE VALID AND EFFECTIVE, MUST BE DELIVERED AT THE REGISTERED/CORPORATE

OFFICE OF THE COMPANY NOT LATER THAN FORTY-EIGHT HOURS BEFORE THE COMMENCEMENT OF THE MEETING.

|

Pursuant

to the provisions of the Companies Act, 2013 and the underlying rules viz. Companies (Management and Administration) Rules, 2014,

a person can act as proxy on behalf of Members not exceeding fifty and holding in the aggregate not more than ten perc

ent

of the total share capital of the company carrying voting rights.

|

|

c.

|

Voting

through electronic means:

|

|

|

I.

|

In compliance with Regulation 44 of SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015 and Section 108 of the Companies Act, 2013 and Rule 20 of the Companies (Management and Administration) Rules, 2014, as amended,

the Company is pleased to provide Members the facility to exercise their right to vote at the 23

rd

Annual General Meeting

(AGM) by electronic means.

The

facility of casting votes by a Member using an electronic voting system from a place other than the venue of the AGM (remote e-voting)

will be

provided by National Securities Depository Limited (NSDL) and the items of business as detailed in this Notice may

be transacted through remote e-voting.

|

|

|

II.

|

A person whose name is recorded in the Register of Members or in the Register of Beneficial Owners

maintained by the depositories as on the cut-off date of June 23, 2017 only shall be entitled to avail the facility of remote e-voting

as well as voting at the AGM.

|

|

|

III.

|

A person who is not a Member as on the cut-off date should treat this Notice for information purpose

only.

|

|

|

IV.

|

The facility for electronic voting shall also be made available at the AGM and the Members attending

the AGM who have not already cast their votes through remote e-voting shall be able to exercise their voting rights at the AGM.

|

|

|

V.

|

The Members who have cast their votes through remote e-voting prior to the AGM may also attend

the AGM but shall not be entitled to cast their vote again.

|

The instructions for remote e-voting

are as under:

|

|

i.

|

Members whose shareholding is in the dematerialised form and whose email addresses are registered

with the Company/Depository Participant(s) will receive an email from NSDL informing the User-ID and Password/PIN. Once the Member(s)

receive the email, he or she will need to go through the following steps to complete the e-voting process:

|

|

|

1.

|

Open email and open PDF file viz.; “ICICI Bank remote e-voting.pdf” with your Client

ID or Folio No. as password. The said PDF file contains your user ID and password for remote e-voting. Please note that the password

is an initial password.

|

Note: Shareholders already registered

with NSDL for e-voting will not receive the PDF file “ICICI Bank remote e-voting.pdf”.

|

|

2.

|

Launch

internet browser by typing the following URL:

https://www.evoting.nsdl.com

.

|

|

|

3.

|

Click on Shareholder – Login.

|

|

|

4.

|

Enter the User ID and password/PIN as initial password noted in step (1) above. Click Login.

|

|

|

5.

|

Password change menu appears. Change the password/PIN with new password of your choice with minimum

8 digits/characters or combination thereof. Note new password. It is strongly recommended not to share your password with any other

person and take utmost care to keep your password confidential.

|

|

|

6.

|

Home page of remote e-voting opens. Click on remote e-voting: Active Voting Cycles.

|

|

|

7.

|

Select “EVEN” (Remote E Voting Event Number) of ICICI Bank Limited.

|

|

|

8.

|

Now you are ready for remote e-voting as Cast Vote page opens.

|

|

|

9.

|

Cast your vote by selecting appropriate option and click on “Submit” and also “Confirm”

when prompted.

|

|

|

10.

|

Upon confirmation, the message “Vote cast successfully” will be displayed.

|

|

|

11.

|

Once you have voted on the resolution, you will not be allowed to modify your vote.

|

|

|

12.

|

Institutional Members (i.e. other than individuals, HUF, NRI etc.) are required to send scanned

copy (PDF/JPG Format) of the relevant Board Resolution/Authority letter etc. together with attested specimen signature of the duly

authorised signatory(ies) who are authorised to vote, to the Scrutinizer through e-mail to scrutinizericicibank@gmail.com or evoting@icicibank.com

with a copy marked to evoting@nsdl.co.in.

|

|

|

ii.

|

For Members holding shares in dematerialised form whose email IDs are not registered with the Company/Depository

Participants, Members holding shares in physical form as well as those Members who have requested for a physical copy of the Notice

and Annual Report, the following instructions may be noted:

|

|

|

1.

|

Initial password is provided as below/at the bottom of the Attendance Slip for the AGM:

|

|

EVEN

(Remote E Voting Event Number)

|

USER

ID

|

PASSWORD/PIN

|

|

|

2.

|

Please follow all steps from Sr. No. 2 to Sr. No. 12 of (i) above, to cast vote.

|

|

|

VI.

|

In case of any queries/grievances,

you may refer the Frequently Asked Questions (FAQs) for Members and remote e-voting user

manual for Members available at the downloads section of

www.evoting.nsdl.com

or may contact on the NSDL toll free no. 1800-222-990 or may contact Mr. Amit

Vishal, Senior Manager, National Securities Depository Ltd., Trade World, ‘A’

Wing, 4th Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai –

400 013, at the designated email IDs:

evoting@nsdl.co.in

or

AmitV@nsdl.co.in

or at telephone

nos. +91-22-2499 4600/+91-22-2499 4360. Alternatively, Members may also write to Mr.

P. Sanker, Senior General Manager (Legal) & Company Secretary at the email ID:

companysecretary@icicibank.com

or contact at telephone no. +91-22-2653 8900.

|

|

|

VII.

|

Login to the remote e-voting website will be disabled upon five unsuccessful attempts to key in

the correct password. In such an event, you will need to go through the 'Forgot Password' option available on the site to reset

the password/PIN.

|

|

|

VIII.

|

If you are already registered with NSDL for remote e-voting then you can use your existing user

ID and password/PIN for casting your vote.

|

Note: Shareholders who forgot the

User Details/Password can use “

Forgot User Details/Password?

” or “

Physical

User Reset Password?

” option available on

www.evoting.nsdl.com

.

In case Members are holding shares in demat mode,

USER – ID is the combination of (DPID + Client ID).

In case Members are holding shares in physical mode,

USER – ID is the combination of (EVEN + Folio No.)

|

|

IX.

|

You can also update your mobile number and e-mail id in the user profile details of the folio which

may be used for sending future communication(s).

|

|

|

X.

|

The remote e-voting period commences on Tuesday, June 27, 2017 (9:00 a.m. IST) and ends on Thursday,

June 29, 2017 (5:00 p.m. IST). During this period Members of the Bank, holding shares either in physical form or in dematerialised

form, as on the cut-off date of June 23, 2017 may cast their vote electronically. The remote e-voting module shall be disabled

by NSDL for voting thereafter. Once the vote on a resolution is cast by the Member, the Member shall not be allowed to change it

subsequently.

|

|

|

XI.

|

Any person, who acquires shares

of the Company and become Member of the Company after dispatch of the notice and holding

shares as on the cut-off date i.e. June 23, 2017, may obtain the login ID and password

by sending a request at

evoting@nsdl.co.in

|

|

|

XII.

|

The voting rights of Members shall be in proportion to their share of the paid-up equity share

capital of the Bank as on the cut-off date of June 23, 2017 subject to the provisions of Banking Regulation Act, 1949.

|

|

|

XIII.

|

Alwyn D’Souza of Alwyn D’ Souza & Co., Company Secretaries has been appointed as

the Scrutinizer to scrutinize the remote e-voting process as well as the electronic voting process at the AGM in a fair and transparent

manner.

|

|

|

XIV.

|

The Chairman shall, at the AGM, at the end of discussion on the resolutions on which voting is

to be held, allow e-voting with the assistance of scrutinizer for all those Members who are present at the AGM but have not cast

their votes by availing the remote e-voting facility.

|

|

|

XV.

|

The Scrutinizer after the conclusion of voting at the AGM will unblock the votes cast through e-voting

in the presence of at least two witnesses not in the employment of the Company and shall make, not later than three days of the

conclusion of the AGM, a consolidated scrutinizer’s report of the total votes cast in favour or against, if any, to the Chairman

or a Director authorised by him in writing, who shall countersign the same. The Chairman or the authorised Director shall declare

the result of the voting forthwith.

|

|

|

XVI.

|

The Results declared alongwith

the Scrutinizer’s Report shall be displayed at the Registered Office as well as

the Corporate Office of the Company and uploaded on the Company’s website

www.icicibank.com

as well as on the website of NSDL after the same is declared by the Chairman/authorized

person. The Results shall also be simultaneously forwarded to the stock exchanges.

|

|

|

d.

|

Members

are requested to note that the Company’s equity shares are under compulsory demat trading for all investors, subject to the

provisions of SEBI Circular No.21/99 dated July 8,

1999. Members are, therefore, requested to dematerialise

their shareholding to avoid inconvenience.

|

|

|

e.

|

The

Register of Members and the Share Transfer Books of the Company will remain closed from June 22, 2017 to June 24, 2017 (both days

inclusive). Dividend for the year ended March 31, 2017, at the rate of

Rs.

2.50

per fully paid-up equity share of

Rs.

2/-

each if declared at

|

the

Meeting, will be paid on and from July 1, 2017:

|

|

(i)

|

to

those Members, holding shares in physical form, whose names appear on the Register of Members of the Company, at the close of business

hours on June 24 , 2017 after giving effect to all valid transfers in physical form lodged on or before June 21, 2017 with the

Company and/or its Registrar and Transfer Agent; and

|

|

|

(ii)

|

in

respect of shares held in electronic form, to all beneficial owners as per the details furnished by National Securities Depository

Limited (NSDL) and Central Depository Services (India) Limited (CDSL) at the close of business hours on June 21, 2017.

|

In

terms of the directives of Securities and Exchange Board of India, shares issued by companies should rank

pari passu

in

all respects, including dividend entitlement, and accordingly the equity shares allotted/to be allotted by the Company upto June

21, 2017 under the ICICI Bank Employees Stock Option Scheme will be entitled for full dividend for the financial year ended March

31, 2017, if declared at the Meeting.

The dividend proposed is in accordance with applicable RBI guidelines and the dividend

policy of the Bank.

|

|

f.

|

Members

holding shares in physical form are requested to immediately notify change in their address, to the Registrar and Transfer Agent

of the Company, viz. 3i lnfotech Limited, International Infotech Park, Tower 5, 3rd Floor, Vashi Railway Station Complex, Vashi,

Navi Mumbai 400 703, quoting their Folio Number(s).

|

In

order to avoid fraudulent encashment of dividend warrants, Members holding shares in physical form are requested to send to the

Registrar and Transfer Agent of the Company, at the above mentioned address, on or before June 21, 2017 a Bank Mandate (providing

details of name and address of bank branch, PIN code and particulars of the bank account) or changes therein, if not provided earlier,

under the signature of the Sole/First holder quoting their Folio Number. This information will be printed on the dividend warrants.

Members may also avail of the Electronic Clearing Service (ECS) mandate facility provided by the Company.

|

|

g.

|

Members

holding shares in dematerialised mode are requested to intimate all changes pertaining to their bank details, ECS mandates, email

addresses, nominations, power of attorney, change of address/name etc. to their Depository Participant (DP) only and not to the

Company or its Registrar and Transfer Agent. Any such changes effected by the DPs will automatically reflect in the Company’s

subsequent records.

|

|

|

h.

|

Pursuant

to the provisions of Section 124 of the Companies Act, 2013, the amounts of dividend remaining unpaid or unclaimed for a period

of seven years from the date of its transfer to the Unpaid Dividend Accounts of the Company are required to be transferred to the

Investor Education and Protection Fund (IEPF) established by the Central Government. The amount of unclaimed dividend for the financial

year ended March 31, 2010 would be transferred to the IEPF in FY2018.

|

The

Act has also provided that all shares in respect of which unpaid or unclaimed dividend has been transferred to IEPF is also required

to be transferred to the IEPF Authority. The Ministry of Corporate Affairs has

notified the Investor Education and Protection

Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 (‘IEPF Rules’) on September 7, 2016 and further

amendment and clarification on the same which provides for manner of transfer of unpaid and unclaimed dividends to IEPF and also

the manner of transfer of shares

in respect of which dividend has

not been encashed by the Members for a continuous period of seven years to the IEPF Authority. The Rules also prescribe the procedures

to be followed by an investor to claim the shares/amount transferred to IEPF.

The

Bank has sent letters in November 2016 to

Members

whose

dividend amount for FY2009 was transferred to IEPF in FY2016 and whose dividend amounts from FY2010 to FY2016 were outstanding

as per the Bank’s records to claim the same so as to avoid the corresponding shares to be transferred to the IEPF Authority.

An advertisement to this effect was also published in leading English and vernacular newspapers on November 26, 2016. The Bank

has also uploaded the details of such

Members

and

shares due for transfer to the IEPF Authority on its website www.icicibank.com under the weblink https://www.icicibank.com/aboutus/invest-relations.page

and under the drop down titled “Unpaid/Unclaimed Dividend” to enable such

Members

to

verify the details of unencashed dividends and the shares liable to be transferred to the IEPF Authority. Pursuant to the IEPF

Rules, where the period of seven years provided under Section 124(5) has been completed during the period from September

7, 2016 to May 31, 2017, the due date of transfer of such shares shall be May 31, 2017.

Further,

letters were sent in April 2017 to shareholders whose dividend amount for FY2010 as well as subsequent dividend warrants issued

upto FY2016 were outstanding indicating a timeline of July 18, 2017 to claim the outstanding dividend amounts failing which the

corresponding shares alongwith unclaimed dividend of 2010 will be transferred to the Demat account of the IEPF Authority in adherence

to the procedures prescribed under the Rules. An advertisement to this effect was also published in leading English and vernacular

newspapers on May 6, 2017.

|

|

i.

|

Members

may avail of the nomination facility as provided under Section 72 of the Companies Act, 2013

.

|

|

|

j.

|

Pursuant

to Regulation 36(3) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations,

2015, the information about the Directors proposed to be appointed/re-appointed is given in the Annexure I to the Notice.

|

|

|

k.

|

This

Notice and the Annual Report of the Company circulated to the Members of the Company, will be made available on the Company’s

website at

www.icicibank.com

and

on the website of NSDL at

www.nsdl.co.in

.

|

|

|

l.

|

Members

desirous of getting any information about the accounts and/or operations of the Company are requested to write to the Company at

least seven days before the date of the Meeting to enable the Company to keep the information ready at the Meeting.

|

|

|

m.

|

During

the period beginning 24 hours before the time fixed for the commencement of the Meeting and ending with the conclusion of the meeting,

a Member would be entitled to inspect the proxies lodged with the Bank between 9:00 a.m. IST and 6:00 p.m. IST at the registered

office of the Company, provided that a requisition for the same from a Member is received in writing not less than 3 days before

the commencement of the Meeting.

|

|

|

n.

|

All

the documents referred to in the Notice and Explanatory Statement will be available for inspection by the Members at the Registered/Corporate

Office of the Company between 11:00 a.m. IST and 1:00 p.m. IST on all working days from the date hereof upto the date of

|

the

Meeting. The relevant documents referred to in the Notice and Explanatory Statement will also be available for inspection by the

Members at the Meeting.

Regulation

36 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015

permits

sending of

soft copies of Annual Reports to all those Members who have registered their email addresses for the said purpose.

The Companies Act, 2013 has also

recognised serving of documents to any Member through electronic mode.

In

terms of the Circular No. NSDL/CIR/II/10/2012 dated March 9, 2012 issued by National Securities Depository Limited, email addresses

made available by the Depository for your respective Depository Participant accounts as part of the beneficiary position downloaded

from the Depositories from time to time will be deemed to be your registered email address for serving notices/documents including

those covered under Sections 101 and 136 of the Companies Act, 2013 read with Section 20 of the Companies Act, 2013 and the underlying

rules relating to transmission of documents in electronic mode. In light of the requirements prescribed by the aforesaid circulars,

for those Members whose Depository Participant accounts do not contain the details of their email address, printed copies of the

Notice of Annual General Meeting and Annual Report for the year ended March 31, 2017 would

be despatched.

The

Notice of Annual General Meeting and the copies of audited financial statements, directors’ report, auditors’ report,

business responsibility report etc. will also be displayed on the website of the Bank

www.icicibank.com

and the other requirements as applicable will be duly complied with. Members holding shares in electronic mode are requested to

ensure to keep their email addresses updated with the Depository Participants. Members who have not registered their email id with

their Depository Participants are requested to do so and support the green initiative. Members holding shares in physical mode

are also requested to update their email addresses by writing to the Registrar and Transfer Agent of the Company at the address

mentioned in (f) above quoting their folio number(s).

By

Order of the Board

P.

Sanker

Senior

General Manager (Legal)

&

Company Secretary

Mumbai,

May 15, 2017

CIN:

L65190GJ1994PLC021012

Website:

www.icicibank.com

E-mail:

investor@icicibank.com

|

Registered

Office:

ICICI Bank Tower

Near Chakli Circle,

Old Padra Road Vadodara- 390 007

|

Corporate

Office:

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051

|

|

Phone:

0265-6722286

|

Phone:

022-26538900

|

|

|

Fax:

022-26531230

|

EXPLANATORY

STATEMENT UNDER SECTION 102(1) OF THE COMPANIES ACT, 2013

Item

No. 5

B

S R & Co. LLP, Chartered Accountants were appointed as statutory auditors by the Members at the Twentieth Annual General Meeting

(AGM) held on June 30, 2014 to hold office from the conclusion of the Twentieth AGM till conclusion of the Twenty-Fourth AGM. In

terms of Section 139 of the Companies Act, 2013 (“the Act”), the approval has been sought from the Members for ratification

of the appointment of BSR & Co. LLP, Chartered Accountants as statutory auditors of the Bank

to

hold office from the conclusion of this Meeting i.e the Twenty-Third Annual General Meeting (AGM) until the conclusion of the Twenty-Fourth

AGM of the Company and authorisation for the Board to fix their remuneration in connection with the audit of accounts for fiscal

2018

.

As

per the requirement of the Act, B S R & Co. LLP, Chartered Accountants have confirmed that the appointment if made would be

within the limits specified under Section 141(3)(g) of the Act and they are not disqualified to be appointed as statutory auditors

in terms of the proviso to Section 139(1), Section 141(2) and Section 141(3) of the Act and the provisions of the Companies (Audit

and Auditors) Rules, 2014. The appointment of BSR & Co. LLP, Chartered Accountants as Statutory Auditors for fiscal 2018 has

been approved by RBI.

The

Directors recommend the Resolution at Item No. 5 of the accompanying Notice for approval of the Members of the Bank.

None

of the Directors, Key Managerial Personnel of the Bank and their relatives are in any way concerned or interested, financially

or otherwise in the passing of the Resolution at Item No. 5 of the accompanying Notice.

Item

Nos. 7 and 8

The Board at its Meeting held on October

14, 2016 subject to approval of Reserve Bank of India (RBI), Members and such other regulatory approvals as may be applicable,

appointed Mr. Anup Bagchi as a Wholetime Director designated as Executive Director of the Bank for a period of five years effective

from February 1, 2017 or the date of receipt of approval from RBI, whichever is later. RBI

vide

its letter dated January

20, 2017 approved his appointment as Executive Director for a period of three years effective February 1, 2017.

In terms of Section 160 of the Companies

Act, 2013 (“the Act”), the Bank has received a notice from a Member along with requisite deposit of Rs. 100,000 signifying

intention to propose Mr. Bagchi as a candidate for the office of Director of the Bank. The required details in terms of Regulation

36(3) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 are provided

herein after.

Your Directors recommend the resolutions

at Item Nos. 7 and 8 of the accompanying Notice for approval of the Members of the Bank.

None of the Directors, Key Managerial Personnel

of the Bank and their relatives are concerned or interested, financially or otherwise, in the passing of these resolutions.

The terms and conditions relating to the

appointment and remuneration of Mr. Bagchi as a Wholetime Director (designated as Executive Director), would be available for inspection

at the Registered Office of the Bank on all working days from 11:00 a.m. IST to 1:00 p.m. IST from the date hereof upto June 30,

2017 and also at the Meeting.

Item

No. 9

Section 42 of the Companies Act, 2013 and

its underlying rules viz. Companies (Prospectus and Allotment of Securities) Rules, 2014 (including any modification(s) or re-enactment(s)

thereof) provide that a Company shall make a private placement of its securities only if the proposed offer of securities or invitation

to subscribe to securities has been previously approved by the Members of the Company, by a Special Resolution, for each of the

Offers or Invitations. It further provides that the explanatory statement annexed to the notice for the general meeting shall disclose

the basis or justification for the price (including premium, if any) at which the offer or invitation is being made. It also provides

that in case of offer or invitation for non-convertible debentures, it shall be sufficient if the Company passes a prior special

resolution once in a year for all the offers or invitation for such debentures during the year.

At the Annual General Meeting held on July

11, 2016, the Members had approved a limit of Rs. 25,000 crore for borrowings by way of securities including but not limited to

bonds and non-convertible debentures on private placement basis. The Bank has borrowed Rs. 7,425 crores (Rupees Seven Thousand

Four Hundred and Twenty Five Crores only) by way of issue of non-convertible debentures (NCDs) on private placement basis since

the last AGM. Considering the same, the Bank has assessed its fund requirements and it is proposed that the borrowing limits for

the purpose of Section 42 read with the rules relating to this Section for borrowing by way of non-convertible securities including

but not limited to bonds and NCDs be retained at the same level of Rs. 25,000 crore (Rupees twenty five thousand crore). This would

form part of the overall borrowing limits under Section 180(1)(c) of the Companies Act, 2013 of Rs. 250,000 crore (Rupees two hundred

and fifty thousand crore) approved by the Members at the AGM held on June 30, 2014. The resolution under Section 42 will be valid

for a period of one year from the date of passing this resolution. The pricing of the non-convertible securities including but

not limited to bonds and non-convertible debentures (NCDs) depends primarily upon the rates prevailing for risk free instruments,

rates on other competing instruments of similar rating and tenor in the domestic market, investors’ appetite for such instruments

and investor regulations which enable investments in such instruments. Accordingly, during the validity of this resolution, the

Bank proposes to issue non-convertible securities including but not limited to bonds and non-convertible debentures (NCDs) by way

of private placement at upto 300 basis points (bps) above the rates prevailing for risk free instruments as represented by the

respective tenor rupee sovereign bonds for issuances in rupee market. The pricing for each of the issuance/program would be approved

by the Board or a Committee of Board.

Your

Directors recommend the Resolution at Item No. 9 of the accompanying Notice for approval of the Members of the

Bank.

None

of the Directors, Key Managerial Personnel of the Bank and their relatives are in any way concerned or interested, financially

or otherwise in the passing of the Resolution at Item No. 9 of the accompanying Notice.

By

Order of the Board

P.

Sanker

Senior

General Manager (Legal)

&

Company Secretary

Mumbai,

May 15, 2017

CIN:

L65190GJ1994PLC021012

Website:

www.icicibank.com

E-mail:

investor@icicibank.com

|

Registered

Office:

|

Corporate

Office:

|

|

ICICI Bank Tower

|

ICICI Bank Towers

|

|

Near Chakli Circle

|

Bandra-Kurla Complex

|

|

Old Padra Road, Vadodara 390 007

|

Mumbai 400 051

|

|

Phone:

0265-6722286

|

Phone: 022-26538900

|

|

|

Fax: 022-26531230

|

ANNEXURE

I TO ITEM NOS. 4, 7 AND 8 OF THE NOTICE

Pursuant

to Regulation 36(3) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations,

2015 and

Secretarial Standard 2 issued by the Institute of Company Secretaries of India

,

following information is furnished about the Directors proposed to be appointed/re-appointed.

|

Name of the Director

|

Vishakha Mulye

|

|

Age

|

48 years

|

|

Date of first appointment on Board

|

January 19, 2016

|

|

Qualification

|

B.Com, C.A.

|

|

Brief resume including experience

|

Ms. Vishakha Mulye is an Executive Director

of ICICI Bank. She is presently the head of Wholesale Banking Group. Ms. Mulye, is a qualified Chartered Accountant, joined the

ICICI Group in 1993, and has vast experience in the areas of strategy, treasury & markets, proprietary equity investing and

management of long-term equity investments, structured finance, management of special assets and corporate & project finance.

She led the team that planned and executed the merger of ICICI and ICICI Bank in 2002. From 2002 to 2005, she was responsible for

the Bank's structured finance and global markets businesses, and its financial institutions relationships. From 2005 to 2007, Ms.

Mulye was the Group Chief Financial Officer of ICICI Bank. She was elevated to the Board of ICICI Lombard General Insurance Company

in 2007. In 2009, she assumed leadership of ICICI Venture Funds Management Company as its Managing Director & CEO. She moved

back to ICICI Bank in December 2015 and headed the Wholesale Banking Group.

|

|

|

Ms. Mulye was selected as 'Young Global Leader' for the year 2007 by World Economic Forum. She received the India CFO Award in 2006 from IMA for 'excellence in finance in a large corporate' and CA Corporate Leader Award in 2008 from ICAI. In February 2012, she received the GR8! Women award from ITA for her contribution as "an Eminent Personality in the field of Banking". She was featured in the list of 'Most Powerful Women in Indian Business' by Business Today on several occasions. She is also a member of the Aspen Institute for 'India Leadership Initiative'.

|

|

Expertise in specific functional areas

|

Ms. Vishakha Mulye has vast experience in areas of strategy, treasury & markets, proprietary equity investing and management of long-term equity investments, structured finance, management of special assets and corporate & project finance.

|

|

Other Directorships

|

ICICI Securities Limited

|

|

Chairmanship/Membership

of Committees in companies in which position of Director is held

|

ICICI

Bank Limited

Committee

of Executive Directors

Committee

for Identification of

Wilful

Defaulters/Non Co-operative borrowers

Asset

Liability Management Committee

Committee

of Senior Management

|

|

Relationship with other Directors, Managers and other Key Managerial Personnel of the Company

|

None

|

|

No. of equity shares held in the Company (as on May 5, 2017)

|

588,625 equity shares

|

|

No. of board meetings attended during the year

|

9

|

|

Terms and conditions of appointment or re-appointment

|

whole-time Director liable to retire by rotation

|

|

Name of the Director

|

Anup Bagchi

|

|

Age

|

47 years

|

|

Date of first appointment on Board

|

The Board at its Meeting held on October 14, 2016 approved the appointment of Mr. Anup Bagchi as a Wholetime Director (designated as Executive Director). RBI vide its letter dated January 20, 2017 approved his appointment as Executive Director for a period of three years effective February 1, 2017.

|

|

Qualification

|

B. Tech. , PGDM

|

|

Brief resume including experience

|

Mr. Anup Bagchi was the Managing Director &

|

|

|

CEO of ICICI Securities Limited (I-Sec),

where he led capital raising by corporates. Under his leadership, the organisation won the prestigious Outlook Money - India’s

Best e-Brokerage House for seven consecutive years. It also won the CNBC Awaaz Consumer Award for the Most Preferred Brand of Financial

Advisory Services.

Mr. Bagchi joined the ICICI Group in 1992

and has worked in the areas of retail banking, corporate banking and treasury. He has a management degree from the Indian Institute

of Management, Bangalore and an engineering degree from the Indian Institute of Technology, Kanpur.

Mr. Bagchi has been honoured with

The Asian Banker Promising Young Banker Award as well as Business Today has recognised him as one of India's Hottest Young Executives.

|

|

Expertise in specific functional areas

|

Retail Banking, Corporate Banking and Treasury

|

|

Other Directorships

|

ICICI Home Finance Company Limited

ICICI Securities Limited

Comm Trade Services Limited

|

|

Chairmanship/Membership of Committees in

companies in which position of Director is held

|

ICICI Bank Limited

Committee of Executive Directors

Committee for Identification of

Wilful Defaulters/ Non Co-operative borrowers

Committee of Senior Management

Asset Liability Management Committee

Customer Service Committee

Fraud Monitoring Committee

ICICI Home Finance Company Limited

Audit & Risk Management Committee

Nomination and Remuneration Committee

Asset Liability Management Committee

Committee of Directors

Management Committee

ICICI Securities Limited

Audit Committee

|

|

Relationship with other Directors, Managers and other Key Managerial Personnel of the Company

|

None

|

|

No. of equity shares held in the Company (as on May 5, 2017)

|

37,500 equity shares

|

|

No. of board meetings attended during the year

|

None

|

|

Terms and conditions of appointment including remuneration

|

Terms of appointment:

For a period of five years effective

February 1, 2017

|

|

|

Proposed compensation:

Salary:

In the range of Rs. 950,000 to Rs. 1,700,000

per month with the present salary being in the scale of Rs. 1,327,500 per month.

Perquisites:

Perquisites (evaluated as per Income-tax

Rules, wherever applicable, and at actual cost to the Bank in other cases) such as the benefit of the Bank’s furnished accommodation,

gas, electricity, water and furnishings, club fees, personal insurance, use of car and telephone at residence or reimbursement

of expenses in lieu thereof, payment of income-tax on perquisites by the Bank to the extent permissible under the Income-tax Act,

1961 and rules framed thereunder, medical reimbursement, leave and leave travel concession, education benefits, provident fund,

superannuation fund, gratuity and other retirement benefits, in accordance with the scheme(s) and rule(s) applicable from time

to time to retired Wholetime Directors of the Bank or the members of the staff. In line with the staff loan policy applicable to

specified grades of employees who fulfill prescribed eligibility criteria to avail loans for purchase of residential property,

the whole time directors are also eligible for housing loans subject to approval of Reserve Bank of India (RBI).

Supplementary Allowance:

In the range of Rs. 675,000 to Rs. 1,225,000

per month with the present monthly allowance being in the scale of Rs. 975,200 per month.

Bonus:

An amount up to the maximum limit

permitted under RBI guidelines or any modifications thereof, as may be determined by the Board or any Committee thereof, based

on achievement of such performance parameters as may be laid down by the Board or any Committee thereof, and subject to such other

approvals as may be necessary.

|

By

Order of the Board

P.

Sanker

Senior

General Manager (Legal)

&

Company Secretary

Mumbai,

May 15, 2017

CIN:

L65190GJ1994PLC021012

Website:

www.icicibank.com

E-mail:

investor@icicibank.com

|

Registered

Office:

|

Corporate

Office:

|

|

ICICI Bank Tower

|

ICICI Bank Towers

|

|

Near Chakli Circle

|

Bandra-Kurla Complex

|

|

Old Padra Road, Vadodara 390 007

|

Mumbai 400 051

|

|

Phone:

0265-6722286

|

Phone: 022-26538900

|

|

|

Fax: 022-26531230

|

MAP SHOWING LOCATION OF THE VENUE OF

THE TWENTY-THIRD ANNUAL GENERAL MEETING OF ICICI BANK LIMITED

Venue:

Professor

Chandravadan Mehta Auditorium, General Education Centre,

Opposite

D. N. Hall Ground,

The

Maharaja Sayajirao University,

Pratapgunj,

Vadodara

390002

Landmark:

Maharaja

Sayajirao University Cricket Ground

Item 2

ICICI Bank Limited

CIN: L65190GJ1994PLC021012

Registered

Office: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara 390 007, Phone: 0265-6722286

Corporate

Office: ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051, Phone: 022-26538900, Fax: 022-26531230

Website:

www.icicibank.com

,

E-mail:

investor@icicibank.com

|

Notice to American

Depositary Shares (“ADS”) Holders

Notice to ADS

Holders

The attached

is being provided by ICICI Bank Limited (the “Bank”) FOR INFORMATIONAL PURPOSES ONLY and is not to be construed, and

does not purport to be, an offer to sell or solicitation of an offer to buy any securities.

Deutsche Bank

Trust Company Americas, the Depositary (the “Depositary”), has not reviewed the enclosed, and expressly disclaims any

responsibility for, and does not make any recommendation with respect to, the Bank or the matters and/or transactions described

or referred to in the enclosed documentation. Furthermore, neither the Depositary nor any of its officers, employees, directors,

agents or affiliates controls, is responsible for, endorses, adopts, or guarantees the accuracy or completeness of any information

provided at the Bank’s request or otherwise made available by the Bank and none of them are liable or responsible for any

information contained therein.

Registered Holders

have no voting rights with respect to the Shares or other Deposited Securities represented by their American Depositary Shares.

The instructions of Registered Holders shall not be obtained with respect to the voting rights attached to the Shares or other

Deposited Securities represented by their respective ADSs. In accordance with the Governmental Approval, the Depositary is required,

at the direction of the Board of Directors of the Bank (the “Board”), to vote as directed by the Board.

The matters referred

to in the attached are being made with respect to the securities of an Indian company. The proposed action is subject to the disclosure

requirements of India, which are different from those of the United States.

It may be difficult

for you to enforce your rights and any claim you may have arising under the U.S. federal securities laws, since the issuer is located

in India, and some or all of its officers and directors may be residents of India. You may not be able to sue an Indian company

or its officers or directors in an Indian court for violations of the U.S. securities laws. It may be difficult to compel an Indian

company and its affiliates to subject themselves to a U.S. court’s judgment.

Capitalized terms

used in this notice but not defined herein shall have the meanings ascribed to them in the Deposit Agreement, dated as of March

31, 2000 (as amended) between the Bank, the Depositary and all Registered Holders and Beneficial Owners from time to time of Receipts

issued thereunder.

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorised.

|

|

|

For ICICI Bank Limited

|

|

|

|

|

|

Date:

|

May 24, 2017

|

By:

|

/s/ Shanthi Venkatesan

|

|

|

|

|

Name :

|

Shanthi Venkatesan

|

|

|

|

|

Title :

|

Deputy General Manager

|

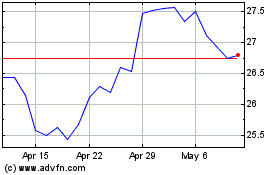

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

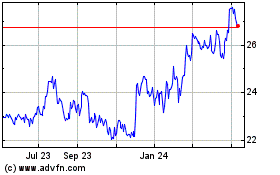

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024