Fewer plans, strict new enrollment rules,

and increased costs complicate insurance options for college

grads

Today eHealth, Inc. (NASDAQ:EHTH), which operates eHealth.com, a

leading private online health insurance exchange, outlined the

challenging health insurance landscape for this year’s college

graduates, and provided shopping advice and insurance product data

for would-be shoppers.

Young adults frequently purchase health insurance on their own

after leaving college, though many anticipate becoming eligible for

other forms of coverage (such as employer-based coverage) in the

future. Ongoing voluntary surveys of eHealth shoppers show an

increase every spring/summer (compared to the fall) in the number

of recent college grads under age 24 who expect to only need

individually-purchased coverage for less than a year:

Question: “How long do you expect to

need coverage?”

Surveyed May-August 2015

SurveyedSeptember-October2015

Surveyed May-August 2016

SurveyedSeptember-October2016

“Less than 12 months” 64% 54%

69% 58%

“12 months or more”

36% 46% 31%

42%

Young men and women graduating from college this year will find

themselves in an unprecedented situation. Many may have difficulty

finding, qualifying for, or affording self-purchased health

insurance – especially with the recent uncertainty in the health

insurance market.

Here’s why:

- There are fewer major medical plans

available. Some major insurance companies have left the

individual health insurance market. In nearly one third of U.S.

counties, college grads may have only one insurance company to

choose from for Obamacare-compliant coverage. By 2018 shoppers in

several states may have none at all.

- There are stricter enrollment

rules. In February 2017, the Centers for Medicare and Medicaid

Services issued rules that make it more difficult for applicants to

claim they have experienced a qualifying life event allowing them

to purchase coverage outside of the annual open enrollment

period.

- There are new restrictions on

short-term health plans. Short-term health insurance plans

provide a limited but valuable option for those who do not qualify

for or cannot afford major medical coverage, but new rules that

took effect in April 2017 reduced the maximum coverage period for a

single policy from 12 months to three months.

- The cost of major medical coverage

continues to increase. As reported in eHealth’s most recent

Price Index Report, the average monthly premium for individual

unsubsidized major medical health insurance increased 18% between

2016 and 2017, or 39% since the 2014 open enrollment period, when

major provisions of Obamacare first took effect.

Top 5 Health Insurance

Tips for 2017 College Grads

1. Mom & Dad’s plan – When to say “Thanks but no thanks”

- Current law allows your parents to keep you on the family

health insurance plan until your 26th birthday, and many grads get

covered that way. However, buying coverage on your own may make

more sense if you live in a different city without access to the

network providers for your parents’ plan or if you can save money

by purchasing coverage for yourself that better meets your personal

needs.

2. Special enrollment periods – Use ‘em before you lose ’em

- If you want to purchase a major medical Obamacare-compliant

health insurance plan on your own, you need to do so during the

annual open enrollment period (which typically begins November 1)

or when you experience a “qualifying life event.” Graduating from

college is not a qualifying life event, but events such as

moving to a new city or state, losing qualified coverage that you

had before, getting married or having a child may allow you to

purchase coverage on your own outside of open enrollment.

3. Obamacare subsidies – Understand the risks and rewards

- As a single person, if you earn less than about $48,000 per

year, you may be eligible for government subsidies when you

purchase a major medical health plan. This can make your coverage

significantly more affordable, depending on your income. However,

keep in mind that your initial subsidy determination is based on

your estimated income for the year. If you end up earning

more than expected, you may be required to pay back some or all of

the subsidy dollars that were applied toward your monthly premiums

during the year. Proposals by Congressional Republicans may change

the way subsidies work, but income-based Obamacare subsidies are

still in place for now.

4. Obamacare taxes – Avoid the sting of an unexpected tax hit

- If you go without major medical health insurance for more

than two consecutive months during the 2017 calendar year, you may

be subject to an Obamacare tax penalty. The penalty for 2017 is

$695 per adult or 2.5% of your taxable income, whichever is

greater. Congressional Republicans’ health reform proposals would

do away with this tax penalty for going uninsured, but for now the

Obamacare tax penalty is still the law.

5. Obamacare alternatives – What is packaged medical

insurance? - Some people simply cannot afford to purchase major

medical coverage or they don’t qualify for coverage because they

haven’t had a qualifying life event. Where can you turn if you

still want some protection against unexpected medical bills? Other

insurance products that may be available year-round include

short-term health insurance plans, accident insurance, critical

illness insurance, dental or vision insurance, etc. These may be

purchased individually or conveniently purchased together as a

recommended package of medical insurance products. Coverage under

products like these can be significantly more affordable than major

medical coverage, but keep in mind that these plans will not

protect you from Obamacare tax penalties and do not typically have

Obamacare features such as coverage for pre-existing conditions or

the full set of minimum essential benefits required by

Obamacare.

How Much Does Health

Insurance Cost for 2017 Grads?

It helps to know what you’re looking at when it comes to the

cost of health insurance. Below, eHealth provides average premiums

and deductibles for major medical and short-term health insurance

plans selected by eHealth shoppers aged 20-25 during the 2017 open

enrollment period (November 1, 2016 through January 31, 2017).

These are aggregated averages for plans across the country, but you

can search for specific plans, premiums, and deductibles available

to you in your particular geographical area by visiting

eHealth.com.

For major medical coverage:

- $231 was the average monthly

premium

- $5,058 was the average annual

deductible

- $161 was the average monthly

premium for a catastrophic level plan

- $7,149 was the average annual

deductible for a catastrophic level plan

- $362 was the average monthly

premium for gold level plan

- $704 was the average annual

deductible for gold level plan

“Catastrophic” plans tend to come with higher out-of-pocket

costs and are typically only available to people under age 30.

“Gold” plans provide the second-highest level of coverage, in terms

of cost-sharing, among Obamacare-compliant major medical plans.

For short-term health insurance plans:

- $72 was the average monthly

premium

- $6,024 was the average annual

deductible

Short-term health insurance plans and other insurance products

that are not major medical plans provide limited coverage for a

limited period of time. They typically exclude coverage for things

like preventive medical care, pre-existing conditions, and

maternity care. It may be possible to be declined for such plans

due to a pre-existing medical condition. Despite this, short-term

plans and other insurance products that are not major medical plans

can still provide a valuable level of protection against unexpected

medical costs.

For more information about major medical costs and trends, refer

to eHealth’s Price Index Report for the 2017 Open Enrollment

Period.

About eHealth

eHealth, Inc. (NASDAQ: EHTH) owns eHealth.com, a

leading private online health insurance exchange where individuals,

families and small businesses can compare health insurance products

from leading insurers side by side and purchase and enroll in

coverage online. eHealth offers thousands of individual, family and

small business health plans underwritten by many of the nation's

leading health insurance companies. eHealth (through its

subsidiaries) is licensed to sell health insurance in all 50 states

and the District of Columbia. eHealth also offers educational

resources and powerful online and pharmacy-based tools to

help Medicare beneficiaries navigate Medicare health

insurance options, choose the right plan and enroll in select plans

online through Medicare.com (www.Medicare.com), eHealthMedicare.com

(www.eHealthMedicare.com) and PlanPrescriber.com

(www.PlanPrescriber.com).

For more health insurance news and information, visit

eHealth's Consumer Resource Center.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170524005373/en/

DMA Communications for eHealth, Inc.Sande Drew,

916-207-7674sande.drew@ehealth.comoreHealth, Inc.Nate Purpura,

650-210-3115nate.purpura@ehealth.com

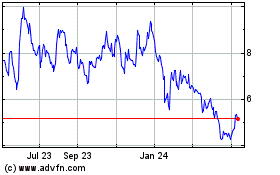

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

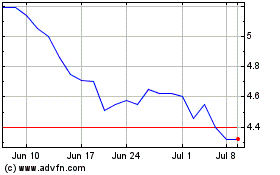

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Apr 2023 to Apr 2024