As filed with the Securities and Exchange Commission on May 23, 2017

Registration No. 333-217777

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________

PRE-EFFECTIVE AMENDMENT NO.1 TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________________________________________________________

DLH HOLDINGS CORP.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey

|

|

|

|

22-1899798

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

__________________________________________________________________________________________

3565 Piedmont Road, NE

Building 3, Suite 700

Atlanta, Georgia 30305

(866) 952-1647

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

____________________________________________________________________________________________________________________

Kathryn M. JohnBull

Chief Financial Officer

3565 Piedmont Road, NE

Building 3, Suite 700

Atlanta, Georgia 30305

(866) 952-1647

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

__________________________________________________________________________________________

Copies to:

Victor J. DiGioia, Esq.

Michael A. Goldstein, Esq.

Becker & Poliakoff LLP

45 Broadway, 8

th

Floor

New York, New York 10006

(212) 599-3322

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

þ

|

|

Emerging growth company

¨

|

|

(Do not check if a smaller

reporting company)

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Title of each Class of

Securities to be Registered

|

Amount

to be

Registered (1)(2)

|

Proposed

Maximum

Offering Price

Per Security (1)(3)

|

Proposed

Maximum

Aggregate

Offering Price (1)(3)

|

Amount of

Registration

Fee (1) (4)

|

|

Common Stock, par value $0.001

|

|

|

|

|

|

Preferred Stock, par value $0.10

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

Rights

|

|

|

|

|

|

Units

|

|

|

|

|

|

Total

|

$35,000,000

|

|

$35,000,000

|

$4,056.50 *

|

|

|

|

|

|

|

(1)

|

There are being registered hereunder such indeterminate number of shares of common stock and preferred stock, such indeterminate number of warrants to purchase common stock or preferred stock,

such indeterminate number of rights to purchase common stock or preferred stock of one or more series, and

such indeterminate number of units,

that may from time to time be issued at indeterminate prices, with an aggregate maximum offering price not to exceed $

35,000,000.

The securities registered also include such indeterminate number of securities as may be issued upon exercise, settlement, exchange, or conversion of securities offered or sold hereunder, or pursuant to the antidilution provisions of any such securities.

Information as to the amount to be registered, proposed maximum offering price, and proposed maximum aggregate offering price is not specified by each class of securities being registered pursuant to General Instruction II.D of Form S-3. Such amount represents the offering price of any shares of common stock or preferred stock, warrants to purchase common stock or preferred stock, rights to purchase common or preferred stock, or units of securities. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. Separate consideration may or may not be received for securities that are issuable upon conversion, exercise or exchange of other securities.

|

|

|

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, this registration statement also covers an indeterminate amount of securities that may become issuable under the terms of the securities being registered upon exercise or conversion of such securities or as a result of a stock dividend, stock split, or other recapitalization.

|

|

|

|

|

(3)

|

The proposed maximum offering price per security will be determined from time to time by the registrant in connection with the issuance by the registrant of the securities registered hereunder.

|

|

|

|

|

(4)

|

The total amount to be registered and the proposed maximum aggregate offering price for the securities registered hereunder are estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

|

|

*

|

Registration fee previously paid

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement relates to securities being registered pursuant to Rule 415 of the Securities Act of 1933, as amended, which may be offered from time to time on a delayed or continuous basis by DLH Holdings Corp., a New Jersey corporation. This Registration Statement contains a form of basic prospectus relating to DLH Holdings Corp. which will be used in connection with an offering of securities by DLH Holdings Corp. The specific terms of the securities to be offered will be set forth in a prospectus supplement relating to such securities.

The information in this prospectus is not complete and may be changed. These securities may not be sold nor may offers to buy these securities be accepted prior to the time the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 23, 2017

PROSPECTUS

$35,000,000

DLH HOLDINGS CORP.

Common Stock

Preferred Stock

Warrants

Rights

Units

We may offer and sell an indeterminate number of shares of our common stock, preferred stock, warrants to purchase common stock or preferred stock; rights to purchase common stock or preferred stock; either individually or in units comprised of any such securities, from time to time under this prospectus.

The maximum aggregate offering price for these securities will not exceed $35,000,000.

This prospectus provides a general description of the securities we may offer. We will describe in a prospectus supplement, which must accompany this prospectus, the securities we are offering and selling, as well as the specifications of the securities. The prospectus supplement may also add, update or change information contained in the prospectus. You should read this prospectus and the applicable prospectus supplement, as well as the documents incorporated by reference or deemed incorporated by reference into this prospectus, carefully before you invest in any securities.

We may offer these securities in amounts, at prices and on terms determined at the time of offering. We may sell the securities directly to you, through agents we select, or through underwriters and dealers we select. If we use agents, underwriters or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” beginning on page 30.

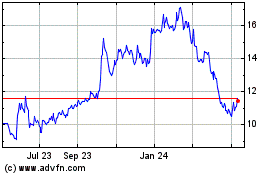

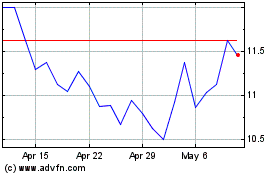

Our common stock is traded on the Nasdaq Capital Market under the symbol “DLHC.” On May 22, 2017, the last reported sale price of our common stock on the Nasdaq Capital Market was $5.10 per share. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the Nasdaq Capital Market or any securities market or other exchange of the securities covered by the applicable prospectus supplement.

As of May 22, 2017, the aggregate market value of our outstanding common stock held by non-affiliates is $32,269,506, based on 11,251,614 shares of outstanding common stock, of which approximately 5,516,155 shares are held by non-affiliates, and a per share price of $5.85 based on the closing sale price of our common stock on April 3, 2017. We have not issued any securities pursuant to Instruction I.B.6. of Form S-3 during the 12 calendar month period that ends on and includes the date hereof.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus, in any prospectus supplement that we may file and in the documents we incorporate by reference in this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

The date of this prospectus is , 2017

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page

|

|

Forward-Looking Statements

|

1

|

|

Prospectus Summary

|

2

|

|

Risk Factors

|

5

|

|

Use of Proceeds

|

16

|

|

The Securities We May Offer

|

17

|

|

Description of Capital Stock

|

17

|

|

Description of Warrants

|

23

|

|

Description of Rights

|

25

|

|

Description of Units

|

26

|

|

Legal Ownership of Securities

|

27

|

|

Plan of Distribution

|

30

|

|

Legal Matters

|

34

|

|

Experts

|

34

|

|

Where You Can Find More Information

|

34

|

|

Incorporation of Certain Information by Reference

|

35

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under the shelf process, we may sell, from time to time, common stock, preferred stock, warrants, rights, or units in one or more offerings, up to a total aggregate offering price of $35,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. The prospectus supplement may add, update, or change the information contained in this prospectus. You should read this prospectus and any supplements, together with any documents incorporated by reference into this prospectus or any prospectus supplement carefully and the additional information described under “Where You Can Find More Information,” before you decide to invest in any of these securities. This prospectus may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement.

The SEC allows us to incorporate into this prospectus certain information contained in other documents that we file with the SEC, which means we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. The reports and other documents that we file after the date of this prospectus will modify, supplement and supersede the information in this prospectus. You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give you any information or to represent anything not contained in this prospectus or any prospectus supplement, and, if given or made, you must not rely on any such information or representation as being authorized by us.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained in this prospectus is correct as of any time after its date. You should not assume that the information contained or incorporated by reference in this prospectus or any prospectus supplement is accurate as of any date other than the date on the cover of such prospectus, regardless of the time of delivery of the prospectus or any sale of these securities.

Unless otherwise stated or the context otherwise requires, the terms “we,” “us,” “our,” “DLH” and the “Company” refer to DLH Holdings Corp. and its subsidiaries. Our logo, trademarks and service marks are the property of DLH. Other trademarks or service marks appearing in this prospectus are the property of their respective holders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. These statements are based on current expectations, estimates, forecasts and projections about the industry in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” and “may” and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections regarding our future financial performance; our anticipated growth and trends in our businesses; our capital needs and capital expenditures; competitive changes in the marketplace for our services; and other characterizations of future events or circumstances are forward-looking statements.

These statements reflect our reasonable judgment with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The factors listed under “Risk Factors” in this prospectus, any applicable prospectus supplement, and in any documents incorporated by reference into this prospectus as well as any cautionary language in this prospectus, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Such risks and uncertainties include, among other things, risks and uncertainties related to:

|

|

|

|

•

|

the effects of future legislative or government budgetary changes or delays in the U.S. government contract procurement process or the award of contracts;

|

|

|

|

|

•

|

incurrence of a substantial amount of debt with increased interest expense and amortization demands, compliance with new bank financial and other covenants,

|

|

|

|

|

•

|

difficulties in integrating acquired businesses;

|

|

|

|

|

•

|

the outcome of reviews or audits, which might result in financial penalties and reduce our ability to respond to invitations for new work;

|

|

|

|

|

•

|

a failure to comply with laws governing our business, which might result in our being subject to fines, penalties and other sanctions;

|

|

|

|

|

•

|

our ability to successfully bid for and accurately price contracts to generate our desired profit;

|

|

|

|

|

•

|

our ability to maintain relationships with key government entities or prime contractors or joint venture partners, from whom a substantial portion of our revenue is derived;

|

|

|

|

|

•

|

the ability of government customers to terminate contracts on short notice, with or without cause;

|

|

|

|

|

•

|

our ability to manage capital investments and up-front costs incurred before we receive related contract payments;

|

|

|

|

|

•

|

our ability to maintain technology systems and otherwise protect confidential or protected information; and

|

|

|

|

|

•

|

other factors, including those discussed in “Risk Factors” in this prospectus and incorporated by reference into this prospectus.

|

You should carefully read this prospectus, any applicable prospectus supplement, together with the information incorporated herein by reference as described under the section entitled “Where You Can Find Additional Information,” before you invest in our securities. You should be aware that the occurrence of the events described in these risk factors and elsewhere in this prospectus and in any applicable prospectus supplement under the heading “Risk Factors,” and in any documents incorporated by reference into this prospectus could have a material adverse effect on our business, results of operations and financial position. Any forward-looking statement made by us in this prospectus speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ will emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. You are advised to consult any further disclosures we make on related subjects in the reports we file with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary does may not contain all of the information that you should consider before investing. You should read this entire prospectus, any applicable prospectus supplement, and the other documents which are incorporated by reference in this prospectus carefully, including the section titled “Risk Factors” and our financial statements and the notes thereto, before making an investment in our securities.

General

DLH Holdings Corp. is a full-service provider of technology-enabled business process outsourcing and program management solutions, primarily to improve and better deploy large-scale federal health and human services initiatives. DLH is a federal contractor providing services to several agencies including the Department of Veteran Affairs, Department of Health and Human Services, Department of Defense, and others. On May 3, 2016, we acquired Danya International, a provider of technology-enabled program management, consulting, and digital communications solutions. This expands our government services market coverage, with our primary focus on healthcare and social programs delivery and readiness.

DLH Solutions is our legacy business, employing over 1,400 skilled healthcare and support personnel, technicians, logisticians, and engineers at approximately 30 locations around the United States for various U.S. government customers. Our primary focus has been service members and veterans’ requirements for telehealth, pharmaceuticals, behavioral healthcare, medication therapy management, health IT commodities, process management, and healthcare delivery. With Danya now absorbed into our business, we have expanded our market coverage with over 140 skilled human services and healthcare professionals in approximately 29 states. Our capabilities include managing, monitoring, and supporting large-scale healthcare and human services programs for the Department of Health and Human Services. These new programs we manage ensure that education, health, and social standards are being achieved to ensure school readiness for underprivileged children. Prior to our acquisition, Danya’s single largest program was with the Office of Head Start Monitoring Support project under the Department of Health and Human Services.

Our business offerings are focused on three primary sources of revenue within the Federal health services market space, as follows:

•

Defense and Veterans’ Health Solutions:

We provide a wide range of healthcare services and delivery solutions to the Department of Veteran Affairs, US Army Medical Materiel Command and its subordinate US Army Medical Research Acquisition Activity, Navy Bureau of Medicine and Surgery, and the Defense Health Agency and Army Medical Command. Services provided to these customers comprise approximately 55% of our current business base.

•

Human Services and Solutions:

DLH provides a wide range of human services and solutions to the Department of Health and Human Services’ Office of Head Start and the Department of Homeland Security. Services provided to these customers comprise approximately 40% of our current business base.

•

Public Health and Life Sciences:

DLH provides a wide range of services to Department of Health and Human Services’ Center for Disease Control and Prevention, the Department of the Interior, and the Department of Agriculture. Services provided to these customers comprise approximately 5% of our current business base.

Presently, we derive all of our revenue from agencies of the federal government, primarily as a prime contractor but also as a subcontractor to other federal prime contractors. Our largest customer continues to be the Department of

Veteran Affairs, which comprised approximately 58% and 95% of revenue for the six months ended March 31, 2017 and 2016, respectively. Additionally, the Department of Health and Human Services represents a major customer, comprising 30% of revenue for the six months ended March 31, 2017.

Acquisition of Danya International and Financing Arrangements

On May 3, 2016, we acquired 100% of the equity interests of Dayna International, LLC for a purchase price of $38.75 million plus transaction expenses. The acquisition was financed through a combination of borrowings of $30.0 million under our new senior credit facility with Fifth Third Bank, cash on hand of approximately $5.0 million, shares of common stock issued to the seller with a value of $2.5 million, and $2.5 million financed by the sale of subordinated notes to entities associated with Wynnefield Capital, Inc., our largest stockholder. The acquisition of Danya is consistent with our growth strategy, which calls for expanding our government service offerings both organically and through mergers and acquisitions. As of March 31, 2017, the outstanding loan balance on the term loan was approximately $21.6 million, all prior draws under the revolving credit facility were repaid and the principal amount of $2.5 million of subordinated notes held by entities associated with Wynnefield Capital, Inc. were repaid.

On September 30, 2016, we announced that we completed a rights offering and raised $2.65 million from the sale of 710,455 shares of our common stock at the per share offering price of $3.73. Officers and directors of DLH purchased an aggregate of 59,546 shares in the rights offering. Further, in connection with the rights offering, we had entered into a standby purchase agreement with Wynnefield Capital, Inc., which beneficially owned, prior to the rights offering, approximately 42% of our common stock through certain affiliated entities. Funds affiliated with Wynnefield Capital exercised their basic subscription rights and purchased a total of 298,834 shares of our common stock on the same terms as all other participants at $3.73 per share. The $2.5 million of subordinated notes we issued to these funds in May 2016, along with accrued and unpaid interest thereon, were repaid through proceeds from the rights offering.

Risks Associated with Our Business

Investing in our securities involves a high degree of risk. These risks are discussed more fully in the “Risk Factors” section of this prospectus. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in this prospectus and in our other reports filed with the SEC, together with all of the other information contained in or incorporated by reference in this prospectus.

The Offering

From time to time we may offer common stock, preferred stock, warrants, rights, and units at an aggregate initial offering price not to exceed $35,000,000. However, we are currently subject to General Instruction I.B.6 of Form S-3 and are only permitted to utilize the registration statement of which this prospectus forms a part to sell a maximum amount of securities equal to one-third (33.33%) of the aggregate market value of the outstanding voting and non-voting common equity held by our non-affiliates in any 12 month period for as long as our public float remains below $75.0 million. The warrants or rights that we may offer will consist of warrants or rights to purchase any of the other securities that may be sold under this prospectus and the units that we may offer will be comprised of combinations of the other securities that may be sold under this prospectus. The securities offered under this prospectus may be offered separately, or as units, which may include combinations of the securities and in amounts, at prices and on terms to be determined at the time of sale. A prospectus supplement that will set forth the terms of the offering of any securities will accompany this prospectus. The terms described in a prospectus supplement will include:

|

|

|

|

•

|

in the case of common stock, the offering price and number of shares;

|

|

|

|

|

•

|

in the case of preferred stock, with respect to the relevant class or series, the offering price, title, maximum number of shares, dividend rate, if any (which may be fixed or variable), time of payment and relative priority of any dividends, any terms for redemption at our option or the option of the holder, any terms for sinking fund payments, any terms for conversion or exchange into other securities, any voting rights, any restrictions on future issuances, any listing on a securities exchange and any other terms of the preferred stock;

|

|

|

|

|

•

|

in the case of warrants, the offering price, designation and terms of the security purchasable upon exercise of the warrant (which may be common or preferred stock), exercise price, amount of such underlying security that may be purchased upon exercise, exercisability and expiration dates, redemption provisions, if any, and any other terms of the warrants;

|

|

|

|

|

•

|

in the case of rights, the offering price, designation and terms of the security purchasable upon exercise of the right (which may be common or preferred stock), exercise price, amount of such underlying security that may be purchased upon exercise, exercisability and expiration dates, and any other terms of the rights; and

|

|

|

|

|

•

|

in the case of units, the terms of the units offered and the terms of the underlying securities comprising the units (which may be common or preferred stock, rights or warrants), and

any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units.

|

Any prospectus supplement may also add, update, or change information contained in this prospectus. Such prospectus supplement will also contain the following information about the offered securities: names of any lead or managing underwriters or agents and a description of any underwriting or agency arrangements; and any underwriting discounts and commissions or agency fees, and our net proceeds. This prospectus may not be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of this offering.

Certain persons participating in an offering of securities may engage in transactions that stabilize, maintain or otherwise affect the price of the securities, including over-allotment and stabilizing transactions in such securities and the imposition of a penalty bid, in connection with such offering. For a description of these activities, see “Plan of Distribution” in this prospectus.

Corporate History

DLH Holdings Corp., a New Jersey corporation, provides government services both as a prime contractor as well as partnering with other government contractors. We were originally incorporated in 1969 as a payroll staffing company. Through several transactions, we have evolved considerably and in early 2010, we divested our commercial temporary staffing business and made the strategic decision to build our company around our wholly-owned government services subsidiary, DLH Solutions, Inc. On May 3, 2016, we acquired Danya International, LLC, a provider of technology-enabled program management, consulting, and digital communications solutions. Our principal executive offices are located at 3565 Piedmont Road, NE, Building 3- Suite 700, Atlanta, GA 30305. We maintain an Internet site at www.dlhcorp.com. The information on our website is not incorporated by reference into this prospectus and you should not consider it to be a part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below, the risks that will be discussed in the applicable prospectus supplement, the risks described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2016, and any risks described in our other filings with the Securities and Exchange Commission, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, before making an investment decision. See the section of this prospectus entitled “Where You Can Find More Information.” Any of the risks we describe below, any applicable prospectus supplement or in the information incorporated herein by reference could cause our business, financial condition, results of operations or future prospects to be materially adversely affected. The market price of our common stock could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition, results of operations or future prospects. Some of the statements in this section of the prospectus are forward-looking statements. For more information about forward-looking statements, please see the section of this prospectus entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Our Industry

We depend on contracts with the Federal government for virtually all of our revenue and our business could be seriously harmed if the Federal government decreased or ceased doing business with us or changed its budgets or budgetary priorities.

Presently, we derive all of our revenue from agencies of the federal government, primarily as a prime contractor but also as a subcontractor to other Federal prime contractors. A major customer is defined as a customer from whom the company derives at least 10% of its revenues. Our largest customer continues to be the Department of Veterans Affairs (VA), which comprised approximately 72% and 95% of revenue for the twelve months ended September 30, 2016 and 2015, respectively, and approximately 58% and 95% of revenue for the six months ended March 31, 2017 and 2016, respectively. Additionally, the Department of Health and Human Services (HHS) represents a major customer, comprising 30% of revenue for the six months ended March 31, 2017 and 13% of revenue for the twelve months ended September 30, 2016, after taking into account the Danya acquisition. In addition, substantially all accounts receivable, including unbilled accounts receivable, are from agencies of the U.S. Government as of March 31, 2017 and September 30, 2016. Accordingly, we remain dependent upon the continuation of our relationships with the VA and HHS. We believe that the credit risk associated with our receivables is limited due to the creditworthiness of these customers.

As of March 31, 2017, awards from VA and HHS include anticipated periods of performance ranging up to three years. These agreements are subject to the Federal Acquisition Regulations, and there can be no assurance as to the actual amount of services that we will ultimately provide to the customers under these awards. While there can be no assurance as to the actual amount of services that we will ultimately provide to VA and HHS under its current contracts, we believe that our strong working relationships and our effective service delivery support ongoing performance for the contract term. Moreover, there is no guarantee that our customers, including the VA will extend existing contracts or that we will be the successful bidder on any new requests for proposals.

Because we derive all of our revenue from contracts with the Federal government, the success and development of our business will continue to depend on our successful participation in Federal government contract programs. In recent years past, we have seen frequent debates regarding the scope of funding of our customers, thereby leading to budgetary uncertainty for our Federal customers. Future instances of this uncertainty may result in reduced awards, postponements in procurement of services and delays in collection of payments, which may affect our results of

operations. Therefore, period-to-period comparisons of our operating results may not be a good indication of our future performance. In the event the budgets or budgetary priorities of the U.S. Government entities with which we do business are delayed, decreased or underfunded, or one or more of our major programs are not continued, our consolidated revenues and results of operations could be materially and adversely affected.

Loss of our GSA schedule contracts or other contracting vehicles could impair our ability to win new business and perform under existing contracts.

We currently hold multiple GSA schedule contracts, including a Federal supply schedule contract for professional and allied healthcare services and the logistics worldwide services contract. If we were to lose one or more of these contracts or other contracting vehicles, we could lose a significant revenue source and our operating results and financial condition could be materially and adversely affected.

Our contract proposals and in many cases our invoices are subject to audits and investigations by U.S. Government agencies and unfavorable government audit results could force us to refund previously recognized revenues and could subject us to a variety of penalties and sanctions.

From time to time, U.S. Government representatives may audit our performance on and invoices submitted on our U.S. Government contract. Further, federal agencies can also audit and review our compliance with applicable laws, regulations and standards. Under these audits, if it is found that we incorrectly invoiced or invoiced work not performed or claimed hours to be performed that were not performed we would have to refund these amounts. Normally, these audits are performed throughout the year and as such if found represent a refund within the current year. However, the government may go further back in time than the present fiscal year and adjustments may result over one or more fiscal years. Additionally, as a government contractor, we are from time to time subject to inquiries and investigations of our business practices by the U.S. Government due to our participation in government contracts. We cannot assure you that any such inquiry or investigation will not have a material adverse effect on our results of operations, cash flows, and financial condition.

If a government audit uncovers illegal activities or activities not in compliance with a contract's terms or conditions, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines, and suspension or debarment from doing business with federal government agencies. In addition, we could suffer serious harm to our reputation if allegations of impropriety were made against us, whether or not true. If we were suspended or debarred from contracting with the federal government generally or with any specific agency, if our reputation or relationships with government agencies were impaired, or if the government otherwise were to cease doing business with us or were to significantly decrease the amount of business it does with us, our revenue, cash flows and operating results would be materially adversely affected. If an audit determines that any of our administrative processes and systems do not comply with requirements, we may be subjected to increased government scrutiny and approval that could delay or otherwise adversely affect our ability to compete for or perform contracts or collect our revenue in a timely manner. Therefore, an unfavorable outcome of an audit could cause actual results to differ materially and adversely from those anticipated. Moreover, if an audit determines that costs were improperly allocated to a specific contract, such amounts would not be reimbursed, and any such costs already reimbursed must be refunded and certain penalties may be imposed

We may experience fluctuations in our revenues and operating results from period to period.

Our profitable financial results depend upon increasing our revenue while managing costs and expense. Our quarterly revenue and operating results may fluctuate significantly and unpredictably in the future. We have expended, and will continue to expend, substantial resources to enhance our health services offerings and expansion into the Federal health market. We may incur growth expenses before new business revenue is realized, thus showing lower profitability in a particular period or consecutive periods. We may be unable to achieve desired levels of revenue growth due to circumstances that are beyond our control, as already expressed regarding competition, government budgets, and the procurement process in general. Although we continue to manage our operating costs and expenses, there is no guarantee that we will increase future revenue and profit in any particular future period. Revenue levels achieved from our customers, the mix of solutions that we offer and our performance on future contracts will affect our financial results.

Future legislative or government budgetary and spending changes could negatively impact our business.

U.S. Government programs are subject to annual congressional budget authorization and appropriation processes. For many programs, Congress appropriates funds on a fiscal year basis even though the program performance period may extend over several years. Consequently, programs are often partially funded initially and additional funds are committed only as Congress makes further appropriations. Further, congressional seats may change during election years, and the balance of spending priorities may change along with them. The election of a new President of the United States could also change Federal spending priorities. These potential shifts in spending priorities could result in lower funding for our VA and Head Start programs.

Our growth into government markets may be impacted by measures in place since March 2013, when the federal government began operating under sequestration required by the Budget Control Act of 2011 (BCA). Under sequestration, reductions in both defense and civil agency expenditures have taken place in each of the government’s fiscal years since 2013 and, unless the BCA is amended or repealed, will continue through the government’s Fiscal Year 2021. VA programs, which accounted for approximately 72% and 95% of our revenue for the fiscal years ended September 30, 2016 and 2015, respectively, and approximately 58% and 95% of revenue for the six months ended March 31, 2017 and 2016, respectively, were exempt from the spending caps established under Federal government sequestration targets enacted in 2013.

A final federal FY2017 budget was not passed into law prior to October 1, 2016. Consequently, a continuing resolution (CR), H.R.5325 Continuing Appropriations and Military Construction, Veterans Affairs, and Related Agencies Appropriation Act, 2017, and Zika Response and Preparedness Act was passed into law on September 29, 2016. This CR provides full-year fiscal 2017 funding for the VA and military construction projects. The measure gives VA officials $74.4 billion in discretionary spending next year, a nearly 4 percent increase over fiscal 2016. The CR freezes spending at fiscal 2016 levels with an additional across-the-board cut of nearly 0.5 percent. On December 10, 2016, a further CR was signed into law to continue funding for federal programs and services until April 28, 2017 and on April 28, 2017, Congress passed a one-week funding extension. On May 5, 2017, a final fiscal year 2017 budget was passed into law. The budget includes additional funding for defense and for border security, but does not implement a number of non-defense budget cuts outlined by the President in March. We do not believe these measures will have a material impact on our current business base for fiscal year 2017, however, any delays in addressing funding may delay the timing of awards for new business, which could result in a significant loss of revenue.

The U.S. Government contract bid process is highly competitive, complex and sometimes lengthy, and is subject to protest and implementation delays.

Many of our contracts and task orders with the Federal government are awarded through a competitive bidding process, which is complex and sometimes lengthy. We expect that much of the business that we will pursue in the foreseeable future will continue to be awarded through competitive bidding. Many of our competitors are larger and have greater resources than we do, larger client bases and greater brand recognition. Our competitors, individually or through relationships with third parties, may be able to provide clients with different or greater capabilities or benefits than we can provide. If we are unsuccessful in competing with these other companies, our revenues and margins may materially decline.

This competitive bidding process presents a number of risks, including the following: (i) we expend substantial cost and managerial time and effort to prepare bids and proposals for contracts that we may not win, and to defend those bids through any protest process; (ii) we may be unable to estimate accurately the resources and cost structure that will be required to service any contract we win; and (iii) we may encounter expenses and delays if our competitors protest or challenge awards of contracts to us in competitive bidding, and any such protest or challenge could result in the resubmission of bids on modified specifications, or in the termination, reduction or modification of awarded contracts. There can be no assurance that we will win any particular bid, or that we will be able to replace business lost upon expiration or completion of a contract. The termination or non-renewal of any of our significant contracts could cause our actual results to differ materially and adversely from those anticipated.

If a bid is won and a contract awarded, there still is the possibility of a bid protest or other delays in implementation. Our business could be adversely affected by delays caused by our competitors protesting major contract awards received by us, resulting in the delay of the initiation of work. It can take many months to resolve protests by one or more of our competitors of contract awards we receive. The resulting delay in the startup and funding of the work under these contracts may cause our actual results to differ materially and adversely from those anticipated, and there can be no assurance that such protest process or implementation delays will not have a material adverse effect on our financial condition or results of operations in the future.

Our business may suffer if we or our employees are unable to obtain the security clearances or other qualifications we and they need to perform services for our clients.

Many federal government contracts require us to have security clearances and employ personnel with specified levels of education, work experience and security clearances. Depending on the level of clearance, security clearances can be difficult and time-consuming to obtain. If we or our employees lose or are unable to obtain necessary security clearances, we may not be able to win new business and our existing clients could terminate their contracts with us or decide not to renew them. To the extent we cannot obtain or maintain the required security clearances for our employees working on a particular contract, we may not derive the revenue anticipated from the contract, which could cause our results to differ materially and adversely from those anticipated.

Our business is regulated by complex federal procurement laws and regulations, and we are subject to periodic compliance reviews by governmental agencies.

We must comply with complex laws and regulations relating to the formation, administration, and performance of federal government contracts. These laws and regulations create compliance risk and affect how we do business with our federal agency clients, and may impose added costs on our business. The government may in the future reform its procurement practices or adopt new contracting rules and regulations, including cost accounting standards, that could be costly to satisfy or that could impair our ability to obtain new contracts.

Our performance on our U.S. Government contracts and our compliance with applicable laws and regulations, including submission of invoices to our customers, are subject to audit by the government. The scope of any such audits could span multiple fiscal years. If a government review or investigation uncovers illegal activities or activities not in compliance with a particular contract's terms or conditions, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, harm to our reputation, suspension of payments, fines, and suspension or debarment from doing business with Federal government agencies. Any of these events could lead to a material reduction in our revenues, cash flows and operating results. Further, as the reputation that we have established and currently maintain with government personnel and agencies is important to our ability to maintain existing business and secure new business, damage to our reputation could have a material adverse effect on our revenue and operating results.

U.S. Government contracts may be terminated at will and we may not receive the full amounts authorized under the contracts included in our backlog, which could reduce our revenue in future periods below the levels anticipated.

Many of the U.S. Government programs in which we participate as a contractor or subcontractor may extend for several years. The U.S. Government may modify, curtail or terminate its contracts and subcontracts for convenience and to the extent that a contract award contemplates one or more option years, the Government may decline to exercise such option periods. Accordingly, the maximum contract value specified under a government contract or task order awarded to us is not necessarily indicative of the revenue that we will realize under that contract. Due to our dependence on these programs, the modification, curtailment or termination of our major programs or contracts may have a material adverse effect on our results of operations and financial condition. In addition, our contracts may only be partially funded at any point during their term, and some of the work intended to be performed under such contracts may remain unfunded pending subsequent appropriations of funds to the contract by the procuring agency. Our backlog consists of funded backlog, which is based on amounts actually committed by a client for payment for goods and services, and unfunded backlog, which is based upon management's estimate of the future potential of our existing contracts and task orders, including options, to generate revenue. Our backlog may not result in actual revenue in any particular period, or at all, which could cause our actual results to differ materially and adversely from those anticipated.

Our business growth and profitable operations require that we develop and maintain strong relationships with other contractors with whom we partner or otherwise depend.

We may enter into future teaming ventures with other companies, which carry risk in regards to maintaining strong, trusted working relationships in order to successfully fulfill contract obligations. Teaming arrangements may include being engaged as a subcontractor to a prime contractor, engaging a subcontractor on a contract for which we are the prime contractor, or entering into a joint venture with another company. We may lack control over fulfillment of such contracts, and poor performance on the contract could impact our customer relationship, even if we perform as required. We expect to depend on relationships with other contractors for a portion of our revenue in the foreseeable future. Our revenue and operating results could differ materially and adversely from those anticipated if any such prime contractor or teammate choses to offer directly to the client services of the type that we provide or if they team with other companies to provide those services.

Our employees, or those of our teaming partners, may engage in misconduct or other improper activities which could harm our business.

We are exposed to risk from misconduct or fraud by our employees, or employees of our teaming partners. Such violations could include intentional disregard for Federal government procurement regulations, engaging in unauthorized activities, seeking reimbursement for improper expenses, or falsifying time records. Employee misconduct could also involve the improper use of our clients’ sensitive or classified information and result in a serious harm to our reputation. While we have appropriate policies in effect to deter illegal activities and promote proper conduct, it is not always possible to deter employee misconduct. Precautions to prevent and detect this activity may not be effective in controlling

such risks or losses, which could materially and adversely affect our business, results of operations, financial condition, cash flows, and liquidity.

Our profits and revenues could suffer if we are involved in legal proceedings, investigations and disputes.

We are exposed to legal proceedings, investigations and disputes. In addition, in the ordinary course of our business we may become involved in legal disputes regarding personal injury or employee disputes. While we provision for these types of incidents through commercial third party insurance carriers, we often defray these types of cost through higher deductibles. Any unfavorable legal ruling against us could result in substantial monetary damages by losing our deductible portion of carried insurance. We maintain insurance coverage as part of our overall legal and risk management strategy to lower our potential liabilities. If we sustain liabilities that exceed our insurance coverage or for which we are not insured, it could have a material adverse impact on our results of operations, cash flows and financial condition, including our profits, revenues and liquidity.

We are dependent upon certain of our management personnel and do not maintain “key personnel” life insurance on our executive officers.

Our success to date has resulted in part from the significant contributions of our executive officers. Our executive officers are expected to continue to make important contributions to our success. Currently, certain of our officers are under employment contracts. However, we do not maintain “key person” life insurance on any of our executive officers. Loss for any reason of the services of our key personnel could materially affect our operations.

We may not be fully covered by the insurance we procure and our business could be adversely impacted if we were not able to renew all of our insurance plans.

Although we carry multiple lines of liability insurance (including coverage for medical malpractice and workers’ compensation), they may not be sufficient to cover the total cost of any judgments, settlements or costs relating to any present or future claims, suits or complaints. If we are unable to secure renewal of our insurance contracts or the renewal of such contracts with favorable rates and with competitive benefits, our business could be adversely affected. In addition, sufficient insurance may not be available to us in the future on satisfactory terms or at all. The placement of our employees at customer locations increases our potential liability for negligence and professional malpractice and such liabilities may not become immediately apparent. Any increase in our costs of insurance will impact our profitability to the extent that we cannot offset these increases into our costs of services. If the insurance we carry is not sufficient to cover any judgments, settlements or costs relating to any present or future claims, suits or complaints, our business, financial condition, results of operations and liquidity could be materially adversely affected.

Our financial condition may be affected by increases in employee healthcare claims and insurance premiums, unemployment taxes and workers’ compensation claims and insurance rates.

Our current workers’ compensation and medical plans are partially self-funded insurance programs. We currently pay base premiums plus actual losses incurred, not to exceed certain individual and aggregate stop-loss limits. In addition, our health insurance premiums, state unemployment taxes and workers’ compensation rates are in large part determined by our claims experience. These categories of expenditure comprise a significant portion of our direct costs. If we experience a large increase in claim activity, our direct expenditures, health insurance premiums, unemployment taxes or workers’ compensation rates may increase. Although we employ internal and external risk management procedures in an attempt to manage our claims incidence and estimate claims expenses and structure our benefit contracts to provide as much cost stability as reasonably possible given the self-funded nature of our plans, we may not be able to prevent increases in claim activity, accurately estimate our claims expenses or pass the cost of such increases on to our clients. Since our ability to incorporate such increases into our fees to our clients is constrained by contractual arrangements with our clients, a delay could occur before such increases could be reflected in our fees, which may

reduce our profit margin. As a result, such increases could have a material adverse effect on our financial condition, results of operations and liquidity.

If we are unable to attract qualified personnel, our business may be negatively affected.

We rely heavily on our ability to attract and retain qualified professionals and other personnel who possess the skills, experience and licenses necessary in order to provide our solutions for our assignments. Our business is materially dependent upon the continued availability of such qualified personnel. Our inability to secure qualified personnel would have a material adverse effect on our business. The cost of attracting qualified personnel and providing them with attractive benefits packages may be higher than we anticipate and, as a result, if we are unable to pass these costs on to our clients, our profitability could decline. Moreover, if we are unable to attract and retain qualified personnel, the quality of our services may decline and, as a result, we could lose clients.

We are exposed to increased costs and risks associated with complying with increasing and new regulation of corporate governance and disclosure standards.

Due to the requirements of the Sarbanes-Oxley Act of 2002, we spend an increasing amount of management’s time and resources (both internal and external) to comply with changing laws, regulations and standards relating to corporate governance and public disclosures. This compliance requires management’s annual review and evaluation of our internal control systems. This process has caused us to engage outside advisory services and has resulted in additional accounting and legal expenses. We may encounter problems or delays in completing these reviews and evaluation and the implementation of improvements. If we are not able to timely comply with the requirements set forth in the Sarbanes-Oxley Act of 2002, we might be subject to sanctions or investigation by regulatory authorities. Any such action could materially adversely affect our business and our stock price.

We are highly dependent on the proper functioning of our information systems.

We are highly dependent on the proper functioning of our information systems in operating our business. Critical information systems used in daily operations match employee resources with client assignments and track regulatory credentialing. They also perform payroll, billing and accounts receivable functions. While we have multiple back up plans for these types of contingencies, our information systems are vulnerable to fire, storm, flood, power loss, telecommunication outages, physical or software break-ins and similar events. If our information systems become inoperable, or are otherwise unavailable, these functions would have to be accomplished manually, which in turn could impact our financial viability, due to the increased cost associated with performing these functions manually.

Our systems and networks may be subject to cybersecurity breaches.

Many of our operations rely heavily upon technology systems and networks to receive, input, maintain and communicate participant and client data pertaining to the programs we manage. If our systems or networks were compromised by a security breach, we could be adversely affected by losing confidential or protected information of program participants and clients, and we could suffer reputational damage and a loss of confidence from prospective and existing clients. Similarly, if our internal networks were compromised, we could be adversely affected by the loss of proprietary, trade secret or confidential technical and financial data. The loss, theft or improper disclosure of that information could subject the Company to sanctions under the relevant laws, lawsuits from affected individuals, negative press articles and a loss of confidence from our government clients, all of which could adversely affect our existing business, future opportunities and financial condition.

We may have difficulty identifying and executing acquisitions on favorable terms and therefore may grow at slower than anticipated rates.

One of our potential paths to growth is to selectively pursue acquisitions. Through acquisitions, we expect to be able to expand our base of federal government customers, increase the range of solutions we offer to our customers and deepen our penetration of existing markets and customers. We may not identify and execute suitable acquisitions. To the extent that management is involved in identifying acquisition opportunities or integrating new acquisitions into our business, our management may be diverted from operating our core business. Without acquisitions, we may not grow as rapidly as expected, which could cause our actual results to differ materially and adversely from those anticipated.

We may encounter other risks in executing our acquisition strategy, including:

|

|

|

|

•

|

increased competition for acquisitions may increase the costs of our acquisitions;

|

|

|

|

|

•

|

non-discovery or non-disclosure of material liabilities during the due diligence process, including omissions by prior owners of any acquired businesses or their employees in complying with applicable laws or regulations, or their inability to fulfill their contractual obligations to the federal government or other customers; and

|

|

|

|

|

•

|

acquisition financing may not be available on reasonable terms or at all.

|

Any of these risks could cause our actual results to differ materially and adversely from those anticipated.

We may have difficulty integrating the operations of companies we acquire, which could cause actual results to differ materially and adversely from those anticipated.

The success of our acquisition strategy will depend upon our ability to successfully integrate any businesses we may acquire in the future. The integration of these businesses into our operations may result in unforeseen operating difficulties, absorb significant management attention and require significant financial resources that would otherwise be available for the ongoing development of our business. Integration difficulties may also include the alignment of personnel with disparate business backgrounds, the transition to new information systems, coordination of geographically dispersed organizations, loss of key employees of acquired companies, and reconciliation of different corporate cultures. For these or other reasons, we may be unable to retain key customers of acquired companies. Moreover, any acquired business may not generate the revenue or net income we expected or produce the efficiencies or cost-savings we anticipated. Any of these outcomes could cause our actual results to differ materially and adversely from those anticipated.

If our subcontractors do not perform their contractual obligations, our performance as a prime contractor and our ability to obtain future business could be materially and adversely impacted and our actual results could differ materially and adversely from those anticipated.

Our performance of government contracts may involve the issuance of subcontracts to other companies upon which we rely to perform all or a portion of the work we are obligated to deliver to our customers. Unsatisfactory performance by one or more of our subcontractors to deliver on a timely basis the agreed-upon supplies, perform the agreed-upon services, or appropriately manage their vendors may materially and adversely impact our ability to perform our obligations as a prime contractor. A subcontractor’s performance deficiency could result in the government terminating our contract for default. A default termination could expose us to liability for excess costs of re-procurement by the government and have a material adverse effect on our ability to compete for future contracts and task orders. Depending upon the level of problem experienced, such problems with subcontractors could cause our actual results to differ materially and adversely from those anticipated.

We have incurred new debt in connection with our recent acquisition and we must make the scheduled principal and interest payments on the facility and maintain compliance with other debt covenants.

On May 2, 2016, we entered into a loan agreement with Fifth Third Bank under which the bank agreed to provide (i) a $25.0 million senior secured term loan, the term loan, with a five-year maturity date and (ii) a two-year revolving loan facility in an aggregate amount of up to $10.0 million, the revolving loan facility. Upon closing, we received the full $25.0 million under the term loan and drew $5.0 million from the revolving loan facility. The loan is secured by all of our assets. Interest on the loan accrues at the rate of LIBOR plus 3.0% per annum. As of March 31, 2017, the outstanding loan balance on the term loan was approximately $21.6 million and all prior draws under the revolving credit facility were repaid.

The loan agreement requires compliance with a number of financial covenants and contains restrictions on our ability to engage in certain transactions. Among other matters, we must comply with limitations on: granting liens; incurring other indebtedness; maintenance of assets; investments in other entities and extensions of credit; mergers and consolidations; and changes in nature of business. Also, the loan agreement requires us to comply with certain financial covenants including a minimum fixed charge coverage ratio and a Funded Indebtedness to Adjusted EBITDA ratio. In addition to monthly payments of the outstanding indebtedness, the loan agreement also requires prepayments of a percentage of excess cash flow, as defined in the loan agreement. Accordingly, a portion of our cash flow from operations will be dedicated to the repayment of our indebtedness.

The loan agreement provides for customary events of default following which the bank may, at its option, terminate the commitments under the loan agreement, stop making additional credit available, declare amounts outstanding, including principal and accrued interest and fees, payable immediately, and enforce any and all rights and interests of the lenders. The defined events of default include, among other things, a payment default, covenant default or defaults on other indebtedness or judgments in excess of a stipulated amount, change of control events, suspension or disbarment from contracting with the federal government and the material inaccuracy of our representations and warranties. If we are unable to make the scheduled principal and interest payments on the loan agreement or maintain compliance with other debt covenants, we may be in default under the loan agreement, which would likely have a material adverse effect on our business, financial condition and results of operations.

We have a substantial amount of goodwill on our balance sheet. Future write-offs of goodwill may have the effect of decreasing our earnings or increasing our losses.

We have previously obtained growth through acquisitions of other companies and businesses. Under existing accounting standards, we are required to periodically review goodwill assets for possible impairment. In the event that we are required to write down the value of any assets under these pronouncements, it may materially and adversely affect our earnings.

We have a significant amount of net operating loss carry forwards which we may not be able to utilize in certain circumstances.

At September 30, 2016, we had net operating losses, or NOLs, of approximately $36 million and $3.6 million for U.S. and state tax return purposes, respectively. Our U.S. NOLs begin to expire in 2021 and continue to expire through 2033. Due to our recent trend of positive operating results, in the fiscal year ended September 30, 2016 we realized a $0.9 million net tax benefit related to the release of a portion of our valuation allowance, to reflect the amount of our deferred tax asset that we expect to realize in future years. This release is based upon our current estimate of future taxable earnings based on results generated through the fiscal year ended September 30, 2016. As a result of our non-cash valuation allowance release during our fiscal year ended September 30, 2016, our U.S. tax provision expense in future periods may be at a higher effective tax rate, which will reduce our net income (or loss) and earnings (or loss) per

share by a greater amount than it has in the past. Further, our ability to utilize our NOL carryforwards to reduce taxable income in future years could become subject to significant limitations under Section 382 of the Internal Revenue Code if we undergo an ownership change. We would undergo an ownership change if, among other things, the stockholders who own or have owned, directly or indirectly, 5% or more of our common stock, or are otherwise treated as 5% stockholders under Section 382 and the regulations promulgated thereunder, increase their aggregate percentage ownership of our stock by more than 50 percentage points over the lowest percentage of the stock owned by these stockholders at any time during the testing period, which is generally the three-year period preceding the potential ownership change. In the event of an ownership change, Section 382 imposes an annual limitation on the amount of taxable income a corporation may offset with NOL carryforwards. While the offering of our stock pursuant to this prospectus is not expected to result in an ownership change, it may increase the likelihood that we may undergo an ownership change for purposes of Section 382 of the Internal Revenue Code in the future, which would limit our ability to use any NOL carryforwards as described above.

Risks Relating to the Ownership of Our Common Stock

The price of our common stock is volatile and may suffer a decline in value.

The market price of our common stock is subject to fluctuations in response to numerous factors, including factors that have little or nothing to do with us or our performance, and these fluctuations could materially reduce our stock price. These factors include, among other things:

|

|

|

|

•

|

actual or anticipated variations in our operating results and cash flow;

|

|

|

|

|

•

|

the nature and content of our earnings releases, and our competitors’ earnings releases;

|

|

|

|

|

•

|

changes in financial estimates by securities analysts;

|

|

|

|

|

•

|

business conditions in our markets and the general state of the securities markets and the market for similar stocks;

|

|

|

|

|

•

|

the number of shares of our common stock outstanding;

|

|

|

|

|

•

|

our ability to stay in compliance with credit facility covenants;

|

|

|

|

|

•

|

conditions of our competitors and of our current and desired clients;

|

|

|

|

|

•

|

the impact of our ability to effectively implement acquisitions, investments, joint ventures and divestitures that we may undertake;

|

|

|

|

|

•

|

changes in capital markets that affect the perceived availability of capital to companies in our industry;

|

|

|

|

|

•

|

governmental legislation or regulation;

|

|

|

|

|

•

|

the impact of litigation, government investigations or customer or other disputes on our operating performance and future prospects; and

|

|

|

|

|

•

|

general economic and market conditions, such as recessions.

|

In addition, the stock market historically has experienced significant price and volume fluctuations. These fluctuations are often unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common stock.

Significant sales of our common stock, or the perception that significant sales may occur in the future, could adversely affect the market price for the subscription rights and our common stock.

The sale of substantial amounts of our common stock, including the sale of the shares included in this prospectus, could adversely affect the price of these securities. Sales of substantial amounts of our common stock in the public market, and the availability of shares for future sale, including, as March 31, 2017 a total of (A) 2,616,000 shares of our common stock issuable upon exercise of outstanding options to acquire shares of our common stock under our

stock incentive plans and (B) 53,619 shares of common stock which may be issued upon the exercise of presently exercisable warrants, could adversely affect the prevailing market price of our common stock and could cause the market price of our common stock to remain low for a substantial amount of time. Additional options and other equity awards may also be granted under our incentive plans. We cannot foresee the impact of such potential sales on the market, but it is possible that if a significant percentage of such available shares and subscription rights were attempted to be sold within a short period of time, the market for our shares and the subscription rights would be adversely affected. It is also unclear whether or not the market for our common stock could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered. Even if a substantial number of sales do not occur within a short period of time, the mere existence of this “market overhang” could have a negative impact on the market for our common stock and the subscription rights and our ability to raise additional capital.

Since we have not paid dividends on our common stock, you cannot expect dividend income from an investment in our common stock.

We have not paid any dividends on our common stock since our inception and do not contemplate or anticipate paying any dividends on our common stock in the foreseeable future. Future potential lenders may prohibit us from paying dividends without its prior consent. Therefore, holders of our common stock may not receive any dividends on their investment in us. We plan to continue to utilize all earnings, if any, to finance the development and expansion of our business.

We may issue preferred stock with rights senior to our common stock, which may adversely impact the voting and other rights of the holders of our common stock.