Current Report Filing (8-k)

May 23 2017 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 23, 2017

SYNDAX

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37708

|

|

32-0162505

|

|

(state or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

35 Gatehouse Drive, Building D, Floor 3

Waltham, Massachusetts

|

|

02451

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(781) 419-1400

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

❑

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

❑

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

❑

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

❑

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

On May 23, 2017, Syndax Pharmaceuticals, Inc. (the

“Company”) announced that it had commenced a public offering of $50,000,000 of its common stock, par value $0.0001 per share, in an underwritten public offering (the “Offering”). A copy of the press release is attached as Exhibit

99.1 hereto, the terms of which are incorporated herein by reference.

In the prospectus supplement used in connection with the Offering

and filed with the Securities and Exchange Commission (“SEC”), the Company provided the following disclosures as to recent clinical developments:

|

|

•

|

|

In May 2017, the Company announced that the ENCORE 601 non-small cell lung cancer (“NSCLC”) cohort enrolling patients with disease progression on or after PD-1 therapy has met the prespecified objective

response threshold to advance into the second stage of the Phase 2 trial. The cohort of NSCLC patients with disease progression on or after PD-1 therapy will now re-open and enroll a total of 56 patients, and the Company expects to present initial

results from this cohort in the fourth quarter of 2017. Completion of enrollment is anticipated in the first half of 2018. Later this quarter, the Company anticipates being able to determine whether to expand the cohort of NSCLC patients naïve

to PD-1 or PD-L1 therapy.

|

|

|

•

|

|

Also, in May 2017, the Company announced results from the melanoma cohort of the ongoing Phase 2 ENCORE 601 trial of entinostat in combination with KEYTRUDA

®

(pembrolizumab), Merck’s anti-PD-1 (programmed death receptor-1) therapy. The Company reported that the first cohort of 13 melanoma patients who had progressed on or after prior immune checkpoint inhibitor therapy in ENCORE 601 met the

pre-specified objective response criteria to advance into the second stage of the trial, defined as a minimum of two patients demonstrating a confirmed or unconfirmed objective response. Data from the first cohort of patients indicate that four

patients achieved an objective response by irRECIST criteria (three patients had a confirmed response; one patient had an unconfirmed response; 31% ORR, 95% CI: 9—61%). Of the four responders, two patients had stable disease and two patients

had progressive disease as best response to their prior anti-PD-1 therapy prior to progressing, with a median duration on prior anti-PD-1 therapy of 4.9 months (range 2.7-12.5). Three patients remain on treatment, without progression, as of the data

cutoff, one with a partial response, and two with stable disease.

|

|

|

•

|

|

During the fourth quarter of 2017, the Company expects to present correlative data from the biomarker assessments of melanoma patients enrolled in Stage 1 of the Phase 2 ENCORE 601 trial. The Company also expects to

present results from Stage 2 of the Phase 2 melanoma and NSCLC cohorts of ENCORE 601 and from Stage 1 of the Phase 2 colorectal cohort of ENCORE 601 during the first half of 2018.

|

|

|

•

|

|

The Company anticipates presenting efficacy and safety data from the Phase 2 portion of the ENCORE 602 clinical trial during the second half of 2018.

|

This Current Report shall not constitute an offer to sell, or the solicitation of an offer to buy, nor shall there be any sale of the Shares

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Any offer, if at all, will be made only by means of a

prospectus supplement and accompanying prospectus, which will be a part of the Company’s registration statement previously declared effective by the SEC.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated May 23, 2017.

|

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995,

including statements relating to Syndax’s expectations regarding the completion, timing and size of the proposed public offering. These statements are subject to significant risks and uncertainties and actual results could differ materially

from those projected. Syndax cautions investors not to place undue reliance on the forward-looking statements contained in this release. These risks and uncertainties include, without limitation, risks and uncertainties related to market conditions

and the satisfaction of customary closing conditions related to the proposed public offering. There can be no assurance that Syndax will be able to complete the proposed public offering on the anticipated terms, or at all. Risks and uncertainties

relating to Syndax and its business can be found in Syndax’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” sections contained therein, as well as the risks identified in the registration

statement and the preliminary prospectus supplement relating to the offering. These forward-looking statements are based on Syndax’s expectations and assumptions as of the date of this press release. Except as required by law, Syndax undertakes

no duty or obligation to update any forward-looking statements contained in this report as a result of new information, future events or changes in Syndax’s expectations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

SYNDAX PHARMACEUTICALS, INC.

|

|

|

|

|

By:

|

|

/s/ Luke J. Albrecht

|

|

|

|

Luke J. Albrecht

Vice President, General

Counsel and Secretary

|

Dated: May 23, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated May 23, 2017.

|

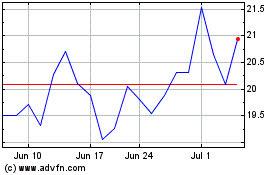

Syndax Pharmaceuticals (NASDAQ:SNDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Syndax Pharmaceuticals (NASDAQ:SNDX)

Historical Stock Chart

From Apr 2023 to Apr 2024