From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that

shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed

to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a

smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of

the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell, either individually or in combination, in one or more offerings, up to a total dollar amount of $50,000,000 of shares of our

common stock as described in this prospectus. In addition, under this shelf process, the selling stockholders to be named in a supplement to this prospectus may, from time to time, offer and sell up to 18,419,274 shares of our common stock, as

described in this prospectus, in one or more offerings.

This prospectus provides you with a general description of the securities we or

the selling stockholders may offer. Each time we or the selling stockholders offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also

authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you

may also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. We urge you to read carefully this prospectus, any applicable prospectus supplement

and any related free writing prospectuses we have authorized for use in connection with a specific offering, together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information By

Reference,” before buying any of the securities being offered.

This prospectus may not be used to consummate a sale of shares of

our common stock unless it is accompanied by a prospectus supplement.

You should rely only on the information contained in, or

incorporated by reference into, this prospectus and any applicable prospectus supplement, along with the information contained in any free writing prospectuses we have authorized for use in connection with a specific offering. Neither we nor any

selling stockholder have authorized anyone to provide you with information in addition to or different from that contained in this prospectus, any applicable prospectus supplement and any related free writing prospectus. We take no responsibility

for, and can provide no assurances as to the reliability of, any information not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we or a selling stockholder may authorize to be provided

to you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus

supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those

dates.

Unless the context otherwise indicates, references in this prospectus to “Rapid7,” “we,” “our,”

“us” and “the Company” refer, collectively, to Rapid7, Inc., a Delaware corporation. Our principal executive offices are located at 100 Summer Street, Boston, Massachusetts 02110 and our telephone number is

(617) 247-1717.

1

PROSPECTUS SUMMARY

The following summary highlights selected information contained or incorporated by reference elsewhere in this prospectus

and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, the applicable prospectus supplement and any

related free writing prospectus, including the information under the caption “Risk Factors” herein and the applicable prospectus supplement and under similar headings in the other documents that are incorporated by reference into this

prospectus. You should also carefully read the other information incorporated by reference into this prospectus, including our financial statements and the related notes, and the exhibits to the registration statement of which this prospectus is a

part.

Rapid7, Inc.

Business

Overview

Rapid7 is a leading provider of analytics for security and IT operations that enable organizations to implement an active,

analytics-driven approach to cyber security and IT operations. Our data and analytics platform was purpose-built for today’s increasingly complex and chaotic IT environment. We make it simple to collect and unify operational data from across

the entire IT infrastructure, and our advanced analytics unlock the information required to securely operate, manage and develop today’s sophisticated applications and services.

We combine our extensive experience in collecting disparate data, deep insight into attacker behaviors and techniques and our purpose-driven

analytics to make sense of the wealth of data available to organizations about their IT environments and users. Our powerful and proprietary analytics enable organizations to contextualize and prioritize the threats facing their physical, virtual

and cloud assets, including those posed by the behaviors of their users. Leveraging our IT data and analytics platform, our solutions enable organizations to strategically and dynamically manage their cyber security exposure and manage IT

operations. Our solutions empower organizations to prevent attacks by providing visibility into vulnerabilities, and allow them to rapidly detect compromises, respond to breaches and correct the underlying causes of attacks. By providing a unified

IT and security platform, with automated workflow, we enable IT and security to work together more effectively to develop, operate and secure their environment. For example, our platform and proprietary technologies were developed to help customers

identify the weaknesses and exposures in their environment and are designed to enable them to detect and respond to breaches immediately. We help them troubleshoot performance issues across their infrastructure, applications and endpoints. Our

platform approach enables organizations to collect data once and use it for ongoing unlimited use and access to solve the specific problems their organization faces, reducing the costs and overhead associated with relying on point solutions, and

enabling workflow between organizations that must work together to resolve issues, reduce risk and increase resiliency.

We have three

offerings: (1) threat exposure management, which includes our Nexpose, InsightVM, Metasploit, AppSpider and InsightAppSec products, (2) incident detection and response, which includes our InsightIDR, Managed Detection and Response

(formerly known as “Analytic Response”), InsightOps and Logentries products, as well as our incident response services and (3) security advisory services.

We also offer various professional services across all of our offerings, including deployment and training services related to our Nexpose,

Metasploit, AppSpider and InsightIDR software products, incident response services and security advisory services. Customers can purchase our professional services together with our product offerings or on a stand-alone basis pursuant to fixed fee

or time-and-materials agreements.

Corporate Information

We were initially incorporated in July 2000 in Delaware. Rapid7 LLC, a limited liability company organized under the laws of the Commonwealth

of Massachusetts, was formed in January 2004. In August 2004, pursuant to an exchange agreement among Rapid7 LLC and the stockholders of Rapid7, Inc., the stockholders exchanged their shares in Rapid7, Inc. for equity interests in Rapid7 LLC, after

which Rapid7, Inc. was dissolved. In August 2008, Rapid7 LLC was merged with and into Rapid7 LLC, a newly-formed Delaware limited liability company. Rapid7, Inc. was reincorporated in Delaware in October 2011. In a series of transactions in November

2011, equity holders of Rapid7 LLC exchanged their equity interests in Rapid7 LLC for capital stock in Rapid7, Inc. and Rapid7 LLC became a wholly-owned subsidiary of Rapid7, Inc., which is the registrant and issuer of the shares of common stock in

this offering.

2

Our principal executive offices are located at 100 Summer Street, Boston, Massachusetts. Our

telephone number is (617) 247-1717. Our website address is www.rapid7.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not

consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

“Rapid7,” the Rapid7 logo, and other trademarks or service marks of Rapid7, Inc. appearing in this prospectus are the property of

Rapid7, Inc. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear

without the

®

or TM symbols.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act.

An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. As an emerging growth company:

|

|

•

|

|

we have availed ourselves of the exemption from the requirement to obtain an attestation and report from our

auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

|

|

|

•

|

|

we will provide less extensive disclosure about our executive compensation arrangements; and

|

|

|

•

|

|

we will not require stockholder non-binding advisory votes on executive compensation or golden parachute

arrangements.

|

We may use these provisions until the last day of our fiscal year following the fifth anniversary of our

initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion

of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. We may choose to take advantage of some but not all of these reduced burdens. To the extent that we continue

to take advantage of these reduced burdens, the information that we provide stockholders may be different than you might obtain from other public companies in which you hold equity interests.

The Shares of Common Stock We May Offer

We may offer shares of our common stock up to a total dollar amount of $50,000,000, from time to time under this prospectus, together with any

applicable prospectus supplement and any related free writing prospectuses, at prices and on terms to be determined by market conditions at the time of any offering. In addition, the selling stockholders to be named in a supplement to this

prospectus may offer or sell, from time to time, up to 18,419,274 shares of our common stock. This prospectus provides you with a general description of the common stock we or the selling stockholders may offer. Each time we or the selling

stockholders offer common stock under this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the offering.

Any applicable prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update

or change any of the information contained in this prospectus or in the documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this

prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

THIS PROSPECTUS MAY NOT

BE USED TO CONSUMMATE A SALE OF SHARES OF OUR COMMON STOCK UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

3

We or the selling stockholders may sell the common stock directly to investors or to or

through agents, underwriters or dealers. We and the selling stockholders, and our or their agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of common stock. If we or the selling stockholders do offer

common stock to or through agents or underwriters, we will include in the applicable prospectus supplement:

|

|

•

|

|

the names of those agents or underwriters;

|

|

|

•

|

|

applicable fees, discounts and commissions to be paid to them;

|

|

|

•

|

|

details regarding over-allotment or other options, if any; and

|

|

|

•

|

|

the net proceeds to us.

|

We may issue shares of our common stock from time to time. The selling stockholders may offer shares of our common stock to the extent such

shares were issued and outstanding, or issuable upon exercise or conversion of securities issued and outstanding, prior to the original date of filing of the registration statement to which this prospectus relates. The holders of our common stock

are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Subject to preferences that may be applicable to any outstanding shares of preferred stock, the holders of common stock are entitled to

receive ratably such dividends as may be declared by our board of directors out of legally available funds. Upon our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in all assets remaining after

payment of liabilities and the liquidation preferences of any outstanding shares of preferred stock. Holders of common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or

sinking fund provisions applicable to our common stock. In this prospectus, we have summarized certain general features of the common stock under “Description of Capital Stock—Common Stock.” We urge you, however, to read the

applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related to any common stock being offered.

Use of Proceeds

Except as described in

any applicable prospectus supplement or in any related free writing prospectuses we have authorized for use in connection with a specific offering, we currently intend to use the net proceeds from the sale of the common stock offered by us

hereunder, if any, for working capital, capital expenditures and other general corporate purposes, funding future acquisition, or for any other purpose we describe in the applicable prospectus supplement. We will not receive any proceeds from the

sale of shares of our common stock by any selling stockholder. See “Use of Proceeds” in this prospectus.

Exchange Listing

Our common stock is listed on the NASDAQ Global Market under the symbol “RPD.” The applicable prospectus supplement will contain

information, where applicable, as to other listings, if any, of the shares of our common stock covered by the applicable prospectus supplement.

4

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risks described in the documents incorporated by reference in this prospectus and any applicable prospectus supplement and any related free writing prospectus, as well as other information we include or incorporate by reference into this

prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities

could decline due to the occurrence of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and

uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described above and in the documents incorporated herein by reference, including in

(1) our most recent annual report on Form 10-K on file with the SEC, (2) our most recent quarterly report on Form 10-Q on file with the SEC and is incorporated herein by reference, and 3) as well as any amendments thereto

reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus, the documents incorporated by reference and any free writing prospectus

that we may authorize for use in connection with a specific offering.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives,

assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “may,” “could,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” and similar expressions, or

the negative of these terms, or similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements

are qualified in their entirety by reference to the factors discussed throughout this prospectus, and in particular those factors referenced in the section “Risk factors.”

This prospectus contains forward-looking statements that are based on our management’s belief and assumptions and on information

currently available to our management. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could

differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

Except as described in any applicable prospectus supplement or in any related free writing prospectuses we may

authorize for use in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered by us hereunder, if any, for working capital, capital expenditures and other general corporate purposes. In

addition, we may use a portion of the proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or

investments. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from the sale of the securities offered by us hereunder. We will set forth in the applicable prospectus

supplement or free writing prospectus our intended use for the net proceeds received from the sale of any securities sold pursuant to the prospectus supplement or free writing prospectus.

We will not receive any proceeds from the sale of shares of our common stock by any selling stockholder.

5

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock, of certain provisions of our amended and restated certificate of incorporation and amended and

restated by-laws, and of certain provisions of Delaware law, together with the additional information we include in any applicable prospectus supplement and in any related free writing prospectus, summarizes the material terms and provisions of our

capital stock. The following description of our capital stock is a summary and does not purport to be complete and is subject to, and qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and

restated by-laws, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Authorized Capital Stock

Our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.01 per share, and 10,000,000 shares of

preferred stock, par value $0.01 per share, all of which are undesignated. As of May 19, 2017, we had 43,154,999 shares of common stock outstanding and no shares of preferred stock outstanding.

Common Stock

The holders of our common

stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock do not have any cumulative voting rights. Because of this, the holders of a majority of the shares of common

stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose. Holders of our common stock are entitled to receive ratably any dividends declared by the board of directors out of

funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund

provisions.

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in

all assets remaining after payment of all debts and other liabilities and any liquidation preference of any outstanding preferred stock. All of our outstanding shares of common stock are, and the shares of common stock to be sold in this offering

are, fully paid and nonassessable.

The rights, preferences and privileges of the holders of common stock are subject to, and may be

adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future.

Preferred Stock

Our board of directors has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred

stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation

preferences, sinking fund terms and the number of shares constituting, or the designation of, such series, any or all of which may be more favorable than the rights of our common stock. The issuance of our preferred stock could adversely affect the

voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a

change in control of our company or other corporate action.

We have no present plans to issue any shares of preferred stock.

Anti-Takeover Provisions of Our Certificate of Incorporation and By-laws and Delaware Law

Our certificate of incorporation and by-laws, as well as Section 203 of the Delaware General Corporation Law, include a number of

provisions that may have the effect of delaying, deferring or preventing another party from acquiring control of us and encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of

directors rather than pursue non-negotiated takeover attempts. These provisions include the items described below.

6

Board composition and filling vacancies

Our certificate of incorporation provides for the division of our board of directors into three classes serving staggered three-year terms,

with one class being elected each year. Our certificate of incorporation also provides that directors may be removed only for cause and then only by the affirmative vote of the holders of 66

2

⁄

3

% or more of the shares then entitled to vote at an election of directors. Furthermore, the authorized number of directors number of directors may be changed only by resolution of the board of directors, and any

vacancy on our board of directors, however occurring, including a vacancy resulting from an increase in the size of our board, may only be filled by the affirmative vote of a majority of our directors then in office, even if less than a quorum. The

classification of directors, together with the limitations on removal of directors and treatment of vacancies, has the effect of making it more difficult for stockholders to change the composition of our board of directors.

No written consent of stockholders

Our certificate of incorporation provides that all stockholder actions are required to be taken by a vote of the stockholders at an annual or

special meeting, and that stockholders may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take stockholder actions and would prevent the amendment of our by-laws or removal of

directors by our stockholders without holding a meeting of stockholders.

Meetings of stockholders

Our certificate of incorporation and by-laws provide that only our chairman of the board, chief executive officer or a majority of the

members of our board of directors then in office may call special meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon at a special meeting of stockholders. Our by-laws limit

the business that may be conducted at an annual meeting of stockholders to those matters properly brought before the meeting.

Advance notice

requirements

Our by-laws establish advance notice procedures with regard to stockholder proposals relating to the nomination of

candidates for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to our corporate secretary prior to the meeting at

which the action is to be taken. Generally, to be timely, notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. Our

by-laws specify the requirements as to form and content of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an annual or special meeting.

Amendment to certificate of incorporation and by-laws

Any amendment of our certificate of incorporation must first be approved by a majority of our board of directors, and if required by law or our

certificate of incorporation, must thereafter be approved by a majority of the outstanding shares entitled to vote on the amendment and a majority of the outstanding shares of each class entitled to vote thereon as a class, except that the amendment

of the provisions relating to stockholder action, board composition, limitation of liability, forum selection and the amendment of our by-laws or our certificate of incorporation must be approved by not less than

66

2

⁄

3

% of the outstanding shares entitled to vote on the amendment. Our by-laws may be amended by the affirmative vote of a majority of the directors then in

office, subject to any limitations set forth in the by-laws; and may also be amended by the affirmative vote of at least 66

2

⁄

3

% of the outstanding shares

entitled to vote on the amendment, voting together as a single class.

Undesignated preferred stock

Our certificate of incorporation provides for 10,000,000 authorized shares of preferred stock. The existence of authorized but unissued shares

of preferred stock may enable our board of directors to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in the due exercise of its fiduciary obligations, our board of

directors were to determine that a takeover proposal is not in the best interests of our stockholders, our board of directors could cause shares of preferred stock to be issued without stockholder approval in one or more private offerings or other

transactions that might dilute the voting or other

7

rights of the proposed acquirer or insurgent stockholder or stockholder group. In this regard, our certificate of incorporation grants our board of directors broad power to establish the rights

and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares of common stock. The issuance may also

adversely affect the rights and powers, including voting rights, of these holders and may have the effect of delaying, deterring or preventing a change in control of us.

Section 203 of the Delaware general corporation law

We are subject to the provisions of Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a publicly

held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes an interested stockholder, unless the business

combination is approved in a prescribed manner. Under Section 203, a business combination between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

|

|

•

|

|

before the stockholder became interested, our board of directors approved either the business combination or

the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the

interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and

also officers, and employee stock plans, in some instances, but not the outstanding voting stock owned by the interested stockholder; or

|

|

|

•

|

|

at or after the time the stockholder became interested, the business combination was approved by our board of

directors and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least 66

2

⁄

3

% of the outstanding voting stock which

is not owned by the interested stockholder.

|

Section 203 defines a business combination to include:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, lease, pledge or other disposition involving the interested stockholder of 10% or more of

the assets of the corporation;

|

|

|

•

|

|

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any

stock of the corporation to the interested stockholder;

|

|

|

•

|

|

subject to exceptions, any transaction involving the corporation that has the effect of increasing the

proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other

financial benefits provided by or through the corporation.

|

In general, Section 203 defines an interested

stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

Choice of Forum

Our certificate of

incorporation provides that the Court of Chancery of the State of Delaware is the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty owed by and of our directors, officers

or employees to us or our stockholders; any action asserting a claim against us arising pursuant to the Delaware General Corporation Law, our certificate of incorporation or our by-laws; or any action asserting a claim against us that is governed by

the internal affairs doctrine. Several lawsuits have been filed in Delaware challenging the enforceability of similar choice of forum provisions and it is possible that a court determines such provisions are not enforceable.

8

Registration Rights

Certain holders of shares of our common stock are entitled to certain rights with respect to registration of such shares under the Securities

Act pursuant to the terms of an investors’ rights agreement. These shares are collectively referred to herein as registrable securities.

The investors’ rights agreement provides the holders of registrable securities with demand, piggyback and S-3 registration rights as

described more fully below. As of May 19, 2017, an aggregate of 21,895,075 registrable securities were entitled to these demand, piggyback and S-3 registration rights.

Demand Registration Rights

The

holders of 20% of the registrable securities held by (1) affiliates of Bain Capital Venture Partners, LLC and (2) affiliates of Technology Crossover Ventures each respectively have the right to make up to two demands that we file a

registration statement under the Securities Act covering at least 40% of the registrable securities then outstanding (or lesser percentage if the proposed aggregate offering price would exceed $15.0 million, net of underwriting discounts and

commissions), subject to specified exceptions. We are not obligated to effect any such registration during the period that is sixty days prior to our good faith estimate of the date of filing of, and ending on a date that is one hundred eighty days

after the effective date of, a registration initiated by us.

Piggyback Registration Rights

If we register any securities for public sale, the holders of our registrable securities then outstanding are each entitled to notice of the

registration and have the right to include their shares in the registration statement. The underwriters of any underwritten offering will have the right to limit the number of shares having registration rights to be included in the registration

statement, but not below 30% of the total number of securities included in such registration.

Registration on Form S-3

As long as we are eligible to file a registration statement on Form S-3, the holders of at least 15% of our registrable securities held by

(i) affiliates of Bain Capital Venture Partners, LLC and (ii) affiliates of Technology Crossover Ventures each respectively have the right to demand that we file a registration statement on Form S-3 provided that the aggregate amount of

securities to be sold under the registration statement is at least $5.0 million, net of underwriting discounts and commissions. Affiliates of Bain Capital Venture Partners, LLC, on the one hand, and affiliates of Technology Crossover Ventures, on

the other hand, each respectively may only demand a registration on Form S-3 once during each 12-month period. The right to have such shares registered on Form S-3 is further subject to other specified conditions and limitations. We are not

obligated to effect any such registration during the period that is thirty days prior to our good faith estimate of the date of filing of, and ending on a date that is ninety days after the effective date of, a registration initiated by us.

Expenses of Registration

We will

pay all expenses relating to any demand, piggyback or Form S-3 registration, other than underwriting discounts and commissions, subject to specified conditions and limitations.

Termination of Registration Rights

These registration rights will terminate on July 22, 2022, or, with respect to any particular stockholder, when such stockholder is able

to sell all of its shares pursuant to Rule 144 under the Securities Act or a similar exemption during any three-month period without volume limitations.

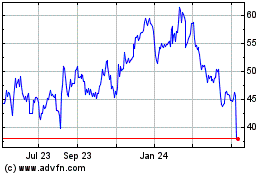

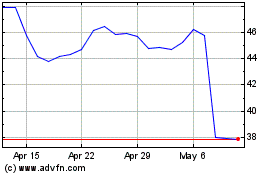

Exchange Listing

Our common stock is

listed on the NASDAQ Global Market under the symbol “RPD.” On May 22, 2017, the closing price for our common stock was $18.04 per share. As of May 19, 2017, we had approximately 153 stockholders of record.

9

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. The transfer agent’s address is 250 Royall

Street, Canton, Massachusetts 02021.

10

SELLING STOCKHOLDERS

This prospectus also relates to the possible resale by certain of our stockholders, who we refer to in this prospectus as the selling

stockholders, of up to 18,419,274 shares of our common stock that were issued and outstanding prior to the date of the registration statement of which this prospectus forms a part. The selling stockholders are former holders of our preferred stock

and common stock originally acquired through several private placements prior to or concurrently with our initial public offering. All of such shares of preferred stock were converted into shares of our common stock in connection with our initial

public offering.

The applicable prospectus supplement will set forth the name of each of the selling stockholders and the number of

securities beneficially owned by such selling stockholder that are covered by such applicable prospectus supplement. The applicable prospectus supplement will also disclose whether any of the selling stockholders has held any position or office

with, has been employed by, or otherwise has had a material relationship with us during the three years prior to the date of the applicable prospectus supplement.

The selling stockholders shall not sell any shares of our common stock pursuant to this prospectus until we have identified such selling

stockholders and the shares being offered for resale by such selling stockholders in a subsequent prospectus supplement. However, the selling stockholders may sell or transfer all or a portion of their shares of our common stock pursuant to any

available exemption from the registration requirements of the Securities Act.

11

PLAN OF DISTRIBUTION

We or the selling stockholders may sell our common stock from time to time:

|

|

•

|

|

to or through underwriters;

|

|

|

•

|

|

directly to one or more purchasers; or

|

|

|

•

|

|

through a combination of any of these methods or any other method permitted by law.

|

We or the selling stockholders may directly solicit offers to purchase securities, or agents may be designated to solicit such offers. In any

applicable prospectus supplement relating to such offering, we will name any agent that could be viewed as an underwriter under the Securities Act and describe any commissions that we or the selling stockholders must pay to any such agent. Any such

agent will be acting on a best efforts basis for the period of its appointment or, if indicated in the applicable prospectus supplement, on a firm commitment basis. This prospectus may be used in connection with any offering of our securities

through any of these methods or other methods described in the applicable prospectus supplement.

The distribution of the shares of our

common stock may be effected from time to time in one or more transactions:

|

|

•

|

|

at a fixed price, or prices, which may be changed from time to time;

|

|

|

•

|

|

at market prices prevailing at the time of sale;

|

|

|

•

|

|

at prices related to such prevailing market prices; or

|

Each prospectus supplement will describe the method of distribution of the shares of our common stock and any applicable restrictions.

A prospectus supplement or supplements (and any related free writing prospectus that we may authorize to be provided to you with respect to a

particular offering) will describe the terms of the offering of the shares of our common stock, including the following:

|

|

•

|

|

the name or names of the agent or any underwriters;

|

|

|

•

|

|

the public offering or purchase price of the shares of our common stock or other consideration therefor, and

the proceeds, if any, we will receive from the sale;

|

|

|

•

|

|

any over-allotment options under which underwriters may purchase additional shares of our common stock from

us;

|

|

|

•

|

|

any agency fees or underwriting discounts and commissions to be allowed or paid to the agent or underwriters;

|

|

|

•

|

|

all other items constituting underwriting compensation;

|

|

|

•

|

|

any discounts and commissions to be allowed or paid to dealers; and

|

|

|

•

|

|

any securities exchange or market on which the shares of our common stock will be listed.

|

If any underwriters or agents are used in the sale of the shares of our common stock in respect of which this

prospectus is delivered, we or the selling stockholders will enter into an underwriting agreement, sales agreement or other agreement with them at the time of sale to them, and we will set forth in the applicable prospectus supplement relating to

such offering the names of the underwriters or agents and the terms of the related agreement with them.

12

In connection with the offering of securities, we or the selling stockholders may grant to the

underwriters an option to purchase additional securities with an additional underwriting commission, as may be set forth in the applicable prospectus supplement. If the selling stockholders grant any such option, the terms of such option will be set

forth in the applicable prospectus supplement for such securities.

If a dealer is used in the sale of the securities in respect of which

the prospectus is delivered, we or the selling stockholders will sell such securities to the dealer, as principal. The dealer, who may be deemed to be an “underwriter” as that term is defined in the Securities Act, may then resell such

securities to the public at varying prices to be determined by such dealer at the time of resale.

We or the selling stockholders may

provide agents and underwriters with indemnification against civil liabilities, including liabilities under the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect to those liabilities. In

addition, we will indemnify the selling stockholders against certain civil liabilities, including certain liabilities under the Securities Act, and the selling stockholders will be entitled to contribution from us with respect to those liabilities.

The selling stockholders will indemnify us against certain civil liabilities, including liabilities under the Securities Act, and we will be entitled to contribution from the selling stockholders with respect to those liabilities.

If so indicated in the applicable prospectus supplement, we or the selling stockholders will authorize underwriters or other persons acting as

agents to solicit offers by certain institutions to purchase securities from us or the selling stockholders pursuant to delayed delivery contracts providing for payment and delivery on the date stated in the applicable prospectus supplement. Each

contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to such contracts shall not be less nor more than, the respective amounts stated in the applicable prospectus supplement. Institutions with whom the

contracts, when authorized, may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and other institutions. Delayed delivery contracts will not be subject to

any conditions except that:

|

|

•

|

|

the purchase by an institution of the securities covered under that contract shall not at the time of delivery

be prohibited under the laws of the jurisdiction to which that institution is subject; and

|

|

|

•

|

|

if the securities are also being sold to underwriters acting as principals for their own account, the

underwriters shall have purchased such securities not sold for delayed delivery. The underwriters and other persons acting as the selling stockholders’ agents will not have any responsibility in respect of the validity or performance of delayed

delivery contracts.

|

Offered securities may also be offered and sold, if so indicated in the applicable prospectus

supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or more remarketing firms, acting as principals for their own accounts or as agents for us

or the selling stockholders. Any remarketing firm will be identified and the terms of its agreement, if any, with us or the selling stockholders and its compensation will be described in the applicable prospectus supplement. Remarketing firms may be

deemed to be underwriters in connection with their remarketing of offered securities.

Certain agents, underwriters and dealers, and their

associates and affiliates, may be customers of, have borrowing relationships with, engage in other transactions with, or perform services, including investment banking services, for us or one or more of our respective affiliates and/or the selling

stockholders or one or more of its respective affiliates in the ordinary course of business for which they receive compensation.

In order

to facilitate the offering of the shares of our common stock, any underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the securities or any other securities the prices of which may be used to determine

payments on such securities. Specifically, any underwriters may overallot in connection with the offering, creating a short position for their own accounts. In addition, to cover overallotments or to stabilize the price of the securities or of any

such other securities, the underwriters may bid for, and purchase, the securities or any such other securities in the open market. Finally, in any offering of the shares of our common stock through a syndicate of underwriters, the underwriting

syndicate may reclaim selling concessions allowed to an underwriter or a dealer for distributing the securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in

stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. Any such underwriters are not required to engage in these activities and may end any of

these activities at any time.

13

We or the selling stockholders may engage in at the market offerings into an existing trading

market in accordance with Rule 415(a)(4) under the Securities Act. In addition, we or the selling stockholders may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in

privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in

short sale transactions. If so, the third party may use securities pledged by us or the selling stockholders or borrowed from us or the selling stockholders or others to settle those sales or to close out any related open borrowings of stock, and

may use securities received in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the

applicable prospectus supplement (or a post-effective amendment). In addition, we or the selling stockholders may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using

this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in three business days, unless the

parties to any such trade expressly agree otherwise. The applicable prospectus supplement may provide that the original issue date for your securities may be more than three scheduled business days after the trade date for your securities.

Accordingly, in such a case, if you wish to trade securities on any date prior to the third business day before the original issue date for your securities, you will be required, by virtue of the fact that your securities initially are expected to

settle in more than three scheduled business days after the trade date for your securities, to make alternative settlement arrangements to prevent a failed settlement.

In compliance with the guidelines of the Financial Industry Regulatory Authority, Inc., or FINRA, the aggregate maximum discount,

commission or agency fees or other items constituting underwriting compensation to be received by any FINRA member or independent broker-dealer will not exceed 8% of the proceeds from any offering pursuant to this prospectus and any applicable

prospectus supplement.

The specific terms of any lock-up provisions in respect of any given offering will be described in the applicable

prospectus supplement.

The anticipated date of delivery of offered securities will be set forth in the applicable prospectus supplement

relating to each offer.

14

LEGAL MATTERS

Cooley LLP, Boston, Massachusetts will pass upon the validity of the shares of common stock offered hereby unless otherwise indicated in

the applicable prospectus supplement. Any underwriters will also be advised about the validity of the securities and other legal matters by their own counsel, which will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Rapid7, Inc. and subsidiaries as of December 31, 2016 and 2015, and for each of the years in the

three-year period ended December 31, 2016, have been incorporated by reference herein and in the registration statement in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein,

and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE

INFORMATION

We are subject to the information requirements of the Exchange Act and, in accordance therewith, file annual, quarterly

and special reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330

for further information on the operation of the Public Reference Room. These documents also may be accessed through the SEC’s electronic data gathering, analysis and retrieval system, or EDGAR, via electronic means, including the SEC’s

home page on the Internet (

www.sec.gov

).

This prospectus is part of the registration statement on Form S-3 we filed with the SEC

under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and

you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information and reports we file with it, which means that we can disclose

important information to you by referring you to these documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede the

information already incorporated by reference. We are incorporating by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the

Exchange Act (other than Current Reports or portions furnished under Items 2.02 or 7.01 of Form 8-K), including all filings made after the date of the filing of this registration statement of which this prospectus is a part and prior to the

effectiveness of this registration statement until we file a post-effective amendment that indicates the termination of the offering of the securities covered by this prospectus

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on

March 9, 2017;

|

|

|

•

|

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the year

ended December 31, 2016 from our definitive proxy statement on Schedule 14A related to our 2017 annual meeting of stockholders, which was filed with the SEC on April 27, 2017;

|

|

|

•

|

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, which was filed with the SEC

on May 10, 2017;

|

|

|

•

|

|

our Current Report on Form 8-K filed with the SEC on February 2, 2017; and

|

|

|

•

|

|

the description of our common stock contained in our registration statement on Form 8-A, which was filed

with the SEC on July 13, 2015, including any amendment or report filed for the purpose of updating such description.

|

15

Upon request, we will provide, without charge, to each person, including any beneficial owner, to

whom a copy of this prospectus is delivered, a copy of the documents incorporated by reference into this prospectus but not delivered with the prospectus. You may request a copy of these filings, and any exhibits we have specifically incorporated by

reference as an exhibit in this prospectus, at no cost by writing or telephoning us at the following address: Rapid7, Inc., 100 Summer Street, Boston, Massachusetts 02110, Attention: General Counsel, or by telephone request to

(617) 247-1717.

Neither we nor any selling stockholder have authorized anyone to provide you with information other than what is

incorporated by reference or provided in this prospectus or any applicable prospectus supplement. Neither we nor any selling stockholder are making an offer of these securities in any state where the offer is not permitted. You should not assume

that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

16

$50,000,000 of

Common Stock

and

18,419,274 Shares of

Common Stock

Offered by

Selling Stockholders

PROSPECTUS

, 2017

Part II—INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the expenses payable by us, other than underwriting discounts and commissions, in connection with the sale and

distribution of the common stock being registered hereby. Each item listed is estimated, except for the Securities and Exchange Commission (the “SEC”) registration fee.

|

|

|

|

|

|

|

Securities and Exchange Commission registration fee

|

|

$

|

44,884

|

|

|

NASDAQ Global Market fee

|

|

|

*

|

|

|

FINRA filing fee

|

|

|

*

|

|

|

Accounting fees and expenses

|

|

|

*

|

|

|

Legal fees and expenses

|

|

|

*

|

|

|

Transfer agent fees

|

|

|

*

|

|

|

Printing and miscellaneous fees and expenses

|

|

|

*

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

44,884

|

|

|

|

|

|

|

|

|

*

|

Estimated expenses not presently known.

|

Item 15. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law, or DGCL, authorizes a corporation to indemnify its directors and officers against

liabilities arising out of actions, suits and proceedings to which they are made or threatened to be made a party by reason of the fact that they have served or are currently serving as a director or officer to a corporation. The indemnity may cover

expenses (including attorneys’ fees) judgments, fines and amounts paid in settlement actually and reasonably incurred by the director or officer in connection with any such action, suit or proceeding. Section 145 permits corporations to

pay expenses (including attorneys’ fees) incurred by directors and officers in advance of the final disposition of such action, suit or proceeding. In addition, Section 145 provides that a corporation has the power to purchase and maintain

insurance on behalf of its directors and officers against any liability asserted against them and incurred by them in their capacity as a director or officer, or arising out of their status as such, whether or not the corporation would have the

power to indemnify the director or officer against such liability under Section 145.

We have adopted provisions in our certificate

of incorporation and by-laws that limit or eliminate the personal liability of our directors to the fullest extent permitted by the DGCL, as it now exists or may in the future be amended. Consequently, a director will not be personally liable to us

or our stockholders for monetary damages or breach of fiduciary duty as a director, except for liability for:

|

|

•

|

|

any breach of the director’s duty of loyalty to us or our stockholders;

|

|

|

•

|

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

any unlawful payments related to dividends or unlawful stock purchases, redemptions or other distributions; or

|

|

|

•

|

|

any transaction from which the director derived an improper personal benefit.

|

These limitations of liability do not alter director liability under the federal securities laws and do not affect the availability of

equitable remedies such as an injunction or rescission.

In addition, our by-laws provide that:

|

|

•

|

|

we will indemnify our directors and executive officers to the fullest extent permitted by the DGCL, as it now

exists or may in the future be amended;

|

|

|

•

|

|

we will indemnify certain other officers and employees when determined appropriate by our board of directors;

and

|

|

|

•

|

|

we will advance reasonable expenses, including attorneys’ fees, to our directors and executive officers

in connection with legal proceedings relating to their service for or on behalf of us, subject to limited exceptions.

|

II-1

We have entered into indemnification agreements with each of our directors and executive

officers. These agreements provide that we will indemnify each of our directors and executive officers and, at times, their affiliates to the fullest extent permitted by Delaware law. We will advance expenses, including attorneys’ fees (but

excluding judgments, fines and settlement amounts), to each indemnified director, executive officer or affiliate in connection with any proceeding in which indemnification is available and we will indemnify our directors and officers for any action

or proceeding arising out of that person’s services as a director or officer brought on behalf of the Company and/or in furtherance of our rights. Additionally, each of our directors may have certain rights to indemnification, advancement of

expenses and/or insurance provided by their affiliates, which indemnification relates to and might apply to the same proceedings arising out of such director’s services as a director referenced herein. Nonetheless, we have agreed in the

indemnification agreements that the Company’s obligations to those same directors are primary and any obligation of the affiliates of those directors to advance expenses or to provide indemnification for the expenses or liabilities incurred by

those directors are secondary.

We also maintain general liability insurance which covers certain liabilities of our directors and

officers arising out of claims based on acts or omissions in their capacities as directors or officers, including liabilities under the Securities Act.

The underwriting agreement that we and the selling stockholders may enter into, filed as Exhibit 1.1 to this registration statement, may

provide for indemnification of us and our directors and officers and the selling stockholders by the underwriters against certain liabilities under the Securities Act and the Exchange Act.

Item 16. Exhibits

A list of

exhibits filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this

registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the

Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously

disclosed in the registration statement or any material change to such information in the registration statement;

provided,

however

, that paragraphs (a)(l)(i), (a)(l)(ii) and (a)(l)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the

Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement;

II-2

(2) That, for the purpose of determining any liability under

the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona

fide

offering thereof;

(3) To remove from registration by means of a post-effective amendment any

of the securities being registered which remain unsold at the termination of the offering;

(4) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a

registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall

be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the

prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof;

provided, however

, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such effective date;

(5) That, for the purpose of determining liability of the registrant

under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement,

regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary

prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned

registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free

writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the

purchaser;

II-3

(6) That, for purposes of determining any liability under

the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof;

(7) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted

to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will

be governed by the final adjudication of such issue;

(8) That, for purposes of determining any

liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to

Rule 424(b)(1) or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective; and

(9) That, for the purpose of determining any liability under the Securities Act of 1933, each

post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona

fide

offering thereof.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Boston, Commonwealth of Massachusetts, on this 23rd day

of May, 2017.

|

|

|

|

|

RAPID7, INC.

|

|

|

|

|

By:

|

|

/s/ Jeffrey Kalowski

|

|

|

|

Jeffrey Kalowski

Chief Financial Officer

|

II-5

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby

severally constitutes and appoints Corey Thomas and Jeffrey Kalowski, and each of them singly, as such person’s true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for such person and in such

person’s name, place and stead, in any and all capacities, to sign any or all amendments (including, without limitation, post-effective amendments) to this registration statement (or any registration statement for the same offering that is to

be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto each said

attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in person, hereby

ratifying and confirming all that any said attorney-in-fact and agent, or any substitute or substitutes of any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the

capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|