Current Report Filing (8-k)

May 23 2017 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 23, 2017

ImmunoGen, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Massachusetts

|

0-17999

|

04-2726691

|

|

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

830 Winter Street, Waltham, MA 02451

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (781) 895-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is a an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On May 23, 2017, ImmunoGen, Inc. (also referred to as “we,” “our,” or “ImmunoGen”) and Debiopharm International, S.A. (“Debiopharm”) entered into an Exclusive License and Asset Purchase Agreement (the “Agreement”), pursuant to which Debiopharm has acquired our antibody-drug conjugate IMGN529, a potential new treatment for patients with CD37-positive B-cell malignancies, such as non-Hodgkin lymphoma (NHL). The transaction includes the sale to Debiopharm of specified intellectual property and other assets related to the IMGN529 program, and an exclusive license to additional intellectual property necessary or useful for Debiopharm to develop and commercialize certain antibody-drug conjugates targeting CD37, including IMGN529 (also referred to as a “Licensed Product”).

Under the terms of the Agreement, we received a $25 million upfront payment for the IMGN529 program. We are entitled to receive a $5 million milestone payment following the transfer of technology relating to IMGN529 to Debiopharm, and a $25 million milestone upon IMGN529 entering a Phase 3 clinical trial. Except for the foregoing upfront and milestone payments, we will not be entitled to receive any additional milestone payments or royalties under the Agreement.

We have made customary representations and warranties, and have agreed to customary covenants, for transactions of this type. In addition, we have agreed to indemnify Debiopharm for damages resulting from (i) any breach of our representations and warranties, (ii) our failure to perform any covenant or agreement contained in the Agreement, (iii) certain specifically excluded liabilities relating to the IMGN529 program that were not assumed by Debiopharm, and (iv) with respect to actions brought by third parties, liabilities relating to the conduct of the IMGN529 program prior to the effective date of the Agreement.

In addition, we have agreed not to conduct any research, development or commercialization activities for any antibody product targeting CD37 for a period commencing on the effective date of the Agreement and ending upon the earliest of (i) the first marketing approval of IMGN529 in any of the U.S. or certain other specified countries, (ii) ten years from the effective date of the Agreement, and (iii) such time as Debiopharm abandons the development and commercialization of all Licensed Products.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d): The following exhibit is being filed herewith:

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

|

99.1

|

|

Press Release of ImmunoGen, Inc. dated May 23, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ImmunoGen, Inc.

|

|

|

(Registrant)

|

|

|

|

|

Date: May 23, 2017

|

/s/ David B. Johnston

|

|

|

|

|

|

David B. Johnston

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

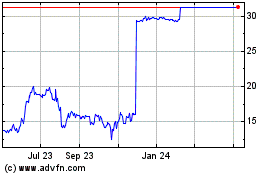

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024