Current Report Filing (8-k)

May 23 2017 - 11:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported):

May 22, 2017

Ekso Bionics Holdings, Inc.

(Exact

Name of Registrant as specified in its charter)

|

Nevada

|

001-37854

|

99-0367049

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

1414 Harbour Way South, Suite 1201

Richmond, California 94804

(Address of principal executive offices,

including zip code)

(510) 984-1761

(Registrant’s telephone number, including

area code)

Not Applicable

(Registrant’s name or former address,

if change since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (

see

General Instruction A.2. below):

|

|

o

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

x

|

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities

|

On May 22, 2017, Ekso Bionics Holdings,

Inc. (the “Company”) implemented a plan to streamline its operations and reduce its workforce by approximately 25%

in order to lower operating expenses and reduce cash burn.

The Company is offering severance benefits

to the affected employees, including cash severance payments, grants of restricted stock units, outplacement services and payment

of health care insurance premiums for specified periods. Each affected employee’s eligibility for the severance benefits

is contingent upon such employee’s execution of a separation agreement, which includes a general release of claims against

the Company.

The Company expects to record restructuring-related

expenses in 2017 of approximately $1.0 million related to termination benefit costs and other costs associated with the workforce

reduction. Approximately $0.8 million of these expenses are expected to represent cash expenditures, most of which will be expensed

and paid in the second quarter of 2017, with the remaining cash expenditures paid in the third quarter of 2017. The remaining approximately

$0.2 million are one-time, non-cash, stock-based compensation expenses and are expected to be expensed in the third quarter of

2017.

The charge that the Company expects to incur

in connection with these actions is subject to a number of assumptions, and actual results may differ. The Company may also incur

other charges not currently contemplated due to events that may occur as a result of, or associated with, the plan. The Company

expects to complete these actions by the end of the third quarter of 2017.

Forward-Looking Statements

Any statements contained in this Current Report on Form 8-K

that do not describe historical facts may constitute forward-looking statements. Forward-looking statements may include, without

limitation, statements regarding (i) the timing and amount of expenditures related to the workforce reduction and anticipated

costs savings, (ii) the plans and objectives of management for future operations, including plans or objectives relating to the

design, development and commercialization of human exoskeletons, (iii) estimates or projection of financial results, financial

condition, capital expenditures, capital structure or other financial items, (iv) the Company's future financial performance and

(v) the assumptions underlying or relating to any statement described in points (i), (ii), (iii) or (iv) above. Such forward-looking

statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized

because they are based upon the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions

and are subject to a number of risks and uncertainties and other influences, many of which the Company has no control over. Actual

results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements

as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking

statements or cause actual results to differ materially from expected or desired results may include, without limitation, the

timing of planned expense reductions, the Company's inability to obtain adequate financing to fund the Company's operations and

necessary to develop or enhance our technology, the significant length of time and resources associated with the development of

the Company's products, the Company's failure to achieve broad market acceptance of the Company's products, the failure of our

sales and marketing organization or partners to market our products effectively, adverse results in future clinical studies of

the Company's medical device products, the failure to obtain or maintain patent protection for the Company's technology, failure

to obtain or maintain regulatory approval to market the Company's medical devices, lack of product diversification, existing or

increased competition, and the Company's failure to implement the Company's business plans or strategies. These and other factors

are identified and described in more detail in the Company's filings with the Securities and Exchange Commission, including, but

not limited to, its latest Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. The Company does not undertake

to update these forward-looking statements.

|

|

Item 7.01

|

Regulation FD Disclosure

|

On May 23, 2017, the Company issued a press

release announcing the events described above. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information in this Item

7.01, including the exhibit attached hereto, is furnished pursuant to Item 7.01 and shall not be deemed “filed”

for any other purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or

otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be deemed incorporated by

reference into any filing under the Securities Act of 1933 or the Exchange Act of 1934 regardless of any general

incorporation language in such filing unless specifically provided otherwise.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

99.1

|

Press release dated May 23, 2017

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

EKSO BIONICS HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Maximilian Scheder-Bieschin

|

|

|

Name:

|

Maximilian Scheder-Bieschin

|

|

|

Title:

|

Chief Financial Officer

|

Dated: May 23, 2017

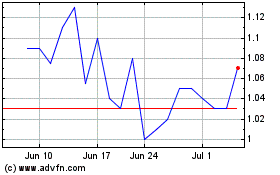

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024