Current Report Filing (8-k)

May 23 2017 - 7:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 23, 2017

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

000-49728

|

87-0617894

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

27-01 Queens Plaza North, Long Island City, New York

|

11101

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01 Regulation FD Disclosure.

Executives of JetBlue Airways Corporation (“JetBlue” or the “Company”) will present today at the 10

th

Annual Wolfe Research Global Transportation Conference to discuss a variety of information regarding our business, including our updated guidance for revenue per available seat mile for the second quarter of 2017. Materials to be used in conjunction with the presentation are furnished as Exhibit 99.1 to this Form 8-K.

The information in this report (including the exhibits) that is being furnished pursuant to Item 7.01 of Form 8−K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth in such filing. This report will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management's beliefs and assumptions concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily aircraft utilization; our dependence on the New York and Boston metropolitan markets and the Northeast Corridor of the United States and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns and/or increased labor costs; our reliance on a limited number of suppliers; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional government regulation; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year and you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company’s Securities and Exchange Commission filings, including but not limited to, the Company's 2016 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation.

The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. We refer you to the reconciliations made available in our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K (available on our website at jetblue.com and at sec.gov) and in our April 2017 first quarter earnings call, which reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Description

|

|

99.1

|

|

|

Investor Presentation*

|

*Furnished herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JETBLUE AIRWAYS CORPORATION

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Date:

|

May 23, 2017

|

|

By:

|

/s/ Alexander Chatkewitz

|

|

|

|

|

|

Vice President, Controller, and Chief Accounting Officer (Principal Accounting Officer)

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Exhibit

|

|

99.1

|

|

|

Investor Presentation*

|

*Furnished herewith

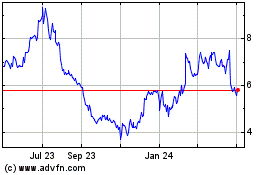

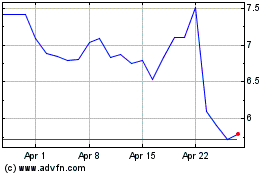

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024