Post Holdings, Inc. (NYSE:POST) (the “Company” or “Post”) today

announced the early tender results as of 5:00 p.m. New York City

time on May 19, 2017 (the “Early Tender Deadline” and the

“Withdrawal Deadline”) for its previously announced cash tender

offers (the “Tender Offers”) and consent solicitations (the

“Consent Solicitations”) for its (i) 7.75% senior notes due 2024

(the “2024 Notes”), having an aggregate outstanding principal

amount of $800.0 million, and (ii) its 8.00% senior notes due 2025

(the “2025 Notes”), having an aggregate outstanding principal

amount of $400.0 million.

According to Global Bondholder Services Corporation, as of the

Early Tender Deadline, $650,979,000 in aggregate principal amount,

or approximately 81.4%, of 2024 Notes outstanding, had been validly

tendered and not validly withdrawn, and $262,422,000 in aggregate

principal amount, or approximately 65.6%, of 2025 Notes

outstanding, had been validly tendered and not validly

withdrawn.

The Company also announced it has extended the Early Tender

Deadline for the 2025 Notes to 5:00 p.m. New York City time on May

23, 2017 (the “Extended Early Tender Deadline”). Holders that

validly tender their 2025 Notes prior to the Extended Early Tender

Deadline will be entitled to receive the previously announced

consent payment of $30.00 per $1,000 principal amount of 2025

Notes. The Company expects to accept for payment on May 24, 2017,

the previously announced initial payment date (the “Initial Payment

Date”), subject to the terms and conditions specified in the Offer

to Purchase and Consent Solicitation Statement dated May 8, 2017

(the “Offer to Purchase”), all 2024 Notes and 2025 Notes validly

tendered and not validly withdrawn on or prior to the Early Tender

Deadline or the Extended Early Tender Deadline, as applicable. 2024

Notes and 2025 Notes validly tendered after the Withdrawal Deadline

may not be withdrawn or revoked.

All references to the “Early Tender Deadline” in the Offer to

Purchase and the Letter of Transmittal and Consent (the “Letter of

Transmittal”) as they pertain to the 2025 Notes shall now be deemed

to be references to the Extended Early Tender Deadline. The other

terms and conditions of the Tender Offers and the Consent

Solicitations remain unchanged except as provided in this

announcement.

The Company has received consents sufficient to approve

amendments to the respective indentures governing the 2024 Notes

and 2025 Notes (together, the “Indentures”) and the Company, the

trustee for the Indentures, and certain guarantors party to each

Indenture executed supplemental indentures (the “Supplemental

Indentures”) on May 19, 2017. The Supplemental Indentures amend the

Indentures to eliminate substantially all of the restrictive

covenants and certain events of default applicable to the 2024

Notes and 2025 Notes on the terms and subject to the conditions set

forth in the Offer to Purchase, and the amendments will become

operative upon the Company’s acceptance of the validly tendered and

not validly withdrawn 2024 Notes and 2025 Notes for purchase on the

Initial Payment Date. Each of the Tender Offers and Consent

Solicitations remains subject to the satisfaction or waiver of

several conditions as set forth in the Offer to Purchase, including

the receipt by the Company of proceeds from a new incremental term

loan under the Company’s existing credit agreement on terms

satisfactory to the Company that, together with cash on hand, is in

an amount that is sufficient to effect the repurchase of the 2024

Notes and 2025 Notes validly tendered and not validly withdrawn and

accepted for purchase pursuant to the Tender Offers. Once

operative, the Supplemental Indentures will be binding on all

holders of 2024 Notes or 2025 Notes, even those whose 2024 Notes or

2025 Notes were not validly tendered and not validly withdrawn on

or before the Early Tender Deadline and accepted for purchase, as

described in the Offer to Purchase.

Holders of 2024 Notes and 2025 Notes may still tender their 2024

Notes and 2025 Notes pursuant to the Offer to Purchase until

midnight, New York City time, at the end of June 5, 2017, unless

the Tender Offers are extended or earlier terminated by the Company

(such time and date, as they may be extended or earlier terminated,

the “Expiration Time”). The final settlement date for 2024 Notes

tendered after May 19, 2017 and 2025 Notes tendered after May 23,

2017 but prior to the Expiration Time is currently expected to

occur on June 6, 2017. Holders that validly tender their 2024 Notes

after May 19, 2017 or 2025 Notes after May 23, 2017 but prior to

the Expiration Time will receive only the Tender Offer

Consideration (as defined below) on the final settlement date.

The following table summarizes the material pricing terms for

the Tender Offers:

|

Title of Notes |

|

OutstandingPrincipal Amount |

|

ConsentPayment (1) (3) |

|

Tender OfferConsideration (1) (2) |

|

TotalConsideration (1) (2) |

| 7.75%

Senior Notes due 2024 |

|

$ |

800,000,000 |

|

$ |

30.00 |

|

$ |

1,106.25 |

|

$ |

1,136.25 |

| 8.00%

Senior Notes due 2025 |

|

$ |

400,000,000 |

|

$ |

30.00 |

|

$ |

1,135.00 |

|

$ |

1,165.00 |

| |

|

|

|

|

|

|

|

|

| (1) Per

$1,000 principal amount of 2024 Notes or 2025 Notes tendered and

accepted for purchase. |

| (2) Does

not include accrued and unpaid interest that will be paid on the

2024 Notes and 2025 Notes accepted for purchase. |

| (3)

Included in the Total Consideration for 2024 Notes tendered and

accepted for purchase at or prior to the Early Tender Deadline and

2025 Notes tendered and accepted for purchase at or prior to the

Extended Early Tender Deadline. |

The Total Consideration for each $1,000 principal amount of 2024

Notes validly tendered and not validly withdrawn prior to the Early

Tender Deadline or 2025 Notes validly tendered and not validly

withdrawn prior to the Extended Early Tender Deadline is $1,136.25

and $1,165.00, respectively, which includes a consent payment of

$30.00 per $1,000 principal amount of 2024 Notes and a consent

payment of $30.00 per $1,000 principal amount of 2025 Notes.

Holders tendering 2024 Notes after the Early Tender Deadline or

2025 Notes after the Extended Early Tender Deadline will be

eligible to receive only the Tender Offer Consideration, which is

$1,106.25 for each $1,000 principal amount of 2024 Notes or

$1,135.00 for each $1,000 principal amount of 2025 Notes. Holders

will also receive accrued and unpaid interest to, but not

including, the applicable settlement date for such 2024 Notes or

2025 Notes that the Company accepts for purchase in the Tender

Offers.

Credit Suisse is acting as the sole dealer manager for the

Tender Offers. The information agent and tender agent is Global

Bondholder Services Corporation. Copies of the Offer to Purchase,

Letter of Transmittal and related tender offering and consent

solicitation materials are available by contacting the information

agent at (212) 430-3774 (banks and brokers) and at (866) 470-4500

(all others). Questions regarding the Tender Offers and Consent

Solicitations should be directed to Credit Suisse at (800)

820-1653.

The Company intends to issue a notice of redemption on May 22,

2017 to redeem the remaining outstanding 2024 Notes pursuant to the

redemption and satisfaction and discharge provisions of the

Indenture for the 2024 Notes, as supplemented by the Supplemental

Indenture for the 2024 Notes, at a redemption price pursuant to the

terms of the Indenture for the 2024 Notes, plus accrued and unpaid

interest, if any, to the redemption date of June 7, 2017. At this

time, the Company does not contemplate a redemption of any 2025

Notes that are not validly tendered in the Tender Offers.

None of the Company, the dealer manager, the information agent

and tender agent, or the trustee for the 2024 Notes and 2025 Notes,

or any of their respective affiliates, is making any recommendation

as to whether holders should tender any 2024 Notes or 2025 Notes in

response to the Tender Offers. Holders must make their own decision

as to whether to tender any of their 2024 Notes or 2025 Notes and,

if so, the principal amount of 2024 Notes or 2025 Notes to tender.

This announcement is for informational purposes only and does not

constitute an offer to sell or the solicitation of an offer to buy

any security and shall not constitute an offer, solicitation or

sale in any jurisdiction in which such offering, solicitation or

sale would be unlawful. The Tender Offers are being made solely by

means of the Offer to Purchase. In those jurisdictions where the

securities, blue sky or other laws require any tender offer to be

made by a licensed broker or dealer, the Tender Offers will be

deemed to be made on behalf of the Company by the dealer manager or

one or more registered brokers or dealers licensed under the laws

of such jurisdiction.

Cautionary Statement on Forward-Looking

Language

Forward-looking statements, within the meaning of Section 21E of

the Securities Exchange Act of 1934, are made throughout this

release. These forward-looking statements are sometimes identified

by the use of terms and phrases such as “believe,” “should,”

“would,” “expect,” “project,” “estimate,” “anticipate,” “intend,”

“plan,” “will,” “can,” “may,” or similar expressions elsewhere in

this release. All forward-looking statements are subject to a

number of important factors, risks, uncertainties and assumptions

that could cause actual results to differ materially from those

described in any forward-looking statements. These factors and

risks include, but are not limited to, unanticipated developments

that prevent, delay or negatively impact the Tender Offers and

Consent Solicitations, the new incremental term loan and other

financial, operational and legal risks and uncertainties detailed

from time to time in the Company’s cautionary statements contained

in its filings with the Securities and Exchange Commission. These

forward-looking statements represent the Company’s judgment as of

the date of this press release. The Company disclaims, however, any

intent or obligation to update these forward-looking statements.

There can be no assurance that the proposed transactions will be

completed as anticipated or at all.

Contact:

Investor Relations

Brad Harper

brad.harper@postholdings.com

(314) 644-7626

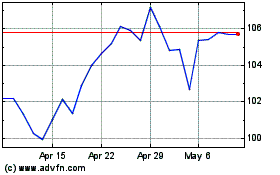

Post (NYSE:POST)

Historical Stock Chart

From Mar 2024 to Apr 2024

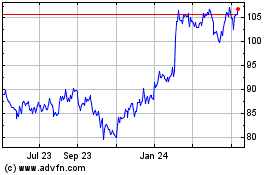

Post (NYSE:POST)

Historical Stock Chart

From Apr 2023 to Apr 2024