Current Report Filing (8-k)

May 19 2017 - 5:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 18, 2017

MEDICAL PROPERTIES TRUST, INC.

MPT OPERATING PARTNERSHIP, L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Maryland

Delaware

|

|

001-32559

333-177186

|

|

20-0191742

20-0242069

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

1000 Urban Center Drive, Suite 501

Birmingham, AL

|

|

35242

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (205) 969-3755

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

|

1.01. Entry into a Material Definitive Agreement.

|

Acquisition of IASIS Healthcare Hospital

Portfolio

On May 18, 2017, affiliates of Medical Properties Trust, Inc. (the “Company”) entered into definitive

agreements pursuant to which affiliates of the Company will invest in a portfolio of ten acute care hospitals and one behavioral health facility currently operated by IASIS Healthcare (“IASIS”) for a combined purchase price and investment

of approximately $1.4 billion. The portfolio will be operated by Steward Health Care System LLC (“Steward”), which separately announced its simultaneous merger transaction with IASIS, the completion of which is a condition to the

Company’s investment.

Pursuant to the terms of an asset purchase agreement with IASIS and its affiliates, dated May 18, 2017,

subsidiaries of the Company’s operating partnership will acquire from IASIS and its affiliates all of their interests in the real estate of eight acute care hospitals and one behavioral health facility for an aggregate purchase price of

approximately $700 million. At closing, these facilities will be leased to Steward pursuant to the existing master lease agreement. In addition, pursuant to the terms of the agreement, subsidiaries of the Company’s operating

partnership will make mortgage loans in an aggregate amount of approximately $700 million, secured by first mortgages in two acute care hospitals. The real estate master lease and mortgage loans will have substantially similar terms, which has

an initial fixed term expiration of October 31, 2031 and includes three 5-year extension options, plus annual inflation protected escalators. The Company expects that the initial GAAP yield for the properties under the master lease to be

approximately 10.2%.

The table below sets forth pertinent details with respect to the hospitals in the IASIS portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital

|

|

Location

|

|

|

Form of

Investment

|

|

|

Licensed

Beds

|

|

|

Davis Hospital and Medical Center

|

|

|

Layton, UT

|

|

|

|

Mortgage

|

|

|

|

220

|

|

|

Jordan Valley Medical Center

|

|

|

West Jordan, UT

|

|

|

|

Mortgage

|

|

|

|

171

|

|

|

Odessa Regional Medical Center

|

|

|

Odessa, TX

|

|

|

|

Lease

|

|

|

|

225

|

|

|

Salt Lake Regional Medical Center

|

|

|

Salt Lake City, UT

|

|

|

|

Lease

|

|

|

|

158

|

|

|

St. Luke’s Medical Center

|

|

|

Phoenix, AZ

|

|

|

|

Lease

|

|

|

|

219

|

|

|

St. Luke’s Behavioral Health Center

|

|

|

Phoenix, AZ

|

|

|

|

Lease

|

|

|

|

124

|

|

|

Southwest General Hospital

|

|

|

San Antonio, TX

|

|

|

|

Lease

|

|

|

|

327

|

|

|

Wadley Regional Medical Center at Hope

|

|

|

Hope, AR

|

|

|

|

Lease

|

|

|

|

79

|

|

|

Tempe St. Luke’s Hospital

|

|

|

Tempe, AZ

|

|

|

|

Lease

|

|

|

|

87

|

|

|

St. Joseph Medical Center

|

|

|

Houston, TX

|

|

|

|

Lease

|

|

|

|

790

|

|

|

Mountain Point Medical Center

|

|

|

Lehi, UT

|

|

|

|

Lease

|

|

|

|

40

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Licensed Beds

|

|

|

|

|

|

|

|

|

|

|

2,440

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition, in conjunction with the real estate and mortgage loans transactions described above, a subsidiary

of the Company’s operating partnership will also invest approximately $100 million in minority preferred interests of Steward. The Company will have no management authority or control of Steward except for certain protective rights consistent

with a minority passive ownership interest, such as a limited right to approve certain extraordinary transactions.

Subject to customary

closing conditions, the Company expects to consummate the transactions described above in the second half of 2017.

The Company intends to

finance the transaction with all-debt financing, which may include borrowings under the Company’s revolving credit facility (of which approximately $1 billion is currently available), borrowings under a new fully committed $1.0 billion term

loan facility with a term of up to two years, the issuance of unsecured debt securities, or a combination thereof.

|

Item

|

7.01. Regulation FD Disclosure.

|

On May 19, 2017, the Company issued a press release

announcing the transactions with IASIS and Steward described above in Item 1.01 of this Current Report on Form 8-K. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

In addition, in connection with the IASIS and Steward transaction described above in Item 1.01 of this Current Report on Form 8-K, the

Company has prepared an investor presentation for use with analysts and investors beginning on May 19, 2017. A copy of this presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference. The presentation may also be viewed

on the Company’s website at www.medicalpropertiestrust.com.

The information contained in this Item 7.01 and exhibits

thereto is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise. The information in this Item 7.01, including the exhibits thereto and

referenced materials posted to the Company’s website, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or into any filing or other document pursuant to the Securities

Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

2

|

Item

|

9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated May 19, 2017

|

|

|

|

|

99.2

|

|

Investor Presentation dated May 19, 2017

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunder duly authorized.

|

|

|

|

|

MEDICAL PROPERTIES TRUST, INC.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: May 19, 2017

|

|

|

|

|

MPT OPERATING PARTNERSHIP, L.P.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer of the sole member of the general partner of MPT Operating Partnership, L.P.

|

Date: May 19, 2017

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated May 19, 2017

|

|

|

|

|

99.2

|

|

Investor Presentation dated May 19, 2017

|

5

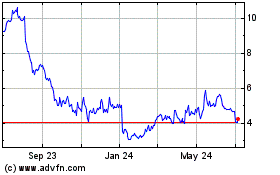

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

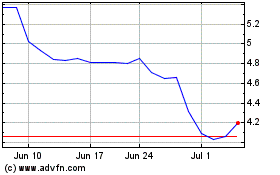

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Apr 2023 to Apr 2024