- Net Sales and Organic Sales Decreased 1

Percent

- Earnings Before Interest and Taxes

(EBIT) Increased 11 Percent, Adjusted EBIT Decreased 2 Percent

- Earnings Per Share (EPS) Decreased 2

Percent to $0.58, Adjusted EPS Decreased 9 Percent to $0.59

Reflecting Higher Adjusted Tax Rate

- Campbell Revises Fiscal 2017

Guidance

Campbell Soup Company (NYSE:CPB) today reported its

third-quarter results for fiscal 2017.

Three Months

Ended

Nine Months

Ended

($ in millions, except per share)

Apr.

30,2017

May

1,2016

%Change

Apr.

30,2017

May

1,2016

%Change

Net Sales

As Reported (GAAP)

$1,853 $1,870 (1)%

$6,226 $6,274

(1)% Organic (1)% (1)%

Earnings Before Interest and

Taxes

As Reported (GAAP)

$298 $268 11%

$960 $997 (4)%

Adjusted

$305 $312 (2)%

$1,210 $1,214 - %

Diluted Earnings Per Share

As Reported (GAAP)

$0.58 $0.59 (2)%

$1.85 $2.07 (11)%

Adjusted

$0.59 $0.65 (9)%

$2.51 $2.48 1%

Note: A detailed reconciliation of the reported (GAAP) financial

information to the adjusted financial information is included at

the end of this news release.

CEO Comments

Denise Morrison, Campbell’s President and Chief Executive

Officer, said, “While organic sales declined 1 percent in the

quarter, the team performed well in a difficult environment,

gaining market share in many of our categories and continuing to

execute our cost savings program.

“This was a challenging quarter across the food industry as

top-line growth remained scarce, especially in center store

categories. The industry, including Campbell, experienced

significant consumption declines early in the calendar year. These

industry trends coincided with weak consumer spending, which was at

its lowest growth rate since 2009. While we rebounded with sales

growth in March and April, we were unable to offset the earlier

declines.

“In this context, Campbell delivered competitive performance. A

bright spot in the quarter was our Global Biscuits and Snacks

division, which delivered top-line and double-digit bottom-line

growth. Looking ahead as we finish the fiscal year, we expect

Global Biscuits and Snacks to maintain its positive momentum, and

we will also be cycling the C-Fresh protein drink recall from last

year.

“We are adjusting our fiscal 2017 guidance, reflecting our

performance in the quarter, the difficult operating environment and

our outlook for the remainder of the year. We lowered our sales

outlook by one percentage point to a range of -1 to 0 percent. We

raised our expectations for adjusted EBIT and adjusted EPS,

increasing the low end of both ranges to 2 to 4 percent and 3 to 5

percent, respectively. Despite the challenges on the top line, we

expect that we will be able to offset the impact of lower sales

with our ongoing cost-savings efforts, which are ahead of our

expectations for the fiscal year.”

Items Impacting Comparability

The company reported earnings of $0.58 per share in the quarter.

The current-quarter results reflect pre-tax charges related to cost

savings initiatives of $7 million, or $0.01 per share. The

prior-year quarter included a pre-tax charge related to a pension

benefit mark-to-market adjustment of $54 million, or $0.11 per

share, and pre-tax charges related to cost savings initiatives of

$15 million, or $0.03 per share. The prior-year quarter also

included a gain from the settlement of a claim related to the

Kelsen acquisition of $25 million, or $0.08 per share. Excluding

items impacting comparability in both periods, adjusted EPS

decreased 9 percent to $0.59 per share, compared with $0.65 per

share in the year-ago quarter. A detailed reconciliation of the

reported (GAAP) financial information to the adjusted information

is included at the end of this news release.

Third-Quarter Results

Sales decreased 1 percent to $1.853 billion driven by a 1

percent decline in organic sales, reflecting higher promotional

spending, while volumes were comparable to the prior year. Organic

sales declines in Americas Simple Meals and Beverages and Campbell

Fresh were partly offset by gains in Global Biscuits and

Snacks.

Gross margin increased from 35.3 percent to 36.6 percent.

Excluding items impacting comparability in the prior year, adjusted

gross margin decreased 0.4 percentage points from 37.0 percent to

36.6 percent. The decrease in adjusted gross margin was primarily

driven by higher supply chain costs and inflation, including the

unfavorable impact of lapping gains on open commodity contracts in

the prior-year quarter, as well as higher promotional spending,

partly offset by productivity improvements and the benefits from

cost savings initiatives.

Marketing and selling expenses decreased 8 percent to $209

million. Excluding items impacting comparability in the prior year,

adjusted marketing and selling expenses decreased 5 percent

primarily due to lower advertising and consumer promotion expenses

and the benefits from cost savings initiatives. Administrative

expenses decreased 9 percent to $140 million. Excluding items

impacting comparability, adjusted administrative expenses increased

1 percent.

EBIT increased 11 percent to $298 million. Excluding items

impacting comparability, adjusted EBIT decreased 2 percent to $305

million reflecting a lower adjusted gross margin percentage and

lower sales, partly offset by lower marketing and selling

expenses.

Net interest expense was comparable to prior year at $28 million

reflecting lower levels of debt offset by higher average interest

rates on the debt portfolio. The tax rate increased to 34.8 percent

as compared with a tax rate of 22.9 percent in the prior year.

Excluding items impacting comparability, the adjusted tax rate

increased 6.5 percentage points to 35.0 percent driven by lower

taxes on foreign earnings in the prior year. In the fourth quarter

of fiscal 2016, a $13 million correction on deferred tax expense

was recognized, most of which related to the third quarter of

fiscal 2016.

Nine-Month Results

Sales decreased 1 percent to $6.226 billion driven by a 1

percent decline in organic sales, reflecting higher promotional

spending and lower volume.

EBIT decreased 4 percent to $960 million. Excluding items

impacting comparability, adjusted EBIT was comparable to the prior

year at $1.210 billion reflecting a higher adjusted gross margin

percentage offset by lower sales volume and higher marketing and

selling expenses.

Net interest expense increased 1 percent to $84 million

reflecting higher average interest rates on the debt portfolio,

partly offset by lower levels of debt. The tax rate increased 5.5

percentage points to 35.0 percent. Excluding items impacting

comparability, the adjusted tax rate decreased 0.5 percentage

points to 31.3 percent.

Cash flow from operations was $1.011 billion compared to $1.211

billion in the prior year, which benefited from significant

reductions in working capital.

Fiscal 2017 Guidance

Campbell has revised its fiscal 2017 guidance. Campbell now

expects sales to change by -1 to 0 percent (previously 0 to 1

percent); adjusted EBIT to increase by 2 to 4 percent (previously 1

to 4 percent), and adjusted EPS to increase by 3 to 5 percent

(previously 2 to 5 percent), or $3.04 to $3.09 per share. This

guidance assumes the impact from currency translation will be

nominal. A non-GAAP reconciliation is not provided for 2017

guidance since certain items are not estimable, such as pension and

postretirement mark-to-market adjustments, and these items are not

considered to be part of the company's ongoing business

results.

Segment Operating Review

An analysis of net sales and operating earnings by reportable

segment follows:

Three Months

Ended Apr. 30, 2017

($ in millions)

AmericasSimple Mealsand

Beverages

Global Biscuitsand

Snacks

Campbell

Fresh

Total Net Sales, as Reported $982 $623 $248 $1,853

Volume and Mix -% 3% (6)% -% Promotional Spending (2)% (1)% -% (1)%

Organic Net Sales (2)% 2% (6)% (1)% Currency -% -% -% -% % Change

vs. Prior Year (2)% 2% (6)% (1)% Segment Operating Earnings $226

$98 $1 % Change vs. Prior Year -% 14% n/m n/m – not

meaningful Note: A detailed reconciliation of the reported (GAAP)

net sales to organic net sales is included at the end of this news

release.

Nine Months Ended

Apr. 30, 2017

($ in millions)

AmericasSimple Mealsand

Beverages

Global Biscuitsand

Snacks

CampbellFresh

Total Net Sales, as Reported $3,510 $1,974 $742

$6,226

Volume and Mix -% 1% (7)% (1)% Promotional Spending (1)% (1)% -%

(1)% Organic Net Sales (1)% -% (7)% (1)%* Currency -% 1% -% -% %

Change vs. Prior Year (1)% 2%* (7)% (1)% Segment Operating Earnings

$922 $345 $(1) % Change vs. Prior Year 5% 1% n/m n/m – not

meaningful * Numbers do not add due to rounding. Note: A detailed

reconciliation of the reported (GAAP) net sales to organic net

sales is included at the end of this news release.

Americas Simple Meals and

Beverages

Sales in the quarter decreased 2 percent to $982 million driven

by declines in soup and V8 beverages, partly offset by gains in

Prego pasta sauces. Sales of U.S. soup decreased 4 percent driven

by declines in condensed soups and broth, partly offset by gains in

ready-to-serve soups. For the first nine months of fiscal 2017,

sales of U.S. soup decreased 1 percent.

Segment operating earnings for the quarter were comparable to

prior year at $226 million, as a higher gross margin percentage was

offset by lower sales volume.

Global Biscuits and Snacks

Sales in the quarter increased 2 percent to $623 million driven

by gains in Pepperidge Farm, as well as gains in Arnott’s biscuits

in both Australia and Indonesia. Pepperidge Farm sales increased

due to gains in Goldfish crackers and Pepperidge Farm cookies,

partly offset by declines in fresh bakery and frozen products.

Segment operating earnings increased 14 percent to $98 million.

The increase was primarily driven by higher sales volume and lower

advertising and consumer promotion expenses.

Campbell Fresh

Sales in the quarter decreased 6 percent to $248 million driven

by lower sales of Bolthouse Farms refrigerated beverages.

Segment operating earnings decreased from $13 million to $1

million driven by unfavorable sales volume and mix, as well as the

cost impact of both reduced beverage capacity and enhanced quality

processes.

Unallocated Corporate Expenses

Unallocated corporate expenses for the quarter were $27 million

compared to $54 million in the prior year. The current quarter

included $7 million of charges associated with cost savings

initiatives. The prior-year quarter included $54 million of charges

related to a pension benefit mark-to-market adjustment and $13

million of charges associated with cost savings initiatives. The

prior-year quarter also included a $25 million gain from the

settlement of a claim related to the Kelsen acquisition. The

remaining increase in expenses reflects the unfavorable impact of

lapping gains on open commodity contracts in the prior-year

quarter, partly offset by lower postretirement benefit costs.

Conference Call

Campbell will host a conference call to discuss these results

today at 8:30 a.m. Eastern Daylight Time. To join, dial +1 (703)

639-1316. The conference ID is 6692640. Access to a live webcast of

the call with accompanying slides, as well as a replay of the call,

will be available at investor.campbellsoupcompany.com. A recording

of the call will also be available until midnight on June 2, 2017,

at +1 (404) 537-3406. The access code for the replay is

6692640.

About Campbell Soup Company

Campbell (NYSE:CPB) is driven and inspired by our Purpose, “Real

food that matters for life’s moments.” We make a range of

high-quality soups and simple meals, beverages, snacks and packaged

fresh foods. For generations, people have trusted Campbell to

provide authentic, flavorful and readily available foods and

beverages that connect them to each other, to warm memories and to

what’s important today. Led by our iconic Campbell’s brand, our

portfolio includes Pepperidge Farm, Bolthouse Farms, Arnott’s, V8,

Swanson, Pace, Prego, Plum, Royal Dansk, Kjeldsens and Garden Fresh

Gourmet. Founded in 1869, Campbell has a heritage of giving back

and acting as a good steward of the planet’s natural resources. The

company is a member of the Standard & Poor’s 500 and the Dow

Jones Sustainability Indexes. For more information, visit

www.campbellsoupcompany.com or follow company news on Twitter via

@CampbellSoupCo. To learn more about how we make our food and the

choices behind the ingredients we use, visit

www.whatsinmyfood.com.

Forward-Looking Statements

This release contains “forward-looking statements” that reflect

the company’s current expectations about the impact of its future

plans and performance on the company’s business or financial

results. These forward-looking statements, including the statements

made regarding sales, EBIT and EPS guidance for fiscal 2017, rely

on a number of assumptions and estimates that could be inaccurate

and which are subject to risks and uncertainties. The factors that

could cause the company’s actual results to vary materially from

those anticipated or expressed in any forward-looking statement

include (1) the company’s ability to manage changes to its

organizational structure and/or business processes; (2) the

company’s ability to realize projected cost savings and benefits

from its efficiency programs; (3) the impact of strong competitive

responses to the company’s efforts to leverage its brand power in

the market; (4) the impact of changes in consumer demand for the

company’s products and favorable perception of the company’s

brands; (5) the impact of product quality and safety issues,

including recalls and product liabilities; (6) the risks associated

with trade and consumer acceptance of the company’s initiatives,

including its trade and promotional programs; (7) the practices,

including changes to inventory practices, and increased

significance of certain of the company’s key trade customers; (8)

the impact of disruptions to the company’s supply chain, including

fluctuations in the supply or costs of energy and raw and packaging

materials; (9) the impact of non-U.S. operations, including trade

restrictions, public corruption and compliance with foreign laws

and regulations; (10) the impact of business portfolio changes;

(11) the uncertainties of litigation and regulatory actions against

the company; (12) disruption to the independent contractor

distribution models used by certain of the company’s businesses,

including the results of litigation or regulatory actions that

could affect their independent contractor classification; (13) the

company’s ability to protect its intellectual property rights; (14)

the impact of an impairment to goodwill or other intangible assets;

(15) the impact of increased liabilities and costs related to the

company’s defined benefit pension plans; (16) the impact of a

material failure in or breach of the company’s information

technology systems; (17) the company’s ability to attract and

retain key talent; (18) the impact of changes in currency exchange

rates, tax rates, interest rates, debt and equity markets,

inflation rates, economic conditions, law, regulation and other

external factors; (19) the impact of unforeseen business

disruptions in one or more of the company’s markets due to

political instability, civil disobedience, terrorism, armed

hostilities, natural disasters or other calamities; and (20) other

factors described in the company’s most recent Form 10-K and

subsequent Securities and Exchange Commission filings. The company

disclaims any obligation or intent to update the forward-looking

statements in order to reflect events or circumstances after the

date of this release.

CAMPBELL SOUP COMPANY CONSOLIDATED STATEMENTS OF EARNINGS

(unaudited) (millions, except per share amounts)

Three

Months Ended April 30, 2017 May 1, 2016 Net sales

$ 1,853 $ 1,870 Costs and expenses Cost

of products sold

1,175 1,210 Marketing and selling expenses

209 228 Administrative expenses

140 154 Research and

development expenses

27 31 Other expenses / (income)

4 (23 ) Restructuring charges

— 2 Total

costs and expenses

1,555 1,602 Earnings before

interest and taxes

298 268 Interest, net

28 28

Earnings before taxes

270 240 Taxes on earnings

94 55 Net earnings

176 185 Net loss

attributable to noncontrolling interests

— —

Net earnings attributable to Campbell Soup Company

$

176 $ 185 Per share - basic Net earnings

attributable to Campbell Soup Company

$ .58 $

.60 Dividends

$ .35 $ .312

Weighted average shares outstanding - basic

304 309

Per share - assuming dilution Net earnings attributable to

Campbell Soup Company

$ .58 $ .59

Weighted average shares outstanding - assuming dilution

306

311 CAMPBELL SOUP COMPANY CONSOLIDATED

STATEMENTS OF EARNINGS (unaudited) (millions, except per share

amounts)

Nine Months Ended April 30, 2017

May 1, 2016 Net sales

$ 6,226 $ 6,274

Costs and expenses Cost of products sold

3,882 4,040

Marketing and selling expenses

674 677 Administrative

expenses

402 456 Research and development expenses

78

86 Other expenses / (income)

230 (14 ) Restructuring charges

— 32 Total costs and expenses

5,266

5,277 Earnings before interest and taxes

960

997 Interest, net

84 83 Earnings before taxes

876 914 Taxes on earnings

307 270 Net

earnings

569 644 Net loss attributable to noncontrolling

interests

— — Net earnings attributable to

Campbell Soup Company

$ 569 $ 644 Per

share - basic Net earnings attributable to Campbell Soup Company

$ 1.86 $ 2.08 Dividends

$

1.05 $ .936 Weighted average shares

outstanding - basic

306 309 Per share -

assuming dilution Net earnings attributable to Campbell Soup

Company

$ 1.85 $ 2.07 Weighted average

shares outstanding - assuming dilution

308 311

CAMPBELL SOUP COMPANY CONSOLIDATED SUPPLEMENTAL

SCHEDULE OF SALES AND EARNINGS (unaudited) (millions, except per

share amounts)

Three Months Ended April 30,

2017 May 1, 2016

PercentChange

Sales

Contributions: Americas Simple Meals and Beverages

$

982 $ 999 (2)% Global Biscuits and Snacks

623 608 2%

Campbell Fresh

248 263 (6)% Total sales

$ 1,853 $ 1,870 (1)%

Earnings

Contributions: Americas Simple Meals and Beverages

$

226 $ 225 —% Global Biscuits and Snacks

98 86 14%

Campbell Fresh

1 13 NM Total operating

earnings

325 324 —% Unallocated corporate expenses

27

54 Restructuring charges

— 2 Earnings before

interest and taxes

298 268 11% Interest, net

28 28

Taxes on earnings

94 55 Net earnings

176 185 (5)% Net loss attributable to noncontrolling

interests

— — Net earnings attributable to

Campbell Soup Company

$ 176 $ 185 (5)%

Per share - assuming dilution Net earnings attributable to Campbell

Soup Company

$ .58 $ .59 (2)%

CAMPBELL SOUP COMPANY CONSOLIDATED SUPPLEMENTAL SCHEDULE OF

SALES AND EARNINGS (unaudited) (millions, except per share amounts)

Nine Months Ended April 30, 2017

May 1, 2016

PercentChange

Sales

Contributions: Americas Simple Meals and Beverages

$

3,510 $ 3,538 (1)% Global Biscuits and Snacks

1,974

1,942 2% Campbell Fresh

742 794 (7)% Total

sales

$ 6,226 $ 6,274 (1)%

Earnings

Contributions: Americas Simple Meals and Beverages

$

922 $ 878 5% Global Biscuits and Snacks

345 341 1%

Campbell Fresh

(1 ) 52 NM Total operating

earnings

1,266 1,271 —% Unallocated corporate expenses

306 242 Restructuring charges

— 32

Earnings before interest and taxes

960 997 (4)% Interest,

net

84 83 Taxes on earnings

307 270 Net

earnings

569 644 (12)% Net loss attributable to

noncontrolling interests

— — Net earnings

attributable to Campbell Soup Company

$ 569 $

644 (12)% Per share - assuming dilution Net earnings

attributable to Campbell Soup Company

$ 1.85 $

2.07 (11)% CAMPBELL SOUP

COMPANY CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(millions)

April 30, 2017 May 1, 2016 Current assets

$ 1,790 $ 2,042 Plant assets, net

2,372 2,371

Intangible assets, net

3,170 3,574 Other assets

119

82 Total assets

$ 7,451 $ 8,069 Current

liabilities

$ 2,352 $ 2,377 Long-term debt

2,270 2,540 Other liabilities

1,339 1,478 Total

equity

1,490 1,674 Total liabilities and equity

$ 7,451 $ 8,069 Total debt

$

3,392 $ 3,674 Cash and cash equivalents

$

313 $ 383 Certain amounts in the prior year

were reclassified to conform to the current-year presentation.

CAMPBELL SOUP COMPANY CONSOLIDATED STATEMENTS

OF CASH FLOWS (unaudited) (millions)

Nine Months

Ended April 30, 2017 May 1, 2016 Cash

flows from operating activities: Net earnings

$ 569 $

644 Adjustments to reconcile net earnings to operating cash flow

Impairment charges

212 — Restructuring charges

— 32

Stock-based compensation

48 50 Pension and postretirement

benefit expense (income)

(35 ) 167 Depreciation and

amortization

234 228 Deferred income taxes

11 4

Other, net

15 2 Changes in working capital Accounts

receivable

1 5 Inventories

144 172 Prepaid assets

(20 ) 7 Accounts payable and accrued liabilities

(116 ) (59 ) Receipts from hedging activities

1 5 Other

(53 ) (46 ) Net cash

provided by operating activities

1,011

1,211 Cash flows from investing activities: Purchases of

plant assets

(195 ) (225 ) Sales of plant assets

— 5 Other, net

(14 ) (14 ) Net

cash used in investing activities

(209 )

(234 ) Cash flows from financing activities: Net short-term

repayments

(66 ) (425 ) Long-term repayments

(76 ) — Dividends paid

(314 ) (294 )

Treasury stock purchases

(305 ) (118 ) Treasury stock

issuances

2 2 Payments related to tax withholding for

stock-based compensation

(21 ) (21 )

Net cash used in financing activities

(780 )

(856 ) Effect of exchange rate changes on cash

(5 ) 9 Net change in cash and cash

equivalents

17 130 Cash and cash equivalents — beginning of

period

296 253 Cash and cash

equivalents — end of period

$ 313 $ 383

The company adopted new accounting guidance for stock-based

compensation in the first quarter of 2017. Certain amounts in the

prior year were reclassified to conform to the current-year

presentation.

Reconciliation of GAAP to Non-GAAP

Financial Measures

Third Quarter Ended April 30,

2017

Campbell Soup Company uses certain non-GAAP financial

measures as defined by the Securities and Exchange Commission in

certain communications. These non-GAAP financial measures are

measures of performance not defined by accounting principles

generally accepted in the United States and should be considered in

addition to, not in lieu of, GAAP reported measures. Management

believes that also presenting certain non-GAAP financial measures

provides additional information to facilitate comparison of the

company's historical operating results and trends in its underlying

operating results, and provides transparency on how the company

evaluates its business. Management uses these non-GAAP financial

measures in making financial, operating and planning decisions and

in evaluating the company's performance.

Organic Net

Sales

Organic net sales are net sales excluding the impact of

currency. Management believes that excluding this item, which is

not part of the ongoing business, improves the comparability of

year-to-year results. A reconciliation of net sales as reported to

organic net sales follows.

Three Months Ended

April 30, 2017 May 1, 2016

% Change (millions)

Net

Sales,asReported

Impact ofCurrency

OrganicNet Sales

Net

Sales,asReported

Net

Sales,asReported

OrganicNet Sales

Americas Simple Meals and Beverages $ 982

$ 1 $ 983 $ 999 (2 )%

(2 )%

Global Biscuits and Snacks 623 (2

) 621 608 2 % 2 %

Campbell Fresh

248 — 248

263 (6 )% (6 )%

Total Net Sales $

1,853 $ (1 ) $

1,852 $ 1,870 (1 )% (1 )%

Nine

Months Ended April 30, 2017 May 1, 2016 %

Change (millions)

Net

Sales,asReported

Impact ofCurrency

OrganicNet Sales

Net

Sales,asReported

Net

Sales,asReported

OrganicNet Sales

Americas Simple Meals and Beverages $ 3,510

$ (2 ) $ 3,508 $ 3,538 (1 )% (1

)%

Global Biscuits and Snacks 1,974 (23

) 1,951 1,942 2 % — %

Campbell Fresh

742 — 742

794 (7 )% (7 )%

Total Net Sales $

6,226 $ (25 ) $

6,201 $ 6,274 (1 )% (1 )%

Items Impacting

Gross Margin, Costs and Expenses, and Earnings

The company believes that financial information excluding

certain items that are not considered to be part of the ongoing

business, such as those listed below, improves the comparability of

year-to-year results. Consequently, the company believes that

investors may be able to better understand its results excluding

these items. The following items impacted gross margin,

costs and expenses, and earnings: (1) In the

first quarter of fiscal 2017, the company incurred losses of $20

million in Costs and expenses ($13 million after tax, or $.04 per

share) associated with mark-to-market adjustments for defined

benefit pension and postretirement plans. In the third quarter of

fiscal 2016, the company incurred losses of $54 million in Costs

and expenses ($34 million after tax, or $.11 per share) associated

with mark-to-market adjustments for defined benefit pension and

postretirement plans. In the nine-month period of fiscal 2016, the

company incurred losses of $175 million in Costs and expenses ($110

million after tax, or $.35 per share) associated with

mark-to-market adjustments for defined benefit pension and

postretirement plans. For the year ended July 31, 2016, the company

incurred losses of $313 million in Costs and expenses ($200 million

after tax, or $.64 per share) associated with mark-to-market

adjustments for defined benefit pension and postretirement plans.

(2) In fiscal 2015, the company implemented a new enterprise

design and initiatives to reduce costs and to streamline its

organizational structure. In the third quarter of fiscal 2017, the

company recorded implementation costs and other related costs of $7

million in Administrative expenses ($4 million after tax, or $.01

per share) related to these initiatives. In the nine-month period

of fiscal 2017, the company recorded implementation costs and other

related costs of $18 million in Administrative expenses ($11

million after tax, or $.04 per share) related to these initiatives.

In the third quarter of fiscal 2016, the company recorded

Restructuring charges of $2 million and implementation costs and

other related costs of $13 million in Administrative expenses

related to the fiscal 2015 initiatives (aggregate impact of $9

million after tax, or $.03 per share). In the nine-month period of

fiscal 2016, the company recorded Restructuring charges of $35

million and implementation costs and other related costs of $35

million recorded in Administrative expenses related to the fiscal

2015 initiatives. The company also recorded a reduction to

Restructuring charges of $3 million related to the fiscal 2014

initiative to improve supply chain efficiency in Australia. The

aggregate after-tax impact of Restructuring charges, implementation

costs and other related costs was $42 million, or $.14 per share.

For the year ended July 31, 2016, the company recorded

Restructuring charges of $35 million and implementation costs and

other related costs of $47 million in Administrative expenses

related to the fiscal 2015 initiatives. The company also recorded a

reduction to Restructuring charges of $4 million related to the

fiscal 2014 initiatives. The aggregate after-tax impact of

Restructuring charges, implementation costs and other related costs

was $49 million, or $.16 per share. (3) In the second

quarter of fiscal 2017, the company performed an interim impairment

assessment on the intangible assets of the Bolthouse Farms carrot

and carrot ingredients reporting unit and the Garden Fresh Gourmet

reporting unit as operating performance was well below expectations

and a new leadership team of the Campbell Fresh division initiated

a strategic review which led to a revised outlook for future sales,

earnings, and cash flow. The company recorded a non-cash impairment

charge of $147 million ($139 million after tax, or $.45 per share)

related to intangible assets of the Bolthouse Farms carrot and

carrot ingredients reporting unit and a non-cash impairment charge

of $65 million ($41 million after tax, or $.13 per share) related

to the intangible assets of the Garden Fresh Gourmet reporting unit

(aggregate pre-tax impact of $212 million, $180 million after tax,

or $.58 per share). The charges are included in Other expenses /

(income). For the year ended July 31, 2016, as part of the

annual review of intangible assets, the company recorded a non-cash

impairment charge of $141 million in Other expenses / (income)

($127 million after tax, or $.41 per share) related to the

intangible assets of the Bolthouse Farms carrot and carrot

ingredients reporting unit. (4) In the third quarter of

fiscal 2016, the company recorded a gain of $25 million in Other

expenses / (income) ($.08 per share) from a settlement of a claim

related to the Kelsen acquisition. The following tables

reconcile financial information, presented in accordance with GAAP,

to financial information excluding certain items:

Three Months Ended April 30, 2017 May 1,

2016 (millions, except per share amounts)

Asreported

Adjustments(a) Adjusted

Asreported

Adjustments(a) Adjusted

AdjustedPercentChange

Gross margin

$ 678 $ — $

678 $ 660 $ 32 $ 692 (2 )% Gross margin percentage

36.6 % 36.6 % 35.3 % 37.0 % Marketing

and selling expenses

209 — 209 228 (9 ) 219

Administrative expenses

140 (7 ) 133

154 (22 ) 132 Research and development expenses

27 —

27 31 (4 ) 27 Other expenses / (income)

4 —

4 (23 ) 25 2 Restructuring charges

— —

— 2 (2 ) — Earnings before

interest and taxes

$ 298 $ 7

$ 305 $ 268 $ 44 $ 312

(2 )% Interest, net

28 —

28 28 — 28 Earnings before taxes

$ 270 $ 7 $

277 $ 240 $ 44 $ 284 Taxes

94 3 97 55 26 81 Effective income tax rate

34.8 % 35.0 % 22.9 % 28.5

% Net earnings attributable to Campbell Soup Company

$

176 $ 4 $ 180

$ 185 $ 18 $ 203 (11 )% Diluted net

earnings per share attributable to Campbell Soup Company

$

.58 $ .01 $ .59

$ .59 $ .06 $ .65 (9 )% (a)See

following table for additional information.

Three Months

Ended April 30, 2017 May 1, 2016

(millions, except per share amounts)

Restructuring

charges,implementation costsand other related

costs(2)

Mark-to-market

(1)

Restructuring

charges,implementation costsand other related

costs

(2)

ClaimSettlement (4)

Adjustments Gross margin

$ — $ 32 $ — $

— $ 32 Marketing and selling expenses

— (9 ) — — (9 )

Administrative expenses

(7 ) (9 ) (13 ) — (22 )

Research and development expenses

— (4 ) — — (4 ) Other

expenses / (income)

— — — 25 25 Restructuring charges

— — (2 ) — (2 ) Earnings before

interest and taxes

$ 7 $ 54 $ 15

$ (25 ) $ 44 Interest, net

— — —

— — Earnings before taxes

$ 7 $

54 $ 15 $ (25 ) $ 44 Taxes

3 20

6 — 26 Net earnings attributable to

Campbell Soup Company

$ 4 $ 34 $ 9

$ (25 ) $ 18 Diluted net earnings per share

attributable to Campbell Soup Company

$ .01 $

.11 $ .03 $ (.08 ) $ .06

Nine

Months Ended April 30, 2017 May 1, 2016

(millions, except per share amounts)

Asreported

Adjustments(a) Adjusted

Asreported

Adjustments(a) Adjusted

AdjustedPercentChange

Gross margin

$ 2,344 $ 20 $

2,364 $ 2,234 $ 113 $ 2,347 1 % Gross margin percentage

37.6 % 38.0 % 35.6 % 37.4 % Marketing

and selling expenses

674 — 674 677 (26 ) 651

Administrative expenses

402 (18 ) 384

456 (61 ) 395 Research and development expenses

78 —

78 86 (10 ) 76 Other expenses / (income)

230

(212 ) 18 (14 ) 25 11 Restructuring charges

— — — 32 (32 ) —

Earnings before interest and taxes

$ 960

$ 250 $ 1,210 $

997 $ 217 $ 1,214 — % Interest, net

84

— 84 83 — 83

Earnings before taxes

$ 876 $

250 $ 1,126 $ 914 $ 217

$ 1,131 Taxes

307 46 353 270 90

360 Effective income tax rate

35.0 %

31.3 % 29.5 % 31.8 % Net earnings attributable

to Campbell Soup Company

$ 569 $

204 $ 773 $ 644 $ 127

$ 771 — % Diluted net earnings per share attributable

to Campbell Soup Company

$ 1.85 $

.66 $ 2.51 $ 2.07 $ .41

$ 2.48 1 % (a)See following table for additional

information.

Nine Months Ended April 30, 2017

May 1, 2016 (millions, except per share amounts)

Mark-to-market

(1)

Restructuringcharges,implementationcosts

and otherrelated costs

(2)

Impairmentcharges

(3)

Adjustments

Mark-to-market

(1)

Restructuringcharges,implementationcosts

and otherrelated costs

(2)

ClaimSettlement (4)

Adjustments Gross margin

$ 20 $

— $ — $ 20 $ 113 $ — $ — $ 113

Marketing and selling expenses

— — — —

(26 ) — — (26 ) Administrative expenses

— (18

) — (18 ) (26 ) (35 ) — (61 ) Research

and development expenses

— — — — (10 )

— — (10 ) Other expenses / (income)

— — (212

) (212 ) — — 25 25 Restructuring charges

— — — — —

(32 ) — (32 ) Earnings before interest and taxes

$ 20 $ 18 $

212 $ 250 $ 175 $ 67

$ (25 ) $ 217 Interest, net

— —

$ — — — — —

— Earnings before taxes

$ 20

$ 18 $ 212 $

250 $ 175 $ 67 $ (25 ) $ 217

Taxes

7 7 32 46

65 25 — 90 Net earnings

attributable to Campbell Soup Company

$ 13

$ 11 $ 180 $

204 $ 110 $ 42 $ (25 ) $ 127

Diluted net earnings per share attributable to Campbell Soup

Company

$ .04 $ .04

$ .58 $ .66 $ .35

$ .14 $ (.08 ) $ .41

Year Ended

(millions, except per share amounts)

July 31, 2016 Gross

margin, as reported $ 2,780 Add: Pension and

postretirement benefit mark-to-market adjustments (1)

176

Adjusted Gross margin $ 2,956

Adjusted Gross margin percentage 37.1 %

Earnings before interest and taxes, as reported $

960 Add: Total pension and postretirement benefit

mark-to-market adjustments (1)

313 Add: Restructuring

charges, implementation costs and other related costs (2)

78

Add: Impairment charges (3)

141 Deduct: Claim settlement (4)

(25 ) Adjusted Earnings before interest and

taxes $ 1,467 Interest, net, as

reported $ 111 Adjusted Earnings before

taxes $ 1,356 Taxes on earnings, as

reported $ 286 Add: Tax benefit from total

pension and postretirement benefit mark-to-market adjustments (1)

113 Add: Tax benefit from restructuring charges,

implementation costs and other related costs (2)

29 Add: Tax

benefit from impairment charges (3)

14 Adjusted

Taxes on earnings $ 442 Adjusted

effective income tax rate 32.6 % Net earnings

attributable to Campbell Soup Company, as reported $

563 Add: Net adjustment from total pension and

postretirement benefit mark-to-market adjustments (1)

200

Add: Net adjustment from restructuring charges, implementation

costs and other related costs (2)

49 Add: Net adjustment

from impairment charges (3)

127 Deduct: Claim settlement (4)

(25 ) Adjusted Net earnings attributable to

Campbell Soup Company $ 914 Diluted net

earnings per share attributable to Campbell Soup Company, as

reported $ 1.81 Add: Net adjustment from total

pension and postretirement benefit mark-to-market adjustments (1)

.64 Add: Net adjustment from restructuring charges,

implementation costs and other related costs (2)

.16 Add:

Net adjustment from impairment charges (3)

.41 Deduct: Claim

Settlement (4)

(.08 ) Adjusted Diluted net

earnings per share attributable to Campbell Soup Company

$ 2.94

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170519005247/en/

Campbell Soup CompanyINVESTOR

CONTACT:Ken Gosnell,

856-342-6081ken_gosnell@campbellsoup.comorMEDIA CONTACT:Carla Burigatto,

856-342-3737carla_burigatto@campbellsoup.com

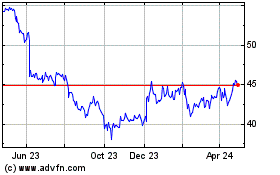

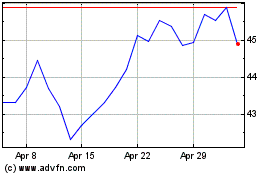

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Apr 2023 to Apr 2024